In Defense of “Childless Cat Ladies”

![]() Carrots and Sticks and “Childless Cat Ladies”

Carrots and Sticks and “Childless Cat Ladies”

“Dave, all those stereotypes about a woman turning 30 and still living alone? And then she gets a cat? That’s me now!” said my friend Nicole, over margaritas and quesadillas.

“Dave, all those stereotypes about a woman turning 30 and still living alone? And then she gets a cat? That’s me now!” said my friend Nicole, over margaritas and quesadillas.

It was summertime, over 20 years ago. I took a few days off from my newsroom job in Chicago to go hiking out west.

One evening I met up for dinner with Nicole (not her real name). I’d hired her a few years earlier to be a reporter at a small-market Midwestern TV station. Now she was covering big-city news — in the big city where she grew up, no less.

She was living the dream — except for the discouragement she disclosed about finding a committed relationship.

The story has a happy ending. Over time, she got married, had a couple of kids and left the TV news racket to start her own business.

Little did I suspect that Nicole’s plight at the turn of the millennium would become a political football a generation later.

Little did I suspect that Nicole’s plight at the turn of the millennium would become a political football a generation later.

As you’ve likely heard, Donald Trump’s running mate J.D. Vance has raised eyebrows with some remarks from 2021 that have now resurfaced — in which he labeled Democratic politicians a “bunch of childless cat ladies with miserable lives.”

It wasn’t just a one-off comment. From a fundraising email that went out over Vance’s name during his campaign for the U.S. Senate in Ohio: “Our country is basically run by childless Democrats who are miserable in their own lives and want to make the rest of the country miserable too… What I want to know is: why have we turned our country over to people who don’t have a direct stake in it?”

Nor was his critique limited to politicians and other public officials…

But Vance is not engaging exclusively in culture-war politics. There’s an economic subtext — which is why we’re taking up the topic in today’s 5 Bullets.

But Vance is not engaging exclusively in culture-war politics. There’s an economic subtext — which is why we’re taking up the topic in today’s 5 Bullets.

Vance’s views — specifically, that a declining birth rate poses a threat to the nation’s future — translate to policy stances, however half-baked they are.

From another 2021 interview: "If you're making $100,000 [or] $400,000 a year, and you've got three kids, you should pay a different, lower tax rate than if you're making the same amount of money and you don't have kids."

Never mind the fact that the tax code already favors people with kids.

“There's the child tax credit, of course,” economist Veronique de Rugy writes in her syndicated column. “Then there's the earned income tax credit, which is more generous for families with children than those without. And there is no shortage of other provisions, such as a very significant deduction for heads of households and another for dependent care, which do the same thing.

“It's hard to know what Vance's proposal really entails. Does he want another surtax on childless parents? Does he want to expand the child tax credit and make it a universal basic income like many conservatives and progressives want? It's also unclear whether he is simply failing to see that our tax code already delivers on his wishes and punishes childless adults.”

Then again, the details don’t really matter. What matters is that Vance has a view of the federal government’s role in people’s lives that doesn’t seem very “conservative” as most of us understand the term.

Then again, the details don’t really matter. What matters is that Vance has a view of the federal government’s role in people’s lives that doesn’t seem very “conservative” as most of us understand the term.

Amid his musings about imposing higher tax rates on the childless, he was upfront about the motive. He said government should "reward the things that we think are good" and "punish the things that we think are bad."

What?!

There’s a disturbing control-freak aspect underlying Vance’s worldview — this notion that the tax code is something the government should use for social engineering purposes, to “nudge” people into one or another behavior.

Isn’t that what conservatives used to accuse liberals of doing? (It is; Paradigm’s own Jim Rickards devoted an entire chapter to the nudge phenomenon in his 2019 book Aftermath.)

![]() How to Encourage Americans to Make More Babies

How to Encourage Americans to Make More Babies

Vance is all sticks, no carrots: If you want to increase fertility rates, you need to foster a culture in which people will want to have kids for reasons other than avoiding higher taxes.

Vance is all sticks, no carrots: If you want to increase fertility rates, you need to foster a culture in which people will want to have kids for reasons other than avoiding higher taxes.

It comes back to that most fundamental of American beliefs — that your kids will live a better life than you do.

In the 16 years since the bank bailouts, and especially in the four years since COVID lockdowns, that belief has been smashed to bits.

In a survey of U.S. adults conducted for The Wall Street Journal in March 2023, 78% said they “do not feel confident” that life for their children’s generation will be “better than it has been.” Only 21% did.

Now imagine how their children must feel. Where’s the hope for the future?

And in the absence of that hope, why the hell would you want to have kids?

Rather than badgering people who rationally choose to be childless, why doesn’t Vance propose measures that would restore a thriving middle class with a belief in the future?

Rather than badgering people who rationally choose to be childless, why doesn’t Vance propose measures that would restore a thriving middle class with a belief in the future?

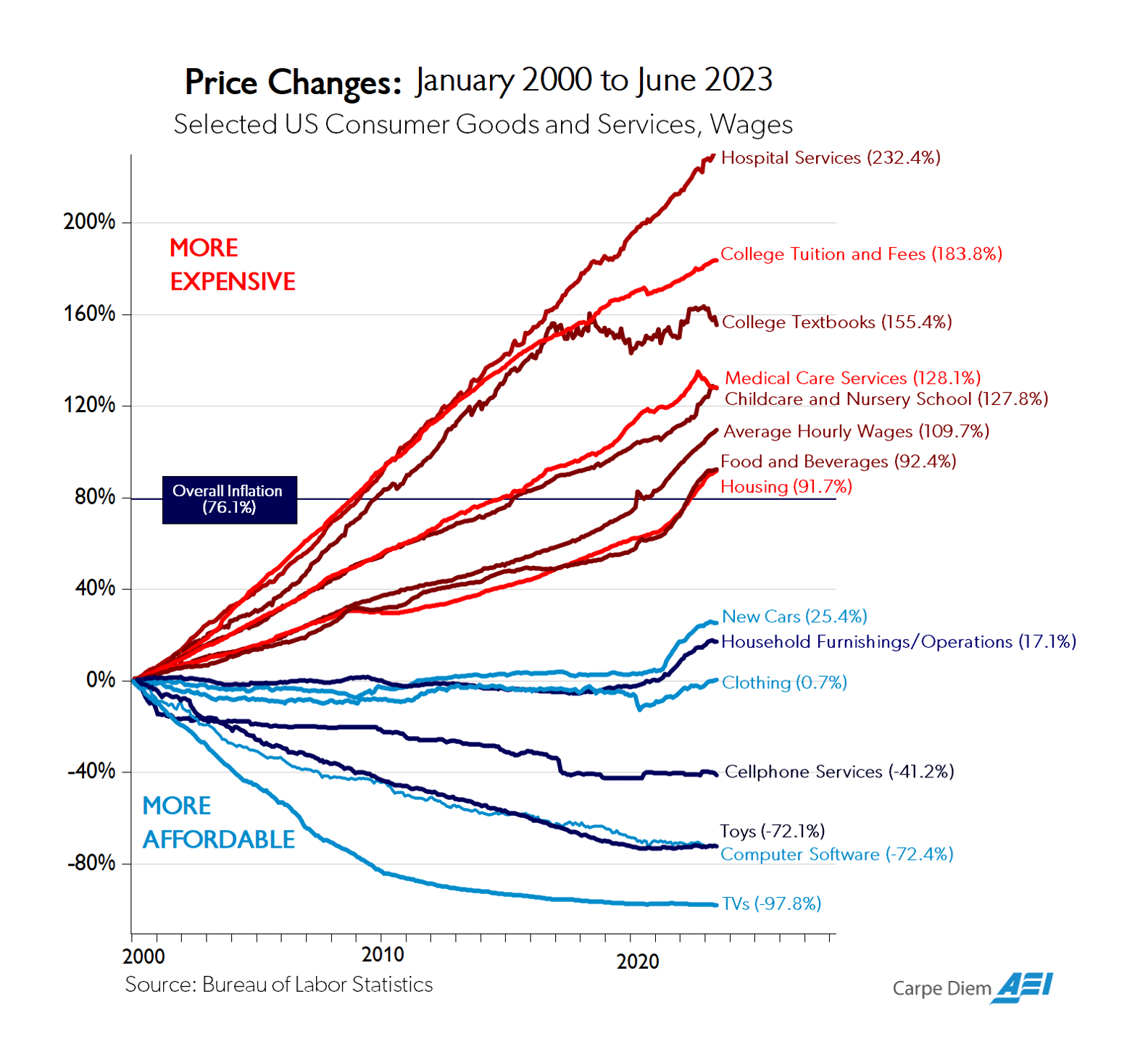

Where to begin? Well, here’s a chart we share once in a while, courtesy of American Enterprise Institute economist Mark Perry. It speaks volumes about how the middle class has been hollowed out during the 21st century…

Seems pretty simple. Start by smashing the crony-capitalist health care cartel that charges different people different prices depending on who provides their insurance — and you don’t know the price of anything until after services are rendered! (In a free-market health care system, having a baby in a deluxe private room would cost $628 — the inflation-adjusted price of delivering a baby at California’s Santa Monica Hospital in 1952).

Then smash the higher-education cartel. An end to subsidized student loans, among other steps, would wipe out the perverse incentives that have resulted in layers of costly administrative bloat that didn’t exist 40 years ago. (Back then, you actually could pay for school by flipping pizzas part-time.)

Once health care and higher ed are fixed, the “childcare and nursery school” part of the chart takes care of itself: An affordable middle-class lifestyle means a family that can live comfortably on one income — not the two-income, scratching-and-struggling, earning-and-burning treadmill that defines whatever’s left of the middle class here in 2024.

That would give people an incentive to make more babies.

But no, it’s easier for control freaks and power trippers like J.D. Vance to harp on how “childless people should pay higher taxes” when they already do.

One final thought before we move on: Vance and his high-powered corporate lawyer wife have three kids.

One final thought before we move on: Vance and his high-powered corporate lawyer wife have three kids.

They married in San Francisco 10 years ago. Until last month, she worked for a law firm with offices in San Fran, Los Angeles and Washington, D.C.

Presumably, Vance’s residence is in Ohio, seeing as that’s the state he represents in the Senate.

Huh. Of course, commuter couples can have successful marriages. But when you bring kids into the mix? Sorta brings a different spin to Vance’s “pro-family” rhetoric, no?

As Karl “Tickerguy” Denninger wrote on his blog a few days ago, “No matter how you slice it there is no way you have two fully involved parents when they're separated by 1,500-plus miles.”

![]() Rate Cuts… for the Wrong Reasons

Rate Cuts… for the Wrong Reasons

A September rate cut? For Mr. Market, that’s old and busted. The new hotness is “fears over a possible recession.”

A September rate cut? For Mr. Market, that’s old and busted. The new hotness is “fears over a possible recession.”

As noted yesterday, the Federal Reserve left the benchmark fed funds rate at 5.5%. And as expected, Fed chair Jerome Powell set the table for a rate cut at the next Fed meeting in mid-September. The decision would be “data-dependent,” although he didn’t use that term: If inflation and the economy continue to cool down, a rate cut would be in order.

None of that was a surprise. The major U.S. stock indexes ended yesterday at about the same levels where they were when we wrote to you before the meeting, holding on to big morning gains.

Alas, the good vibes aren’t extending into today: At last check the S&P 500 is down 1% to 5,465. The Dow’s losses are a bit steeper, the Nasdaq’s steepest of all despite Facebook parent Meta reporting good quarterly numbers.

➢ META is up over 6% on the day, the first of the Magnificent 7 stocks that didn’t disappoint during earnings season. Apple and Amazon report after the closing bell today.

The mainstream is chalking up the slide to a couple of punk economic numbers. First-time unemployment claims came in higher than expected, indeed the highest in a year. The ISM Manufacturing Index came in lower than expected, indeed the lowest since last December.

Suddenly the “soft landing” narrative is falling apart. This is exactly what our Jim Rickards has been warning about for months now: If the Fed “pivots” to interest rate cuts, it won’t be because inflation and the economy are slowing to some sort of happy equilibrium. It will be because the economy is flirting with recession, and that will be bad for corporate earnings.

If there was a clear beneficiary from the Fed decision, it was gold.

If there was a clear beneficiary from the Fed decision, it was gold.

It rallied hard yesterday, and it’s hanging onto those gains today — the bid $2,447 as we write. Unfortunately, silver is surrendering some of its gains, down 50 cents to $28.44.

Crude is giving up some of its rally yesterday that was spurred by the proverbial “Middle East tensions.” In the absence of dramatic new developments, a barrel of West Texas Intermediate is down over 1% at $77.11.

Bitcoin has gotten positively crushed in the last 24 hours — from over $66,000 to under $63,000.

The expectation for lower short-term interest rates is translating to falling long-term rates (as is the fear of a recession): The yield on a 10-year Treasury note has slipped below 4% for the first time since February. Barely three months ago, it peaked at 4.7%.

![]() Where Are the New High-Voltage Electric Lines?

Where Are the New High-Voltage Electric Lines?

In what’s becoming an almost daily dirge for us about the fragility of the U.S. power grid… the construction of high-voltage power lines has slowed alarmingly in the last decade.

In what’s becoming an almost daily dirge for us about the fragility of the U.S. power grid… the construction of high-voltage power lines has slowed alarmingly in the last decade.

An outfit called Grid Strategies has released a report detailing that utilities and other transmission developers nationwide brought only 55 miles of high-voltage lines into service last year.

In the early 2010s, the figure was on the order of 1,700 miles annually. Even as recently as 2015-19, the annual average was 925 miles.

The report doesn’t get into the whys behind the dramatic drop, but it’s not hard to guess — higher commodity prices and metals shortages along with COVID supply-chain snags.

Result: Even while construction has slowed, costs have escalated. “Despite the decline in building high-voltage power lines,” says the Utility Dive website, “utility spending on transmission infrastructure increased to more than $25 billion last year, up from about $20 billion in 2013, according to the consulting firm.”

Legislation in Congress would reform the permitting process, perhaps allowing transmission projects to speed up. But the likelihood of passage before year-end is remote.

![]() End of an Era

End of an Era

If you’re old enough to remember the McDonald’s hot-coffee lawsuit from 30 years ago, you’ll have an extra appreciation for this story.

If you’re old enough to remember the McDonald’s hot-coffee lawsuit from 30 years ago, you’ll have an extra appreciation for this story.

For a long time, every passenger on Korean Air was treated to a cup of piping-hot instant noodles, free on request. No more.

“From Aug. 15 onward,” reports the BBC, “the carrier will stop serving the noodles to economy-class passengers. It said the increased risk of turbulence, narrow aisles and passengers sitting closely together could mean ‘burn incidents occur frequently.’”

Noodles will still be served in first and business class, where people are more spread out.

Economy passengers will now be treated to sandwiches, corn dogs, pizza and Hot Pockets. (Now there’s some authentic Asian cuisine!)

The reaction on social media has ranged from relief — some people genuinely feared being scalded — to incredulity.

“Aren’t coffee and tea hot?” said one comment.

Indeed they are, dear commenter. Don’t give them any ideas!