March Market Madness

![]() March Market Madness

March Market Madness

It was one of those events “no one could possibly see coming” — except someone did.

It was one of those events “no one could possibly see coming” — except someone did.

In a few weeks, it’ll be the second anniversary of an event that shook markets badly, if briefly — the collapse of Silicon Valley Bank.

SVB was the marquee event in a cascade of bank failures during that spring of 2023 — the second, third and fourth largest in U.S. history. Oh, plus the Swiss giant Credit Suisse.

Reminder: You personally were harmed by these failures even if you weren’t a customer of these banks.

Reminder: You personally were harmed by these failures even if you weren’t a customer of these banks.

Because SVB had many politically connected depositors, the feds waived the $250,000 limit on FDIC deposit insurance — which was a huge drain on the FDIC’s insurance fund.

To help replenish that fund, the feds ordered a “special assessment” on all banks — a cost passed along to you in the form of higher fees, commissions and anything else you pay your bank.

What if you could have made money knowing in advance that turmoil was coming for the banks and the markets in March 2023?

What if you could have made money knowing in advance that turmoil was coming for the banks and the markets in March 2023?

To be clear, I’m not talking about “insider information” that would land you in court and ultimately a stay at Club Fed. This is totally aboveboard.

Some backstory: The previous autumn, in 2022, Paradigm Press executive publisher Matt Insley met a fellow at one of Maryland’s top country clubs.

During a presentation to our leadership team, this individual pinpointed a date when the trouble would begin — “Financial damage on March 7.”

“Around the office we made light of it,” Matt recalls. “it was a playful joke. In December we were talking about ‘March 7.’ In January, ‘March 7’… in February, ‘March 7’...”

But it was no joke. The “damage” became apparent first thing in the morning on March 8: Silvergate Bank announced it was liquidating operations.

Thus began the cascade: On March 9. depositors tried to withdraw $42 billion from Silicon Valley Bank. SVB’s share price collapsed 60%. Bank stocks as a group tumbled 7%. The following day, California regulators stepped in to shut the joint down and the FDIC swung into action.

Perhaps you’ve already figured out who made this prescient call.

Perhaps you’ve already figured out who made this prescient call.

If you subscribe to our premium advisory The Map, you know it’s Mason Sexton.

If you don’t yet subscribe, you should know this is only one in a series of brilliant calls over a 45-year career.

In fact, the methodology that went into Mr. Sexton’s 2023 forecast is the same methodology he used to predict the crash of 1987 — still the biggest one-day percentage loss in stock market history.

“If I had to guess the final top,” he said in advance, “I’d say first or second week of October… that would precede a correction of 15–20% minimum.”

OK, so it turned out to be the third week — the Dow plunging 22.7% on Oct. 19. No matter: Anyone who followed his seven specific recommendations leading up to that day fared very well indeed.

But forget about the past — what about the future?

But forget about the past — what about the future?

Well, the second anniversary of the 2023 bank failures is coming up fast. And a few days later, March 14, is the date Uncle Sam is staring at a government shutdown — potentially one more serious than previous episodes. And the next Federal Reserve meeting and policy statement comes on March 19.

But the date that Mason says you should write down is March 20.

“I believe March 20 is an important date where we could see a very important trend change,” he says.

Again, if you’re already a subscriber to The Map, you’re already clued in to what we’re talking about — and you’ll want to keep up with Mason’s regular updates between now and then.

If you’re not a subscriber… you’ll really want to consider becoming one. Today. After all, there’s barely a month to go until March 20.

Watch now… learn why this is such a make-or-break date… and how you can seize the moment.

![]() Congress’ Tax Deadline: 316 Days

Congress’ Tax Deadline: 316 Days

What follows is the latest in what will be a series of reminders throughout 2025 that the current income tax rates expire at year-end.

What follows is the latest in what will be a series of reminders throughout 2025 that the current income tax rates expire at year-end.

The current rates came into effect with the “Tax Cuts and Jobs Act” enacted during Donald Trump’s first term.

If Congress does nothing by year-end, the brackets revert to Obama-era levels. That’s how Congress wrote the law to make all the budget math work out over time.

If you’re in the 22% bracket now, you’d be back to 25%. Not to mention that if you stopped itemizing when the bigger standard deduction took effect, you’d probably have to start itemizing again.

So where does everything stand? Here’s Bloomberg with the state of play this morning: “President Donald Trump backed a House budget plan calling for a $4.5 trillion tax cut, slapping back Senate Republicans’ efforts to rush through funds to help bolster his immigration crackdown in favor of a larger bill that will likely take months to negotiate.”

The original legislation eight years ago also took months to negotiate, also with the GOP in charge of both houses of Congress.

Trump didn’t sign it into law until Dec. 22, 2017 — 11 months after taking office and only 10 days before its provisions took effect. This time might well be down to the wire, too…

But that’s all in the future. Today the market chatter is once again about tariffs.

But that’s all in the future. Today the market chatter is once again about tariffs.

Trump says he’s looking at 25% or higher tariffs on cars, semiconductors and pharmaceuticals. Coincidentally or not, the major U.S. stock indexes are in the red, if only slightly. The S&P 500 sits at 6,126, a mere three points off yesterday’s record close.

A similar story for precious metals — losing ground, but not dramatically. Gold sits at $2,926 and silver at $32.56. Crude’s weak rally continues, now $72.71. Bitcoin did a “pop and drop” within the last 24 hours and is now just over $96,000.

Later today the Federal Reserve will issue the minutes to its most recent meeting at the end of January — a document designed to telegraph the Fed’s intentions for the next meeting next month. If there’s anything significant, we’ll pass it along tomorrow.

![]() Lies, Damn Lies and Statistics

Lies, Damn Lies and Statistics

File this one under “How it started… How it’s going.”

File this one under “How it started… How it’s going.”

The first of those Politico screenshots was from Oct. 10 of last year. It was one of many, many similar headlines and stories we chronicled periodically going back to the spring of 2022…

As an honest lefty on Twitter responded back then, “I think Democrats should run on the slogan ‘Actually the economy is great and you’re wrong to be upset.’”

Turns out that was the Democrats’ position right up to Election Day 2024. The statistics are all good! Why don’t people appreciate everything we’re doing for them?! For a while, they were grousing about a “vibecession.”

Anyway, an economist named Eugene Ludwig says it turns out the statistics weren’t so good after all.

Anyway, an economist named Eugene Ludwig says it turns out the statistics weren’t so good after all.

Ludwig was U.S. comptroller of the currency under Bill Clinton before launching a global consulting firm in 2001; he sold it to IBM in 2016.

Sample paragraph from his Politico article published on Feb.11…

I don’t believe those who went into this past election taking pride in the unemployment numbers understood that the near-record low unemployment figures — the figure was a mere 4.2% in November — counted homeless people doing occasional work as “employed.” But the implications are powerful. If you filter the statistic to include as unemployed people who can’t find anything but part-time work or who make a poverty wage (roughly $25,000), the percentage is actually 23.7 percent. In other words, nearly one of every four workers is functionally unemployed in America today — hardly something to celebrate.

Gee, whaddya know — that real-world unemployment rate more or less lines up with the one from Shadow Government Statistics that we used to play up in these pages.

(Alas, ShadowStats’ founder has dialed back on his research in recent years — which is why we seldom mention it anymore.)

Ludwig steers clear of value judgments, mostly sticking to the numbers in his piece. He does say when he ventures outside Washington, D.C. on business, he notices “cities that appeared increasingly seedy” and “regions that seemed derelict” — observations that don’t square with the official numbers.

The lefty journalist Eoin Higgins, responding to Ludwig’s article, is more scathing — and more on-point. As he writes on X, “I think a lot of liberal econ discourse reaction is driven by fundamental snobbery and paternalism about the working class.”

Yep…

![]() Solar Flares Foul up Farming

Solar Flares Foul up Farming

It was a significant blow for American farmers — and it had nothing to do with financing or the weather.

It was a significant blow for American farmers — and it had nothing to do with financing or the weather.

At least not the weather as we usually think about it.

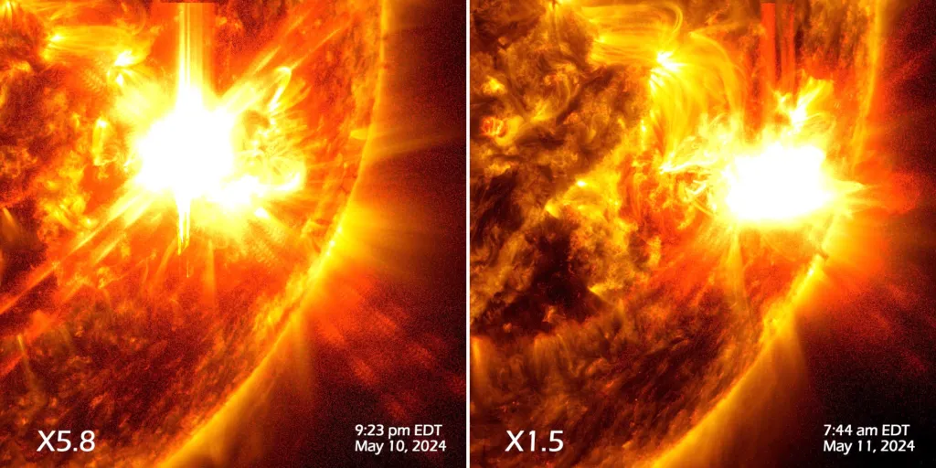

On May 10–11 last year, dozens of solar flares launched a series of five “coronal mass ejections” toward the Earth. The result was the biggest geomagnetic storm to hit the planet in two decades.

The sun was angry last May. [NASA Solar Dynamics Observatory images]

Usually when scientists study these phenomena, they focus on only the most extreme events — such as the 1859 “Carrington event” that fried the early telegraph network, or the 1989 geomagnetic storm that knocked out power to much of Quebec.

“Now researchers are examining the impact on the fields of precision agriculture, satellite operations, aviation and the electric grid,” says a report from SpaceNews magazine.

The geomagnetic storm last May forced many U.S. farmers to delay planting “because the storm disrupted the global navigation satellite systems that guide their tractors with centimeter-level accuracy, allowing them to distribute seeds and fertilizer in precise locations.

“Making matters worse, because few tractors relied on space-based navigation during the previous storm of similar magnitude, the Halloween storms of 2003, many farmers did not have a viable contingency plan.”

Kansas State farm economist Terry Griffin pegs the losses at $500 million. “That’s a conservative estimate,” he said last month at a conference of the American Meteorological Society in New Orleans. “It’s clearly going to be more than that.”

And the impacts extend well beyond agriculture. The whole piece is worth a read, if you’re interested in that sort of thing.

The good news is that we’re at more or less the peak of the current 11-year solar cycle. Expect the frequency and/or intensity of solar storms to start waning within a few months…

![]() Mailbag: Revaluing Gold, New Crypto ETFs

Mailbag: Revaluing Gold, New Crypto ETFs

“OK Dave, leave us hanging with that gold comment without Jim Rickards' input,” a reader writes after yesterday’s edition.

“OK Dave, leave us hanging with that gold comment without Jim Rickards' input,” a reader writes after yesterday’s edition.

“I'm hoping when nothing is found or an unreconciled amount is discovered at Fort Knox that gold finally goes parabolic. Like to hear what Jim has to say about this.”

Dave responds: Jim is busy traipsing through India — the nation-state that’s deftly navigating the divide between Washington on the one hand and Beijing-Moscow on the other. We eagerly await his report.

Here’s the thumbnail sketch: Jim’s said for years that it’s within the Treasury’s power to revalue the gold in its possession. It’s currently valued at $42.22, a relic of the chaos that ensued when President Nixon cut the dollar’s last tie to gold in 1971.

“Nixon said the suspension of convertibility was ‘temporary,’” Jim recalled in these digital pages on the 50th anniversary in 2021.

“I spoke with two of the officials present at Camp David with Nixon the weekend of the announcement, Paul Volcker and Kenneth Dam. They both confirmed to me that the suspension was meant to be temporary.

“The plan was to have a new Bretton Woods-style conference, devalue the dollar against gold (and against other currencies such as the yen, the Deutsche mark and French francs) and then return to the gold standard at the new valuations.

“The first part happened — there was an international financial conference in Washington, D.C., in December 1971 — but the rest did not. While the world was waiting for the conference, countries moved to floating exchange rates without reference to gold.”

The conference revalued gold in stages, starting at $35 and ending at $42.22. And that’s where it’s sat ever since.

Revaluing the gold stash to the current spot price would render — give or take — another $750–800 billion to the Treasury.

Not much in the scheme of a $36.2 trillion national debt. But it’s a start?

We’ll have Jim weigh in on the matter once his travel schedule settles down…

After our special holiday crypto edition Monday — in which James Altucher anticipated the arrival of ETFs linked to Solana and XRP — a reader inquires…

After our special holiday crypto edition Monday — in which James Altucher anticipated the arrival of ETFs linked to Solana and XRP — a reader inquires…

“If the launch of these two ETFs does indeed come to pass later this year, will they be a basket of mixed crypto products lumped into one share of stock?

“If so, and their main thesis is based on XRP’s and Solana's value, would it be more prudent to obtain those two cryptos independently rather than being diluted by other non-proven or less- performing cryptos by bundling them into a shotgun approach?

“Thank you in advance for your insight and thoughtful reply.”

Dave: So far, the applications submitted to the SEC are for straightforward ETFs linked to a single crypto — not a basket.

At this juncture, the agency has until mid-October to make a decision. But that decision could come sooner. James will keep his ear to the ground, and we’ll keep you posted…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets

P.S. Congratulations to Altucher’s Investment Network subscribers for bagging 340% gains on SoundHound AI (SOUN) after less than 18 months.

“We definitely had a good run with SOUN,” says James Altucher, “but the AI revolution is far from over. There will no doubt be more amazing wins as we move into the future of AI.”

Indeed there are. If you don’t yet subscribe to an Altucher publication, Altucher’s Investment Network is the perfect place to start — especially now, for reasons James lays out at this link.

P.P.S. If you’re wondering… yes, James will be back at the SXSW event in Austin, Texas this year… and yes, once again he’ll be doing a livestream for his readers. We don’t have a date and time nailed down yet, but watch this space…