Elon Musk Can’t Win

- Musk: Damned if he does, damned if he doesn’t

- The more the merrier: BRICS postmortem

- After a lousy August…

- France pays farmers to destroy perfectly fine wine

- What’s holding gold back (Cont’d)

![]() Musk: Damned if He Does, Damned if He Doesn’t

Musk: Damned if He Does, Damned if He Doesn’t

“Show me the man, and I’ll show you the crime.”

“Show me the man, and I’ll show you the crime.”

That’s the line attributed to Lavrentiy Beria, head of the Soviet secret police under Stalin.

It’s a pithy way of saying that if government officials are bound and determined to “get you,” they’ll find any pretext to do so.

And so your editor holds his nose and rises to the defense of Elon Musk.

In April, I posed the question “Musk: Savior or fraud?” I came down on the side of “fraud” — at least when it comes to the issue of free expression.

But this new federal case against one of Musk’s companies? “This lawsuit is so nonsensical it suggests a political motivation,” tweets David Sacks — who along with Musk belonged to the “PayPal mafia” in that company’s earliest days.

But this new federal case against one of Musk’s companies? “This lawsuit is so nonsensical it suggests a political motivation,” tweets David Sacks — who along with Musk belonged to the “PayPal mafia” in that company’s earliest days.

Last Thursday, the Justice Department sued Musk’s privately held SpaceX. The charge? Discrimination against job applicants who were refugees and asylum seekers.

“The lawsuit alleges that, from at least September 2018 to May 2022, SpaceX routinely discouraged asylees and refugees from applying and refused to hire or consider them, because of their citizenship status, in violation of the Immigration and Nationality Act,” said Assistant Attorney General Kristen Clarke.

Here’s the problem: Being a huge government contractor handling sensitive payloads for the Pentagon and the CIA, SpaceX is governed by ITAR or “International Traffic in Arms Regulations.”

Here’s the problem: Being a huge government contractor handling sensitive payloads for the Pentagon and the CIA, SpaceX is governed by ITAR or “International Traffic in Arms Regulations.”

The regulations are extensive and the penalties for violating them are steep, including prison time. Among those regulations are strict limits on the hiring of non-U.S. citizens. Anyone who’s not a lawful permanent resident is basically off-limits.

Curiously, there’s nothing in the Justice Department suit that claims SpaceX was discriminating against permanent residents.

Are you starting to see the dilemma Musk faces here? One of Musk’s competitors in the private space industry — Impulse Space CEO Tom Mueller — sees it clearly…

Musk affirmed that tweet: “SpaceX was told repeatedly that hiring anyone who was not a permanent resident of the United States would violate international arms trafficking law, which would be a criminal offense.”

Well, I suspected the Establishment has had a target on Musk’s back for over three years.

Well, I suspected the Establishment has had a target on Musk’s back for over three years.

Granted, he’s tangled with the feds as far back as 2018 — when he issued an infamous tweet about securing the funding to take Tesla private.

But the real trouble likely began during the pandemic. In May of 2020, Musk kept his Tesla factory in Fremont, California open — defying COVID lockdown orders from Alameda County.

By early 2022, he was tweeting “Canadian truckers rule” — lending his rhetorical support to the Canadian truckers protesting vaccine mandates.

Only days later, Tesla got a subpoena from the SEC inquiring how closely TSLA was complying with a court-ordered settlement after that “funding secured” tweet. Tesla attorney Alex Spiro said, “The SEC seems to be targeting Mr. Musk and Tesla for unrelenting investigation largely because Mr. Musk remains an outspoken critic of the government.”

And that was before Musk launched his ultimately successful bid to buy Twitter — making himself an even bigger enemy of the powers that be, even if his free-speech activism was all for show and not for go.

The Musk case is one more instance of how money and markets are increasingly operating “WROL” — without rule of law.

The Musk case is one more instance of how money and markets are increasingly operating “WROL” — without rule of law.

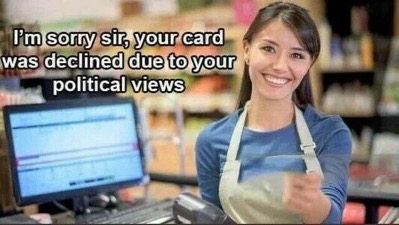

As we’ve often said, the U.S. government freezing the dollar assets of Russia’s central bank last year was a watershed. The Canadian government “de-banking” the trucker activists — denying them access to their own money — was another. What’s next?

I imagine the general topic will come up sometime on Tuesday, Oct. 3 — when the Paradigm editors all converge on Las Vegas for this year’s edition of the Paradigm Shift Summit.

Given the venue and the international escape from the dollar’s influence… this year’s theme is “Don’t Bet on the Dollar.” Of course, Jim Rickards will be speaking — and so will Byron King, Zach Scheidt, Alan Knuckman, Ray Blanco and James Altucher. Our keynote speaker — well, let’s just say he’s the authority on investing in natural resources, which will likely be your best defense against dollar debasement in the years ahead.

Oh — lil’ ol’ me will be there too, moderating a panel with Jim Rickards, Byron King and our special guest. I hope you can join me at the Bellagio on Tuesday, Oct. 3, but I have to warn you — very few seats are left. At the rate they’re going, they’ll probably run out tomorrow. Click here to claim your seat.

![]() The More the Merrier: A BRICS Postmortem

The More the Merrier: A BRICS Postmortem

“In a Multipolar World, the Dollar’s Dominance Won’t Last Forever,” says the headline to an Op-Ed in The Guardian — which is a sign that the Western mainstream is starting to come to terms with the BRICS earthquake.

“In a Multipolar World, the Dollar’s Dominance Won’t Last Forever,” says the headline to an Op-Ed in The Guardian — which is a sign that the Western mainstream is starting to come to terms with the BRICS earthquake.

If you were out of circulation last week, the constellation of Brazil, Russia, India, China and South Africa welcomed six new members — most notably Saudi Arabia. The kingdom is turning its back on the West, even if in slow-motion.

“Expanded BRICS membership does mark the beginning of the end of the petrodollar era,” says Paradigm’s Jim Rickards — who was anticipating these developments since late May.

“Membership of Saudi Arabia in the BRICS is a large step in that direction. If Saudi Arabia chooses to break the petrodollar agreement with the U.S. and sell its oil in currencies other than dollars, it will be a massive blow to America and could weaken U.S. power globally even more.

“But Saudi Arabia’s membership in BRICS is also a large step in the direction of a new BRICS currency because it will expand the size of the currency union, which is critical to making the new currency usable and liquid.”

As Jim explained on Friday, the more members of the club, the more demand there will be for a common currency.

And make no mistake, a common currency is still in the cards even if there was no Big Announcement last week.

And make no mistake, a common currency is still in the cards even if there was no Big Announcement last week.

“Material changes in the international monetary system do occur on a regular basis but none of them happens overnight,” Jim says.

He reminds us the decline of the British pound as the world’s reserve currency took 30 years — from the outbreak of World War I in 1914 until the Bretton Woods agreement of 1944.

“Sterling and dollars went back and forth as the top reserve currency during the 1920s and early 1930s. The process was interrupted by exchange controls during World War I and World War II. It was a relentless process but not especially fast.

“The BRICS will make clear their intention to move to a single currency union with a gold-linked currency in the near future. But it may take five years actually to roll out the new currency for trade settlement purposes and even longer until it solidifies into an attractive reserve currency.

“The key for investors is to see this coming and prepare now for what will inevitably result.”

Jim will definitely be talking about that at the Paradigm Shift Summit in Las Vegas on Tuesday, Oct. 3. If he takes on a different topic for his main talk, the BRICS will surely come up during our ever-popular freewheeling Whiskey Bar roundtable. (This year’s edition should be positively over-the-top with the addition of Rude Awakening editor Sean Ring!)

There’s no event quite like it — and it won’t be the same without you. Registration closes tomorrow — last call at this link.

![]() After a Lousy August…

After a Lousy August…

On the one hand, as August starts to wind down, the U.S. stock market is only 3.4% below its year-to-date peak set at the end of July.

On the one hand, as August starts to wind down, the U.S. stock market is only 3.4% below its year-to-date peak set at the end of July.

On the other hand, the U.S. stock market is no better off than it was in August 2021 — 4,425 on the S&P 500 as we check our screens.

Where from here? “Although we’ve seen a pullback over the last couple of weeks, we’re still in a pretty decent spot,” says Paradigm retirement authority Zach Scheidt. The S&P has dipped below its 50-day moving average but remains above the 200-day. To his mind, that’s “proof that the overall market trend is still bullish.

“When stocks move sharply higher (like we saw in July), people realize they have profits on the table, so they sell their positions and take profits. This creates fear in the market, which causes markets to move lower, more people to sell and so on.”

Then, he says, they step back and look at the bigger picture: “We just wrapped up earnings season, and we saw a lot of companies reporting earnings and revenue that were above expectations, meaning we had a higher-than-average beat rate. Guidance was also moved higher for many of the important companies in the market.

“This tells us that most companies are profitable and continuing to grow their profits over time. This fundamental backdrop should help to drive stocks higher over the long term.”

That includes today, building on Friday’s rally momentum.

That includes today, building on Friday’s rally momentum.

That 4,425 reading on the S&P 500 is nearly a half-percent improvement from Friday’s close. And that’s the weakest performance among the major indexes. The Nasdaq is up nearly a half percent and the Dow more than a half percent.

Gold is also staging a modest rally, up ten bucks to $1,924. Silver has added a dime to $24.32. Crude is back above $80 after bouncing off support at $77 last week — just as many chart hounds were anticipating. Bitcoin has inched back above $26,000.

For the record: If you’re a higher earner over 50, you have two more years in which to max out your 401(k) contributions tax-deferred.

For the record: If you’re a higher earner over 50, you have two more years in which to max out your 401(k) contributions tax-deferred.

As we’ve mentioned a couple of times this year, Congress voted at year-end 2022 to change the rules governing the “catch-up contributions” older workers can make beyond the usual contribution limits.

Under the original plan, workers earning over $145,000 a year would see all their catch-up contributions going into a Roth account starting next year — meaning you’d pay the taxes upfront and Uncle Sam would collect his revenue sooner rather than later.

The problem is that many 401(k) plans aren’t set up to handle Roth contributions — including about 30% of Fidelity’s 401(k) clients. Result? The only way they could comply with the new rules would be to do away with catch-up contributions altogether.

On Friday, the IRS issued new guidance: The new rule won’t take effect until 2026. That means 401(k) administrators will have an additional two years to set up their plans for Roth contributions… and higher earners have an additional two years to salt away their catch-up contributions pretax.

![]() France Pays Farmers to Destroy Perfectly Good Wine

France Pays Farmers to Destroy Perfectly Good Wine

It’s one thing to read about how the U.S. government pays farmers not to grow crops. But this is criminal…

It’s one thing to read about how the U.S. government pays farmers not to grow crops. But this is criminal…

It seems there’s a wine glut in France. Thus, the French government will shell out $216 million of taxpayer money to farmers so they can destroy their wine.

“The French agriculture ministry has obtained approval and financial support from the EU to pay so-called crisis distillation aid, which is expected to go mostly to the regions of Bordeaux and Languedoc,” says the Financial Times. “Under the programme, wine is distilled into ethanol that can be sold for industrial uses, such as perfume or hydroalcoholic gel.

“It is part of a wider government effort to help the country’s wine producers struggling to adapt to falling demand among French drinkers, competition on the export market and weaker sales in China.”

Well, those aren’t the only factors: Also in play are U.S. tariffs on European wines and even overproduction for folks stuck at home during lockdown. According to the European Commission, French domestic wine consumption is down 15% year-over-year.

Tragic…

![]() What’s Holding Gold Back (Cont’d)

What’s Holding Gold Back (Cont’d)

For today’s mailbag, we need to pick up where we left off on Friday.

For today’s mailbag, we need to pick up where we left off on Friday.

At the start of Friday’s edition, a reader characterized the outcome of the BRICS conference as a “dud” compared with Jim Rickards’ projections. I think we made a compelling case to the contrary… but the reader wasn’t done with his indictment.

“I have followed Mr. Rickards for nearly five years waiting for his gold predictions of $2,000 an ounce and way beyond with absolutely nothing even coming close. Did I mention 5 years?

“In five years we’ve had enough ‘snowflake’ events to cover the entire surface of the Earth. Very disappointed in Mr. Rickards’ predictions. I am a novice but I could have made much more money by not following his advice.”

Dave responds: I could resort to the old saw about how Jim isn’t wrong, he’s just early… but I readily recognize that’s not good enough.

So here’s what I’ll say instead.

In early 2022 I wrote at some length about what’s holding back gold. At the time — only a month after the S&P 500 set a record high — I said the historical evidence is that the dollar price of gold doesn’t take off until the stock market goes into a protracted slump, unable to exceed its previous record for years on end.

More than 18 months later, the S&P still hasn’t returned to that record high (nearly 4,800 — again, today it’s at 4,425).

If the stock market is headed into another protracted slump, on the order of 1966–1982 or 2000–2013, gold stands to do very, very well indeed — and we’re only in the first two years of a cycle that could easily run through the end of this decade. So hang on tight!

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets