No Ordinary Gold Rally

![]() A Different Kind of Gold Rally

A Different Kind of Gold Rally

Against all odds, gold continues to trade near all-time highs.

Against all odds, gold continues to trade near all-time highs.

Checking our screens this morning, the Midas metal is up $11 to $2,175. True, it’s down from a peak at $2,230 last Wednesday — but that was a nanosecond knee-jerk reaction after the Federal Reserve’s latest policy proclamation.

The key is that gold has held the line on $2,100 for three weeks now.

Still, a substantial number of gold bugs don’t think the rally will stick. They point out the gold stocks haven’t been rallying alongside the metal. Meanwhile, silver is only now starting to play catch-up — and still can’t break through $25. (The bid this morning is $24.72.)

At any moment, they’re expecting what the cool crypto kids call a “rug pull” — with gold set for an ugly correction, and soon.

Paradigm macroeconomics authority Jim Rickards acknowledges this is no ordinary gold rally — but he says that’s the exact reason it’s not over yet.

Paradigm macroeconomics authority Jim Rickards acknowledges this is no ordinary gold rally — but he says that’s the exact reason it’s not over yet.

For starters, he says the basics of supply-and-demand are favorable to a rising gold price.

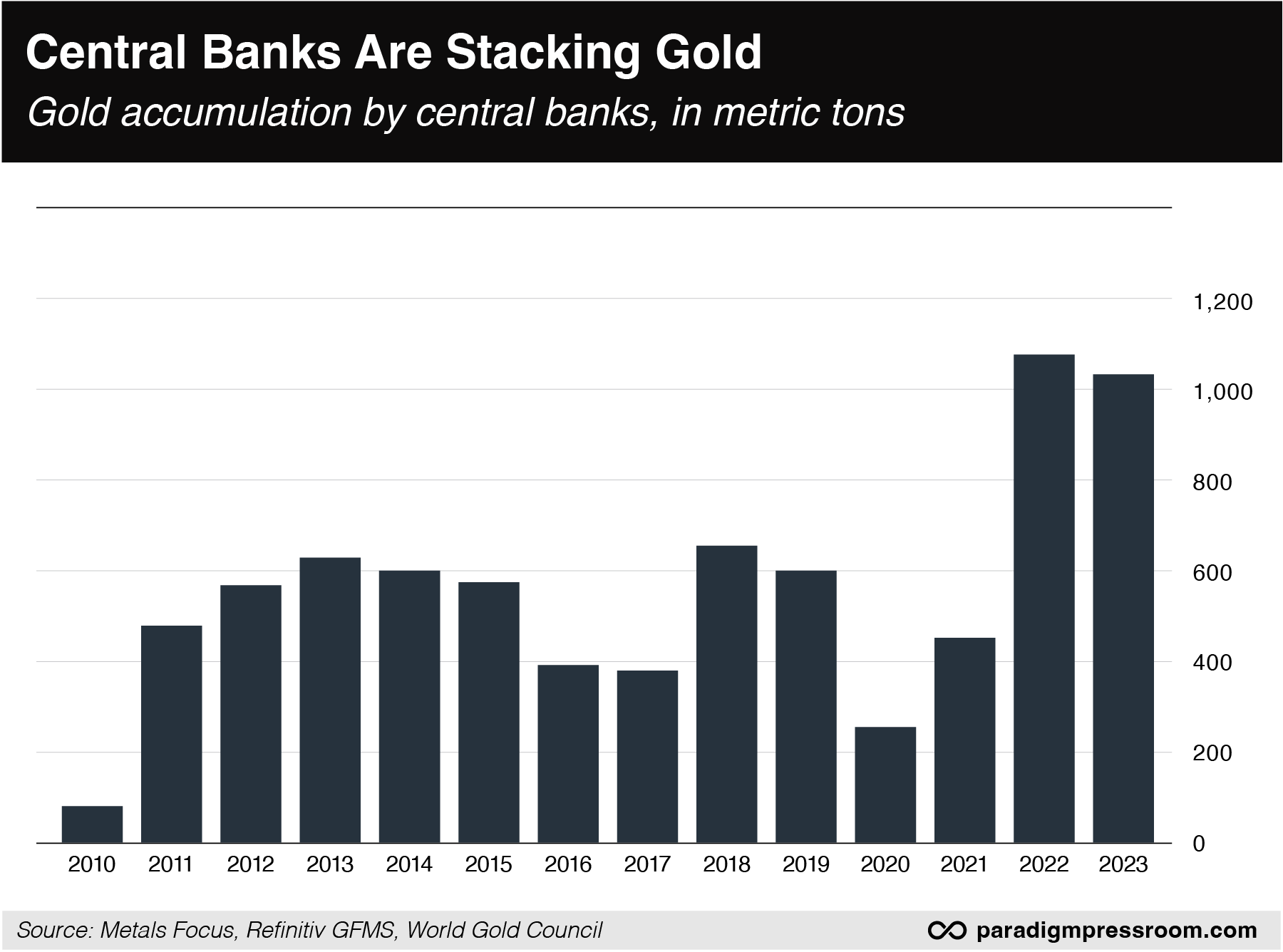

“Mining output and recycled gold have been about flat for the past eight years running between 1,100 metric tonnes and 1,250 metric tonnes per year.

“At the same time, central bank demand for gold has surged from less than 100 metric tonnes in 2010 to 1,100 metric tonnes in 2022, a 1,000% increase in 12 years.”

The 2023 total was 1,037 metric tons — only slightly off 2022’s record pace.

Thus, “continued strong demand by central banks puts a floor under gold prices,” says Jim.

But why are central banks loading up on gold — especially in the last two years? And will it continue?

But why are central banks loading up on gold — especially in the last two years? And will it continue?

That comes back to something Jim’s been hammering away at for, well, the last two years: “Gold prices are being driven higher by U.S. threats to steal $300 billion in U.S. Treasury securities from the Russian Federation.

“Those assets were legally purchased by the Central Bank of Russia as part of their reserve position. The actual securities are held in custody in digital form at European banks, U.S. banks and the Brussels-based Euroclear clearinghouse. Only about $20 billion of those Treasury securities are held by U.S. banks; the majority are held by Euroclear. Those assets were frozen by the United States at the outbreak of the war in Ukraine.”

And now there’s chatter about seizing those assets and handing them to Ukraine — or at least seizing the interest payments from those assets and sending them to Ukraine.

Until 2022, U.S. Treasuries were widely considered the safest asset on the planet. No more. And the bonds issued by U.S. allies like the U.K., Germany and Japan are likewise suspect in the eyes of China, India and much of the Global South.

“The only reserve asset free of this kind of digital theft is gold,” Jim concludes. “Nations are beginning to diversify into gold in order to insulate themselves from digital confiscation by the collective West.”

Expect another big bar on the right side of that chart at year-end 2024 — which can only be positive for the gold price.

The intermediate-term forecast? Jim and his team anticipate a rally to around $2,400 by midsummer.

[Editor’s note: If you missed Jim’s email yesterday, he’s keen to introduce you to someone who can guide you to big gains no matter what the stock market does the rest of this year.

Four years ago, this individual recommended a string of winning trades even as the market melted down during the COVID crash. More recently, he’s guided readers to gains of 224% in 12 days… 493% in 21 days… and 200% in 10 days. And it’s all made possible with the consistent application of one simple strategy — as Jim explains at this link.]

![]() The Markets Today… and Media Malpractice

The Markets Today… and Media Malpractice

Whether it’s the proverbial “geopolitical tensions” or some other factor, crude is back above $82 to start the week.

Whether it’s the proverbial “geopolitical tensions” or some other factor, crude is back above $82 to start the week.

The full scope of the horror from Friday’s terrorist attack in Moscow — the dead number 137 — is only now coming into view.

The market impact might be longer in coming– but come it will, says Paradigm’s Byron King, an authority on both natural resources and military affairs: “Expect upward moves to oil prices and price moves with gold and crypto in the sense that much of the world will edge further away from the dollar, looking for monetary havens.”

If you haven’t read Byron’s piece in full at today’s Rude Awakening, please do so here. It’s a necessary corrective to the bilge spewed out by corporate media today…

- “Attack in Russia Deals a Blow to Putin’s Strongman Image,” says the front page of The Wall Street Journal. Really? George W. Bush’s administration overlooked obvious clues ahead of the 9/11 attacks in 2001, and for a while Dubya was rewarded with a 90% approval rating. Just sayin’...

- The New York Times’ front-page analysis is just as awful, but in a different way: “The Islamic State has long threatened to strike Russia for helping the Syrian president, Bashar al-Assad, stay in control.” The part about “they had it coming” was merely implied. The part about how Barack Obama aided the rise of Islamic State in 2012 by trying to overthrow Assad was ignored completely.

In any event, today is only the second time since early November that crude has eclipsed the $82 level.

As for stocks, all the major U.S. indexes are starting the week in the red — but not by much.

As for stocks, all the major U.S. indexes are starting the week in the red — but not by much.

The Dow is down the most, and that’s less than a third of a percent. At 5,226, the S&P 500 is down a mere eight points on the day — and down 15 points from last Thursday’s record close.

Among the newsworthy names is Boeing — up more than three-quarters of a percent after word that CEO Dave Calhoun is stepping down. The rally might be stronger were it not for the fact Calhoun is staying on through year-end. If the idea is to “send a message” about cleaning up Boeing’s safety culture, the message is mixed…

We covered precious metals up top today. Copper has slipped below $4 a pound for the moment. Bitcoin is back on the move — about $300 below $70,000 again.

![]() Biotech Buyout Bait

Biotech Buyout Bait

Developers of “radionucleotides” are some of the most attractive buyout bait on Wall Street these days.

Developers of “radionucleotides” are some of the most attractive buyout bait on Wall Street these days.

A week ago today, AstraZeneca bought out Fusion Pharmaceuticals for $2.4 billion. “That’s a 97% premium over the previous closing price,” says Paradigm’s biotech maven Ray Blanco.

Companies like Fusion “use a radioactive atom bonded to a targeting molecule to bring pinpoint-accurate attacks against cancer cells, which die as the radionucleotide breaks down and releases a particle of short-ranged radiation,” Ray says.

That’s a huge improvement on traditional radiation therapies — like the one Ray endured as a young adult. They kill the cancer, yes, but they also damage healthy tissue.

Fusion is the third radionucleotide developer to be bought out since last year. Ray’s Catalyst Trader readers own shares of another one that could be an attractive acquisition target. Just the halo from the AstraZeneca-Fusion deal was enough to propel shares to a 52-week high.

And no wonder, given the promise of the technology: “The Fusion buyout is just the latest acquisition move into the space, with Big Pharma buying companies using isotopes that emit either beta or alpha particles as part of a ‘precision-guided nuclear weapon’ strategy against cancer.”

We’ll continue to keep an eye on this niche sector. Meanwhile, watch this space for when we reopen Ray’s Catalyst Trader to new readers…

![]() Business News Website Censored — By AI?

Business News Website Censored — By AI?

On the heels of last week’s depressing Supreme Court hearing into social-media censorship, “the future of AI-powered censorship is here,” writes independent journalist Matt Taibbi at Racket News — “and the early returns are as error-filled and clumsily destructive as Google’s infamous Gemini rollout.”

On the heels of last week’s depressing Supreme Court hearing into social-media censorship, “the future of AI-powered censorship is here,” writes independent journalist Matt Taibbi at Racket News — “and the early returns are as error-filled and clumsily destructive as Google’s infamous Gemini rollout.”

Google has notified the Naked Capitalism website that it’s at risk of losing Google’s ad services — on which the site relies heavily for its revenue.

If you’re not familiar with Naked Capitalism, it’s a vital alternative voice in the business press. Launched in 2006 by a veteran of Goldman Sachs and McKinsey, it leans left of center — but it’s broken consequential stories over the years. It uncovered conflicts of interest that helped force the resignation of a top SEC official and the chief investment officer of CalPERS, the big pension fund for California state employees.

But because the website steps on sensitive toes, the burgeoning censorship-industrial complex put Naked Capitalism in its sights as long ago as 2016 for peddling “fake news” and “Russian propaganda.”

Now Google is threatening the site’s ad revenue for “violent extremism” and “anti-vaccination,” among other offenses. (If you wish, you can see the details in Taibbi’s story, which is not paywalled.)

“This is a threat of complete demonetization,” says Yves Smith, the pen name of the site’s founder. Worse, she says a Google rep has told her that “no human is flagging these posts.”

“Technologists are in love with new AI tools,” writes Taibbi, “but they don’t always know how they work. Machines may be given a review task and access to data, but how the task is achieved is sometimes mysterious. In the case of Naked Capitalism, a site where even comments are monitored in an effort to pre-empt exactly these sorts of accusations, it’s only occasionally clear how or why Google came to tie certain content to categories like ‘Violent Extremism.’

“Worse, the company may be tasking its review bots with politically charged instructions even in the absence of complaints from advertisers.”

Disturbing. As is the first item in today’s mailbag, not unrelated — which follows immediately…

![]() A Tech-Dystopia Mailbag

A Tech-Dystopia Mailbag

“You’re being targeted,” says a reader’s email.

“You’re being targeted,” says a reader’s email.

“Was wondering where my 5 Bullets went today… found it in my junk folder.

“So the hundreds of bulk email junk that arrives in my Inbox everyday....that I mark as junk, or delete without opening, still seem to arrive without issue, but… a newsletter that I'm subscribed to, and physically open 99% of weekdays, for years now, is suddenly assumed to be something that I'd want to throw away?

“I'm only a light conspiracist, but this feels fishy.

“I even did a quick search to see if maybe you're using a different outbound address, but nope… same as always.

“Be careful out there, guys. I know I don't have to tell you, but the war is underway! Keep fighting the good fight!

“Oh, and right behind it in the junk folder was my Not the Bee Daily Newsletter that I also open at least once a day. Coincidence?”

Dave responds: No idea — but I’ve forwarded your message to our executive concierge Dustin Weisbecker. He doesn’t know the answer offhand, but he’s consulting technical types who might.

Given your Hotmail address, we can only hope Microsoft isn’t employing AI tools to suppress any wrongthink…

Staying on the tech-dystopia beat, “As soon as I saw that the feds were suing Apple,” writes a member of our Omega Wealth Circle, “I thought, Payback time! This will teach you what it means to hold your systems encrypted such that the feds can't access everything that your users say and do.

Staying on the tech-dystopia beat, “As soon as I saw that the feds were suing Apple,” writes a member of our Omega Wealth Circle, “I thought, Payback time! This will teach you what it means to hold your systems encrypted such that the feds can't access everything that your users say and do.

“Not to mention restricting the government's ability to bypass the encryption on any iPhone whenever they want.

“This is not the stated issue in the lawsuit, but I have no doubt that the message is being heard loud and clear in Cupertino. Whether or not they will fold is another issue.”

Dave responds: You are almost certainly correct — and thank you for jogging your editor’s memory.

Going back more than a decade, I’ve been chronicling how the FBI and the Justice Department are miffed at Apple’s use of end-to-end encryption of digital messages. Even with a court order, the feds are frequently unable to crack messages between two Apple devices.

Everyone from Barack Obama’s FBI director to Donald Trump’s attorney general complained about it. They demanded Apple build “back doors” into their hardware and software so the feds could obtain easier access to sensitive data.

The problem, as I pointed out all along, is that there’s no such thing as a back door that only “good guys” can pass through. If the feds can get in, so can hackers, foreign governments and so on.

In 2021, Apple announced plans for a deliberate breach of its encryption protocols: IOS would begin to scan the photos on your device if you uploaded them to iCloud, to see if they matched known images of child pornography.

But privacy and security researchers weren’t fooled by the “It’s for the children!” rationalizing. Groups like the Electronic Frontier Foundation protested loudly enough that Apple said it would go back to the drawing board. In late 2022, Apple scrapped the plans altogether.

Now, about 15 months later, the feds have constructed an antitrust case against AAPL. The timing sounds about right. And as I mentioned on Friday, this case is potentially more damaging to Apple than the antitrust cases against Google, Amazon and Facebook.

Too, this is the sort of litigation that carries on even after a change of power in the White House. To be continued…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets