Nix the Income Tax

![]() Nix the Income Tax

Nix the Income Tax

Even if the Trump administration is cutting personnel at the IRS, it’s probably not a good idea to blow off filing your 1040 this spring.

Even if the Trump administration is cutting personnel at the IRS, it’s probably not a good idea to blow off filing your 1040 this spring.

About 6,700 positions are being eliminated, mostly new hires who hadn’t made it through their probationary period yet — roughly 7% of the total workforce.

Nearly half of those positions belong to the Small Business/Self-Employed Division. That’s excellent news, seeing as over the years the agency has aggressively shaken down small-business owners and the self-employed for inflating deductions and (especially) underreporting income.

But if the thought of simply not filing has crossed your mind… well, as Inspector Harry Callahan put it in a different context, “You’ve got to ask yourself one question: ‘Do I feel lucky?’”

“America ran just fine without an income tax for most of its history,” says Paradigm‘s James Altucher. “Actually, not just fine — the economy BOOMED.

“America ran just fine without an income tax for most of its history,” says Paradigm‘s James Altucher. “Actually, not just fine — the economy BOOMED.

“The country grew from a scrappy collection of states to a global powerhouse, all without taking a cut of your paycheck.”

Chances are you know James as our resident AI and crypto authority. But for over a decade now he’s also presided over a wide-ranging podcast with the refreshingly simple title The James Altucher Show.

And in a recent edition, he laid out a comprehensive plan to do away with the IRS: “No more IRS audits, tax filings or loopholes,” he says.

“You keep 100% of what you earn. No payroll deductions. No filing in April. No audits. Nothing.”

What’s more, James says under his scheme Uncle Sam wouldn’t lose a dime of revenue. And yet the U.S. economy would grow by an additional $3.75 trillion a year.

How can it be done?

Hear him out at this link. It’ll take only 29 minutes of your time. And it’s a great opportunity to listen to James opine about something outside his wheelhouse. Enjoy.

Meanwhile, James is gearing up for the event of the year that’s inside his wheelhouse.

Meanwhile, James is gearing up for the event of the year that’s inside his wheelhouse.

One week from today, James and his team of analysts will host a livestream from the annual SXSW confab in Austin, Texas. The theme couldn’t be more timely: Tech Turning Point 2025.

Hoo boy, is there ever a turning point. Those “Magnificent 7” stocks don’t look so magnificent these days, do they?

And yet… big money is making big moves in the tech space. James says when it comes to AI, the top is not in — but the most lucrative opportunities aren’t where you probably think.

Everything that’s Altucher-adjacent will be on the table next Tuesday — AI, crypto, quantum computing, biotech and of course the impact Elon Musk and Donald Trump are having on all of them.

This is a free event strictly for your enlightenment and enjoyment. We won’t try to sell you anything.

It gets underway next Tuesday, March 11 at 2:00 p.m. EDT. We’ll send you more information and a link to the event as we get closer to the day — watch this space.

![]() Tariff Tension

Tariff Tension

Whether it’s tariffs (the mainstream explanation) or simply a market that got out too far out over its skis (more likely)... the S&P 500 has given up all its gains since Election Day.

Whether it’s tariffs (the mainstream explanation) or simply a market that got out too far out over its skis (more likely)... the S&P 500 has given up all its gains since Election Day.

After we went to virtual press yesterday, President Trump announced that 25% tariffs on imports from Canada and Mexico were definitely happening. (Indeed, they’re in effect this morning.) Ditto for a 10% tariff on Chinese imports, on top of the 10% tariff imposed last month. (All three nations have announced tit-for-tat tariffs themselves.)

The market’s gains up to that moment yesterday instantly went poof. The S&P ended the day with a 1.8% loss. Checking our screens this morning, we’re looking at another 1.8% drop. The Dow is taking the blow slightly better, the Nasdaq slightly worse.

At 5,742 the S&P is indeed back to Election Day levels. If it makes you feel any better, this number was a record high in early October.

Yes, the market fell out of bed as soon as Trump made the announcement yesterday. But as we often point out on occasions like this… whenever the market goes up too far too fast, there will always be an excuse to sell.

If it weren’t tariffs this time around, it would be something else.

That’s not to say tariffs won’t have an impact. They will.

That’s not to say tariffs won’t have an impact. They will.

Folks in the know say we’re looking at potential supply-chain disruptions for steel and other metals, fertilizer and auto parts.

And we’re looking at higher prices for a vast array of consumer goods from cars to mobile phones to beef to avocados to lumber. “The easier thing to do might be to list the products that won't be affected,” quips Reason writer Liz Wolfe.

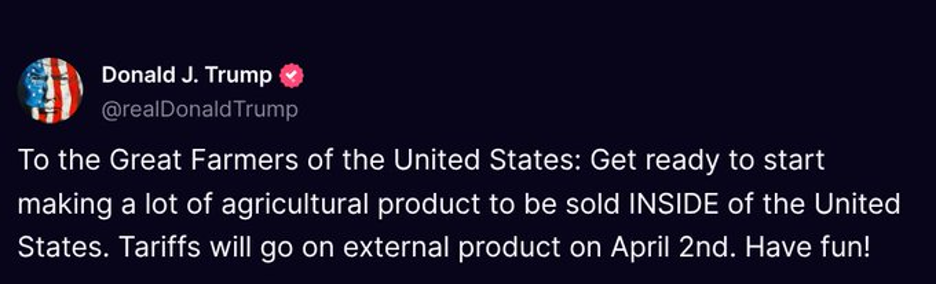

And more is coming, the president promises…

That could be interesting. As one commenter on X says, “I hope the ppl of America develop a taste for soybeans.” (No, thanks.)

To date, Trump has made little effort to sell the American people on the necessity of the sacrifice they’ll inevitably make. He’ll have a chance to remedy that tonight in an address to a joint session of Congress.

[Editor’s note: We’re told the theme of the address is “The Renewal of the American Dream.” And our Jim Rickards believes during the speech Trump will drop “a bombshell surprise no one sees coming” — benefiting one company in particular.

That’s based on a signal from Jim’s patented AI stock software, Project Prophecy 2.0. A very similar signal occurred just before Election Day — which Jim used to help readers make 102% gains in less than two weeks.

For obvious reasons, you’ll want to act before the speech tonight — which as a practical matter means you’ll want to act before the market closes today at 4:00 p.m. EST. Click here and Jim will lay out the stakes.]

![]() Crypto: Do-or-Die Time

Crypto: Do-or-Die Time

Whatever happens next in the crypto space might hinge on Trump’s address tonight.

Whatever happens next in the crypto space might hinge on Trump’s address tonight.

As we mentioned in yesterday’s edition, the president gave a momentary lift to Bitcoin, Ethereum and three other coins with the announcement of plans for a “U.S. Crypto Reserve.”

And we do mean momentary. Bitcoin instantly shot up $9,000 to about $94,100, only for the entirety of the rally to fade within 24 hours. This morning we’re looking at a number under $83,000. The other coins Trump mentioned have made similar moves.

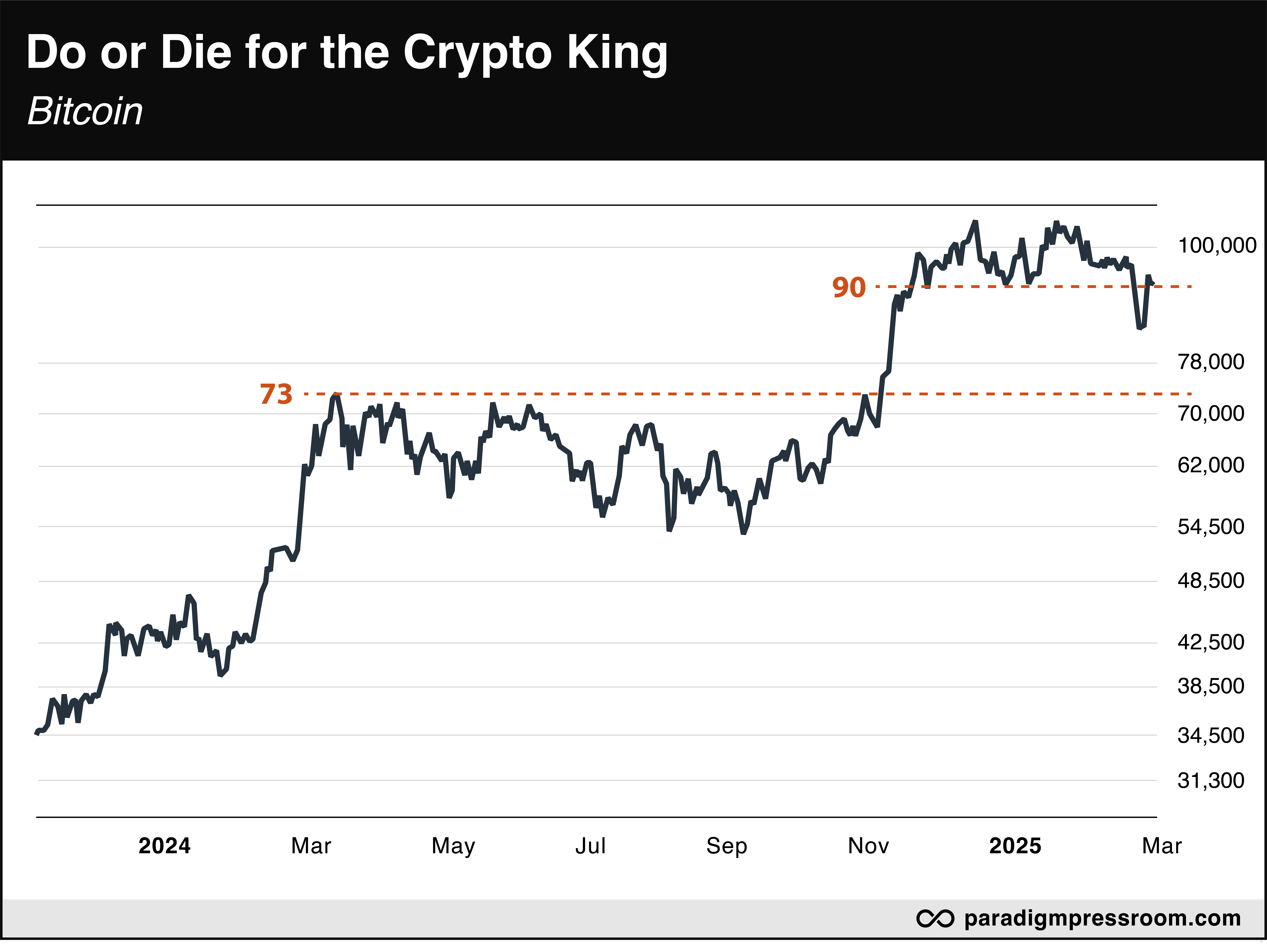

“BTC is living on prayer every day it trades below $90K,” says Paradigm chart hound Greg Guenthner.

“BTC is living on prayer every day it trades below $90K,” says Paradigm chart hound Greg Guenthner.

“To be clear, I believe Bitcoin has a long road ahead. That road merely leads to the downside if it’s trading below its December low. The late-2024 low marks a psychological level that put a floor in Bitcoin until last week.”

Barring a quick recovery to $90K, “We will likely see lower prices in the weeks ahead,” says Greg. “In fact, I bet Bitcoin makes a beeline for $73,000, a likely landing spot marking the top of 2024’s sideways range.

“No, that’s probably not the end of the world for Bitcoin,” Greg allows. “It’ll turn out just fine after a longer drawdown and consolidation.

“Or perhaps Trump will make claims during tonight’s address that steer buyers toward BTC and the entire crypto space.

“I won’t hold my breath. Instead, I’ll focus on the levels.”

As for hard assets, gold has reclaimed the $2,900 level for the first time since Thursday — the bid back to $2,907 at last check.

As for hard assets, gold has reclaimed the $2,900 level for the first time since Thursday — the bid back to $2,907 at last check.

But the move lacks conviction. Silver and the miners aren’t confirming. Indeed, silver is losing ground at $31.55. And the HUI index of mining stocks is down over three-quarters of a percent to 309.

![]() Oil Low and Going Lower

Oil Low and Going Lower

With OPEC planning to open the spigots, the price of crude sits near a three-month low at $67.48.

With OPEC planning to open the spigots, the price of crude sits near a three-month low at $67.48.

OPEC oil ministers have confirmed they’re going ahead with plans to step up production starting next month — a move the Financial Times calls “unexpected.”

“Saudi Arabia and seven other members of the OPEC+ group had previously delayed a plan to unwind long-standing output cuts several times and traders had widely expected it to be postponed again.”

Instead, production will be gradually bumped up by 2.2 million barrels a day over the next 18 months. (Total global production in 2023 was 96.4 million barrels a day.)

A drop in oil prices comes as no surprise to readers of Rickards’ Strategic Intelligence. And it’s likely not over.

A drop in oil prices comes as no surprise to readers of Rickards’ Strategic Intelligence. And it’s likely not over.

Looking back over the last two years, “Oil prices have been stubbornly high,” Jim observed only yesterday. “This persistence is somewhat surprising.

“Over the same period, headline inflation has dropped from 5.0% to 3.0%, global growth has slowed, growth in Germany, Japan and the U.K. are at or near recession levels and there has been a glut in oil supply notwithstanding sanctions on exports of Russian oil (which have failed badly).

“This strength in oil prices is about to end. The supply glut continues. With an end to the Ukraine war in sight, Russian oil will once again flow freely. Trump’s ‘drill, baby, drill’ policies will increase U.S. supply from offshore sources and new drilling on federal lands. Even the long-delayed Keystone XL pipeline may bring more Canadian oil to U.S. users.

“Meanwhile, growth continues to slow in developed economies and Chinese growth is slowing rapidly due to high debts, declining demographics and global trade wars.”

Jim’s bottom line: Don’t be surprised if crude plunges to $60 or even lower in the coming year.

![]() Mailbag: The Oval Office Showdown

Mailbag: The Oval Office Showdown

An offhand request for reader input on the Trump-Zelenskyy confrontation at the White House netted a prolific response we didn’t expect.

An offhand request for reader input on the Trump-Zelenskyy confrontation at the White House netted a prolific response we didn’t expect.

Pasted into a Word document it comes out to 27 pages. Not as many as our broad inquiry “What happened to America?” in 2023 (33 pages)... or our 2020 inquiry about what a “socialist takeover” would mean to you (43 pages!)... but still substantial.

In the interest of brevity we’re truncating many of the responses…

“How anyone can watch that Trump/Zelenskyy press conference and not see Trump as a petulant, amoral schoolyard bully is absolutely beyond me,” says a not-atypical response.

“How anyone can watch that Trump/Zelenskyy press conference and not see Trump as a petulant, amoral schoolyard bully is absolutely beyond me,” says a not-atypical response.

“Zelenskyy behaved admirably and with incredible restraint right up to the point where Trump made it clear he sees moral equivalency between Putin, a brutal authoritarian dictator, and Zelenskyy, a man who’s spent the last three years trying to defend his country against invasion from said brutal authoritarian dictator.”

“I have never been so embarrassed for my country as I was last Friday!” says another. “Trump and Vance were wrong as two left shoes! And Yes Zelenskyy Was Set Up!”

“I laughed out loud watching what seemed like a comedy show in the Oval Office,” a reader writes.

“I laughed out loud watching what seemed like a comedy show in the Oval Office,” a reader writes.

“I watched an entitled dwarf in sweatpants poke the bear and then sit back with arms crossed arrogantly as though he won.”

“I believe Zelenskyy's meltdown handed Trump a huge opportunity to get the hell out of there,” says another. “We've spent billions and have nothing to show for it, other than a heightened prospect of World War III. Run, Donald, RUN!!!! The Europeans are scrambling in the face of actually fighting the war on their own and paying for it for once.”

“I thought you guys had it all wrong about this not being a trap,” reads one observation.

“I thought you guys had it all wrong about this not being a trap,” reads one observation.

“My rationale was that Trump knew the deal was not the deal he wanted, so he and his bro (Vance) decided to blow it up. Yes, I did watch the entire debacle and, yes, I am a rational person.

“However, after seeing how the market reacted to this tiff and how European leaders reacted I believe you are correct. The economic and political indicators point to a spontaneous situation.

“Also, I think Trump screwed up by revealing information he was not supposed to. I am referring to his telling Zelenskyy he is running out of soldiers. Russia heard it and that is why they started hitting Ukrainian training bases and stopped bombing hospitals. I don't think Trump did this on purpose, at least I hope not.

“I do think this was a mistake, hence another indication of a spontaneous situation, not a contrived one.”

Dave responds: It’s not exactly a state secret that Ukraine is “running out of soldiers.” The historian Michael Vlahos compares Ukraine’s losses to those of France in World War I.

As we write, Zelenskyy seems to be backtracking — calling Friday’s events “regrettable” and saying he’s ready to sign a minerals deal with Washington “at any time.”

That comes roughly 12 hours after Trump cut off all U.S. military aid to Ukraine — even materiel that was already being unloaded off ships in Poland.

All that said, it’s hard to imagine how Trump could return to negotiations now without seriously losing face…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets