AI’s “Windows 95” Moment

![]() About “the AI Bubble”...

About “the AI Bubble”...

The mainstream is starting to invoke “the b-word” when it comes to AI.

The mainstream is starting to invoke “the b-word” when it comes to AI.

“Are We In an AI Bubble?” asks U.S. News and World Report.

Several outlets are answering with a definitive yes. Or even asserting that the bubble is bursting.

“As the thrill of the initial AI buzz starts to fade,” write’s CNN’s Allison Morrow, “Wall Street is (finally) getting a little more clear-eyed about the actual value of the technology and, more importantly, how it’s going to actually generate revenue for the companies promoting it.”

The disappointment after Nvidia’s quarterly numbers last week — including a 9.5% drop on Tuesday this week — is adding to the gloomy vibe.

“Shed a tear, if you wish, for Nvidia founder and Chief Executive Jensen Huang, whose fortune (on paper) fell by almost $10 billion that day,” writes Los Angeles Times business columnist Michael Hiltzik. “But pay closer attention to what the market action might be saying about the state of artificial intelligence as a hot technology. It’s not pretty.”

The time for a bubble will surely come — but Paradigm’s AI authority James Altucher says not yet.

The time for a bubble will surely come — but Paradigm’s AI authority James Altucher says not yet.

“It's an easy conclusion to jump to,” he acknowledges. “After all, we've seen this movie before, right? The hype cycle kicks in, valuations go through the roof and then... pop!”

If you lived through the dot-com bubble of the 1990s, you know exactly what James is talking about. The Nasdaq nearly doubled during 1999. Then it peaked in March 2000 and began a sickening grind down for the next 2½ years. When all was said and done, the Nasdaq collapsed 78%.

But if it’s a dot-com analogy you’re looking for, James says rest easy: “If we were to draw a parallel to the internet boom, we'd be somewhere around 1994 or 1996.

But if it’s a dot-com analogy you’re looking for, James says rest easy: “If we were to draw a parallel to the internet boom, we'd be somewhere around 1994 or 1996.

“Remember, Amazon was just a twinkle in Jeff Bezos' eye back then. Google didn't exist. Facebook was still a decade away. The real game-changers were yet to come.”

Speaking of Amazon, James points to the company’s AI assistant called Amazon Q. It “isn’t just a fancy chatbot,” he says. “It’s a workforce multiplier.”

“According to Amazon CEO Andy Jassy, Amazon Q has saved the company a mind-boggling 4,500 developer-years of work” — which translates to $260 million in efficiency gains spread across one year.

“And Amazon isn't alone in embracing AI,” James adds. “A recent Bloomberg Intelligence survey found that 66% of companies are working on deploying generative AI co-pilots.”

As we mentioned two days ago, the next leap forward for AI comes next week — when Apple unveils its AI-enhanced iPhone and other devices on Monday.

As we mentioned two days ago, the next leap forward for AI comes next week — when Apple unveils its AI-enhanced iPhone and other devices on Monday.

It’s been a long time coming — too long, say the Apple critics. But as we also said earlier this week, Apple takes the time to get things right. It learns from its competitors’ early mistakes. That’s why people carry around iPhones these days and not BlackBerrys or Palm Treos.

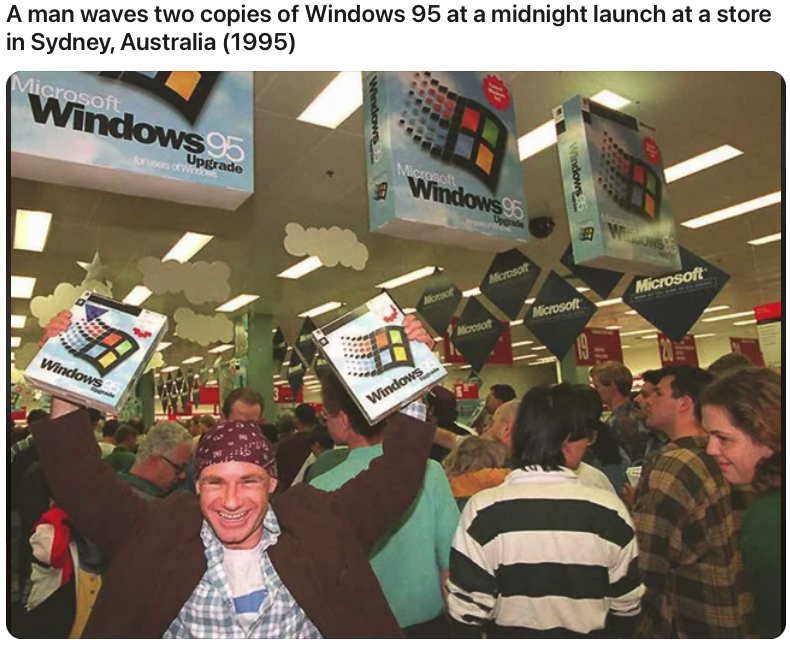

So if the advent of AI is akin to the rollout of the web in 1994–96… then you might say Apple’s “AiPhone” release is comparable to Microsoft’s release of Windows 95.

Remember that? People lining up outside Circuit City in the middle of the night? So they could get their shrink-wrapped boxes of Win95 CD-ROMs?

It sounds so ridiculous now, but that really happened. Here’s a terrific screengrab we spotted on Reddit…

So yes, the AI bubble will blow up to an unsustainable magnitude and then pop. Eventually. But in the meantime, there still are ample opportunities to accumulate life-changing wealth.

![]() The Jobs… and the Reaction

The Jobs… and the Reaction

The much-touted August job numbers are out… and they’re by and large a disappointment.

The much-touted August job numbers are out… and they’re by and large a disappointment.

The “expert consensus” among Wall Street economists was that the wonks at the Bureau of Labor Statistics would conjure 160,000 new jobs for the month.

That’s a weak number; it takes 150,000–200,000 just to keep up with the growth of the working-age population.

In the event, the actual number was 142,000. Worse, the July and June numbers were revised down. Average monthly job growth the last three months is a meager 116,000.

Meanwhile, the official unemployment rate ticked down to 4.2% — an improvement on 4.3% the month before, but up from 3.4% since April of last year.

Of course, Wall Street is viewing these numbers through the prism of what they mean for Federal Reserve policy. The Fed holds one of its every-six-weeks meetings on Sept. 17–18.

“The employment picture is now the focus of the Federal Reserve,” Paradigm’s Jim Rickards wrote his Strategic Intelligence readers this morning. “Fed Chair Jay Powell has pivoted from concern about inflation to concern about unemployment. The latter pivot is much more troubling because it signals that a recession is upon us and the Fed may be too late (as usual) to do anything about it.”

As a reminder, the Fed has pegged its benchmark fed funds rate at 5.5% since July of last year — after the most aggressive rate-raising cycle since the early 1980s, aimed at containing inflation.

In the futures market, traders are pricing in a 57% probability the Fed will cut a quarter percentage point… and a 43% probability of a half-percentage point cut.

But hold on — there’s one more incoming data point between now and the Fed meeting. The official inflation numbers for August will be released next Wednesday. An unexpected rise in the inflation rate will put the Fed in a serious bind.

As for the stock market, Wall Street can interpret these job numbers one of two ways.

As for the stock market, Wall Street can interpret these job numbers one of two ways.

They can say, Oh look, a weak job number — the Fed might cut rates more aggressively. More EZ money for us!

Or they can say, Oh look, a weak job number — the Fed kept rates too high for too long and we’re going into a recession!

It’s the latter interpretation that’s holding sway today: All the major U.S. indexes are in the red, the S&P 500 down nearly 1% at 5,455.

Gold is flat at $2,515. Silver is losing a little ground at $28.57. Bitcoin has slid below $55,000.

Crude can’t catch a break — down another buck to $68.13, the lowest since December of last year. (Reminder: It was over $84 only two months ago.) An oversold bounce is likely soon, but momentum is not on the side of the oil bulls.

![]() Longshoremen Strike Update

Longshoremen Strike Update

“We must be prepared if we have to hit the streets at 12:01 a.m. on Tuesday, Oct. 1, 2024,” says Harold Daggett, president of the International Longshoremen’s Association.

“We must be prepared if we have to hit the streets at 12:01 a.m. on Tuesday, Oct. 1, 2024,” says Harold Daggett, president of the International Longshoremen’s Association.

It’s now 24 days until East Coast and Gulf Coast dockworkers might go on strike. Their current contract expires at the end of the month. Going into a new round of talks with the U.S. Maritime Alliance yesterday, the union did not sound an optimistic note.

“We can’t even get past the economics of the contract,” Daggett says. “We are very, very far apart.”

Vincent Clerc, the CEO of the shipping giant Maersk, says even a one-day strike would foul up supply chains for a week.

“If suddenly you create a big traffic jam because of a strike on a market as big and consequential as the U.S. East Coast and Gulf,” Clerc said at a news conference last month, “it’s going to have serious ripple effects across not only the U.S., but across other geographies.”

A one-week week would have downstream impacts for one month — and shortly before the holidays, to say nothing of Election Day.

The Biden administration stepped in to forestall a freight rail strike ahead of the 2022 midterms. No word yet about how the White House might intervene this time.

![]() Friday Fun Fact

Friday Fun Fact

From the Department of “Who Knew?”

From the Department of “Who Knew?”

Critics point out those Domino’s results are only after dividends are reinvested — while Google parent Alphabet didn’t start paying a dividend until this year. Even so…

![]() Mailbag: The Next Day

Mailbag: The Next Day

The reader response to yesterday’s edition was, by and large, muted.

The reader response to yesterday’s edition was, by and large, muted.

No one accused me of being a “useful idiot” of Vladimir Putin, so there’s that. A couple of people objected to “political” content even though I took pains to lay out the financial implications of Washington’s ongoing animus toward Moscow.

We did hear from one of our regulars who rose to Donald Trump’s defense.

“Dave, I am with you all the way on this except for one thing,” he writes: “Donald Trump has repeatedly stated that we are nearer to nuclear war with Russia than almost anytime in history. I've watched many rallies, interviews and town hall meetings with Trump and it is part of his policy statement: End the war in Ukraine and use diplomacy to lower the risk of nuclear war.

“And I believe he will attain that goal very quickly (maybe not 24 hours as advertised) when he wins the election.

“To rein in the debt we need to stop escalating wars by insisting that a country like Ukraine join NATO, and then paying for war. Slapping sanctions on Russia that do not work, confiscating its property so our currency gets dumped and choking off energy supplies while draining the strategic oil and gasoline reserves for political purposes are also foreign and domestic duds of the Harris-Biden administration (Sleepy Joe did actually refer to his administration that way — Freudian slip...)”

Dave responds: There are words and there are actions.

Trump apologists either downplay or deny it… but the $95 billion in new aid for Ukraine that Congress passed last spring wouldn’t have happened were it not for Trump’s behind-the-scenes support.

House Speaker Mike Johnson pushed it through after a meeting with Trump at Mar-a-Lago. Lindsey Graham greased the skids on the Senate side. Trump even quietly took credit for structuring some of the aid in the form of a loan. (The Wall Street Journal told the whole sordid story at the time, but no one noticed because the truth didn’t serve anyone’s partisan agenda.)

Meanwhile, what is Trump’s plan to end the war? Would Russia gain control of the four Ukrainian regions that Moscow has annexed? Would western Ukraine join NATO while the central part of the country becomes a neutral buffer zone? Would NATO missiles be withdrawn from Poland and Romania?

Don’t we deserve to know, given the stakes?

Absent the specifics, Trump’s promise has no more credibility than Richard Nixon’s “secret plan” to end the Vietnam War.