Beyond “Blackwell”

![]() Nvidia’s “Steve Jobs Moment”

Nvidia’s “Steve Jobs Moment”

Jensen Huang jumped the gun. And James Altucher was right.

Jensen Huang jumped the gun. And James Altucher was right.

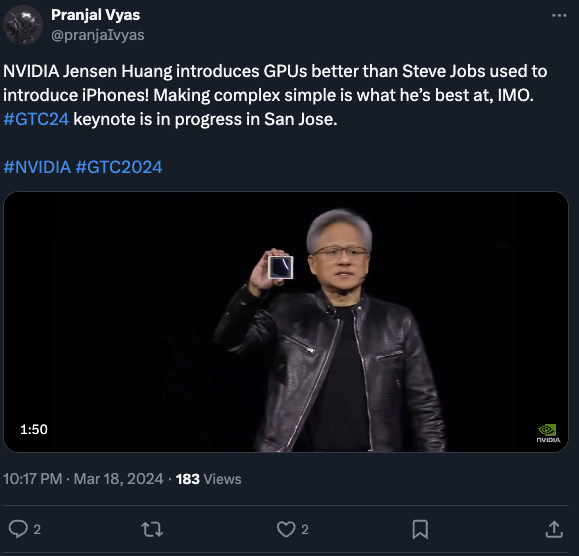

Turns out the “Steve Jobs moment” that James mentioned here yesterday… happened yesterday, a hair sooner than we anticipated.

“Nvidia has unveiled its latest artificial intelligence (AI) chip which it says can do some tasks 30 times faster than its predecessor,” reports the BBC.

CEO Jensen Huang wowed a crowd in San Jose, California, with the chip codenamed “Blackwell” — much as Apple co-founder Steve Jobs did back in the day with iPhones and such.

“He even looked like Steve Jobs!” says our VP of Publishing Doug Hill.

Nor is Doug alone in that assessment. "I haven't seen something like this in the tech industry in quite some time," Bob O’Donnell from Technalysis Research tells the BBC. "In fact, some people were making analogies to the early days of Steve Jobs types of presentations."

Nvidia says major customers are already lined up to use Blackwell in cloud computing and AI — including Amazon, Google, Microsoft and OpenAI.

Now, here’s the story you won’t hear from the corporate media. There’s still another key announcement from Nvidia that has yet to drop.

Now, here’s the story you won’t hear from the corporate media. There’s still another key announcement from Nvidia that has yet to drop.

We can’t predict the precise timing — it might yet come before Nvidia’s annual developer conference wraps up on Thursday — but when it comes, it could prove immensely lucrative.

You see, Nvidia is relying on partner companies to execute its Blackwell vision — including a contractor you might call “the middleman” for every major AI deal. Without this company, Blackwell doesn’t happen.

Nvidia has yet to announce this company’s name. But Paradigm’s own James Altucher says it already has a signed contract with Nvidia.

Little wonder, considering this company is already working with the likes of Tesla, Facebook parent Meta and the Pentagon.

Whenever the announcement comes, expect a rush into this company’s shares — and an explosion in its share price.

You get the idea, right? You want to beat the rush.

![]() SCOTUS Majority: All Hail the Censors

SCOTUS Majority: All Hail the Censors

And now for what the journalist and civil libertarian Glenn Greenwald calls “the most under-reported and under-discussed story” of the last year.

And now for what the journalist and civil libertarian Glenn Greenwald calls “the most under-reported and under-discussed story” of the last year.

Yesterday, the U.S. Supreme Court took up the issue of the pressure the White House brought to bear on the Big Tech companies to exercise censorship.

If you’re a newer reader, this story might seem tangential to our money-and-markets beat. But in reality, it’s central — as I’ve been demonstrating for years now, most recently three months ago.

Since 2018, Big Tech executives have been regularly harangued by members of Congress to exercise increasing amounts of censorship under threat of new regulations.

When the Biden administration came to power in 2021, various three-letter agencies like the FBI began regular email correspondence with Facebook, Twitter, etc. — “flagging” and “reporting” people’s accounts for “misinformation.” Often as not, that pressure ended with account suspensions.

“We are gravely concerned that your service is one of the top drivers of vaccine hesitancy — period,” said a March 2021 email from White House aide Rob Flaherty to an unnamed contact at Facebook. “We want to know how we can help, and we want to know that you’re not playing a shell game with us when we ask you what is going on.”

Astonishingly, it appears a majority of the justices do not view that sort of language as an overt warning to Censor this or else.

Astonishingly, it appears a majority of the justices do not view that sort of language as an overt warning to Censor this or else.

While the tone of a Supreme Court hearing isn’t always indicative of how the justices will rule in the end… the drift from yesterday was disturbing.

Chief Justice John Roberts — the guy who once performed mental backflips to conclude that requiring you to buy health insurance is nothing more than a “tax” — said that not all federal agencies agree on all matters at all times. “That has to dilute the concept of coercion.”

Meanwhile, Trump appointee Brett Kavanaugh seemed inclined to give any government claims of “national security” the benefit of the doubt. (And the feds definitely viewed the virus through the lens of national security.)

The liberal justices were a disaster — with Ketanji Brown Jackson telling a plaintiffs’ attorney at one point, “My biggest concern is that your view has the First Amendment hamstringing the government in significant ways.”

Well yes, that’s the whole point of the First Amendment — and the rest of the Bill of Rights.

The only corporate media account I read was The Wall Street Journal’s front-page story — which was reprehensible.

The only corporate media account I read was The Wall Street Journal’s front-page story — which was reprehensible.

Missing from that story were the names of the individual plaintiffs who joined this case, originally brought by the attorneys general of Missouri and Louisiana.

These are the people who were actually harmed by the actions of the government and the Big Tech employees who all too often collaborated with the government.

So here, we will say their names: There are the epidemiologists Jay Bhattacharya and Martin Kulldorff, and psychiatrist Aaron Kheriaty — all censored for their dissent from orthodoxy when it came to the COVID lockdowns that took effect four years ago this week.

Also Jill Hines, co-director of a group called Health Freedom Louisiana. And Jim Hoft, founder of the Gateway Pundit website. Your editor is no Gateway Pundit fan — but it’s their First Amendment too.

That’s the point. It’s everyone’s First Amendment — not only those whose opinions align with official narratives and conventional wisdom on viruses, elections, the state of the economy, etc.

We end where we began, with Greenwald: As he said last night on his nightly System Update webcast, this case is “the single most important free speech case in the digital era.”

We stand by — nervously — for a ruling sometime before the end of June.

![]() Gold: On the Verge of a Breakout

Gold: On the Verge of a Breakout

Now that gold has held the line on the $2,100 level for over two weeks, a breakout to $2,500 is looking more and more likely.

Now that gold has held the line on the $2,100 level for over two weeks, a breakout to $2,500 is looking more and more likely.

“Gold shot higher at the beginning of March,” says Paradigm income-investing pro Zach Scheidt, “handily clearing previous resistance areas and quickly becoming overbought. That’s the kind of powerful breakout that can lead to months of strong bullish action!”

Here’s a long term — as in, going back to 2005 — chart of GLD, the best-known ETF linked to the dollar price of gold.

The point of taking such a long-term view is seeing that, as Zach says, “the yellow metal has finally surged to a new high that’s well above the consolidation period we’ve endured for the last few years.

“Looking a bit more closely at the recent price action, you can see that gold surged higher during the first week of March.

“Gold then consolidated over the last week, but it hasn’t given back much of its gains. That’s a very healthy pattern and it shows that overall demand for gold remains very strong.

“Gold could have a long way to run this year,” Zach concludes. “After all, gold hasn’t kept up with the high rate of inflation we experienced in the wake of the pandemic. So now it’s time for gold to play catch-up.”

After a few days of backing and filling, Zach expects another leg higher — perhaps a 15% move from here.

For the moment, anyway, precious metals are pulling back: Gold is down five bucks at last check to $2,154 and silver is back below $25.

For the moment, anyway, precious metals are pulling back: Gold is down five bucks at last check to $2,154 and silver is back below $25.

After modest gains yesterday, the major U.S. stock indexes are treading water today — the S&P 500 ruler-flat at 5,150, the Dow up a half a percent and the Nasdaq down about a third of a percent.

[Congratulations are in order, by the way, to readers of Rickards’ Crisis Trader — who yesterday pocketed 101% gains playing put options on the beleaguered Boeing Co. This premium trading advisory is currently closed to new subscribers, but watch this space for announcements.]

Crude has climbed to yet another high last seen in early November — $83.67. That won’t do anything to assuage the Federal Reserve’s concerns about inflation remaining “sticky” as the Fed begins its every-six-weeks policy meeting today.

Bitcoin is getting whacked, down below $64,000 for the first time in about two weeks.

➣ One economic number of note today, and once again it’s housing related: Housing starts leaped 10.7% from January to February, thanks to mild weather and sub-7% mortgage rates. And when it comes to single-family homes, the pace of starts was the strongest since April 2022. Meanwhile, permits for single-family homes — a better indicator of future activity — are the highest since June 2022.

![]() Gold Beans: They’re All the Rage in China

Gold Beans: They’re All the Rage in China

As the kids say these days, “cool beans”...

As the kids say these days, “cool beans”...

“Weighing as little as one gram each,” says a Bloomberg story, “the beans — and other forms of gold jewelry — are increasingly viewed as the safest investment bet for young Chinese in an era of economic uncertainty. It is part of a larger consumer trend for all things gold — from bullion to beans and bracelets — that has gripped the mainland.”

To many teens and 20-somethings in China, one-gram gold beans — the bullion value is about $70 at today’s spot price — are the go-to asset in a time of deflation, low interest rates at the bank and a stomach-churning stock market.

“It’s basically impossible to lose money from buying gold,” says Tina Hong, 18, a college freshman in Fujian province. To date, she’s accumulated two beans.

The story continues: “Generation Z consumers — buffeted by high youth unemployment and the nation’s slide into deflation — are now among the top consumers of gold accessories in the world’s second-largest economy, according to the 2023 China Jewelry Consumer Trends Report by Chow Tai Fook Jewelry Group.”

Too, it’s a social-media phenomenon: “College students post diary-like entries on gold purchases, couples share how they repaired strained relationships with gold gifts and metal resellers and collectors offer gold investing advice.”

Now for some context Bloomberg didn’t provide. Maybe you’re scratching your head at this moment: I thought gold was a hedge against inflation, not deflation.

Now for some context Bloomberg didn’t provide. Maybe you’re scratching your head at this moment: I thought gold was a hedge against inflation, not deflation.

Truth be told, it’s valuable in both scenarios.

This is a point that Paradigm macro maven Jim Rickards has made for many years.

I remember a talk he gave at a conference in Vancouver in 2013. At that time, gold fetched $1,350 an ounce and the S&P 500 registered around 1,700.

Jim entertained a hypothetical scenario of a severe deflation — in which gold crashed to $500 and the S&P crashed to 500. "In that world," he said, "I might like my $500 gold better than my $5,000 gold." That is, gold would still perform the job of preserving purchasing power — and it would perform that job way better than stocks or cash.

Young Chinese instinctively understand that dynamic right now…

![]() The Musk Mailbag

The Musk Mailbag

“Elon is certainly an interesting character,” writes a reader as we carry on with our Musk thread.

“Elon is certainly an interesting character,” writes a reader as we carry on with our Musk thread.

“He's as opinionated as he is brilliant! He easily offends some while astounding others. Love him or hate him, you definitely should pay attention to what he says and what you do with the info is up to you!”

“It’s really not a matter of liking or disliking Elon,” says another. “For the record, I don’t know him, but I can definitely appreciate his ambition. A friend asked me if he should invest in Tesla. I told him you’re basically investing in Elon, so be prepared for the roller coaster ride. However, over time, betting against Elon seems foolish.”

“It seems Elon is a bloody genius but suffers from some form of social dysfunction!” says a third. “He needs to stay out of politics and focus on technical innovation.”

Adds a fourth: “My opinion of Musk is that he is a genius visionary that has the rare ability to implement his creations. And a business genius (less so but…). Look at his results in disruptive ‘new ground’ business. Not many humans have acquired as much wealth.

“Yet, he has an Achilles’ heel. Anything not to do with running the business creating and implementing he should not allow himself to say anything about and should have someone he 100% trusts with reviewing, editing, researching and and releasing anything not related to his ongoing business or science-related.”

Dave responds: Sorry, but whatever your opinion of the guy it’s impossible to separate Musk the businessman from Musk the attention-hogging, s***-stirring carnival barker.

That said, he wasn’t always the political lightning rod he is now. But that’s a story for another day…