Coping With the Media’s Madness

![]() We Appreciate the Praise, But…

We Appreciate the Praise, But…

“The 5 is the only place I get my ‘news’ anymore,” a reader wrote to us some years back — using this e-letter’s bygone nickname. “It's clear to me you call it like you see it with no political bias whatsoever. So keep doing what you're doing!”

“The 5 is the only place I get my ‘news’ anymore,” a reader wrote to us some years back — using this e-letter’s bygone nickname. “It's clear to me you call it like you see it with no political bias whatsoever. So keep doing what you're doing!”

Affirmed another: “The only news I get is here and from a couple of mainly financial newsletters.”

We were aghast. In response, we paraphrased the cereal commercials of days gone by — this daily dispatch is only part of a well-balanced informational diet.

Around the same time, a reader requested “For Dave: I’d be interested in a description of your daily informational intake.”

Nor was he the only one.

It’s a good question — especially considering my own background with two decades in the TV news racket. I’ve been out for 17 years, but the news-junkie part of me never went away. I’ll never tire of coming across a story that makes me say, “Holy $#*%!”... and I hope that zeal comes through to you in these daily missives.

I promised back then to divulge my daily informational diet, more than once — but didn’t get around to delivering until 2022.

Times and circumstances change. What follows is a 2024 update…

For starters, I’m compelled to point out that at the core of this e-letter are the paradigms — the ways of looking at markets and the economy — developed by our own experts at Paradigm Press. Without that, I’d be just another rando on the internet.

For starters, I’m compelled to point out that at the core of this e-letter are the paradigms — the ways of looking at markets and the economy — developed by our own experts at Paradigm Press. Without that, I’d be just another rando on the internet.

Jim Rickards’ input — especially in the early years of his work with our firm — has been seminal. Of course, James Altucher provides a crucial window into the worlds of artificial intelligence and crypto.

Ray Blanco is ahead of the curve in tech and biotech. Zach Scheidt’s passion for income and value investing is second to none. Alan Knuckman — my partner on The Profit Wire — knows trading like no one else. Our recovering investment banker, the inimitable Sean Ring, never lacks for something lively to say. Byron King has been my colleague for 17 years, keeping a pulse on energy and natural resources.

Basically, I have the same level of access to their ideas as do members of our VIP level of service called the Omega Wealth Circle — only I get paid to read our editors’ work instead of the other way around!

[As long as I brought it up: Are you intrigued by the idea of all-you-can-eat access to everything we publish? That’s what our Omega Wealth Circle offers. The key advantage is the substantial savings you achieve over subscribing to all of our services individually.

The Omega Wealth Circle isn’t for everyone… and we don’t open membership to just anyone. But if you already have two or more subscriptions with us, you can expect an invitation sooner or later.]

![]() “So Where Does Dave Get His News?”

“So Where Does Dave Get His News?”

My day begins at 5:00 a.m. Eastern Time. First thing, I skim the news alerts that crossed my iPad overnight. (More about those later.)

My day begins at 5:00 a.m. Eastern Time. First thing, I skim the news alerts that crossed my iPad overnight. (More about those later.)

From there, it’s a regimented sequence that goes like this…

- Front page of The New York Times. Like it or not, the Times’ front page sets the agenda for mainstream discourse in these United States — and its longevity in that regard is formidable. When I was growing up, the Gray Lady was part of an influential troika along with CBS News and Time. The latter two have faded into irrelevance, but the Times prevails — even as much of the rest of corporate media are now owned by only a half-dozen companies. Ignore it at your peril

- The BBC iPad app: Here too, it’s a case of “know thine enemy.” A shame, really. As a young man in pre-internet days, I listened faithfully to the BBC World Service’s straight-arrow coverage on a shortwave radio. Its correspondents were everywhere! But the Beeb was already going downhill in the mid-1990s… and by 2002–03, it was just one more useless mouthpiece for the Bush-Blair death march toward endless war. Still… the BBC retains the same cachet around the world that the Times has here at home

- Financial Times: I scan the front-page stories, but for any number of reasons — including decades of habit — I devote more attention to…

- The Wall Street Journal: Here, every front-page story — including the “What’s News” summary — gets at least enough attention from me to decide whether I should read beyond the first paragraph.

Ideally, I burn through all of that in about 20 minutes. Then it’s off to the rest of my morning activities before I settle in for the day in earnest and resume my morning news cruise…

Even now, I still scan the Drudge Report. Only on workdays, and only once in the morning. Anything more would be an assault on my sanity.

Even now, I still scan the Drudge Report. Only on workdays, and only once in the morning. Anything more would be an assault on my sanity.

In part it’s just habit. Feels as if I’ve been checking Drudge for as long as I’ve owned a computer. (I got my first in 1996.)

And while Matt Drudge is no longer a window into the news consumption habits of our typical reader — many told me they gave up on him during the Trump presidency — he’s still the premier internet news aggregator. To this day, I come across things via Drudge that I won’t learn anywhere else.

Beyond Drudge, I check a handful of other sources before applying fingers to keyboard…

Beyond Drudge, I check a handful of other sources before applying fingers to keyboard…

- Ed Steer’s Gold & Silver Digest: This subscriber-only e-letter is a comprehensive window on the precious metals markets. But equally valuable are the crowdsourced links to financial news items I might not come across otherwise

- Antiwar.com: Geopolitics can always move markets, and it pays to know what sort of trouble the U.S. government is stirring up around the world. For a quarter-century, Antiwar has been second-to-none in this regard — going all the way back to Bill Clinton’s Kosovo war in 1999.

- Reason: The granddaddy of libertarian magazines has a helpful “Reason Roundup” column that posts every morning about 9:30 a.m. Eastern. It covers the gamut from politics to economics to culture. (Alas, it’s not as useful under its current editor as it used to be…)

Too, I still keep up with currency maven and old friend Chuck Butler, proprietor of the venerable Daily Pfennig e-letter.

![]() The Former Bird App, Now Under New Management

The Former Bird App, Now Under New Management

I guess we have to talk about Twitter — or X, as it’s now styled by its new owner, longtime government contractor Elon Musk.

I guess we have to talk about Twitter — or X, as it’s now styled by its new owner, longtime government contractor Elon Musk.

Under the previous management I was able to peruse Twitter without an account. Musk made me break down and get one. No, I don’t post anything — and I’ve managed to resist the site’s addictive qualities.

Then and now, by following a dozen or so key accounts, I discover…

- Pithy hot takes that help punctuate these daily missives and

- More news I might not discover anywhere else.

Here are some of the financial accounts I follow most closely…

- Jim Bianco, @biancoresearch. The founder of Bianco Research has a Xwitter feed chock-full of worthwhile insights. He has one foot in traditional finance — he’s one of the premier fixed-income guys in the business — and another in decentralized finance. Not a lot of people like that

- Luke Gromen, @LukeGromen. Independent newsletter operator and frequent financial podcast guest. His tweets are mighty cryptic unless you’re familiar with his thinking via his interviews, but I think it’s worth the effort

- Don Durrett, @DonDurrett. An interesting fellow with insights into precious metals, mining stocks and crypto

- Karl Denninger, @tickerguy. I’ve been following this retired internet entrepreneur and his Market Ticker blog off and on since probably 2008. Sui generis.

There are also some non-financial accounts that give me fodder now and then…

- Michael Tracey, @mtracey, aka “our favorite political reporter” in these pages. Tracey first came on my radar during the 2016 presidential campaign and he’s never left

- Glenn Greenwald, @ggreenwald. The premier civil libertarian of the 21st century. He came to the fore during the Dubya Bush years as an old-school liberal. He’s still an old-school liberal; it’s the center-left of the Democratic Party that went full-on authoritarian during the 2010s. (In a similar vein is former Rolling Stone writer Matt Taibbi, @mtaibbi, whose Racket News site on Substack comes highly recommended.)

- Unfortunately, my acquaintance Scott Horton, @scotthortonshow, is taking a break from Xwitter at the moment. Director of the Libertarian Institute among many other hats he wears, he’s busy working on his next book titled Provoked: How America Started the New Cold War With Russia and the Catastrophe in Ukraine. In his absence, I try to make do with Daniel McAdams, @DanielLMcAdams, who was Rep. Ron Paul’s top foreign policy aide; and comedian/podcaster Dave Smith, @ComicDaveSmith.

You’ll notice a lack of “conservative” websites on my list.

You’ll notice a lack of “conservative” websites on my list.

Sorry, but most of them are really subpar. Several years ago I solicited reader input about what folks were reading instead of Drudge, and I was shocked at the level of quality. Any worthwhile original reporting was buried in story after story whose only purpose was to reinforce right-wingers’ tribal identity. (Of course, the purpose of much mainstream reporting these days is to merely reinforce left-wingers’ tribal identity.)

If there is worthwhile original reporting at such conservative sites — i.e., Chuck Ross’ Russiagate coverage for The Daily Caller a few years ago — we figure we’ll hear about it via Xwitter or the other sources listed above.

Same goes, by the way, for the premier “alt” financial site ZeroHedge. (We have our issues with ZH — but all the same, we’ve been compelled to rise to its defense more than once.)

![]() News in Progress

News in Progress

Because the news never stops, I stay abreast of events even as I write.

Because the news never stops, I stay abreast of events even as I write.

I like to think one of the unique elements of this e-letter is that of immediacy. Yes, I’m often writing about longer-term trends… but if I can point out that there’s something happening right this minute to underscore my point, well, so much the better.

So my iPad is set up to receive news alerts from maybe a half-dozen sources.

It’s kind of amazing when I think about it: Modern technology can give anyone the same adrenaline rush that was once limited to folks like me who worked in a newsroom.

Long before the internet came along, every newsroom had access to a “wire service” furnished by an agency like The Associated Press.

When breaking news happened, the teletype would go ding-ding-ding. Would it change the lineup of tonight’s newscast? Or the layout of tomorrow morning’s front page? The only way to know was to get up from your desk and walk over to the machine.

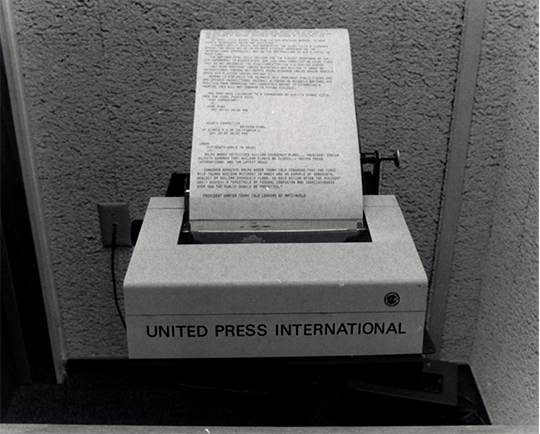

I’m just old enough to have changed the paper and ribbons on a teletype machine exactly like this one [Photo from the Salt Lake County Archives]

As newsrooms computerized in the 1985–95 timeframe, the wire services were fully integrated into those systems along with other functions like word processing, story filing, etc. No need to get up from your desk anymore; breaking news appeared at the top of everyone’s screen at once. But well into the 21st century, the little dopamine hit that came with every “urgent” or “bulletin” (or the extremely rare “flash”) was still limited to newsroom types.

That all changed when Apple launched iOS 3 in 2009 — incorporating push notifications. Every news purveyor with an app could send breaking news straight to your pocket. These 5 Bullets wouldn’t be what they are without it.

Too, I have a handful of international news channels streaming on three or four screens with the sound down. It gives me a ground-truth perspective on the news and the markets in other countries.

Too, I have a handful of international news channels streaming on three or four screens with the sound down. It gives me a ground-truth perspective on the news and the markets in other countries.

There’s France 24, Germany’s DW, Qatar’s Al Jazeera, Russia’s RT and China’s CGTN, among others. Yes, they’re all government-run and have an agenda. But they’re way less crazy-making than American news channels. Too, having them on is kind of a throwback to my shortwave radio-listening days.

And truth be told, it’s also a way to recreate a newsroom atmosphere in my home office — you know, with all the TVs tuned to various channels…

You can take the boy out of the newsroom, but you can’t take the newsroom out of the boy…

![]() Perspective

Perspective

If all of this sounds a little intense, well, I suppose it is.

If all of this sounds a little intense, well, I suppose it is.

Nor is the intensity limited to my “working” hours. There’s always something urgent or important or interesting happening. Rare is the evening or weekend when I’m not jotting something down that I think might be useful for these daily missives.

Which is all fine. What’s less fine is that the intensity has been amped up to extreme levels ever since the world started flying apart in 2020.

In a world of arbitrary lockdowns… riots brought on in part by economic insecurity… a tightening noose of censorship… the risk of getting “financially canceled”… and the starkest threat of nuclear war in 60 years… yeah, it’s overwhelming.

If I’m not careful… I’ll function in a chronic state of anxiety that I’m missing an important piece of information for my writing… or for the life that my wife and I have worked so hard to create for ourselves… or both.

Gotta stay centered and have faith that I’ll see what I need to see when I need to see it. And it’s with that faith I went out for an hour’s hike this morning before sitting down in the chair.

Which reminds me… I ran across this meme in 2022 and keep it on my computer desktop now. I share it with you now because, well, maybe you need it as a reminder too?

P.S. The markets today? There was an interesting pop in the major U.S. stock indexes around 10:30 a.m. EDT — just after the government issued those revisions to the job numbers we mentioned yesterday.

The wonks at the Bureau of Labor Statistics subtracted 818,000 jobs for the period April 2023–March 2024. So “job creation” that had been advertised at a pace of 242,000 per month is actually more like 174,000.

With that, the futures markets are still pricing in a 68% probability of a modest quarter-percentage point cut in interest rates at the next Federal Reserve meeting Sept. 18 — and a 32% probability of a more aggressive half percent.

The major stock averages jumped briefly — only to give it all back. The S&P 500 is flat on the day at 5,597 after snapping a days-long winning streak yesterday.

Gold is still holding the line on $2,500. Crude is sliding to new lows for the month at $72.27.

No economic numbers of any consequence today. Back tomorrow…