Financial Forewarnings (Trump Assassination Attempt)

![]() The Financial Omen Before the Shots Were Fired

The Financial Omen Before the Shots Were Fired

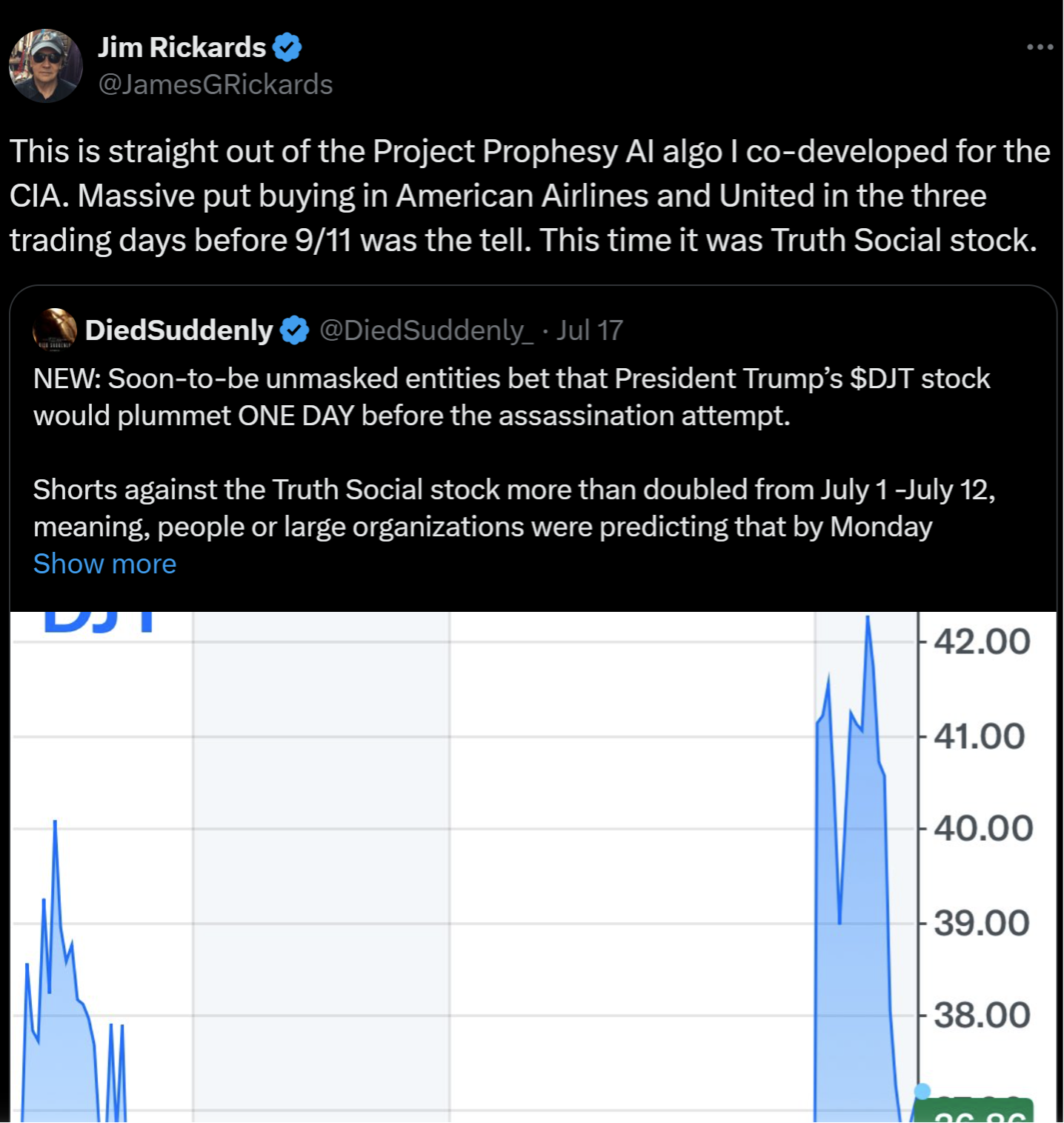

There were hints in the days before the first assassination attempt on Donald Trump that something big was about to go down. And those hints appeared in the stock market.

There were hints in the days before the first assassination attempt on Donald Trump that something big was about to go down. And those hints appeared in the stock market.

Short interest in Trump Media (DJT) — that is, bets the share price would fall — spiked shortly before the gunman opened fire on Saturday July 13.

As Paradigm’s Jim Rickards puts it, “People or large organizations were predicting that by Monday [the 15th] the stock would plummet, something that undoubtedly would have occurred had President Trump died in Pennsylvania,

“This could mean some had foreknowledge of the plot against President Trump’s life and tried to profit off the coming calamity.”

For Jim, there were eerie parallels to the days leading up to the 9/11 attacks in September 2001. He even mentioned it on X-formerly-Twitter…

For Jim, there were eerie parallels to the days leading up to the 9/11 attacks in September 2001. He even mentioned it on X-formerly-Twitter…

We’ll talk more tomorrow about the backstory with Project Prophesy (spelled with an “s”) — which Jim developed with other financial experts for the CIA in the years immediately after 9/11.

Suffice it to say there was massive buying of put options on American and United Airlines in the three trading days before the attacks.

As we chronicled late last year, similar action in the iShares MSCI Israel ETF (EIS) showed up in the days before the Hamas attack inside Israel on Oct. 7, 2023.

![]() Markets Today: China Stimmies vs. Glum Consumers

Markets Today: China Stimmies vs. Glum Consumers

The day’s news is pushing the market up… and pulling it down at the same time.

The day’s news is pushing the market up… and pulling it down at the same time.

On the pushing-up side: "China's central bank unveiled a broad package of monetary stimulus measures to revive the world's second-largest economy,” says Bloomberg — “underscoring mounting alarm within Xi Jinping's government over slowing growth and depressed investor confidence."

In recent days, Paradigm experts were noting on our internal e-chat that Chinese stocks were starting to take off. The iShares China Large-Cap ETF (FXI) put in a meaningful bottom two weeks ago at $25.46. The ETF rallied 8.7% through yesterday’s close… and it’s up another

6.9% as we write this morning at $29.58.

Easy money from a major central bank was enough to push the U.S. stock market up to start the day, but then a half-hour later…

… came the pulling-down side: The monthly consumer confidence numbers from the Conference Board absolutely stunk up the joint — falling from 105.6 in August to 98.7 in September. That’s the steepest one-month drop in three years.

Blame it in large part on a softer job market at the same time inflation fears are not abating:

Confidence is especially poor among people ages 35–54 and earning less than $50,000 a year.

And with that, the major U.S. stock indexes are little moved from yesterday’s close.

And with that, the major U.S. stock indexes are little moved from yesterday’s close.

For the S&P 500, yesterday’s close was a record. Checking our screens, it’s down less than a point at 5,718. The Nasdaq is slightly in the red, the Dow is about a quarter-percent in the green.

It’s the commodity complex that’s on the move today, thanks to that hefty Chinese “stimulus.” Gold is up nearly $17 to $2,644. Silver is up 2.75% to $31.45.

Meanwhile, crude is up nearly 2% to $71.63, a three-week high. In addition to the prospect of more demand from China, it seems that the Pentagon ordering more U.S. troops to the Middle East — it won’t say how many — is finally waking up traders to the potential for disrupted supply as Israel steps up its attacks in Lebanon.

![]() Rural Depression = Rising Food Prices?

Rural Depression = Rising Food Prices?

Rural America hasn’t been this despondent since the early days of COVID lockdowns in 2020.

Rural America hasn’t been this despondent since the early days of COVID lockdowns in 2020.

The Rural Mainstreet Index compiled by Creighton University economist Ernie Goss clocks in for the month of September at 37.5. Any reading below 50 suggests a shrinking rural economy, and this number’s been mired below 50 for 13 straight months.

Goss compiles the index from a survey of bank CEOs in agriculture- or energy-intensive rural areas of a 10-state region stretching from Wyoming east to Illinois. He blames the current poor reading on “weak agriculture commodity prices, sinking agriculture equipment sales and elevated input costs.”

Uncertainty about the fate of the farm bill in Congress can’t be helping matters. Recently a coalition of 300 farm-industry groups issued a warning that if nothing is passed, U.S. farmers will have trouble getting credit to keep operating in 2025, in light of a “farm economy that has taken a downward spiral.”

Yes, these groups are pleading for special favors at taxpayer expense. Today’s not the day to get into the weeds of America’s fouled-up farm policy. All we’re saying is that if a meaningful number of farms shut down next year for lack of operating capital, that’s not going to help alleviate food-price inflation.

![]() The Fort Knox Photo Op 50 Years Later

The Fort Knox Photo Op 50 Years Later

We’re a day late marking an interesting 50th anniversary…

We’re a day late marking an interesting 50th anniversary…

On Sept. 23, 1974, the Treasury Department staged a dog-and-pony show at Fort Knox, Kentucky — where a substantial portion of the government’s gold stash is located.

Access was strictly limited: “A few gold bars in one of the bullion depository's 15 vault compartments were shown to members of Congress and some journalists,” recalls Chris Powell of the Gold Anti-Trust Action Committee. “This did nothing to verify that the rest of the U.S. government's 8,133 tonnes of gold reserves were still in the government's possession.”

According to the folks from the Sound Money Defense League, “the last somewhat credible examination of Fort Knox's gold was in 1953.”

Supposedly the gold is audited every year, but the feds keep the information closely held. As we chronicled in 2017, independent researchers managed to get their hands on a paltry 134 pages of documents — and those only raised more questions than they answered.

In retrospect, it’s fascinating that this event was staged only a few weeks after President Richard Nixon’s resignation on Aug. 9, 1974.

In retrospect, it’s fascinating that this event was staged only a few weeks after President Richard Nixon’s resignation on Aug. 9, 1974.

Watergate and Vietnam had sapped Americans’ trust in “the system.” It had been barely a decade since the JFK assassination and only three years since Nixon cut the dollar’s tie to gold, with highly inflationary consequences.

The powers that be must have felt they had to do something, however small, to make Americans believe they didn’t live in a corrupt and decaying banana republic.

Also figuring into the mix, perhaps, was this: Days after Nixon’s resignation, President Gerald Ford signed a bill making it legal once again for Americans to own gold bullion. It had been verboten ever since FDR issued his gold-confiscation orders in 1933.

In any event, questions still swirl: We don’t buy into conspiracy theories that, for instance, the gold bars were replaced with gold-coated tungsten bars. But it’s an open question whether Uncle Sam has “leased” these bars to commercial banks, who in turn sold that gold to Asian buyers — a complex ruse to keep a lid on the dollar price of gold.

As Powell muses, “The bigger question about the U.S. gold reserve may be not whether there is still metal in Fort Knox but rather how many entities have a claim to it.”

![]() An Inflationary Mailbag

An Inflationary Mailbag

“I liked your article on inflation, but stocks are still the only game in town,” a reader writes after yesterday’s edition.

“I liked your article on inflation, but stocks are still the only game in town,” a reader writes after yesterday’s edition.

“You should compare a good stock account with money in the bank or in a CD where you not only lose from less value to the dollar, but also there is no growth. There are several REITs that give good income and good growth.”

Dave responds: Assuming 8% average annual growth in the stock market, you’re right, 5% on a CD or a money market fund doesn’t compare. (And that 5% will be coming down now that the Fed is cutting short-term interest rates.)

There are times when the stock market is the only game in town — but not all the time.

We spilled a lot of digital ink on the 1970s yesterday because that’s the most extreme example from the post-WWII era of poor returns aggravated by losses from inflation. But there are others that are more recent.

At the peak of the dot-com bubble in early 2000, the S&P 500 sat just over 1,500. The index bottomed in late 2002 and touched 1,500 again in late 2007 — only to collapse again amid the global financial crisis.

After bottoming once more in early 2009, the S&P didn’t return to 1,500 until early 2013. Only then did it leave that level behind for good.

That’s 13 years of going nowhere — before you account for inflation. If you’d put $1,000 into the S&P at the top in early 2000, you’d have waited over 16 years to break even in terms of purchasing power.

Every asset class has its season — stocks in times of prosperity, gold in times of inflation, cash in times of recession, bonds in times of deflation. (Treasury bonds were the only place you wanted to be during the “panic vortex” of the financial crisis in the fall of 2008.)

Of course, there will always be individual stocks that outperform the broad market no matter the season. Identifying them is one of our missions around here!

“The inflation and consumer price data published are indeed scary,” writes one of our longtimers, “but in evaluating its impact we seem to omit the fact that inflation affects prices of all things, i.e., including wages and income of any kind.

“The inflation and consumer price data published are indeed scary,” writes one of our longtimers, “but in evaluating its impact we seem to omit the fact that inflation affects prices of all things, i.e., including wages and income of any kind.

“So when the talk turns to purchasing power, this makes a huge difference.

“A couple of mathematicians developed the ‘time value of prices’ formula to address this and concluded that most things are more affordable today than they were years ago. It measures prices by the time one has to work to earn that item.”

Dave responds: Ah yes, the Pooley-Tupy theorem. I have little time or patience for it.

I understand the concept. The problem with the formula is the same problem that afflicts many government statistics: They don’t jibe with people’s lived experience. They don’t jibe with the fact that one wage earner could provide a middle-class lifestyle for a family a few decades ago and now it takes two.

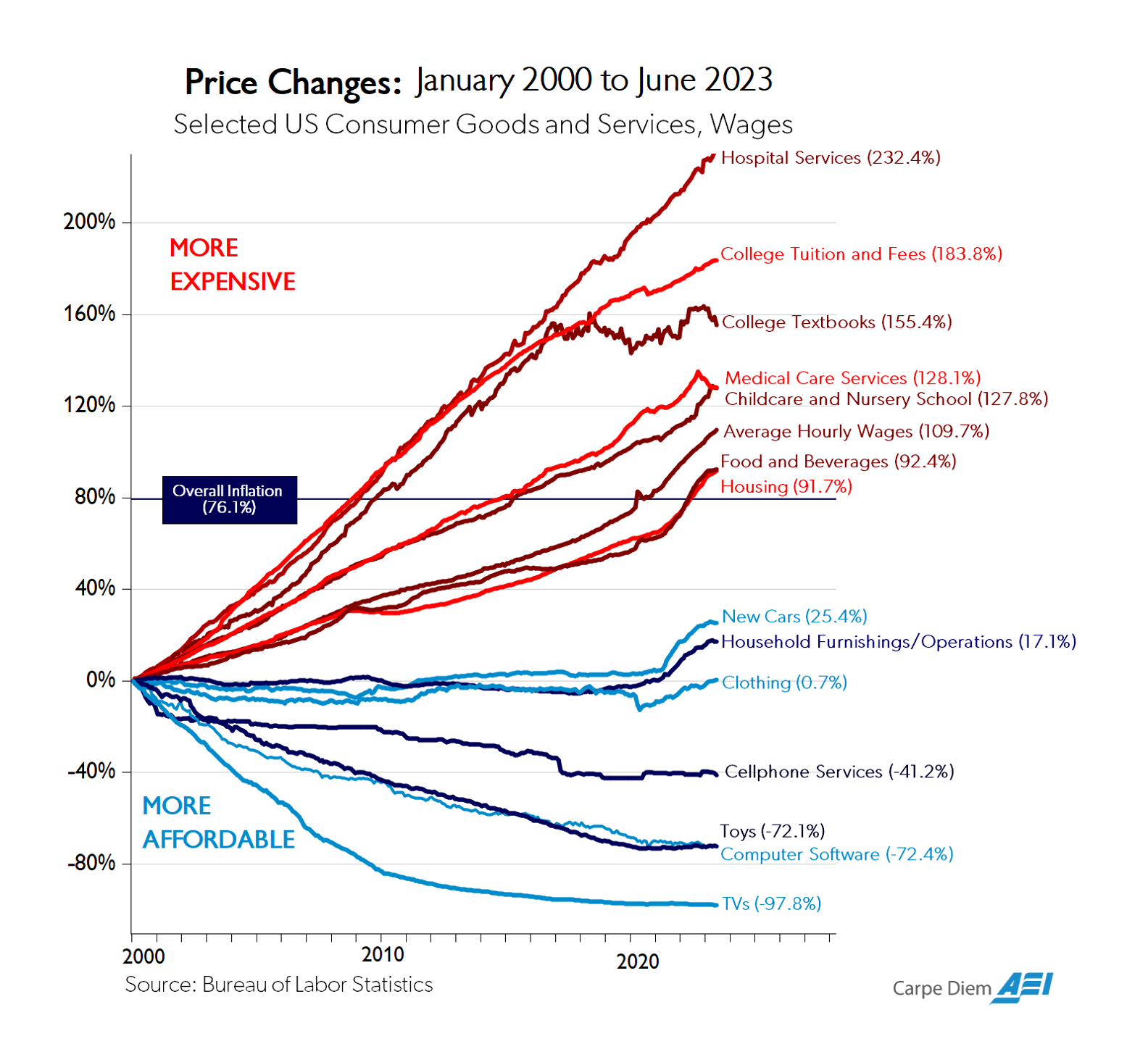

In particular, Pooley-Tupy does not account for the ruinous increase in prices for health care and higher education — both industries controlled by crony-capitalist cartels. Cheaper TVs and cheaper cellphone service don’t really make up for it — as we see in the excellent chart from American Enterprise Institute economist Mark Perry that we run now and then…

Tupy and Pooley try to sidestep the health care elephant in the room by pointing out that cosmetic surgery is getting cheaper relative to wages.

True. Cosmetic surgery also operates largely outside the health care cartel.

Health care spending took up 5% of GDP in 1960 — when only a few percent of adult Americans had some sort of chronic condition. In 2022, it took up 17.3% of GDP — and over half of adult Americans have a chronic condition.

Whatever you want to call that, it’s not “progress.”