MAMA

![]() Where’s the Love for the MAMA Stocks?

Where’s the Love for the MAMA Stocks?

Maybe it’s no longer useful to think of the “Magnificent 7” as one group.

Maybe it’s no longer useful to think of the “Magnificent 7” as one group.

➢ Sorta funny when you consider its origins with a movie made way back in 1960 starring Yul Brynner and Steve McQueen. Would it have even caught on were it not for the 2016 remake with Denzel Washington and Ethan Hawke?

The Mag 7 were the companies that roared back strongest from the tech wreck of 2022 — Apple, Microsoft, Alphabet (Google), Meta (Facebook), Amazon, Tesla and Nvidia.

Aside from being megacaps and being tech-adjacent, there’s not much the Mag 7 have in common. Consider just three of them…

- Apple, as we’ve been saying for nearly a decade now, is no longer a go-go growth company. It’s a mature, dividend-paying stalwart — the Coca-Cola of tech. (Indeed, Warren Buffett owns substantial slugs of both AAPL and KO.)

- Tesla operates in the very capital-intensive business of building automobiles. Its market cap is many multiples of any other automaker. An investment in TSLA is a bet that its technology will dominate the realm of self-driving vehicles

- Nvidia is the lone semiconductor name in the bunch. It had the good fortune of making chips for hardcore gaming computers, chips that just happened to be robust enough to handle the demands of AI as well.

Not much in common there, right?

Ah, but then there are the other four. And within just the last year, they’ve come to share much in common.

Ah, but then there are the other four. And within just the last year, they’ve come to share much in common.

I doubt the term will ever catch on, but for our purposes today we’ll call them the MAMA stocks — Microsoft, Alphabet, Meta, Amazon.

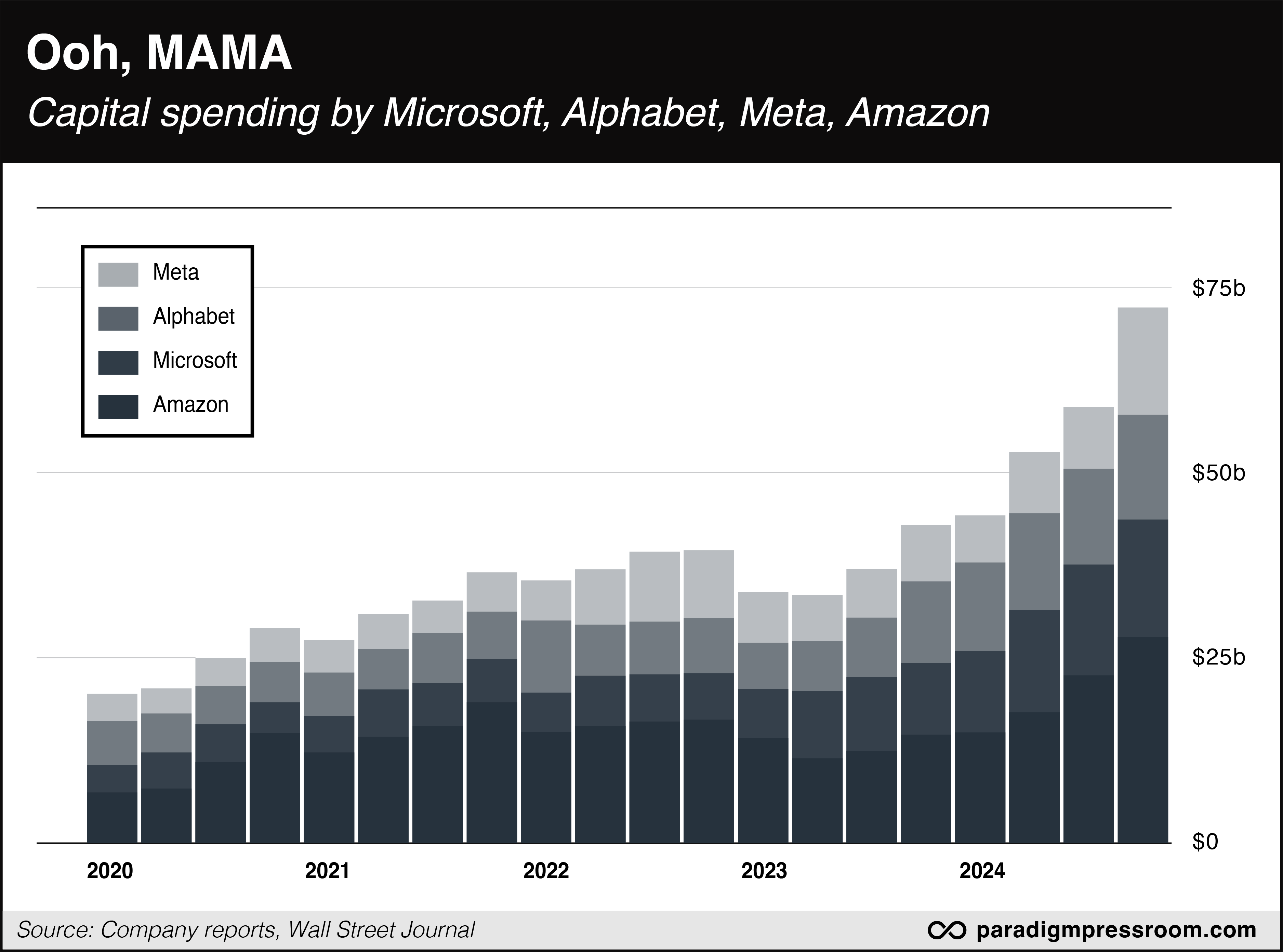

For a long time, all four generated fat profit margins with a minimum of “capex” or capital spending. It didn’t cost that much to invest in server farms and comfy office digs with espresso bars and yoga studios. The major costs were personnel and software development.

No more.

With the advent of AI, the MAMA companies are pouring tens of billions into data centers… and the electricity to power them… and the water to cool them.

Look at how the spending took off last year…

If you’ve been keeping up with these 5 Bullets, you know all that spending came into question last month with the arrival of the upstart Chinese AI engine called DeepSeek.

Assuming DeepSeek is everything it’s cracked up to be, all that spending might be money down the drain: If DeepSeek’s model can achieve nearly the same results as ChatGPT with a fraction of the computing power and cost… it calls into question all of that capex by the MAMA companies.

As it happened, all the MAMA companies reported their quarterly numbers within a few days of DeepSeek shaking up the tech universe.

None of them indicated they would take their foot off the gas. The bars on that chart will stay high or go even higher.

The share prices of Microsoft and Alphabet got pummeled the day after they reported. Amazon took a hit too, though not as severely. Only Meta was rewarded by Mr. Market for its guidance through the rest of the year.

Going forward, the prospect for the MAMA stocks is simply too much of a black box. Every day brings a new headline suggesting DeepSeek either is or isn’t everything its creators claim it is.

What to do?

As it happens, the cloudy outlook for the MAMA companies coincides with what Paradigm’s AI and crypto authority James Altucher says is a $30 trillion shift in U.S. stocks.

As it happens, the cloudy outlook for the MAMA companies coincides with what Paradigm’s AI and crypto authority James Altucher says is a $30 trillion shift in U.S. stocks.

And it begins tomorrow — when a mysterious government file starts making its way around Wall Street.

It was James who anticipated a major shift into Big Tech 14 years ago. It was fun while it lasted… but here in 2025, he predicts we’ll see a new breed of stocks shoot up 1,000% in just a year.

And it all comes back to that strange document. You don’t want to be left in the dark; click here and James will show you how to capture maximum upside from this $30 trillion shift.

![]() Trump’s Vietnam Moment

Trump’s Vietnam Moment

Donald Trump’s phone call to Vladimir Putin yesterday is not the end of the Russia-Ukraine War. It might not even be the beginning of the end.

Donald Trump’s phone call to Vladimir Putin yesterday is not the end of the Russia-Ukraine War. It might not even be the beginning of the end.

To be sure, the Trump administration is shifting its stance: Yesterday at the annual Munich Security Conference in Germany, Defense Secretary Pete Hegseth said NATO membership for Ukraine is off the table.

“Hundreds of thousands of people would still be alive had Biden been willing to say this three years ago,” tweets the independent journalist Aaron Mate.

“Instead, Biden refused, fueled a proxy war, presided over Ukraine's decimation and then turned around and said that Ukraine isn't ready to join NATO anyway. It was all a bait and switch with one goal only: use Ukraine to bleed Russia.”

But much remains up in the air: Treasury Secretary Scott Bessent is in Ukraine this week, promising U.S. aid will continue in exchange for U.S. access to Ukraine’s rare-earth minerals — much of which lie under territory now controlled by Moscow.

Bessent said continued U.S. aid sends a “strong signal to Russian leadership of the U.S. commitment” to Ukraine — which sounds an awful lot like something a Biden administration official would say.

“Trump can’t afford to become consumed by Ukraine if he wants to achieve the rest of his agenda on trade, immigration and real growth,” says Paradigm’s macroeconomics maven Jim Rickards.

“Trump can’t afford to become consumed by Ukraine if he wants to achieve the rest of his agenda on trade, immigration and real growth,” says Paradigm’s macroeconomics maven Jim Rickards.

The moment the war broke out nearly three years ago, Jim said the Biden administration’s unprecedented sanctions on Moscow were doomed to fail.

Events since have borne that out: “The Russian economy is growing faster than the U.S. economy,” says Jim, “its currency has stabilized at a level not far from where it was when the war began and unemployment is near an all-time low. The Russian economy is on a war footing and operating near full capacity with the ability to manufacture advanced weapons that the West cannot.

“The Central Bank of Russia has done a good job of fighting inflation and Russia benefited enormously by building 25% of its reserves in physical gold that cannot be frozen or seized by the West.”

As for the risk facing Trump now, Jim invokes a Vietnam analogy.

As for the risk facing Trump now, Jim invokes a Vietnam analogy.

It was Democrat Lyndon Johnson who first sent the Marines splashing ashore at Da Nang in 1965… but it became Republican Richard Nixon’s war after 1969. And Democrats were happy to hang it on him.

As Jim sees it, Trump has three choices…

- “Basically, agree to Putin’s terms with some face-saving measures.

- “Keep fighting, which will continue indefinitely and end in Ukraine’s collapse.

- “Escalate, which will push the world closer to World War III.

“Most of the advocates for choice 3 have been swept from the playing field,” Jim goes on. “They include warmongers like Victoria Nuland, Antony Blinken, Jake Sullivan and agencies like USAID.

“Choice 1 is the only rational path given Trump’s other priorities and the fact that he has doubts about the conduct of the war in any event. Choice 2 will soon convert the war from Biden’s war to Trump’s war.

“The danger is that Trump’s advisers will seek an improved version of choice 1 and will end up defaulting in choice 2 in order to get there. That will lead nowhere. We will end up in Trump’s war.”

![]() Wall Street Shrugs off Higher Inflation

Wall Street Shrugs off Higher Inflation

Another day, another hot inflation number.

Another day, another hot inflation number.

The producer price index shows that inflation at the wholesale level is now running at a 3.5% annual clip. The “expert consensus” of Wall Street economists was figuring on 3.2%. That’s not a small miss.

And this is worse: A year ago, wholesale inflation appeared to be under control at 1.0%. Now it’s running at the fastest pace in nearly two years.

Today’s release comes on the heels of yesterday’s consumer price index — revealing the official inflation rate has galloped higher in the last four months, from 2.4% to 3.0%.

So much for any more interest rate cuts by the Federal Reserve — at least during the first half of 2025. Trading in the futures market this morning suggests the earliest the next cut might come is the end of July.

But like yesterday, Mr. Market is taking the hot inflation number in stride.

But like yesterday, Mr. Market is taking the hot inflation number in stride.

At last check, all the major U.S. stock indexes are in the green — the Dow the weakest, the Nasdaq the strongest, the S&P 500 splitting the difference. The S&P is up over a half percent to 6,085 — about a half percent below its record close on Jan. 23.

Whether it’s inflation or tariffs, Mr. Market is unbowed. “Every time it looks as if we're in for a bigger drop, buyers step in,” says Paradigm chart hound Greg Guenthner. “That's important information! Do not ignore what the market is telling us here!

“So far, the major averages are up as earnings announcements continue to stack up. The averages look constructive on the daily charts. The popular themes that have worked for traders so far this year continue to work. Altogether, it’s very difficult to get immediately bearish here until we see some evidence that points to lower prices.”

➢ Follow up from Tuesday: Elon Musk now says he’ll drop his $97.4 billion bid for OpenAI if Sam Altman and crew cancel their plans to convert OpenAI to a for-profit model. To be continued…

![]() Comic Relief

Comic Relief

A brief chuckle before we open an overstuffed mailbag…

A brief chuckle before we open an overstuffed mailbag…

![]() Mailbag: 9/11 x 10

Mailbag: 9/11 x 10

The overall reaction to yesterday’s single-topic edition was… peculiar.

The overall reaction to yesterday’s single-topic edition was… peculiar.

There was, as I expected, a handful of people who were triggered. They submitted lengthy emails trying to educate me about the history of the Levant and why one side is good and true and the other side is implacably evil.

That wasn’t the point. The point was that “Gaz-a-Lago” is not in keeping with an America first agenda.

There was one individual who thought I was being disrespectful of Donald Trump — but that’s no different than the treatment I gave Joe Biden or Trump 45 or Barack Obama. (Perhaps Monday’s edition was more to her liking?)

There was one person who seems to think I ran afoul of Godwin’s Law because I made a brief parenthetical reference to Adolf Hitler. OK then…

There were a couple who wondered what any of this had to do with the economy and the markets — even though I recounted the financial fallout of the 9/11 attacks in the course of anticipating a “9/11 x 10” incident.

There was a 9/11 “truther” who wanted to weigh in because of course.

And there were a handful who just wanted to do a little gratuitous Trump-bashing.

Still another: “You keep on telling us to wait (at least) 48 hours to act on or react to Trump's outrageous pronouncements. You're not following your own advice.”

On the contrary, I waited an entire week — specifically to see whether he would walk back or double down. He doubled down. Only then did I figure it was time to grapple with the topic.

On to the more substantive/relevant emails that came in…

“I appreciate the straightforward honesty of this article,” writes one.

“I appreciate the straightforward honesty of this article,” writes one.

“Although I consider myself a conservative former Republican, it's actions like that that always worried me about Trump.

“Although I love hearing about the AI direction and the drive to aggressively move forward, there are many more actions that concern me that this president will take. I don't agree with the tariff decision and although he assured America of inflation reduction he is now blaming Biden for inflation that is going up while he is president.

“Anyway, my point is that I appreciate a very informative and honest article. I have been frustrated with all of the stock videos and articles that have praised the president's recent decisions without expressing the concerns of potential wars and inflation. These actions are not making America great.”

“I do generally support the Israelis — it's a tough neighborhood,” writes another — with a caveat.

“I do generally support the Israelis — it's a tough neighborhood,” writes another — with a caveat.

“When I worked on Capitol Hill, the only lobby one could never criticize was AIPAC (American Israel Public Affairs Committee). If AIPAC summoned a member of Congress, the member immediately cleared their calendar and made themselves available. AIPAC was mentioned in hushed tones only. Very disconcerting.”

Dave responds: More recently, the fiercely independent Rep. Thomas Massie (R-Kentucky) told Tucker Carlson that every Republican member of Congress other than himself has an “AIPAC babysitter” to ensure they act in the interests of the Israeli government. “It’s the only country that does this.”

AIPAC spent about $400,000 to try to knock him out of the primaries last year, but to no avail. Massie won with 75%.

”I'm not too surprised with Trump's suggestions,” says our final correspondent.

”I'm not too surprised with Trump's suggestions,” says our final correspondent.

“He does not know the history of the region and likely has all the perceptions of Israel and Palestine that are propagated on Fox News. I don't think Trump has any personal ill will toward the people of Palestine or particularly understands what he suggested.

“As for accusations of 4D chess, Trump often floats ideas then gauges the reaction to them to see if that is what people want or not. Hardly anything beyond comprehension, and also why I don't put too much weight on everything he says.

“I think putting Trump in a room with someone like Norman Finkelstein would quickly change his mind on trying to resettle the people who live in the region. Trump is a surprisingly quick learner; last I heard after a call with President Putin, Trump has come away with a different view of what's been happening on the ground in Ukraine.

“I don't have too high of expectations that Trump will finally end all violence in the region, but I'm optimistic that when it comes down to it, he'll at least not break his promises and send more Americans soldiers to forever wars on the other side of the world.”

Dave: Finkelstein? Heck, I’d be happy if he engaged with Jeffrey Sachs — which he kinda-sorta did last month when he reposted a clip from a Sachs interview with Tucker Carlson.

Inscrutable, for sure…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets