AI Bull Run: Three More Years?

![]() The Bull Market Is Not Over

The Bull Market Is Not Over

If you had any doubts about whether the present bull market still has legs, this morning’s Wall Street Journal should lay those doubts to rest. It absolutely still has legs.

If you had any doubts about whether the present bull market still has legs, this morning’s Wall Street Journal should lay those doubts to rest. It absolutely still has legs.

Really, a story like this was almost inevitable — the S&P 500 closing last week within a hair of its Jan. 23 record.

The article begins thus: “Investors are fearful that some market gains are outpacing typical measures of underlying value after strong economic growth helped power the S&P 500 to record after record in a nearly two-year bull market.”

Just lame.

“Investors?” All of them? Which investors? This attribution — or lack thereof — is as sketchy as when Fox News invokes “Some say…”

“Underlying value”? Since when did that start to matter? Besides, the price-earnings ratio on the S&P 500 is still comfortably below its most recent peak in late 2020.

Here’s the point of this little rant: You don’t see headlines and stories like this when “the top is in.”

Here’s the point of this little rant: You don’t see headlines and stories like this when “the top is in.”

The time to worry is when you don’t see headlines and stories like this — when the consensus narrative is that trees grow to the sky and nothing can possibly go wrong.

The analogue is the peak of the dot-com bubble in early 2000: Apart from a few far-seeing contrarians (who of course were dismissed as cranks), almost no “investors” were worried about “underlying value” because traditional metrics like revenue and earnings had supposedly been rendered meaningless by clicks and eyeballs.

We’re not there.

In fact, if you compare the AI-fueled bull market to the dot-com bull market of the late ’90s… you could make a case that the current bull still has three years to go.

In fact, if you compare the AI-fueled bull market to the dot-com bull market of the late ’90s… you could make a case that the current bull still has three years to go.

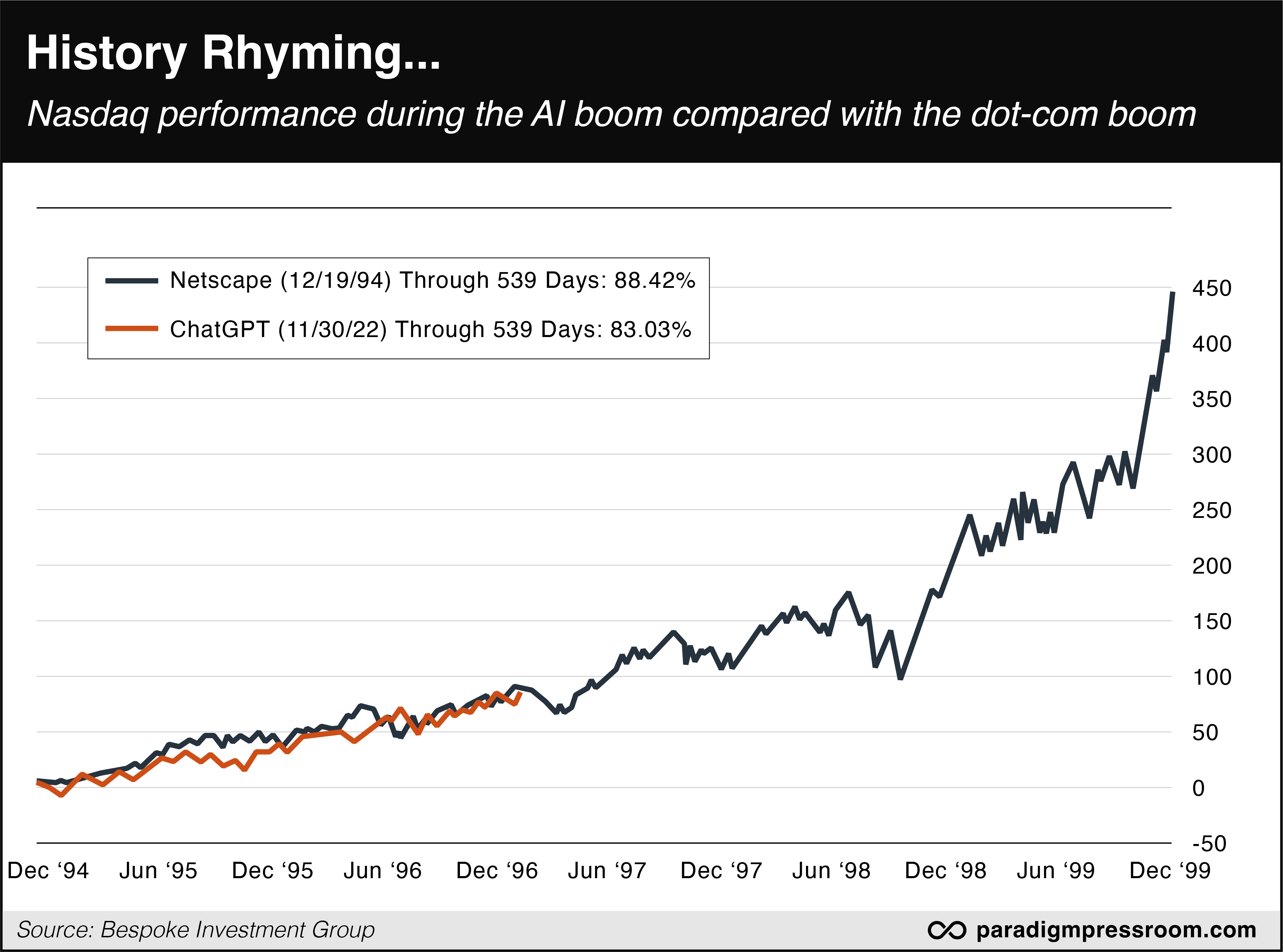

Paradigm’s trading pro Enrique Abeyta spotted the following chart from Bespoke Investment Group, comparing the Nasdaq Composite index during the two eras.

It sets the starting point of the dot-com boom with the launch of the Netscape web browser in December 1994. And it sets the start of the current boom with the launch of ChatGPT 3.5 in November 2022…

Uncanny, huh? In both cases, a gain of over 80% in a little over two years.

“So far, the charts of the stock market performance have lined up almost identically,” says Enrique.

No guarantees that the current bull has three years to run, he cautions: “I can’t say for certain if the market is still in the early innings of this AI bull run (as the chart implies) or if it’s in the later innings.”

But that’s not the point: “In either case, the stock market can go a LOT higher from where it’s at now.”

Indeed, take a look at the final blowoff top of the dot-com bubble on that chart.

“From the end of November 1999 to the end of February 2000, the Nasdaq Composite went from 3,000 to almost 4,500,” Enrique says. “That is a 50% move in just three months.

“For last five years, I have said that we will know when this bull market is truly over — and it will be AFTER we see this kind of move.”

Again, we’re just not there. You’ll know we’re there when stories like today’s front-page splash in the WSJ are nowhere to be found.

“Every time it appears the market will lurch lower based on news or economic data, buyers swoop in and save the day,” chimes in Paradigm chart hound Greg Guenthner.

“Every time it appears the market will lurch lower based on news or economic data, buyers swoop in and save the day,” chimes in Paradigm chart hound Greg Guenthner.

That said, don’t be surprised to see a dip materialize in the next two weeks. “The back half of February tends to be bumpy,” he says.

“After enjoying a seasonally favorable start to the year, the SPDR S&P 500 ETF (SPY), on average since 1994, drops a percentage point during the final two weeks of the month.

“The Nasdaq-100 fares even worse, averaging a 0.28% loss on the month. In fact, the large-cap tech index is halfway through its third-weakest month of the year, behind September and December.”

But those are very near-term concerns. “No matter what,” Greg concludes, “I don’t see a reason to fight this tape until something breaks.”

Greg’s Trading Desk subscribers are happy with the last three weeks of results, that’s for sure — gains of 102%… 158%... and 248%... all materializing in 20 days or less.

If you’re not among the ranks of Greg’s subscribers yet, we urge you to check out this urgent message from our customer service director.

![]() Meta’s Hot Streak

Meta’s Hot Streak

Staying with the tech theme, “Meta is starting to feel like the tech equivalent of Joe DiMaggio,” observes Davis Wilson of our sister e-letter The Million Mission.

Staying with the tech theme, “Meta is starting to feel like the tech equivalent of Joe DiMaggio,” observes Davis Wilson of our sister e-letter The Million Mission.

Baseball aficionados know well that Joltin’ Joe ran up a hitting streak of 56 consecutive games in 1941 — a record that still stands.

In that same vein, Mark Zuckerberg’s Meta Platforms (META) has risen for 20 consecutive trading days.

It’s become the stuff of memes…

Actually, the run-up began the week before Inauguration Day. Never let the facts get in the way of a good meme, right?

In any event, “this is now the longest winning streak in the history of the Nasdaq-100 going back to 1990,” says Davis. “During this surge, Meta’s stock has climbed over 17%, pushing its market capitalization above $1.8 trillion.”

If you’ll recall last Thursday’s edition, we pointed out that Meta belongs to a group of four names we dubbed the MAMA stocks — Meta along with Alphabet (Google), Microsoft and Amazon.

All four are dumping tens of billions of dollars into data centers and power generation for AI. And when all four reported their quarterly numbers recently, Meta was the only one whose share price responded positively.

What makes Meta stand apart from the others is “its execution, its dominant market position and most importantly its early AI investments paying off in a big way,” Davis says.

What makes Meta stand apart from the others is “its execution, its dominant market position and most importantly its early AI investments paying off in a big way,” Davis says.

“While other tech giants like Microsoft and Alphabet are still figuring out how to monetize their AI spending, Meta has already integrated AI into its core business — improving how it targets and measures ads.

“The result? Faster revenue growth and a higher average revenue per user (ARPU).”

That’s why Wall Street isn’t punishing Zuck for planning to spend $65 billion on AI projects this year.

As we check our screens, Meta’s streak is in danger of ending today — but “I still believe Meta has room to grow,” Davis says. “The company’s AI investments continue to yield real, measurable results, and its advertising business remains a juggernaut.

“While short-term traders may look at the impressive win streak and suggest the stock is overbought, I see long-term upside as the fundamentals remain rock solid.

“If there’s any short-term weakness, I’d view it as a buying opportunity rather than a reason to panic.”

By the way, Davis has a big announcement in store for his readers tomorrow. If you’re among them, check your inbox at 8:00 a.m. EDT for the subject line, “Extremely Rare 5X Return Opportunity.” And if you’re not among them, you can sign up for free access at The Million Mission’s homepage. (Yes, you will get the name and ticker symbol tomorrow morning FREE.)

Not much excitement to the major U.S. stock averages as a new week begins. Precious metals, however, are another story.

Not much excitement to the major U.S. stock averages as a new week begins. Precious metals, however, are another story.

At last check none of the big indexes budged more than a tenth of a percent. At 6,117 the S&P 500 is now a point away from last month’s record close.

But gold has vaulted over the $2,900 level to start the week — the bid up about 1% to $2,926 at last check. Silver, alas, isn’t keeping pace — up 0.6% to $32.56. The HUI index of gold stocks is also posting an anemic gain, now 328.

Crude has rallied 55 cents to $71.29. Bitcoin is stuck in the mud under $96,000.

![]() The DOGE Boys Descend on Fort Knox?

The DOGE Boys Descend on Fort Knox?

Well, if the Trump administration is trying to achieve more transparency about the mysterious workings of the federal government… yes, the gold at Fort Knox is fair game.

Well, if the Trump administration is trying to achieve more transparency about the mysterious workings of the federal government… yes, the gold at Fort Knox is fair game.

There seems to be momentum behind unleashing Elon Musk and the DOGE boys on the big gold stash in Kentucky.

The ZeroHedge account on X got it going with this post on Saturday: “It would be great if Elon Musk could take a look inside Fort Knox just to make sure the 4,580 tons of U.S. gold is there. Last time anyone looked was 50 years ago in 1974.”

And that was only a photo op — as we chronicled on the 50th anniversary last year. According to the folks at the Sound Money Defense League, “The last somewhat credible examination of Fort Knox's gold was in 1953.”

In between online arguments with his latest baby mama, Musk piped up: “Surely it’s reviewed at least every year?”

Sen. Rand Paul (R-Kentucky) immediately jumped in...

Musk seems receptive to the idea — even suggesting a live video walkthrough.

The results could be intriguing. As Rude Awakening editor Sean Ring quips on the Paradigm internal e-chat, “It’ll be like when Geraldo Rivera opened Al Capone’s vault in Chicago — empty.”

More likely, perhaps, is that the gold is there — but that its ownership is in question.

More likely, perhaps, is that the gold is there — but that its ownership is in question.

As Paradigm’s metals-and-mining authority Byron King says, “An audit is more than just picking up each bar, weighing it, testing for purity, etc. It ought to involve forensics as well.”

See, it’s an open question whether Uncle Sam has “leased” these bars to commercial banks, who in turn sold that gold to Asian buyers — a complex ruse to keep a lid on the dollar price of gold.

“Has the gold been leased out? Other claimants?” Byron muses. “I suspect that the U.S. doesn't allow bars to exit the facility, but the legal claims of ownership could make for interesting stories.”

Already the buzz surrounding the Fort Knox audit is taking on a life of its own. Speculation abounds online that the audit would be a precursor to the U.S. government “revaluing” its gold to take a whack out of the national debt.

That’s a story our own Jim Rickards has been on since at least 2017. But today’s not the day…

![]() The 48-Hour Rule, Reaffirmed

The 48-Hour Rule, Reaffirmed

Once more we have an illustration that when it comes to investing, it doesn’t pay to have a knee-jerk reaction to whatever Donald Trump says.

Once more we have an illustration that when it comes to investing, it doesn’t pay to have a knee-jerk reaction to whatever Donald Trump says.

In recent weeks we’ve had reason to revive “Knuckman’s law” — coined by Alan Knuckman, Paradigm’s eyes and ears at the Chicago options exchanges.

You can also call Knuckman’s law the 48-hour rule: Don’t react to anything Trump says for 48 hours. Give events that much time to shake out.

Last Thursday, the president told reporters, “One of the first meetings I want to have is with President Xi of China and President Putin of Russia, and I want to say let’s cut our military budget in half. And we can do that, and I think we’ll be able to do that.”

Sure enough, military stocks dropped. The iShares U.S. Aerospace & Defense ETF (ITA) slipped 0.87% Thursday… and another 0.97% Friday.

But today as we write, it’s up 1.22% — solidly in the middle of its trading range going back the last four weeks.

That’s not to say Trump’s idea isn’t worth doing. On the contrary.

Writes Rand Paul’s father, retired Rep. Ron Paul (R-Texas): “I very much hope that President Trump follows through with his plan to drastically reduce our bloated military budget. We can start by closing the hundreds of military bases overseas, bringing back our troops from foreign countries and eliminating our massive commitments to NATO and other international organizations.”

![]() Mailbag: Gaza, Ukraine…

Mailbag: Gaza, Ukraine…

Speaking of U.S. interventions overseas, reaction continues to pour in to last Wednesday’s edition…

Speaking of U.S. interventions overseas, reaction continues to pour in to last Wednesday’s edition…

“Dave, I don’t always agree with you, but when it comes to these overseas wars, you are spot on.

“I was born in 1953, and I cannot think of a single war in my lifetime that helped this country. Vietnam, Iraq, Afghanistan. All these wars did was kill and maim Americans, cost us billions of dollars and made most of the world dislike us. Every politician pushing for war should have a rifle put in their hands and sent to the front lines. Maybe they would learn.”

Writes another: “Regarding your overall point about Gaz-a-Lago (nice one there), I saw it clearly and agreed with you, for what it's worth. I just don't see how this fits in with America first, let alone the fact that for the excellent reasons you laid out, it's just a very bad idea inviting potentially serious blowback if he's arrogant enough to go through with another self-inflicted wound on the level of Ukraine. Unfortunately, I have full confidence that he is…

“Speaking of that ongoing and festering wound,” the reader continues, “I must agree that contrary to his campaign promises, chances are we will not see a quick resolution of the Ukraine debacle.

“Speaking of that ongoing and festering wound,” the reader continues, “I must agree that contrary to his campaign promises, chances are we will not see a quick resolution of the Ukraine debacle.

“If he was serious about that he'd have cut any and all funding immediately, and furthermore issued a very clear and blunt directive that the deep strikes from Ukraine into Russia using Western-supplied munitions were to cease the second he took office.

“I read about another deep strike shortly after his inauguration. Sadly, I fear it will be choice No. 2 — the escalation to make this Trump's conflict — so there will be plenty more unnecessary bloodshed, and for what?

“I cannot agree more with those who've stated that anyone advocating for war, or even the funding of it, should be required to gear up and report to the front lines for combat duty. See how quickly most wars would end, if they even started.”

Dave responds: As we write, U.S. and Russian delegations have wrapped up four-plus hours of talks in Saudi Arabia — talks led by Secretary of State Marco Rubio and Russian Foreign Minister Sergei Lavrov.

Neither side revealed much of substance afterward. Lots of niceties and generalities. Which is fine for the time being.

Let’s hope and pray the U.S. “strategy” isn’t the one described here on the Sunday talk shows…

Back to Gaza — and this fellow is not alone in his sentiments…

Back to Gaza — and this fellow is not alone in his sentiments…

“Methinks you misread and overreacted to Trump's Gaza ‘resort’ plan; you need to reread The Art of the Deal and some of the other ‘how it's done’ manuals by old Don. The guy is just maneuvering all the players into position to try something else instead of just more of the same old ‘diplomacy’ that always gets more people killed.

“Take a deep breath, calm down. You rarely are off target. Keep looking up.”

Dave: I still fail to see what any of it has to do with “America first.”

Too, put yourself in the shoes of a servicemember whose deployment the president said might be “necessary” to carry out the expulsion of 1.8 million people. Even if you knew it was just a negotiating tactic, how would you feel about being made a pawn in that way?

A short note from our final correspondent today: “Good critique. What is your solution?”

A short note from our final correspondent today: “Good critique. What is your solution?”

Dave:Withdraw all 40,000 U.S. troops stationed in the Middle East and issue a statement of regret for every U.S. intervention in that part of the world going back to the Iranian regime-change op in 1953.

Well, you asked…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets