Currency War Climax

- Currency War III, the final showdown

- The rally still has room to run

- The young and the restless (Chinese unemployment)

- 401(k) Nazi: No catch-up contributions for you

- Pros and cons of the draft

![]() Currency War III, The Final Showdown

Currency War III, The Final Showdown

It’s easy to lose track, even for someone like me who’s been working with Jim Rickards for nearly a decade: We remain in the midst of a currency war.

It’s easy to lose track, even for someone like me who’s been working with Jim Rickards for nearly a decade: We remain in the midst of a currency war.

Jim literally wrote the book on currency wars — his first book, 2011’s Currency Wars.

“Currency wars,” he wrote in that volume, “are fought globally in all major financial centers at once, 24 hours per day, by bankers, traders, politicians and automated systems — and the fates of economies and their affected citizens hang in the balance.”

As we mentioned on Friday, Currency Wars opens in dramatic fashion — with the Pentagon’s first-ever “financial war game,” held even as the global financial crisis was still raging in early 2009.

Jim walked senior military leaders through a two-day exercise. At the conclusion of the exercise, the Russians and Chinese teamed up on a new gold-backed currency that muscled aside the U.S. dollar as the globe’s main reserve currency.

To say the other participants in the exercise were gobsmacked would be an understatement. Fourteen years later, it’s starting to look eerily prescient.

As Jim laid out in the book, the present currency war began in 2010… and marks the third such conflict in a century…

As Jim laid out in the book, the present currency war began in 2010… and marks the third such conflict in a century…

Currency War I (1921–1936): It begins with Germany's epic devaluation of the mark. Soon, everyone is devaluing. By 1933, FDR devalued the dollar against gold, from $20.67 an ounce to $35. The war ends in 1936 with a three-way truce between the United States, Britain and France. Alas, Germany was not a party to the agreement, and a shooting war was underway by 1939.

Currency War II (1967–1987): It begins with Great Britain devaluing the pound against the dollar. Soon the dollar is under pressure, and in 1971, Nixon cuts the dollar's last tie to gold – sending the greenback on a roller coaster ride for the next 16 years. The Plaza Accord of 1985 and the Louvre Accord of 1987 lead to a new equilibrium.

Currency War III (2010–present): It begins with President Obama announcing plans to double U.S. exports in five years. The only way to make that happen is to cheapen the currency. Months later, Brazil's finance minister declares, "We're in the midst of an international currency war, a general weakening of currency."

“The traditional and fastest way to increase exports had always been to cheapen the currency,” Jim explained in Currency Wars.

“The traditional and fastest way to increase exports had always been to cheapen the currency,” Jim explained in Currency Wars.

And everyone around the world in 2010 knew it. Cheapening the currency makes your exports less expensive for foreign buyers.

As it happens, Obama’s National Export Initiative — the act that started this dirty snowball rolling downhill — fell way short of its goals. Instead of doubling by 2015, U.S. exports grew only 50%.

We recount this history, both ancient and recent, to jog your memory if you’re a longtime reader — or clue you in if you’re a newer one.

Maybe you’re a Rickards’ Strategic Intelligence subscriber — but you became familiar with his work only in the last year through his “Biden Bucks” thesis. Maybe you didn’t even know until today that we’re in the midst of a currency war.

But no matter how long you’ve been a Paradigm Press reader, you should know that…

The previous two Currency Wars lasted 15–20 years. We’re now 13 years into the current one — and it’s approaching a climax.

The previous two Currency Wars lasted 15–20 years. We’re now 13 years into the current one — and it’s approaching a climax.

With that in mind, Jim is venturing back to the Pentagon City complex in Virginia tomorrow night to host an urgent online briefing exclusively for Paradigm Press readers like you.

He’ll cover a lot of ground in less than 90 minutes, including…

- A major update to Jim’s Currency War thesis (and why this war could be set to go nuclear just a few weeks from now).

- Why “de-dollarization” efforts from China and Russia are just the beginning (and why the chaos in the currency markets is set to get much, much worse).

- Why the next few weeks may be the most disruptive in geopolitics since 1944 (and what that means for you and your investments)

- The #1 thing Jim recommends you do to protect and grow your wealth as this all plays out (This has nothing to do with the gold market. In fact, the returns on this investment could dwarf anything you could get in the gold market).

Jim’s livestream begins promptly tomorrow at 6:45 p.m. EDT. Attendance is absolutely free…and you can confirm your spot by clicking here.

![]() The Rally Still Has Room to Run

The Rally Still Has Room to Run

Earnings season shifts into second gear starting tomorrow — and it might well propel the major U.S. stock averages even higher.

Earnings season shifts into second gear starting tomorrow — and it might well propel the major U.S. stock averages even higher.

“With the current outlook,” says Paradigm income-investing specialist Zach Scheidt, “investors are largely expecting ‘bad news.’ While that may seem like it’d put a damper on the good vibes in the market, it could actually turn out to be beneficial for stocks because the bar is set nice and low.

“With low expectations, it’s easier for companies to post exciting earnings beats. This will likely energize investors and get people excited to jump into some highflying companies.”

This week, two of the eight stocks that have held up the entire S&P 500 for much of this year — Tesla and Netflix — will report their numbers.

In the meantime, the market action is quiet — the S&P 500 up a quarter percent to 4,517, another high last seen in early spring 2022.

➢ No major earnings reports today, but we have one middling economic number: The Empire State Manufacturing Index clocks in at 1.1 — just above the zero dividing line, suggesting New York state’s factory sector is growing, barely. It’s the first time this number has notched two consecutive above-zero readings since late 2021.

Grain futures are little moved despite the news that Russia is walking away from a grain-export deal.

Grain futures are little moved despite the news that Russia is walking away from a grain-export deal.

Under an agreement reached last year after the invasion of Ukraine, Russia allowed cargo ships to pass unmolested through the Black Sea from several Ukrainian ports. Almost from the start, Russia said Western nations didn’t hold up their end of the bargain, including a promise to supply grain to poorer countries.

But at last check, wheat and corn futures are down today, while soybean futures are up modestly.

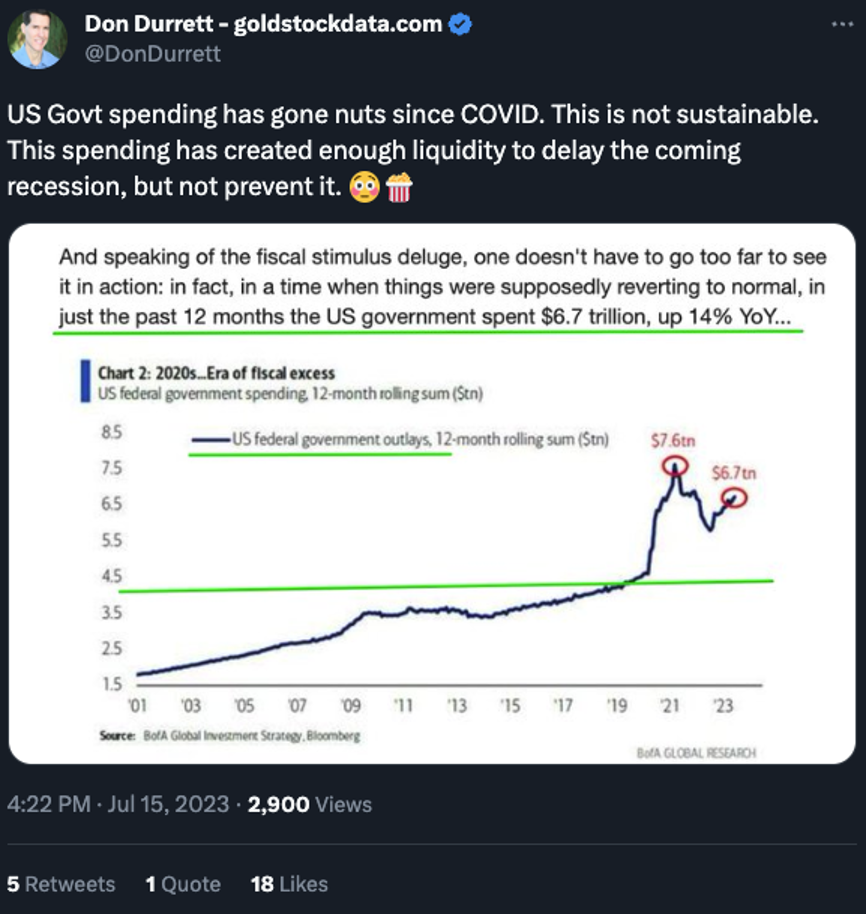

Last for our market wrap today, a reminder that, as the economist Herbert Stein said, “If something cannot go on forever, it will stop.”

Last for our market wrap today, a reminder that, as the economist Herbert Stein said, “If something cannot go on forever, it will stop.”

But in the meantime, the stock market could easily continue to sail higher. Over the weekend, renowned market technician Ari Wald from Oppenheimer was interviewed on the Financial Sense podcast. He said the environment right now is “late cycle” and not “end of cycle.”

An important distinction. Sounds about right…

![]() Chinese Unemployment: The Young and the Restless

Chinese Unemployment: The Young and the Restless

“Youth unemployment in China has hit a new record high as the country's post-pandemic recovery falters,” reports the BBC.

“Youth unemployment in China has hit a new record high as the country's post-pandemic recovery falters,” reports the BBC.

China issued a raft of economic numbers in one fell swoop today: The economy supposedly grew 0.8% during the second quarter — an anemic pace by Chinese standards.

But it’s that urban unemployment rate among the 16–24 set that’s the real eye-opener — a record 21.3%.

“This is due to factors including a mismatch between what graduates were trained to do and the jobs currently available,” says the Beeb. “Authorities have admitted that youth unemployment will probably continue to rise in the coming months, before hitting a peak around August.”

Chinese President Xi Jinping must be looking at these numbers and thinking Oh ****.

Chinese President Xi Jinping must be looking at these numbers and thinking Oh ****.

There’s a passage from Jim Rickards’ Currency Wars that jumped out at me when I read the book a decade ago. I’ve cited it several times since. If you’re a newer Paradigm reader, you’re about to encounter it for the first time.

“No one knows better than the Chinese Communist Party leadership what would happen if… jobs were not available,” Jim wrote.

“The study of Chinese history is the study of periodic collapse. In particular, the 140-year period from 1839–1979 was one of almost constant turmoil.”

1839 marked the start of the Opium Wars. 1979 marked the end of the Cultural Revolution. In between came the Boxer Rebellion, the Japanese invasion, the Great Leap Forward — basically a nonstop level of chaos no American alive today can relate to unless you’ve traveled to a war zone.

“The Chinese Communist Party leadership,” Jim wrote, “understood that the 19th-century Taiping Rebellion had begun with a single disappointed student and soon embroiled the southern half of the empire in a civil war, resulting in 20 million deaths.”

From that perspective, it was no wonder the authorities cracked down so hard on the Tiananmen Square protests in 1989.

Now? Who knows. But at least you’ve got some context for the Chinese youth unemployment statistic that you won’t find in the mainstream.

![]() 401(k) Nazi: No Catch-up Contributions for You

401(k) Nazi: No Catch-up Contributions for You

Yikes: Tens of thousands of over-50 Americans may no longer be able to make “catch-up contributions” to their 401(k)s come next year.

Yikes: Tens of thousands of over-50 Americans may no longer be able to make “catch-up contributions” to their 401(k)s come next year.

As we told you about six months ago, Congress voted at year-end 2022 to change the rules governing these extra contributions by older workers.

There was one bit of good news — an expansion of the contribution limits for workers age 60–63.

Otherwise, the news was all bad: Starting in 2024, for workers earning over $145,000, all catch-up contributions will go into a Roth account. In other words, those contributions will be taxable income. Uncle Sugar wants his revenue and he wants it now. (At least this $145,000 threshold will be indexed to inflation.)

So here’s the new twist: For some employers, implementing these rules is so onerous that they’ll have no choice but to do away with catch-up contributions altogether.

So here’s the new twist: For some employers, implementing these rules is so onerous that they’ll have no choice but to do away with catch-up contributions altogether.

This fact is buried midway through a Wall Street Journal story informing many readers for the first time about this “Rothification” of their catch-up contributions.

“Though the change is set to kick in Jan. 1,” says the article, “some companies and plan providers say they need more time to meet the logistical challenges of identifying who earned more than $145,000 the previous year and retooling payroll and other systems to ensure their catch-ups go into a Roth.

“More than 200 employers, 401(k) record-keepers and payroll providers recently sent a letter to Congress requesting a two-year delay. Signed by companies including Delta Air Lines, Anheuser-Busch and Fidelity Investments, which administers 24,800 corporate retirement accounts for employers, the letter says many won’t be able to change their systems in time to meet the deadline.

“‘For many of these plans, unless this requirement is delayed… their only means of compliance will be to eliminate all catch-up contributions for 2024,’ the letter said.”

If your 401(k) plan already offers a Roth option, you stand at least a fighting chance that your plan will be able to adjust to the new rules and you can keep making those extra contributions next year (even if they’re no longer tax-free upfront).

But at the moment, about 30% of Fidelity’s 401(k) clients do not offer a Roth. They’re the ones who really need that two-year grace period.

![]() The Draft, Pro and Con

The Draft, Pro and Con

“Do you seriously think anyone in their right mind would adhere to a draft?” begins the first of several emails we got in response to our draft query on Friday.

“Do you seriously think anyone in their right mind would adhere to a draft?” begins the first of several emails we got in response to our draft query on Friday.

“Take a serious look at the so-called military leadership — get the jab or get booted, wokeism running rampant, transgenderism if you want to be promoted.

“There is so much wrong with the U.S. military now that I doubt they could put up a decent fight if the U.S. were invaded tomorrow. No ammo, no tanks, no artillery - sent everything to Ukraine - dumb butts!

“Only crazy people would submit to such an asinine idea. I ought to know. I was on the verge of being drafted in 1969 and signed up for three years just to avoid Vietnam. I was with Special Forces Det here in Germany for two years and have since become an expat, because I hate the never-ending war machine pushed by the global elites.

“They are the ones who control the money, the government and the economy.”

Referring to the “backdoor draft” announced by Joe Biden last week, a reader writes: “As a reservist currently on my seventh mobilization since 2003 (pushing 10 years of active-duty time), I can assure you this is not new.

Referring to the “backdoor draft” announced by Joe Biden last week, a reader writes: “As a reservist currently on my seventh mobilization since 2003 (pushing 10 years of active-duty time), I can assure you this is not new.

“A draft is possible with a Democrat in office, but would be fought tooth and nail if a Republican were.

“I spent two years as drill sergeant and the worst soldiers were the ones who were forced to sign up. Eighty percent of my time was spent dealing with them and not training the rest of the soldiers.

“I oppose the draft and mandatory service for this reason alone. I don’t want to serve with slaves (people forced to serve).

“I’m a third-generation military brat. My oldest is turning 18 this year and I told her I don’t want her to enlist. I would rather she go ROTC if she is going to serve. And I’m not pushing her to consider that either.”

“As someone whose husband and father were both in the military and numerous other friends were 'drafted,' I absolutely agree that the draft should be reinstated for several reasons...

“As someone whose husband and father were both in the military and numerous other friends were 'drafted,' I absolutely agree that the draft should be reinstated for several reasons...

“America is 'grossly' short of military personnel; kids today need direction and discipline; this also teaches the 'draftees' a 'trade' and how to take care of themselves, handle money, etc., which seems to be lacking in today’s kids.

“There are many other reasons. The above are just a few.”

Dave responds: I’m legitimately alarmed by the vision you express there.

Isn’t it the job of parents to teach young people how to take care of themselves, handle money, etc.?

Don’t we have on-the-job training and a higher-education system where young people can learn to make themselves self-sufficient?

What you describe sounds like ancient Sparta — where all of civil society exists at the sufferance of a military establishment. No thanks…

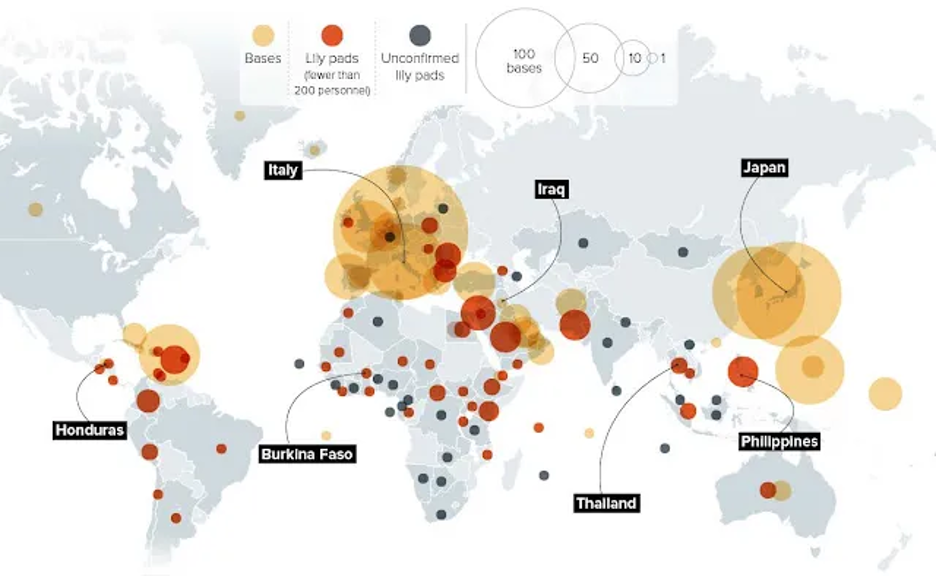

“Israel, Austria and Switzerland have conscription (universal mandatory military service), as do many countries in the Middle East and East Asia.

“Israel, Austria and Switzerland have conscription (universal mandatory military service), as do many countries in the Middle East and East Asia.

“I was one of the last in the U.S. facing the draft. I found that military training and service are outstanding at bringing all sorts of Americans together into a common effort, starting with basic training. It also imparts patriotism and love of country without actually saying it.

“Whether you do active duty for two–four years, or reserves and National Guard for eight years, it’s a very important opportunity in life to learn more about your country and yourself.

“The current environment is not healthy – many people have grown into adulthood without the benefits that military service brings. That is a needless security risk, and lost learning, teamwork and education opportunities for millions of Americans.”

Dave responds: Israel, Austria and Switzerland (let’s throw in Singapore, too) are all countries of fewer than 10 million people “which follow the classical precept that citizenship is inexorably interwoven with defense of the community,” wrote the historian William F. Marina in 1998.

The United States, in contrast, is a far more heterogeneous country of 340 million — an empire whose leaders are obsessed with “power projection” all over the globe…

Agreed that “the current environment is not healthy.” But I have far less faith than you that the state is capable of restoring it to good health.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets