Elon vs. the Pentagon

![]() Elon vs. the Pentagon

Elon vs. the Pentagon

I can’t remember the last time a presidential pre-Super Bowl interview made real news. Heck, yesterday might be the first time.

I can’t remember the last time a presidential pre-Super Bowl interview made real news. Heck, yesterday might be the first time.

The “tradition” of these interviews goes back to George W. Bush in 2004. Typically they’re a snooze. On occasion there’ve been fireworks — Barack Obama and Bill O’Reilly, for instance — but those episodes shed more heat than light.

Not so yesterday.

As if reading your editor’s protest in Friday’s edition — wondering whether Elon Musk’s DOGE boys would be unleashed at the Pentagon — Donald Trump said, “Let’s check the military.

"We're going to find billions, hundreds of billions of dollars of fraud and abuse, and the people elected me on that."

To be sure, that wasn’t a spontaneous remark. Indeed Defense Secretary Pete Hegseth teed it up earlier in the day on the Sunday morning talk-show circuit.

"When we spend dollars,” he said, “we need to know where they're going and why, and that has not existed at the Defense Department,"

That’s an understatement, to say the least.

Mainstream media articles addressing the president’s remarks usually point out the Pentagon has failed an audit for seven straight years.

That doesn’t even begin to tell the whole story — a story we’ve been tracking in these digital pages for more than a decade. Strap in…

If you’re old enough you might remember the outrageous Pentagon spending scandals that emerged in the mid-1980s — $640 toilet seats, $435 hammers.

If you’re old enough you might remember the outrageous Pentagon spending scandals that emerged in the mid-1980s — $640 toilet seats, $435 hammers.

(And those were in 1985 dollars!)

The outrage built throughout the rest of the ’80s — pushing Congress to pass a law in 1990 requiring the Pentagon to be audit-ready by 1996.

As perhaps you’ve already guessed, the Pentagon blew that deadline.

The next chapter in the story has become the stuff of legend — indeed, it turned up in a meme I ran across yesterday, coinciding with the president’s interview.

The next chapter in the story has become the stuff of legend — indeed, it turned up in a meme I ran across yesterday, coinciding with the president’s interview.

There was in fact no audit in the years following the 1996 deadline… but on Sept. 10, 2001, Defense Secretary Donald Rumsfeld made the following remark, on-camera, about the sloppiness of the Pentagon’s books: "According to some estimates, we cannot track $2.3 trillion in transactions."

It was a staggering figure — at the time, more than a third of the $5.8 trillion national debt.

And it was all forgotten the next day because that’s when the Sept. 11 attacks happened. The imperative of tracking all that money took a back seat to bombing and “nation building” in Afghanistan and Iraq.

In 2009, Congress "got tough" and imposed a new cross-your-heart, hope-to-die deadline for the Pentagon to be audit-ready: 2017.

In 2009, Congress "got tough" and imposed a new cross-your-heart, hope-to-die deadline for the Pentagon to be audit-ready: 2017.

Alas, there were no "or else" consequences attached to this deadline — no fines or jail time for anyone, not even a requirement that some assistant secretary of defense read Accounting for Dummies and turn in a three-page book report to the U.S. comptroller general.

The Pentagon’s ham-fisted attempts to meet the deadline became boondoggles of their own: New bookkeeping systems were planned, only to be canceled later — often after $1 billion or more was spent on each.

By the end of 2013, the Pentagon’s Defense Finance and Accounting Service revealed that the total amount of transactions with no paper or electronic trail… going back to the original 1996 deadline set by Congress… had swelled to $8.5 trillion.

Beyond 2013, we don’t even have any reliable totals of untracked transactions to work with.

Beyond 2013, we don’t even have any reliable totals of untracked transactions to work with.

In 2016, a Pentagon inspector general report came up with a figure of $6.5 trillion for the Army alone.

In 2017, Michigan State economist Mark Skidmore took a stab. Together with a former assistant secretary of Housing and Urban Development, Catherine Austin Fitts, they reviewed both the Pentagon and HUD.

Between the two agencies, covering the years 1998–2015, they concluded the total in “undocumented adjustments” was $21 trillion.

Skidmore first revealed his findings during the USAWatchdog podcast on Dec. 3, 2017.

Coincidentally or not, the Pentagon announced new-and-improved audit plans four days later.

So there’s your context for the Pentagon having failed an audit for the last seven years. The first audit didn’t even take place until 21 years after the original deadline set by Congress.

“A successful audit of the Pentagon would be a monumental victory for what’s left of American democracy. It may also prove to be a bridge too far for Trump,” writes retired Air Force Lt. Col. and history professor William Astore.

“A successful audit of the Pentagon would be a monumental victory for what’s left of American democracy. It may also prove to be a bridge too far for Trump,” writes retired Air Force Lt. Col. and history professor William Astore.

“The National Security State is America’s unofficial fourth branch of government and arguably its most powerful. It is a colossus that hides malfeasance and corruption behind a ‘top secret’ security classification. It deters and prevents efforts at transparency by crying that those who try to expose its crimes are endangering national security. It expects your obedience and praise, not your questions and criticism.”

But the same could be said of the U.S. Agency for International Development — over which the DOGE boys have run roughshod.

On the other hand, as we’ve pointed out regularly, Musk is himself a Pentagon contractor — SpaceX collecting $5.32 billion since 2008, according to a recent USA Today analysis.

For a long time, we said that if you’re willing to hold your nose, the defense sector is a surefire winner. But that hasn’t been the case since the market’s COVID crash five years ago; yes, defense posted a big gain, but you’d have done even better sitting in an S&P 500 index fund.

While the DOGE situation shakes out, we’d advise steering clear of broad defense-sector ETFs like XAR and ITA. Of course, if individual defense stocks are recommended in a Paradigm paid advisory you subscribe to, those have been thoroughly vetted for potential to outperform.

And rest assured we’ll stay on top of the Pentagon audit — because the mainstream is sure to forget about it as soon as the next shiny object comes along.

![]() Ron Paul at the Fed?

Ron Paul at the Fed?

In other DOGE-adjacent news, Musk seems warm to the notion of having former Rep. Ron Paul lead an audit of the Federal Reserve.

In other DOGE-adjacent news, Musk seems warm to the notion of having former Rep. Ron Paul lead an audit of the Federal Reserve.

“This will be great,” Musk subsequently posted on X.

Also, in response to a suggestion from Sen. Mike Lee (R-Utah) that Paul be made the next Fed chair, Musk said, “That would be amazing.”

No response from Paul yet, but his longtime aide Daniel McAdams has reposted much of this activity — we can only assume approvingly.

When he was still in Congress, Paul briefly got traction with a proposal to audit the Fed. This was in the years after the 2008 financial crisis and the Fed’s alphabet-soup rescue packages — CPFF, TALF and so on — for the big banks.

When he was still in Congress, Paul briefly got traction with a proposal to audit the Fed. This was in the years after the 2008 financial crisis and the Fed’s alphabet-soup rescue packages — CPFF, TALF and so on — for the big banks.

We still don’t have the full picture of what the Fed did. After a freedom-of-information lawsuit, Bloomberg News concluded the Fed committed nearly $8 trillion to shore up U.S. and foreign financial institutions.

The watchdog group Better Markets came up with an even more stark conclusion: “At least $29 trillion was lent, spent, pledged, committed, loaned, guaranteed and otherwise used or made available to bail out the financial system during the 2008 financial crash… This was a stunning violation of the most basic rule of capitalism, applicable to virtually every other business in America: Failure leads to bankruptcy.”

But the deep state’s representatives in Congress stymied Paul with all their might. In the House, Rep. Mel Watt (D-North Carolina) gutted Paul’s audit-the-Fed bill. (Watt was subsequently appointed by Barack Obama to run the Federal Housing Finance Agency.)

In the Senate, the dirty work was done by Bernie Sanders — watering down the legislation in one of his periodic attempts to prove to Democratic Party bigwigs that he won’t rock the boat at moments when it really counts.

“I'm not a bit surprised that the Federal Reserve got to the Senate,” Paul said at the time. “This is so disappointing to me that this happened, especially since for months now I've worked with Bernie on this.”

Anyway… we’ll keep tabs on this audit effort as well. On to the markets today…

![]() Mr. Market Absorbs Tariff Shock

Mr. Market Absorbs Tariff Shock

Wall Street is handling the latest weekend tariff shock much better than was the case a week ago today.

Wall Street is handling the latest weekend tariff shock much better than was the case a week ago today.

Last Monday brought a minor freakout with the Trump administration imposing 25% tariffs on Canada and Mexico — and a weak relief rally after those tariffs were suspended for 30 days.

Today, the market is shrugging off news that Trump will impose a 25% tariff on all steel and aluminum imports.

At last check, all the major U.S. stock indexes are in the green — the S&P 500 up nearly three-quarters of a percent to 6,067.

Gold has begun a new week powering to record highs, up 1.5% and past $2,900 for the first time. But in a concerning development, silver isn’t keeping pace. Silver is up 0.6% and can’t even cross the $32 mark. Silver has to outperform gold on a sustained basis — not just a day or two — if this precious metals rally is going to have legs.

Crude is starting the week up nearly 2% to $72.40. Bitcoin is mired just over $97,000.

For all the chop in the stock market in recent weeks — the tariff scare, the DeepSeek scare, etc. — the overall trend remains “up and to the right.”

For all the chop in the stock market in recent weeks — the tariff scare, the DeepSeek scare, etc. — the overall trend remains “up and to the right.”

“A series of higher highs and higher lows hugging a well-defined trendline carve out a picture-perfect uptrend,” says Paradigm chart hound Greg Guenthner.

For the record, the S&P 500 is only 0.8% below its record close on Jan. 23 — less than three weeks ago. The Dow is likewise within spitting distance of an all-time high. Even the Nasdaq-100 is less than 2% off its record — “not too shabby,” Greg says, “considering the DeepSeek sell-off.

“I struggle to humor a bearish outlook,” he goes on, “when the averages are challenging all-time highs and investors are being rewarded for buying the dip. Of course, that will change if and when the data supports a potential bearish reversal.

“A trendline break will be the first sign. So far, it’s nowhere to be seen.”

![]() Jobs Postscript

Jobs Postscript

An important follow-up to the monthly job numbers mentioned in Friday’s edition…

An important follow-up to the monthly job numbers mentioned in Friday’s edition…

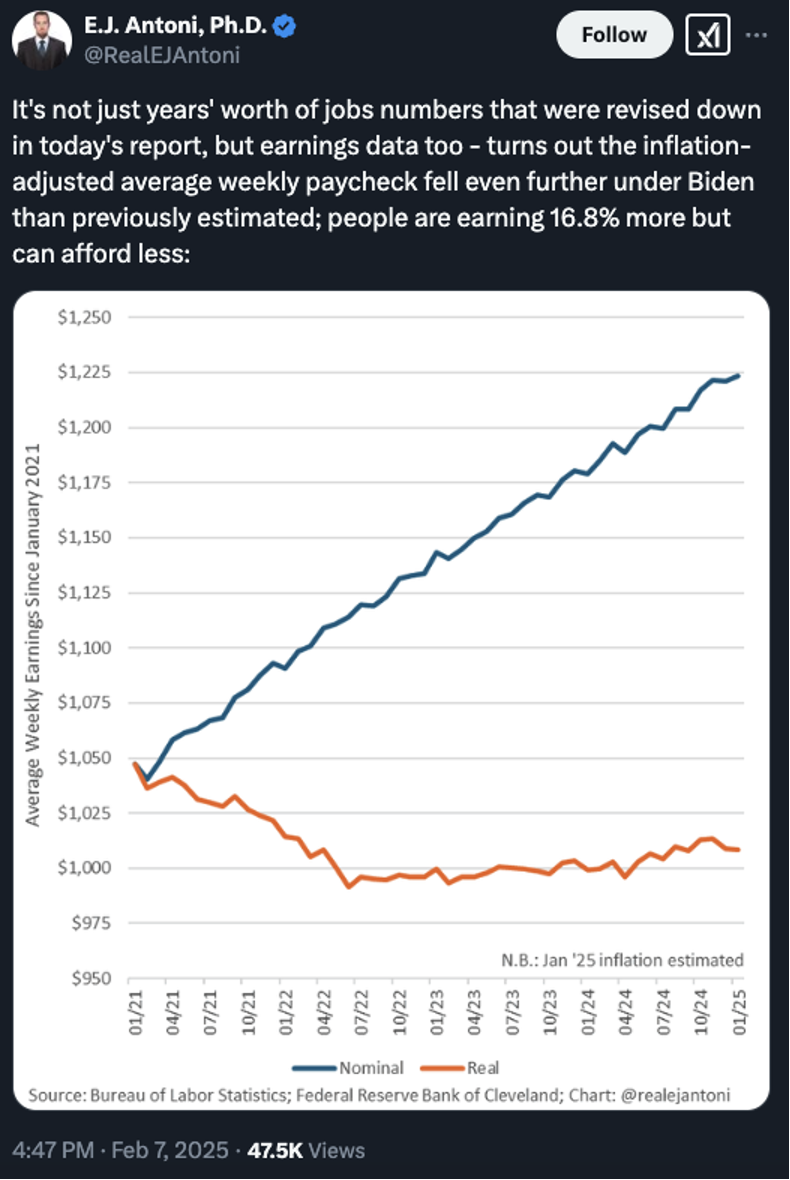

Yes, the annual revisions show nearly 600,000 fewer jobs were created than first thought during a 12-month span. But there’s also a discouraging development in the wage data, as noticed by Heritage Foundation economist E.J. Antoni…

Yeah, no wonder legions of everyday people didn’t want to hear it from Democrats and the media that the economy was awesome and they had nothing to complain about…

![]() An Update: “You’ll Own Nothing and Be Happy”

An Update: “You’ll Own Nothing and Be Happy”

We’re admittedly behind the curve in noticing this development… but Forbes has taken down its infamous 2016 article with the message broadly paraphrased as, “You’ll own nothing and be happy.”

We’re admittedly behind the curve in noticing this development… but Forbes has taken down its infamous 2016 article with the message broadly paraphrased as, “You’ll own nothing and be happy.”

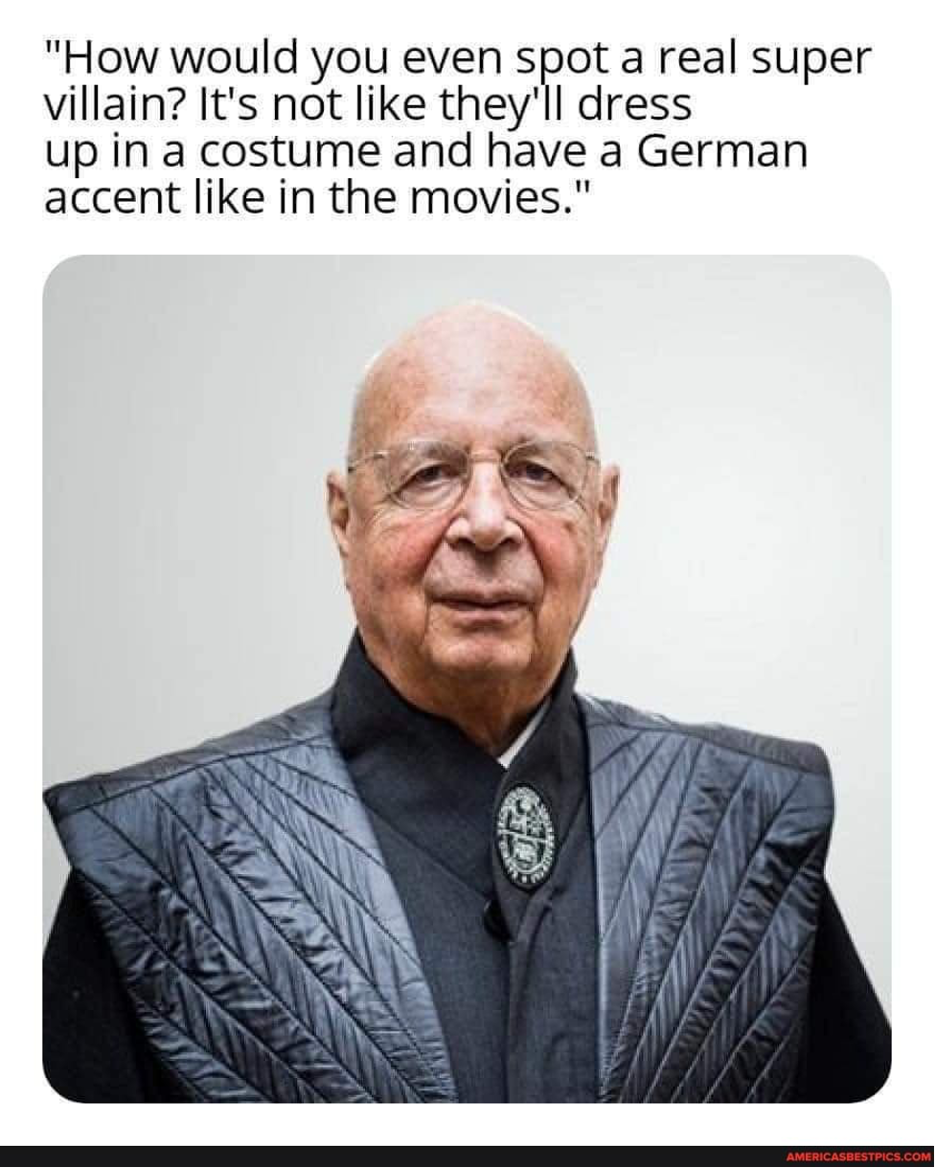

The article was authored by a Danish politician, born in the late 1970s, named Ida Auken. She wrote it under the imprimatur of the World Economic Forum — years before COVID came along and the WEF’s “great reset” agenda alarmed sensible people worldwide…

… also becoming fodder for awesome memes…

Anyway, I ran across a screenshot of the article this morning — and a link, but not to the original post at Forbes. (Nothing completely disappears from the internet; the article is archived for all time at this link.)

Wandering through the Wayback Machine this morning was painfully slow… but I was able to determine Forbes took the article down sometime in mid-August 2023.

Why, I have no idea — but the important thing is that it can still be found online, a living testament to the unbounded ambition of the world’s control freaks and power trippers. Never forget.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets