Stargate

![]() Stargate: Smoke and Mirrors?

Stargate: Smoke and Mirrors?

It was a brilliantly staged photo op. It was also fraudulent — and in the end, meaningless.

It was a brilliantly staged photo op. It was also fraudulent — and in the end, meaningless.

Less than a year into his first term as president in 1993, Bill Clinton invited Israeli and Palestinian leaders to Washington, D.C. to sign an interim peace agreement. Maybe you remember the image…

Bill Clinton’s Potemkin peace deal

Understand, Slick Willie had nothing to do with negotiating the deal — which had been in the works for two years.

All that mattered to him were the “optics” of being seen as Israeli Prime Minister Yitzhak Rabin shook hands with PLO leader Yasser Arafat. Low-information voters half-watching their TVs from the next room would simply assume Clinton was the brilliant leader who made it all possible.

The photo op was a sham and in the end so was the agreement itself. The Palestinians got no closer to having a nation-state of their own, while Rabin so enraged Israel’s right wing that he was assassinated two years later.

Clinton’s sham comes to mind in light of another boomer president’s photo op yesterday…

Clinton’s sham comes to mind in light of another boomer president’s photo op yesterday…

Because you can’t tell the players without a program… the fellow standing next to Trump is the Japanese tech billionaire Masayoshi Son, CEO of SoftBank Group. “Masa” paid a call on Trump at Mar-a-Lago last month, promising to invest $100 billion in the United States over four years.

Next to Son is Larry Ellison, chairman of Oracle, and Sam Altman, CEO of OpenAI.

“OpenAI and SoftBank on Tuesday said they would launch a massive U.S. artificial intelligence infrastructure project, in a move Donald Trump lauded as a ‘declaration of confidence in America,’” reports the Financial Times.

“OpenAI and SoftBank on Tuesday said they would launch a massive U.S. artificial intelligence infrastructure project, in a move Donald Trump lauded as a ‘declaration of confidence in America,’” reports the Financial Times.

“The joint venture, dubbed Stargate, plans to spend $100 billion on Big Tech infrastructure projects, with the figure rising to as much as $500 billion over the next four years, the groups said.” The number of new jobs is pegged at 100,000.

Like the Israeli-Palestinian agreement of the early ’90s, this venture had been in the works well before the president arranged a photo op to take the credit. The tech website The Information reported on the plans in March of last year — all the way down to the $100 billion figure and the “Stargate” name.

Also like the Israeli-Palestinian agreement 30-odd years ago, the details going forward are hazy. “It was not immediately clear how Stargate would obtain funding,” says the FT, “but one person involved in the project said they intended to bring on additional investors.” Likewise The Wall Street Journal says “key elements” of the scheme “remain vague.”

Another uncomfortable parallel comes to mind, this one from Trump’s first term — the Foxconn factory.

Another uncomfortable parallel comes to mind, this one from Trump’s first term — the Foxconn factory.

Trump sought the credit as Foxconn, the Taiwanese electronics giant, announced plans to build a factory making TV and computer screens in the Wisconsin congressional district of House Speaker Paul Ryan. The promise was 13,000 jobs paying an average $53,900 a year plus benefits.

Less publicized was the $3 billion in subsidies Foxconn would get from the state of Wisconsin — which we said at the time worked out to $230,000 per job.

Eighteen months after the announcement in 2017, the plans were already falling apart.

By 2021, Wisconsin Public Radio reported that “roughly 2,500 acres of land in Mount Pleasant remain in a state of construction, marked with unfinished buildings — land that was once peoples’ homes, before they were forced out to make way for the company.”

Last year, Microsoft announced it would build a data center on the site — but now those plans are on hold. Hmmm…

![]() Two Constraints on AI (and All of Digital Tech)

Two Constraints on AI (and All of Digital Tech)

Back to the present: Stargate, and AI in general, faces two huge constraints that digital technology has never grappled with — until now.

Back to the present: Stargate, and AI in general, faces two huge constraints that digital technology has never grappled with — until now.

The first is one we chronicled throughout 2024 — an electric grid whose capacity is no greater now than it was in 2011.

Which was fine as long as the technology industry made steady efficiency improvements. But that’s over now: By one estimate, a typical data center’s computing power needs to double every three months just to keep pace with AI’s demands.

➢Just in: Here’s a fresh reminder of the demands AI is putting on the grid. Amid a cold snap on the East Coast, the grid operator PJM Interconnection is under stress. PJM serves 65 million customers in a region that includes “Data Center Alley” in Virginia, the biggest concentration of data centers in the country. Under an emergency alert just issued by PJM, its member utilities are barred from sending electricity to neighboring power grids. For the moment, PJM does not anticipate resorting to power rationing.

The other new constraint on digital technology’s advancement is less widely known, but no less important — a rising cost of borrowed money.

The other new constraint on digital technology’s advancement is less widely known, but no less important — a rising cost of borrowed money.

Interest rates move in decades-long cycles — 40 years up, 40 years down, give or take. IBM’s introduction of the first mass-market personal computer in 1981 coincided almost perfectly with a secular peak in interest rates — 15.8% on a 10-year U.S. Treasury note.

From that peak, it was generally down for the next four decades — not a straight line, of course, but a steady trajectory. The tech industry was able to ride that wave all the way down; any debt they took on for startup or expansion could be refinanced later at a lower interest rate.

But those days are over. It’s safe to say the bottom of that falling-rate cycle came in August 2020, when the 10-year T-note yielded a paltry 0.5% (and the work-from-home crowd had just loaded up on all the electronics they’d need for a few years).

This morning, the 10-year yield is almost 4.6%. We’re in the early years of a new 40-year cycle of rising interest rates.

Little wonder that it’s “not immediately clear” where Stargate’s funding will come from or who the “additional investors” might be.

Don’t get the wrong idea: Not every AI investment is destined to be a loser. AI has immense potential to change life for the better. But between a rickety power grid and rising interest rates, it won’t be easy money.

The Paradigm team will keep eyes open for the best-of-breed opportunities. And they probably lie somewhere other than in Stargate. (We’ll keep tabs on Stargate’s progress, much as we did with Foxconn…)

![]() After $100K Bitcoin, What’s Next?

After $100K Bitcoin, What’s Next?

On the plus side of the ledger, the new president is moving quickly to bring some order and predictability to crypto.

On the plus side of the ledger, the new president is moving quickly to bring some order and predictability to crypto.

Yesterday, his acting SEC chair “launched a crypto task force dedicated to developing a comprehensive and clear regulatory framework for crypto assets,” says an SEC press release.

At the head of the task force will be SEC commissioner Hester Peirce — widely seen as the most sensible and pro-crypto commissioner during the Biden years, when the now-departed chair Gary Gensler threw as many roadblocks in crypto’s way as possible.

With that sort of reassurance — uhh, the TRUMP memecoin notwithstanding — crypto assets are holding onto their recent gains, Bitcoin just over $104,000 as we write.

But take Trump out of the equation: What does Bitcoin’s price action suggest about the path forward?

But take Trump out of the equation: What does Bitcoin’s price action suggest about the path forward?

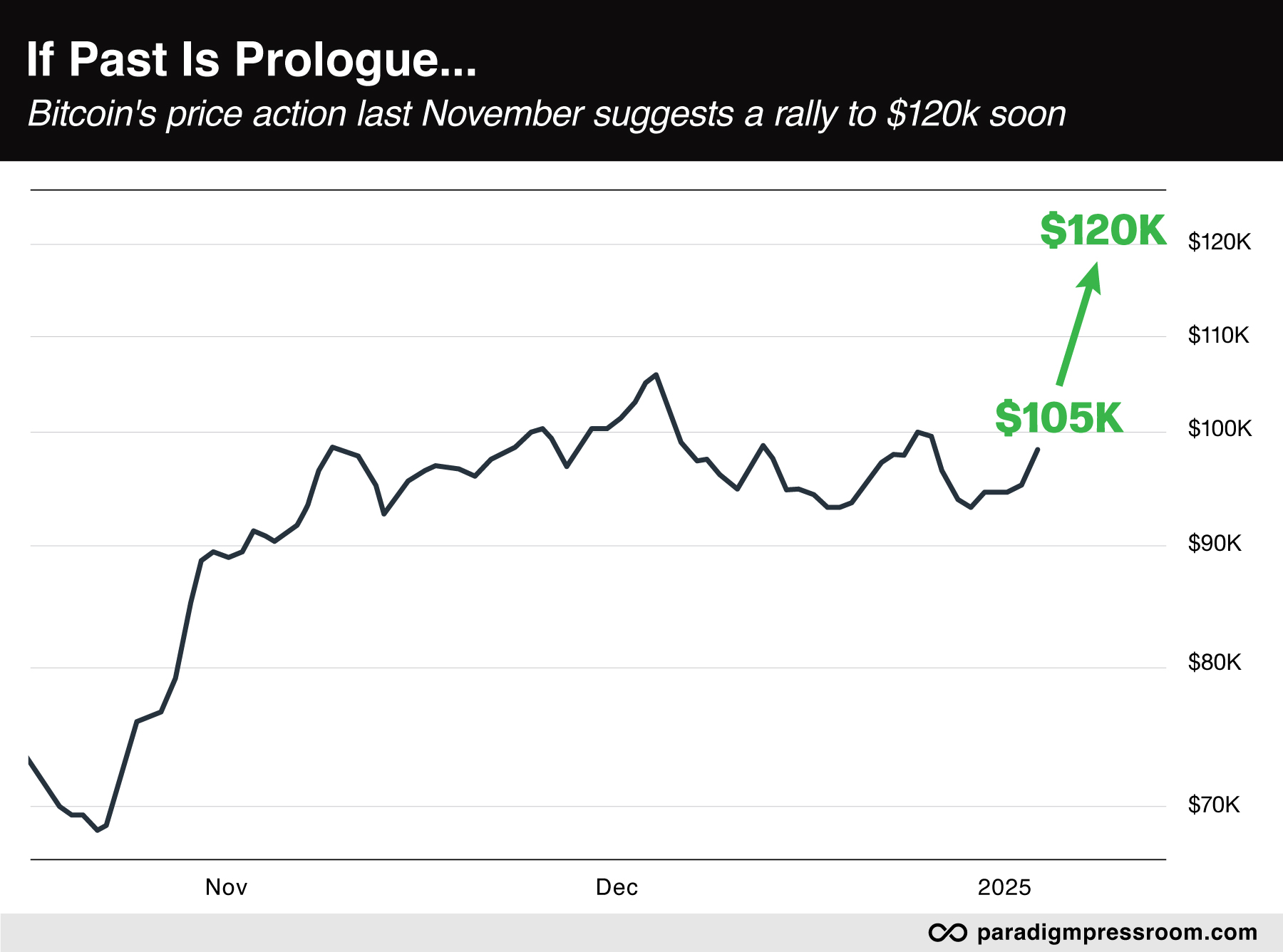

“Bitcoin has essentially traded in a sideways range since late November as it marched to its first breakout above $100K,” says Paradigm chart hound Greg Guenthner. “Now that it’s beginning to turn higher again, we can begin plotting price targets in anticipation of an upside breakout.

“If Bitcoin can get back above $105K and start to run, it will likely escape this sideways chop and produce a rally similar in magnitude to what we saw in early November when it jumped from the low $70K range to the mid $90Ks.”

That sets a near-term target of $120,000 by March.

“Whether Trump’s new administration is the next major catalyst for Bitcoin or not,” says Greg, “it’s looking like the path of least resistance is higher in the short term.”

As for stocks, it’s all good — with the tech-heavy Nasdaq taking the lead, up 1.3% and over 20,000 for the first time since the holidays.

As for stocks, it’s all good — with the tech-heavy Nasdaq taking the lead, up 1.3% and over 20,000 for the first time since the holidays.

At least for the moment, tech is getting a tailwind from the Stargate announcement — with Oracle up 6.7% at last check.

Also helping are boffo earnings numbers from Netflix — which apparently believes its customers’ finances are robust enough to withstand a 9.7% monthly rate increase.

Meanwhile, the S&P 500 is up nearly two-thirds of a percent to 6,087 — *this* close to its record close on Dec. 6. And the Dow’s grip on 44,000 is becoming firmer.

Undoubtedly it’s helping stocks that the dollar is weakening relative to other major currencies. After reaching nearly 110 on Jan. 13, the U.S. dollar index sits this morning at 108.2. (Weaker dollar = stronger stocks is one of the most powerful correlations in the markets…)

With the dollar’s pullback, gold is quietly marching toward record levels — up another $12.50 as we write to $2,757. Alas, silver’s in the red and so are the gold stocks.

Crude continues to pull back — now $75.47, down from $79 last Thursday.

![]() Cease-Fire, but What About Shipping?

Cease-Fire, but What About Shipping?

Maybe with the cease-fire between Israel and Hamas, global shipping can return to some semblance of normal.

Maybe with the cease-fire between Israel and Hamas, global shipping can return to some semblance of normal.

As you might recall, the Houthi faction that governs much of Yemen started harassing Israeli- and U.S.-linked shipping in the Red Sea in late 2023 — an act of solidarity for the Palestinians in Gaza who’d come under attack by Israel. The U.S. military started bombing the Houthis a year ago — which only escalated the tensions.

As a result, the Red Sea was effectively shut down to Western shipping — along with the Suez Canal.

Suddenly, much of global trade was set back to the 1860s, before the canal was built. Ships headed between Asia and Europe had to take the long way around the Horn of Africa. Between extra fuel burn and overtime for crews, the typical cost of a voyage rose 40%.

The U.S. bombing campaign has been a peculiar affair. As we chronicled in late 2023, the Houthis can fire $2,000 drones — and the Navy can respond only with $2 million missiles.

But the Houthis have missiles, too — and they’ve been so effective that in recent weeks, the aircraft carrier USS Harry Truman has been hanging out in the northern Red Sea, out of the range of Houthi salvos. (On social media, the military analyst William Schryver has taken to calling the Truman “the USS Trembling Puppy.”)

Now it seems all of that is winding down with an Israel-Hamas cease-fire taking effect last Sunday. But shippers are wary.

Now it seems all of that is winding down with an Israel-Hamas cease-fire taking effect last Sunday. But shippers are wary.

“If Israel stops the aggression in Gaza, and if the U.S., U.K. and Israel stop the aggression against Yemen, the Houthis will stop their operations, including attacks against navies and commercial ships,” a Houthi spokesman tells Al Jazeera.

Western shippers, however, are proceeding with an abundance of caution. According to the FreightWaves website, only French-based CMA CGM, the world’s third biggest shipping line, has continued to transit the Red Sea.

The biggest, Swiss-based MSC, is still keeping its distance. “In order to guarantee the safety of our seafarers and to ensure consistency and predictability of service for our customers, MSC will continue to transit via the Cape of Good Hope until further notice,” according to an email MSC sent to a FreightWaves reporter.

Perhaps the suits at MSC are seeing the same articles we are — Donald Trump saying he’s “not confident” the cease-fire can hold, and Israel’s prime minister Benjamin Netanyahu saying Trump has given him a guarantee he can resume the war after the first phase of the cease-fire is over.

![]() At Long Last

At Long Last

Before we go, one major plus for Trump, for crypto and for freedom…

Before we go, one major plus for Trump, for crypto and for freedom…

Yesterday, Trump pardoned and freed Ross Ulbricht — a man who never harmed anyone but who was serving two life sentences.

Imprisoned since October 2013, Ulbricht was the founder of an unregulated website called Silk Road. It was a pioneer in Tor anonymity and Bitcoin transactions, of which he took a cut to make a profit.

But the feds accused him of “enabling” drug dealing and money laundering.

“None of the charges were related to either personally selling an illegal substance to anyone — Ulbricht merely ran a website that facilitated it — and none were related to causing direct harm to anyone's life or property,” wrote Reason’s Brian Doherty upon Ulbricht’s sentencing in 2015.

Not only is Ulbricht out more than 11 years of his life, he’s also out the Bitcoin the feds seized from him — about $18 billion worth at current prices. The feds sold most of that at auction over the years.

Trump promised to free Ulbricht during his appearance at the Libertarian Party’s national convention last May — a stance out of character for someone who wants to execute drug dealers, but we’ll take it.

Now if he can do Edward Snowden… and Julian Assange.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets