COVID 9/11

Dave’s Note: We’re only a short time away from the start of Paradigm’s exclusive and FREE Tech Turning Point 2025 event.

James Altucher and his entire research team are gathered at the annual SXSW event in Austin, Texas. They get underway at 2:00 p.m EDT.

“We thought this would be the perfect place to talk about the biggest opportunities and risks ahead,” James says. “Like what’s REALLY happening inside Musk’s AI empire… Is quantum the next trillion-dollar industry… Are artificial intelligence stocks in a bubble that’s ready to pop?”

All that and more is on the agenda — which you can review at this link. That’s also your link for the live event. Don’t expect a sales pitch for any of James’ publications — just two hours (probably more) of insights, revelations and tickers.

In the meantime, on to today’s edition…

![]() COVID 9/11, Five Years Later

COVID 9/11, Five Years Later

Today marks the fifth anniversary of what your editor calls “COVID 9/11.”

Today marks the fifth anniversary of what your editor calls “COVID 9/11.”

Of course, the nature of the pandemic was such that there’s no single date in 2020 that lingers in the collective memory — like Sept. 11, 2001 or Nov. 22, 1963 or Dec. 7, 1941.

COVID was punctuated by one horrendous event after another, stretched out over weeks and months. It all ran together.

And while March 11, 2020 was a watershed… it wasn’t until five days later that our world truly changed forever, and dramatically for the worse.

But we’re getting ahead of ourselves…

Five years after tyranny descended over the land, many of us still haven’t really processed it — perhaps because of the sheer speed with which everything happened.

Five years after tyranny descended over the land, many of us still haven’t really processed it — perhaps because of the sheer speed with which everything happened.

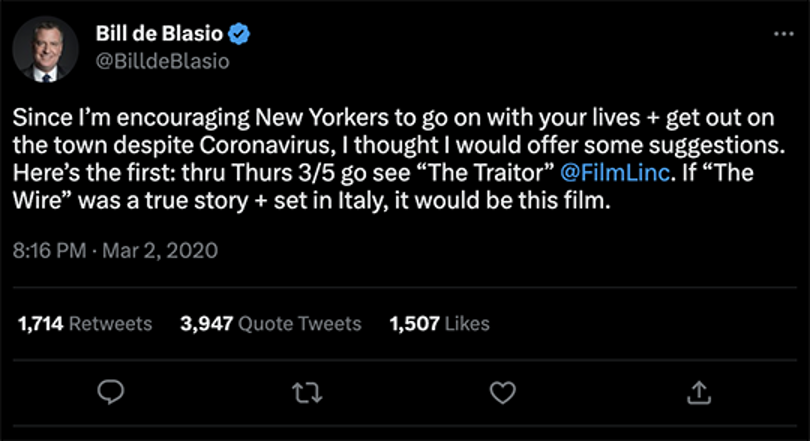

How fast was it? Here’s New York’s mayor at the time, tweeting Monday March 2.

Two Mondays later, the 16th, he ordered the closing of movie theaters — along with night clubs and concert venues. All gatherings of more than 50 people were banned. Restaurants were limited to takeout and delivery. Oh, and gyms were to close at 8:00 that evening — just enough time for the mayor to squeeze in one last workout.

The Monday in between, the ninth, things still seemed mostly normal. The CDC was telling universities to consider postponing or canceling student international travel programs. Florida’s health department was advising anyone who’d traveled internationally to “self-isolate” for 14 days upon their return.

Notice the voluntary nature of everything at this stage.

Most of us probably brushed off — I know I did — the Italian prime minister’s decree that same day, locking down the whole damn country as if it were, well, communist China.

Wednesday, March 11 was, for all intents and purposes, COVID 9/11.

Wednesday, March 11 was, for all intents and purposes, COVID 9/11.

I didn’t really think of it in 9/11 terms, but many finance pros did — certainly if they were in New York, where the number of “cases” was mushrooming.

“Then, as now,” wrote Josh Brown of Ritholtz Wealth Management that day, “the life-and-death issues of the moment overrode concerns about market volatility, although the volatility became expected each morning when we opened our eyes and went to work… Then, as now, there were questions about the U.S. government’s response, the Federal Reserve’s role in shoring up the economy, what Congress would pass in terms of fiscal stimulus and, of course, the rumors, fears and theories about subsequent attacks.”

Talking it over with my wife that evening, I mentioned Brown’s observations. “I was thinking now feels a lot like then, too,” she said. My perception was still different.

Then… in the space of an hour before bedtime… Donald Trump banned incoming flights from Europe, the NBA suspended its season and Tom Hanks made it public that he and his wife had tested positive.

“Yeah,” I told her, “now it’s got the 9/11 vibe.”

The tyranny was starting to come into view the next day, Thursday the 12th — as the word “nonessential” was introduced into general usage.

The tyranny was starting to come into view the next day, Thursday the 12th — as the word “nonessential” was introduced into general usage.

California Gov. Gavin Newsom banned “nonessential” gatherings of more than 250 people. Gov. Mike DeWine in Ohio, not yet hip to the nomenclature, banned “mass” gatherings of 100 or more.

The day after that was Friday the 13th… and Donald Trump declared a national emergency. It didn’t seem like a big deal. Such declarations typically open the spigot of federal aid to the states. If anything, it seemed as if freedom would be expanded a bit as the declaration made it easier for doctors to engage in telehealth visits with out-of-state patients.

Even as late as Sunday the 15th, Washington, D.C., still emphasized the voluntary aspect: Guidance from the CDC recommended canceling or postponing in-person events of 50 or more people nationwide for the next eight weeks.

![]() The Day Everything Changed

The Day Everything Changed

Monday March 16 was the day Trump unleashed the control freaks and power trippers — not that he was paying attention.

Monday March 16 was the day Trump unleashed the control freaks and power trippers — not that he was paying attention.

“Seventy seconds that shook the world,” is how our former colleague Jeffrey Tucker described it during 2022 in an article for the Brownstone Institute.

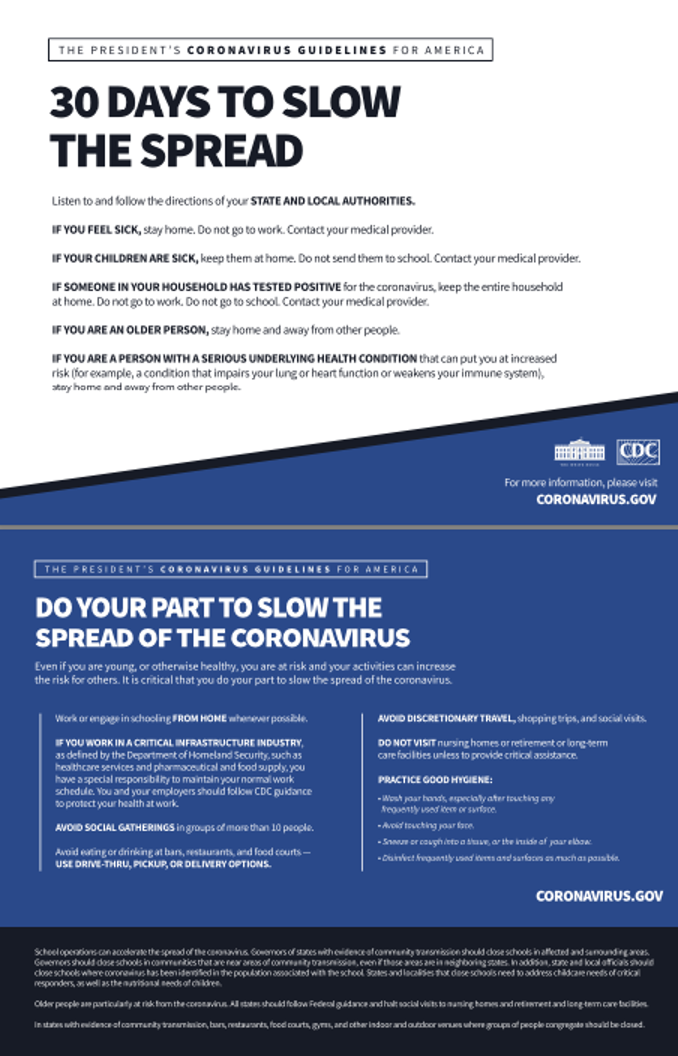

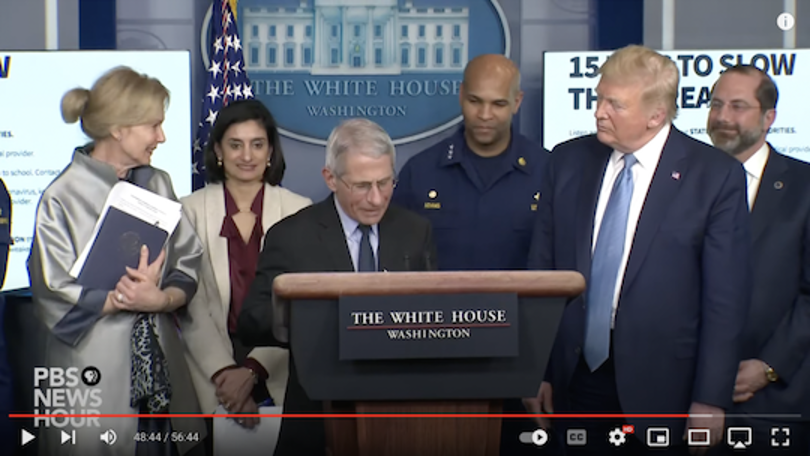

Trump was joined at a White House press event by Anthony Fauci and Deborah Birx. Reporters were handed a two-page flier from the CDC that, as Mr. Tucker wrote, “mostly consisted of conventional health advice.”

But at the very bottom of the second page, in that small print, it said, “In states with evidence of community transmission, bars, restaurants, food courts, gyms and other indoor and outdoor venues where groups of people congregate should be closed.”

Freedom of association, freedom of movement, freedom of commerce, freedom of worship — all of it obliterated in one fell swoop by edict of the “public health” clerisy.

Freedom of association, freedom of movement, freedom of commerce, freedom of worship — all of it obliterated in one fell swoop by edict of the “public health” clerisy.

And the subject didn’t even come up in the opening remarks by Trump and Fauci and Birx — only in the Q&A later: Are people supposed to “avoid restaurants and bars,” a reporter asked, or is the government saying “bars and restaurants should shut down over the next 15 days”?

Trump deferred to Fauci who deferred to Birx, who dodged the question. Fauci ends up reading the fine print aloud.

Jeffrey Tucker picks up the story from here: “As he reads, Birx herself is smiling from ear to ear, as if the words were poetry to her. It was not an unfamiliar text. She had been working on these words the entire weekend. Finally all her work had come to fruition.

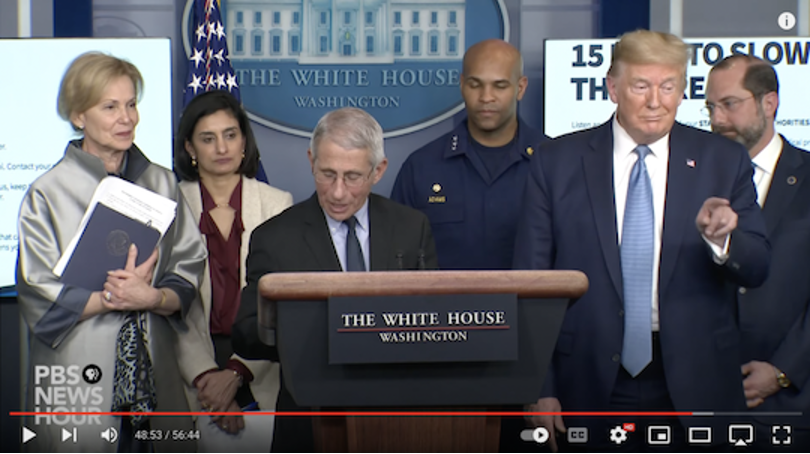

“What was Donald Trump doing during this time? He got distracted by someone in the audience who got his attention. He smiles and points a finger. One wonders who and why.

“Was someone assigned to do the job of distracting him? One cannot rule it out. This was the most significant moment of all. The big reveal had come. And Trump’s attention was clearly elsewhere. To whom was he pointing and smiling?”

Once Trump returned to the lectern, he was oblivious to what just went down…

Reporter: So Mr. President, are you telling governors in those states then to close all their restaurants and their bars?

Trump: Well, we haven’t said that yet.

Reporter: Why not?

Trump: We’re recommending but…

Reporter: But if you think this would work.

Trump: … we’re recommending things. No, we haven’t gone to that step yet. That could happen, but we haven’t gone there yet.

Oh yes they did.

“Everything followed from that brief moment,” Mr. Tucker concluded: “lockdown chaos, the closed schools and churches, the end of basic rights, the wrecking of business, and then began the spending, inflating, mad welfare checks and the demoralization of the population…”

And lockdown didn’t even accomplish its stated goals. The mainstream acknowledged as much by 2023.

And lockdown didn’t even accomplish its stated goals. The mainstream acknowledged as much by 2023.

In October of that year, New York magazine published an excerpt from a book titled The Big Fail: What the Pandemic Revealed About Who America Protects and Who it Leaves Behind. The authors were New York Times veteran Joe Nocera and Vanity Fair contributing editor Bethany McLean. Very mainstream, respectable credentials.

“In the U.S. and the U.K.,” they wrote, “lockdowns went from being regarded as something that only an authoritarian government would attempt to an example of ‘following the science.’ But there was never any science behind lockdowns — not a single study had ever been undertaken to measure their efficacy in stopping a pandemic. When you got right down to it, lockdowns were little more than a giant experiment.”

They even called out the sainted Dr. Fauci: “What he could never acknowledge was that ‘shutting things down’ didn’t stop the virus, and that keeping schools closed didn’t save kids’ lives. Then again, to understand that, you had to be willing to follow the science.” Burn.

Did anything good come from lockdown?

Did anything good come from lockdown?

In a more recent article, Jeffrey Tucker says 2020 was the moment “when perceptions dramatically changed. Government was not what we thought. It is something else. It does not serve the public. It serves its own interests.

“Those interests are deeply woven into the fabric of industry and civil society. The agencies are captured. The largesse flows mainly to the well-connected…

“The COVID operation was an audacious global attempt to deploy all the power of government — in all the directions from and to which it flowed — in service of a goal never before attempted in history. To say that it failed is the understatement of the century. What it did was unleash fires of fury the world over, and whole legacy systems are in the process of burning down.”

Whether those legacy systems will be replaced by something better remains to be seen.

In the meantime, Fauci got a “pre-emptive pardon” as Joe Biden exited the White House… and Birx became a pharma CEO because of course.

![]() More Anniversaries

More Anniversaries

The virus was throwing markets for a loop five years ago this week… and there are two more anniversaries worth noting amid the current market turmoil.

The virus was throwing markets for a loop five years ago this week… and there are two more anniversaries worth noting amid the current market turmoil.

It was two years ago yesterday that California regulators shut down Silicon Valley Bank — the signal moment in a cascade of bank collapses that spring. Before it was all over, America recorded the second-, third- and fourth-largest bank failures in its history… and the Swiss stalwart Credit Suisse went down in flames too.

Also: At our sister e-letter The Million Mission, editor Davis Wilson reminds us the Nasdaq topped out 25 years ago this week — as the dot-com bubble began to deflate. The index went on to tumble nearly 80% from 2000–2002.

Whatever the outcome of the sell-off this month, Davis says “it’s critical to remember that some of the greatest buying opportunities in history have come from periods of uncertainty.”

Amazon’s share price collapsed over 90% — while Jeff Bezos and crew methodically pursued their plan to use an online bookstore as a springboard to transform and dominate all of retail. Today AMZN trades for 45x its early-2000 peak.

Nor was Amazon alone, Davis says: “Investors who focused on real innovation rather than hype made fortunes in the years that followed.”

As for today’s action, the selling has been arrested for the moment — at least in some pockets of the market.

As for today’s action, the selling has been arrested for the moment — at least in some pockets of the market.

The Nasdaq is slightly in the green as we write. But the S&P 500 is down another 0.4%, under 5,600 and down 9% from its record close three weeks ago.

And the Dow is down nearly 1% on the day after Donald Trump doubled his tariffs on Canadian steel and aluminum — a tit-for-tat move after Ontario Premier Doug Ford slapped a 25% duty on electricity his province sends to New York state, Michigan and Minnesota.

Gold sank below $2,900 overnight but it’s since recovered to $2,914. And silver’s racing to test its February highs at $32.74. Crude is up more than 1% to $66.80. Bitcoin is back above $80,000 — not that anyone in crypto-land thinks that’s cause for celebration.

![]() Fed to Wall Street: You’re on Your Own

Fed to Wall Street: You’re on Your Own

Even if the sell-off continues on its recent trajectory, don’t expect the Federal Reserve to ride to the rescue next week.

Even if the sell-off continues on its recent trajectory, don’t expect the Federal Reserve to ride to the rescue next week.

“The Fed actually doesn't care about the stock market unless it becomes ‘disorderly,’” says Paradigm’s macroeconomics maven Jim Rickards. “We're not there yet.

“Down is not the same as disorderly. If markets crash as they did in March 2020, the Fed probably would activate the Powell Put and cut rates. But the Fed won’t do anything specific to help stocks in the slow–grind scenario. That’s not their job.

“The Fed will ‘pause’ again at their next meeting on March 19. There will be no rate cut and no rate hike. The Fed did cut rates beginning last September but they paused the rate cut cycle in January. The Fed doesn’t turn on a dime. They'll need to see a few months of evidence that inflation is under control and unemployment is the bigger problem.

“The Fed will return to rate cuts by their May meeting but not yet. Fed Chair Jay Powell will focus on the dual mandate of low unemployment and price stability. He’s required to do so by law. But the Fed can juggle which part of the mandate (jobs or inflation) takes precedence at any point in time.”

One more major data point is due before the Fed’s meeting next week — the official February inflation numbers coming tomorrow.

Meanwhile, we have a lesser-known economic indicator to chew on today…

The post-election euphoria in small-business America is wearing off.

The post-election euphoria in small-business America is wearing off.

The National Federation of Independent Business is out with its monthly Small Business Optimism Index. The headline number is 100.7 — still up sharply from the months before Election Day but down from 105.1 in only two months.

Meanwhile, the “uncertainty” portion of the survey — where higher numbers are worse — recorded its second-highest reading ever, exceeded only by the month before the 2024 election.

“Uncertainty is high and rising on Main Street and for many reasons,” says NFIB chief economist Bill Dunkelberg. “Those small-business owners expecting better business conditions in the next six months dropped and the percent viewing the current period as a good time to expand fell, but remains well above where it was in the fall.”

On the portion of the survey where respondents are asked to identify their single-most important problem, “quality of labor” is tops — with 19% saying good help is still hard to find. Inflation and taxes are tied for second place at 16%. Labor costs were cited by 12%.

![]() Comic Relief

Comic Relief

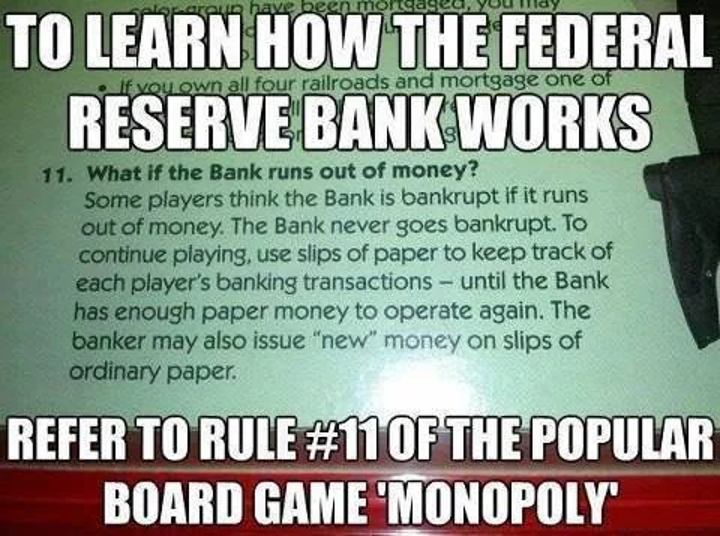

Well, as long as we have the Fed on the brain, we’ll wrap it up today with an oldie but a goodie…

Well, as long as we have the Fed on the brain, we’ll wrap it up today with an oldie but a goodie…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets