Buy? Sell? Hold?

![]() Buy, Sell or Hold? Here’s the Most Important Thing to Know

Buy, Sell or Hold? Here’s the Most Important Thing to Know

“Want to know where a stock is headed? It’s simple: Find out the direction of its earnings revisions.”

“Want to know where a stock is headed? It’s simple: Find out the direction of its earnings revisions.”

A short time ago, the newest member of the Paradigm Press team finished introducing himself to readers during his exclusive “Meet the Maverick” event — where he pulled back the veil on his most powerful trading secrets. (You can watch a replay right away at this link.)

If you’ve been reading these missives the last few weeks, his name will already be familiar — Enrique Abeyta.

At one time, Enrique managed over $1 billion for a hedge-fund outfit. Like many denizens of the newsletter biz, he’s happier working for an audience of everyday folks like you than he ever was amid the backstabbing, brownnosing culture of Wall Street.

Among his bang-on market calls in recent years was during the COVID crash: Within three days of the bottom in March 2020, he said stocks were a “screaming buy.”

Over three decades of successful investing, Enrique has mastered an essential art — “harnessing the power of earnings,” he says. “It is the way that investors keep the ‘score’ with stocks.

Over three decades of successful investing, Enrique has mastered an essential art — “harnessing the power of earnings,” he says. “It is the way that investors keep the ‘score’ with stocks.

“These are the metrics that drive most stock performance, laying the foundation of my approach:

- “Earnings growth — the dominant force driving stocks over the long run

- “Earnings surprises — a catalyst for bullish sentiment and higher share prices.

“Earnings growth is key for a stock to increase, and beating earnings excites would-be investors.”

But even more important than those two metrics is a third…

But even more important than those two metrics is a third…

It’s earnings revisions.

“Whether analysts are repeatedly revising a company’s outlook higher (or lower) is possibly the most important piece of information when deciding to buy, sell or hold,” Enrique says.

“Yet most traders don’t follow this incredibly useful metric.”

Little wonder: You need a Bloomberg terminal for access to earnings revisions data. These days, that runs north of $25,000 a year.

So here’s how it works: “Major brokerages and money-center banks have analysts publishing quarterly and annual financial estimates for large-cap stocks,” Enrique says.

“For instance, 75 analysts publish estimates for Nvidia Corp. (NVDA). Most of them have a ‘buy’ rating. I don’t find the percentage of analysts rating a stock a ‘buy’ or a ‘sell’ particularly useful.

“What I do find useful, though, is the average of analysts’ earnings estimates,” Enrique continues.

“What I do find useful, though, is the average of analysts’ earnings estimates,” Enrique continues.

“Seeing those estimates consistently move higher is the wave that pushes stocks forward. Below is a chart showing the stock price of NVDA along with the average estimate for fiscal-year 2025 earnings per share or (EPS).

“This is the average of the estimates by any of those analysts that have a published estimate.

“Looking at the chart, you can see that the stock price has directly tracked the rising earnings estimates — almost one-for-one. This relationship is true for almost every stock out there.

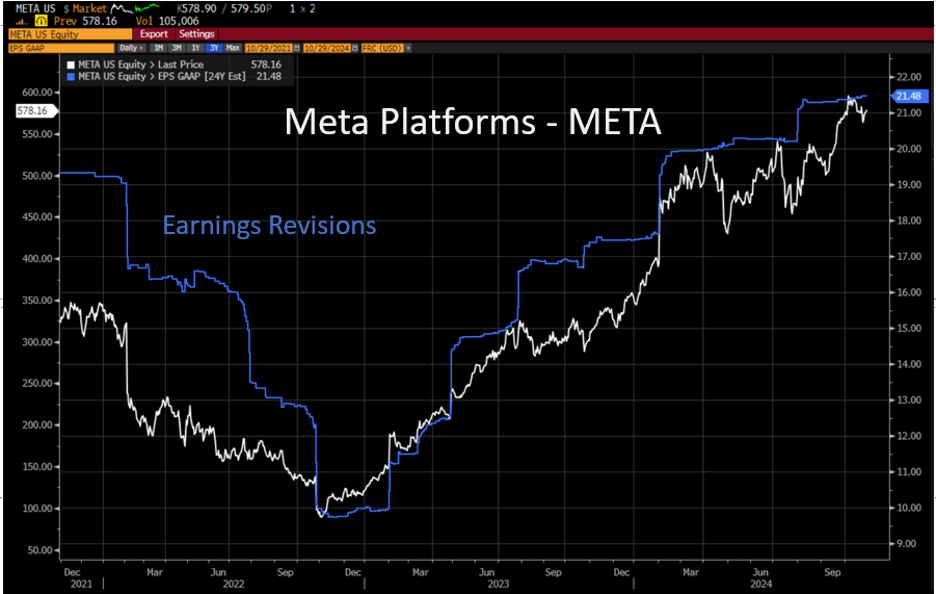

“Here’s the same chart for Meta Platforms Inc. (META), the company that owns Facebook, Instagram and WhatsApp.

“This chart is even more interesting. It shows how the stock rallied as earnings estimates rose and fell when revisions were revised lower.”

As you might recall, META fell hard in 2022. The media narrative was that Mark Zuckerberg had lost his focus and gotten sidetracked by the whole “metaverse” thing.

“In reality,” Enrique says, “the stock was going down because the earnings revisions were negative.

“Put simply, earnings revisions are the combination of earnings growth and surprises that express in one number how these two factors together drive a stock higher.

“If there was only one number you could have when deciding whether to buy a stock — it would be this one!”

But even a Bloomberg terminal isn’t enough to unlock the power of earnings revisions to spot massive gains in advance — such as the ones we cited last week.

But even a Bloomberg terminal isn’t enough to unlock the power of earnings revisions to spot massive gains in advance — such as the ones we cited last week.

It comes back to the unusual chart pattern we mentioned — the one that foreshadowed every one of the top-10 performing stocks of 2024. That includes the 200% gain in Nvidia… the 270% jump in Palantir Technologies… and the 320% leap in Vistra Corp.

“I have access to a special software program that keeps track of this powerful predictor for thousands of stocks,” says Enrique.

And now Enrique is putting this proven tool to work for folks like you. Already he’s pinpointed the top-10 performers of 2025. If they generate anything like the returns of 2024’s leading names… well, no wonder he says the next 60 days could make your retirement.

![]() Tariff Twitchiness

Tariff Twitchiness

Here comes another test of Knuckman’s law. We’re going to have a lot of this over the next few months.

Here comes another test of Knuckman’s law. We’re going to have a lot of this over the next few months.

Knuckman’s law was coined by Alan Knuckman, Paradigm’s eyes and ears at the Chicago options exchanges. His guidance: Avoid knee-jerk reactions to anything Donald Trump says or does. Give it 48 hours for the market to shake things out.

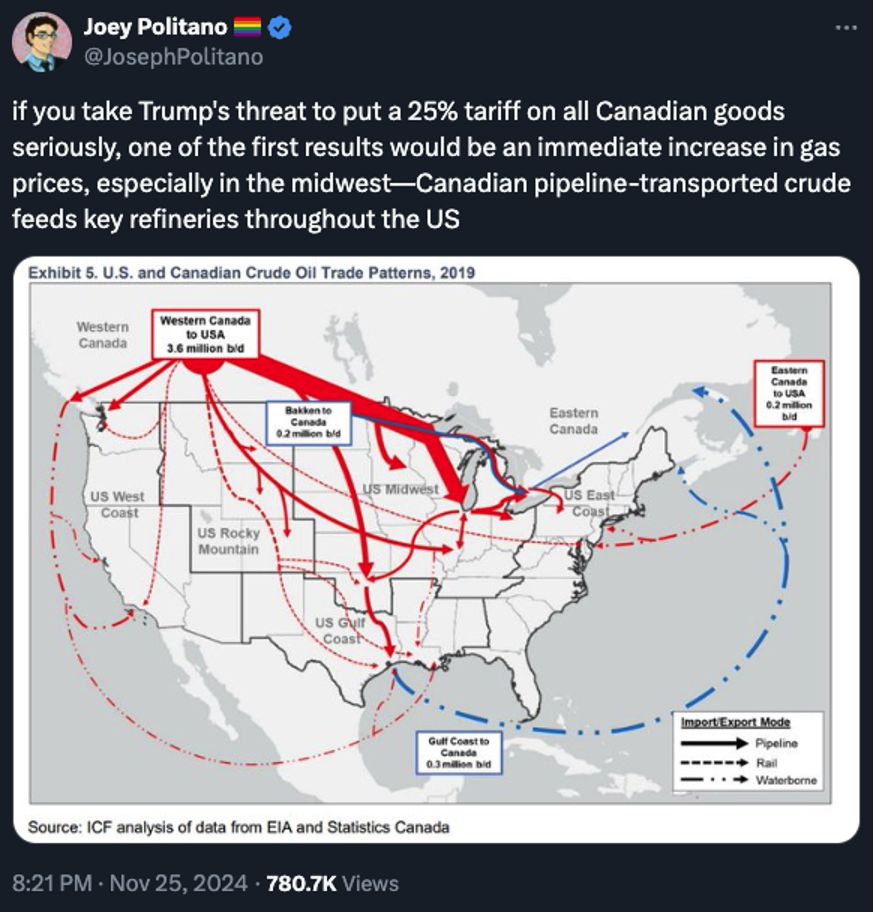

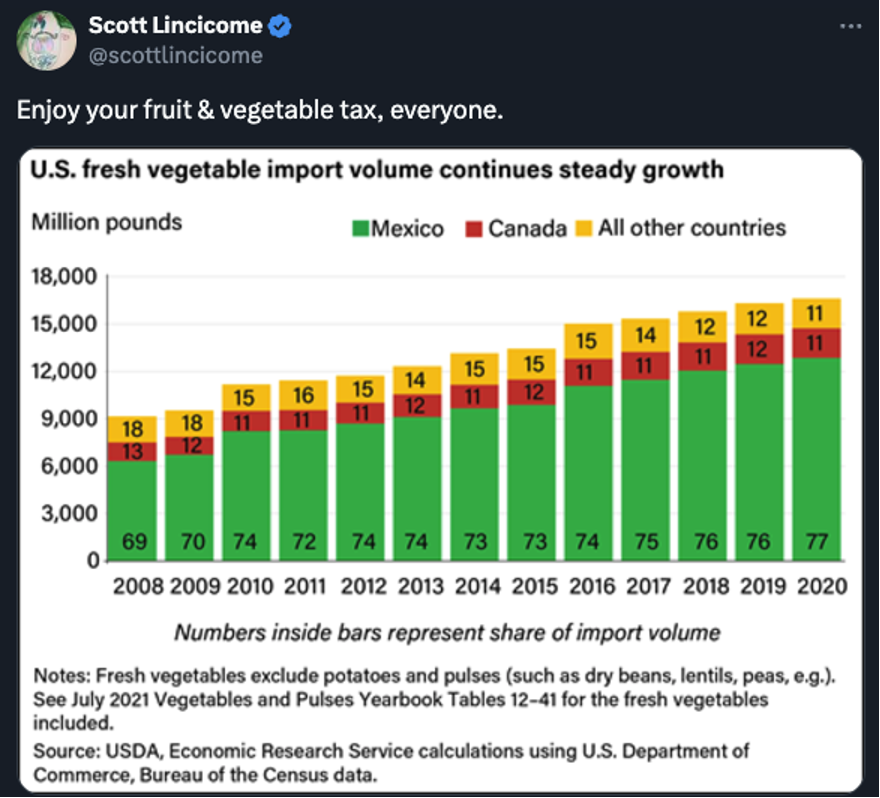

And so it goes with Trump’s tariff announcement last night: "On January 20, as one of my many first Executive Orders, I will sign all necessary documents to charge Mexico and Canada a 25% tariff on ALL products coming into the United States.” In addition, he’s promising 10% tariffs on all imports from China — on top of all the existing tariffs.

Together those three countries account for 40% of U.S. imports.

Thousands of publicly traded U.S. companies could potentially be affected by this move — and the share prices of many are gyrating this morning. The Mexican peso and Canadian dollar are both trading down at least 1% relative to the U.S. dollar. The Chinese yuan is holding up somewhat better.

But the reality is that no one knows exactly how this will play out. Is this announcement merely an opening salvo for new trade negotiations with Mexico, Canada and China?

More importantly — if the tariffs take effect, might certain goods be exempt? Because if they’re not, the prices of energy and food are bound to shoot higher — an outcome Trump presumably… doesn’t… want?

The tariff twitchiness is reflecting itself in the major U.S. stock averages about the way you’d expect.

The tariff twitchiness is reflecting itself in the major U.S. stock averages about the way you’d expect.

At 44,564, the trade-dependent Dow is down about 175 points from yesterday’s record close. The Nasdaq — packed with tech companies not as dependent on foreign customers and suppliers — is up about a half percent to 19,146.

The S&P 500 splits the difference, up about a third of a percent at 6,007. If that holds, it’ll be a record close.

Precious metals are licking their wounds from a particularly wicked smackdown yesterday — gold at $2,624 and silver at $30.40. Crude is back above $69. But Bitcoin is slipping further and further from six figures, now below $95,000.

On the World War III front, a top NATO official is telling European businesses to prepare for a “wartime scenario.”

On the World War III front, a top NATO official is telling European businesses to prepare for a “wartime scenario.”

Dutch Adm. Rob Bauer is the head of NATO’s military committee. At an event in Brussels yesterday, he said, “Businesses need to be prepared for a wartime scenario and adjust their production and distribution lines accordingly. Because while it may be the military who wins battles, it’s the economies that win wars.”

Yikes. Bauer’s remarks come as The New York Times says U.S. officials are thinking about giving nuclear weapons to Ukraine… and France’s Le Monde reports that French and British leaders have discussed deploying troops to Ukraine.

Meanwhile, in the conflict itself…

![]() The Most Valuable Telecom on Earth

The Most Valuable Telecom on Earth

“With SpaceX now reported to be valued at a staggering $250 billion in its latest funding round, attention is turning to what could be the biggest IPO in history: Starlink.”

“With SpaceX now reported to be valued at a staggering $250 billion in its latest funding round, attention is turning to what could be the biggest IPO in history: Starlink.”

So says Paradigm tech-and-biotech specialist Ray Blanco: “The timing couldn't be more perfect. SpaceX just secured a game-changing regulatory win from the FAA, clearing the path for up to 25 Starship launches per year from its Texas facility.

“This breakthrough comes just as Starlink hits nearly 7,000 operational satellites and achieves profitability — a milestone that Facebook hadn't reached when it went public.”

SpaceX president Gwynne Shotwell recently said Starlink could “add a zero” to SpaceX’s valuation. If it’s presently valued at $250 billion, we’re talking about easily a trillion-dollar valuation — in the same rarefied air as the “Magnificent 7.”

“What's unfolding here is the birth of a new kind of telecommunications empire,” Ray says.

“What's unfolding here is the birth of a new kind of telecommunications empire,” Ray says.

“The acceleration of Starship development is the key piece of the puzzle. The next-generation launch vehicle isn't just about reaching Mars — it's essential for deploying Starlink's more advanced next-generation satellites.

“With multiple successful test flights now under their belt and the political winds shifting in their favor under the incoming administration, SpaceX is positioned to dramatically accelerate its Starship launch rate. Shotwell projects an incredible 400 Starship launches in the next four years.

“This matters because it directly impacts Starlink's growth trajectory. More launches mean more satellites, more coverage and, ultimately, more revenue.

“It's a virtuous cycle that could make Starlink the most valuable telecommunications company on Earth — well, above Earth, to be exact.”

Of course, SpaceX/Starlink are not yet public. But Ray’s colleague James Altucher has keyed in on a way to profit from the IPO anyway. James walks you through the opportunity at this link.

![]() DOGE Update

DOGE Update

Your editor’s fears about the Department of Government Efficiency are starting to come true.

Your editor’s fears about the Department of Government Efficiency are starting to come true.

Elon Musk and Vivek Ramaswamy recently took to the pages of The Wall Street Journal to lay out their DOGE plans. Their nearly 1,300-word article was long on process and short on specifics.

If you and I were to give them the benefit of the doubt, we’d say that they don’t want to tip their hand on their priorities — lest the targets of their recommendations get a heads-up and start circling the wagons.

But as I said a few weeks ago, changes for the better — and Elon’s goal of cutting $2 trillion a year — cannot happen without dismantling the military-industrial complex and smashing the health care cartel.

So far, Elon is merely delivering theatrics about… NPR.

Don’t get me wrong. NPR is an illegitimate endeavor of government and its current CEO’s public statements are uniquely despicable.

But that’s what makes it such an easy target relative to the stuff that really matters.

If you’re old enough and conservative enough, you probably remember getting snail-mail fundraising letters in pre-internet times. One of the usual targets was NPR — along with PBS and the National Endowment for the Arts.

But these outfits are such a tiny portion of the federal budget: The Corporation for Public Broadcasting will spend about $500 million in fiscal 2025.

Also, notice how Republicans never get around to defunding those institutions — even when they control the White House and both houses of Congress. If they did, how would they gin up outrage in their fundraising emails?

To be sure, however, the jury is still out: There’s ongoing dialogue on X between Elon and Ron Paul — whose impact on the DOGE effort could be considerable.

![]() Mailbag: The View From Gen Z

Mailbag: The View From Gen Z

After I mentioned yesterday that a survey finds the typical Gen Zer believes a net worth of $1.2 million meets the definition of “rich,” we heard from a Gen Zer.

After I mentioned yesterday that a survey finds the typical Gen Zer believes a net worth of $1.2 million meets the definition of “rich,” we heard from a Gen Zer.

“I thought to myself, That looks like just enough to afford a house.

“As for your question: ‘Sheesh, what’s with the low expectations of the 27-and-under set?’

“Being that I am 27, I could hazard a guess or two. It could be the national shortage of math teachers combined with kids not really being taught anything about money or finance.

“But it could also be that there is a general sense of no matter how hard one works always being a step behind. I know some people around my age out west who were elated to have gotten a 30-year mortgage before the prices went up. I also know quite a few back east who get together in groups of two–four to pool together their funds and credit to get a house or townhouse together.

“I also know a few people getting into crypto hoping that a coin they choose takes off and they hit it big. Of course, I also have my fair share of friends who have been laid off recently.

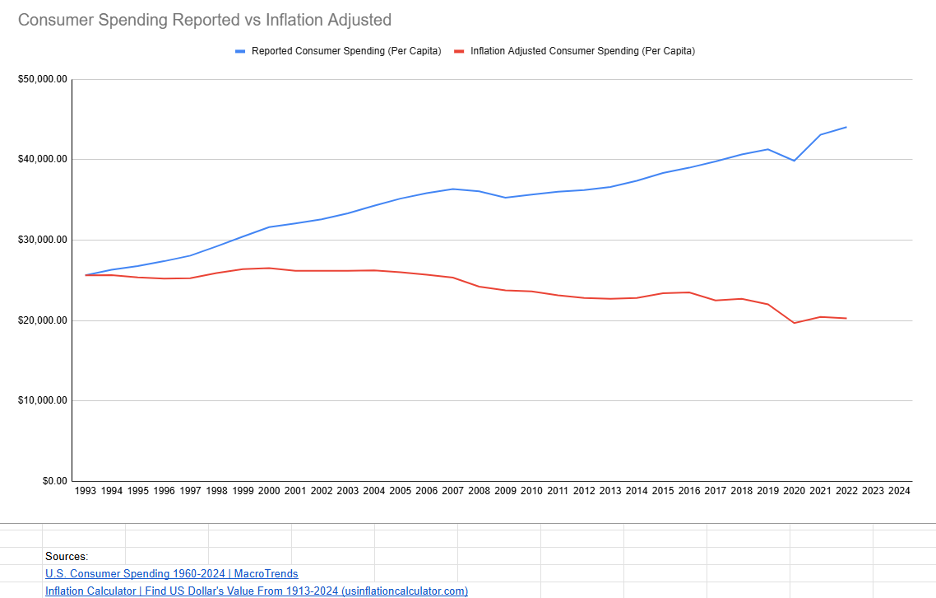

“Perhaps their sense of ‘rich’ is ‘being able to have some amount of savings’ or simply not living paycheck to paycheck? I once put together a graph on Google Sheets adjusting consumer spending for inflation for the past 30 years, and it's a chart that shows a steady decline in how much people have been spending. I'm a bit nervous how the graph would look if I used inflation numbers from someplace like ShadowStats instead of the official government numbers.

“This is after all, the generation that has grown up in the wake of 9/11, the rise of the security state and a steady decline in the wealth of the working class.

“I still don't know what it is like to live in a country that is not at war, I'm mostly just glad the bombs drop on the other side of the ocean.

“Wish I had a quip to lighten the mood this time but nothing comes to mind.

“Still, have a Happy Thanksgiving, Dave. I'll get to see my family, and I hope everyone else gets to spend time with theirs.”

Dave responds: Thank you for the insights.

My low-expectations quip was admittedly rhetorical. It’s little wonder, given everything you cite, that Gen Z’s idea of “rich” is so paltry compared with older generations’.

It’s also why Gen Z is putting off having kids, or forgoing children altogether — a phenomenon I tried to address earlier this year in the context of JD Vance’s remarks about “childless cat ladies.”

Unfortunately in the hyperpoliticized atmosphere of last summer, some readers overlooked those big issues because I dared to say a cross word about the Republican vice presidential nominee. Maybe now that the temperature has come down a bit, readers can look at it with fresh eyes.

And Happy Thanksgiving to you, sir. We’re back tomorrow with one more pre-holiday edition — Emily will take the helm — before we deliver some special content for the long weekend.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets