Altman and Karp: Shape-Shifting Scum

![]() Altman and Karp: Shape-Shifting Scum

Altman and Karp: Shape-Shifting Scum

The subject line of today’s edition emerged spontaneously as your editor experienced a brief moment of fury this week — and expressed it on the Paradigm Press internal e-chat.

The subject line of today’s edition emerged spontaneously as your editor experienced a brief moment of fury this week — and expressed it on the Paradigm Press internal e-chat.

In general, I don’t like calling people names. “Hate the sin, not the sinner” and all that.

But I will make an exception now and then for people who exercise political power — and for those who suck up to people who exercise political power.

We’ll get to the event that sparked my outburst soon enough — but first, we should briefly revisit how corporate America began warming up to Donald Trump early in 2024.

We’ll get to the event that sparked my outburst soon enough — but first, we should briefly revisit how corporate America began warming up to Donald Trump early in 2024.

The first signal came from JPMorgan Chase CEO Jamie Dimon — appearing at the World Economic Forum’s annual shindig in Davos, Switzerland in January 2024: “Take a step back, be honest. He was kind of right about NATO, kind of right on immigration. He grew the economy quite well. Trade tax reform worked. He was right about some of China.”

Shortly after the attempt on Trump’s life in July, Elon Musk and Bill Ackman threw their support behind Trump. Both had given money to Democrats throughout the 2010s.

In the run-up to Election Day, Washington Post owner Jeff Bezos put the kibosh on his editorial board endorsing a presidential candidate — a huge pivot from the Trump 45 days when the paper adopted the pretentious slogan “Democracy Dies in Darkness.”

I wrote about all of that while it was happening — mostly as an observation about how the times were changing and not with any value judgment attached.

Of course, Bezos belonged to the procession of tech-adjacent business magnates who flocked to Trump’s second inauguration. Mark Zuckerberg was there, too.

Of course, Bezos belonged to the procession of tech-adjacent business magnates who flocked to Trump’s second inauguration. Mark Zuckerberg was there, too.

Zuck’s evolution is interesting. At the start, he had zero desire to engage in “content moderation” on Facebook or Instagram.

Amid the bitter Trump-Clinton campaign in 2016, he said, “We're a technology company. We're not a media company. When you think about a media company, you know, people are producing content, people are editing content, and that's not us."

But in 2017–18, Zuckerberg was among the tech executives routinely hauled before Congressional committees — where they’d get raked over the coals for promoting “hate speech” and “misinformation.”

Threatened with tax penalties and new regulations, Zuck caved.

Facebook along with three other companies kicked Alex Jones off their platforms in August 2018. As we feared at the time, that event signaled the advent of a censorship regime carried out under relentless pressure from the feds.

By 2023, Zuck was having serious second thoughts. During a podcast interview, he observed that during COVID time, “the establishment… asked for a bunch of things to be censored that, in retrospect, ended up being more debatable or true.”

Last month, ahead of Trump’s inauguration, Facebook said it would dismantle its “fact-checking” apparatus.

I’m no Zuckerberg fan, but I can kinda-sorta understand his evolution over time. You might even say he got red-pilled during the Biden years.

Alex Karp, however, has no such excuse — which was the occasion for my outburst that inspired today’s subject line.

Alex Karp, however, has no such excuse — which was the occasion for my outburst that inspired today’s subject line.

Karp is co-founder and CEO of Palantir Technologies — once hailed as a “big data” firm, now ballyhooed as an AI play, and always working hand-in-glove with the deep state.

Palantir’s most famous co-founder is Peter Thiel, who is still chairman.

In 2002, Thiel and the rest of the so-called PayPal Mafia cashed out when they sold PayPal to eBay. Thiel was looking for a “next act.”

Knowing that a post-9/11 U.S. government was obsessed with surveillance, Thiel, Karp and their partners launched Palantir in 2003.

They took seed money from In-Q-Tel, the not-for-profit venture capital outfit that invests specifically to develop technology for the CIA and other three-letter agencies.

Over the years, the founders kept all their bases covered politically. Thiel has long been linked with Donald Trump. Karp was a major Joe Biden donor last year and was all-in when Democratic Party bigwigs pivoted to Kamala Harris.

Said Karp to the Financial Times, “I personally am not thrilled by the direction [of the Democratic Party], but how far can they go before I reconsider? I am voting against Trump."

![]() Sucking up to Trump

Sucking up to Trump

That was then, this is now: “The biggest problem in our society from my perspective is the legitimacy of our institutions,” says Karp.

That was then, this is now: “The biggest problem in our society from my perspective is the legitimacy of our institutions,” says Karp.

Sure, easy to say when the electorate repudiated those institutions so thoroughly.

In an interview with CNBC this week, Karp hailed Elon Musk and the DOGE boys as they barge through one torpid bureaucracy after another.

“Why is it that we do not know where every penny of our money goes?” he asked. “How do you explain that to people?”

And then Karp lit out at the Democrats: “The right response is, ‘We want this to happen, we want to have it, we want to be involved in the dialogue.’ The [actual] response is it feels like the people criticizing Elon don’t want it to happen.”

At least Zuck’s pivot toward Trump World seemed to be accompanied by some semblance of an authentic change of heart.

Karp, on the other hand, is bereft of any principle, any virtue, any moral compass — any belief in anything other than his company’s hallowed bottom line.

And so he tailors his words to ensure nothing jeopardizes Palantir’s precious federal contracts — which for most of the company’s history have accounted for more than half its revenue.

In the same craven vein as Karp is OpenAI co-founder Sam Altman.

In the same craven vein as Karp is OpenAI co-founder Sam Altman.

As you’ll recall, it was OpenAI’s release of ChatGPT 3.5 in November 2022 that put AI on the map.

About six months later, Altman appeared before a Senate subcommittee — run by Democrats at the time.

We chronicled that appearance. We said he shamelessly played to his audience — begging for government regulation and licensing on the grounds that AI might be used to propagate “misinformation.”

"We're going to face an election next year," he said. "And these models are getting better."

May 2023: Altman puts on his most earnest election-integrity face [C-SPAN screengrab]

As Paradigm tech expert Ray Blanco told us at the time, regulations always favor large, incumbent companies at the expense of scrappy competitors who lack the money and manpower to comply with the regulations. Altman, with a $10 billion investment from Microsoft, was talking his book.

When asked what AI regulation ought to look like, Altman said “a great analogy” for the sort of regulation he supports was the Nuclear Regulatory Commission — an agency that’s stymied any innovation or expansion of the nuclear-energy space for 40-plus years.

So of course Altman turns around and shows up at Trump’s inauguration.

So of course Altman turns around and shows up at Trump’s inauguration.

And the day after inauguration, Altman appeared at the White House alongside Trump, SoftBank CEO Masayoshi Son and Oracle’s Larry Ellison to tout the “Stargate” AI infrastructure project.

As I said at the time, the event was a meaningless photo-op. Stargate is not a new venture and the funding sources for its $500 billion cost have, by and large, not been lined up yet.

But hey, Altman knows which way the wind is blowing. At a time he’s navigating the legal thicket of converting OpenAI from a nonprofit to a for-profit model, “election misinformation” is the last thing on his mind now.

[By the way, in case you hadn’t heard, OpenAI’s board rejected Elon Musk’s $97.4 billion takeover offer.]

There are members of the Paradigm team who say that Altman gives off vibes that are sketchy — or even fraudulent. “Sam Bankman-Fried Version 2.0” is the none-too-subtle assessment of our trading pro Enrique Abeyta.

But that’s a story for another day. The story on this day is about — well, shape-shifting scum who toady themselves before whichever political tribe holds power at any given moment.

It’s about clout, not capitalism.

The phenomenon will serve up investment opportunities, for sure — and we’ll be tracking them here. But it won’t deliver genuine prosperity for all.

(And to be clear, I don’t believe either Altman or Karp is a reptilian. It’s ridiculous I’d feel the need to issue such a disclaimer, but these are the times we live in.)

![]() The Defense Spending Shell Game

The Defense Spending Shell Game

I suppose we should mention the meltdown in Palantir stock this week — which is completely overblown.

I suppose we should mention the meltdown in Palantir stock this week — which is completely overblown.

As you might recall, Donald Trump said a week ago Thursday he’d like to convene a meeting with the leaders of China and Russia — with an aim of cutting their respective military budgets in half. Defense stocks as a group dipped and then recovered — another manifestation of our 48-hour rule.

Then on Wednesday of this week, The Washington Post reported that Defense Secretary Pete Hegseth ordered a plan to cut defense spending by 8% a year for the next five years.

For whatever reason, defense stocks as a group didn’t react to this news — the ITA ETF barely budging all day. But Palantir took a 10.1% spill.

Yesterday, Acting Deputy Secretary of Defense Robert Salesses issued a clarification: Spending will be “redirected” — not cut.

Secretary Hegseth has directed a review to identify offsets from the Biden administration’s FY26 budget that could be realigned from low-impact and low-priority Biden-legacy programs to align with President Trump’s America First priorities for our national defense.

The Department will develop a list of potential offsets that could be used to fund these priorities, as well as to refocus the department on its core mission of deterring and winning wars. The offsets are targeted at 8% of the Biden administration’s FY26 budget, totaling around $50 billion, which will then be spent on programs aligned with President Trump’s priorities.

Hegseth accused the Post of misrepresenting his memo, which he said was “clear as a bell.”

For whatever reason, PLTR continued selling off yesterday — perhaps because CEO Alex Karp plans to cash out as much as $1.2 billion of his shares. Today the share price is stabilizing.

But in any event, we’ve had what amount to two false alarms in as many weeks about cuts to the Pentagon.

We hailed DOGE’s impending descent on the Pentagon earlier this month — but we haven’t heard anything substantive since. Makes you wonder how serious they really are…

As for the stock market as a whole, it’s firmly in the red on an options-expiration Friday.

As for the stock market as a whole, it’s firmly in the red on an options-expiration Friday.

“We’re seeing some of the highest-flying stocks begin to run out of steam,” writes Paradigm chart hound Greg Guenthner at The Trading Desk. “And as more nervous bulls hit the sell button, these names are cascading lower.” Palantir is one example. Zuckerberg’s Meta is another.

At last check the S&P 500 sits at 6,087 — down a half percent on the day and down 0.93% from its record close on Wednesday. And the S&P is holding up best among the major averages.

“I don’t think this means we aren't going to see any strong rallies,” says Greg. “They’ll just come from other places.”

➢ Speaking of Biden-era litigation the feds are now dropping, it appears the Justice Department will drop its even more ridiculous case against SpaceX, filed because SpaceX was making every effort to comply with the law.

![]() Golden Mystery — Even for Gold Experts

Golden Mystery — Even for Gold Experts

Gold is holding up nicely as the weekend approaches — even as Treasury Secretary Scott Bessent is throwing cold water on the notion the government might revalue its bullion holdings.

Gold is holding up nicely as the weekend approaches — even as Treasury Secretary Scott Bessent is throwing cold water on the notion the government might revalue its bullion holdings.

Toward the end of Wednesday’s edition, we mentioned the chatter about revaluing the Treasury’s gold stash held at Fort Knox and West Point. Officially it’s on Uncle Sam’s books at a mere $42.22 an ounce — a relic of the chaos that ensued when President Nixon cut the dollar’s last tie to gold in 1971.

But Bessent says don’t get your hopes up. As Bloomberg reports, “When discussing plans for a sovereign wealth fund, Bessent said revaluing U.S. gold reserves is ‘not what I had in mind.."

Even so, gold is set to end another week comfortably above $2,900 an ounce — $2,936 at last check.

The relentless flow of physical gold from London vaults to the New York Comex continues. As we mentioned earlier this month, we’re suspicious of the facile explanation from mainstream media — people trying to get ahead of possible new Trump tariffs.

Gold authority Brien Lundin, CEO of the annual New Orleans Investment Conference, affirms our suspicions: Tariff fears don’t explain “the coincident surge of deliveries — physical demand — from Comex, or the tremendous levels of gold demand now being seen from central banks, institutions and individuals around the world,” he writes.

In other words, demand for real metal and not paper promises like gold futures.

“These moves smell of desperation, and they have helped propel gold to record price levels in a historic new bull market.”

The source of the “desperation” is, frankly, anyone’s guess.

The source of the “desperation” is, frankly, anyone’s guess.

One factor at play is growing buzz in the last week about the Trump administration scheming on a “Mar-a-Lago Accord” — a grand bargain with some of America’s foreign creditors in which they’d swap their U.S. Treasuries for 100-year bonds, thereby easing Washington’s debt burden. Those bonds conceivably would have some sort of gold backing.

It’s a complicated story, still entirely in the realm of speculation — which is why we haven’t grappled with it in these digital pages yet.

And again, it’s only one possibility among many. Even the wisest hands in the precious metals markets like Mr. Lundin aren’t certain what to make of it all.

“Nobody knows for sure,” says Ed Steer, another old hand in the gold and silver space — “and everything that we are speculating about contains a kernel or two of truth.

“The fact of the matter is that we won't know until it's sprung on us some Sunday before the 6:00 p.m. EST Globex open. It will be a whole different world starting at that point.”

If you don’t have your gold stash yet — our Jim Rickards recommends 10% of your investable assets — best get cracking.

➢ Elsewhere in the commodity complex today, silver has shed 23 cents to $32.66. Crude is slumping over 2% and is back under $71. Oil bulls can’t catch a break…

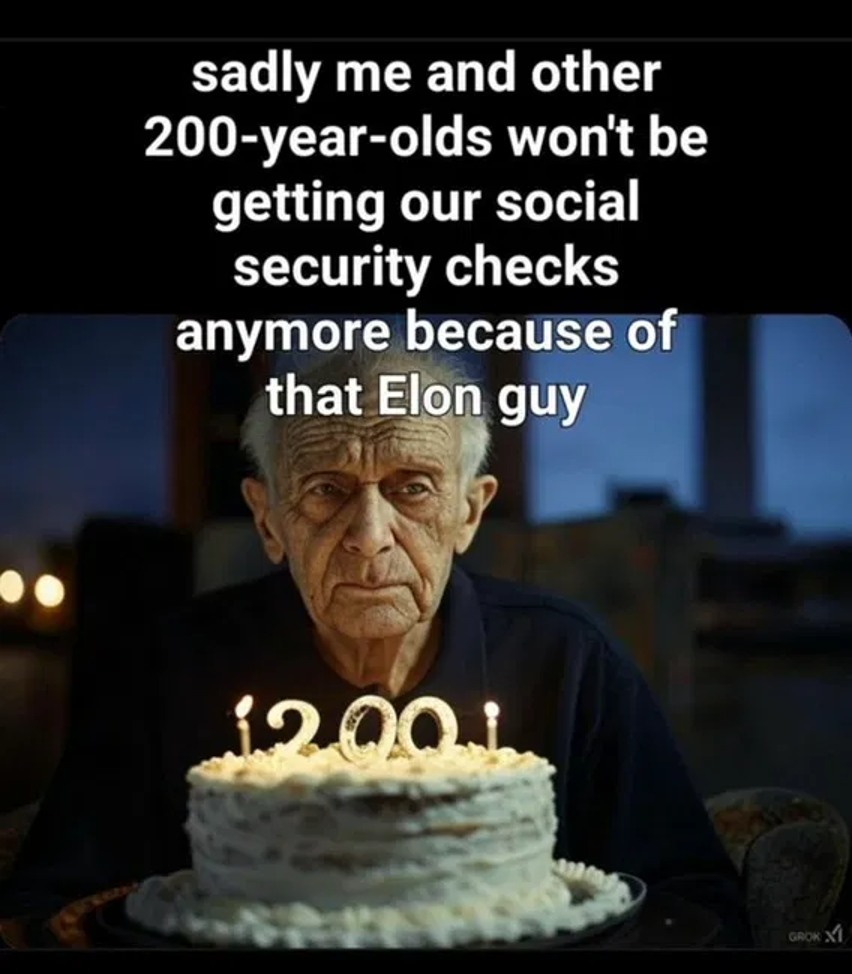

![]() Comic Relief

Comic Relief

Deadline is looming, and so we leave you with this…

Deadline is looming, and so we leave you with this…

Have a good weekend,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets