Nvidia Insurance

![]() Silicon Rebellion: Time to Take out “Nvidia Insurance”

Silicon Rebellion: Time to Take out “Nvidia Insurance”

Heavy is the head that wears the crown — certainly for the king of AI chips, Nvidia, going into the release of its quarterly numbers tomorrow.

Heavy is the head that wears the crown — certainly for the king of AI chips, Nvidia, going into the release of its quarterly numbers tomorrow.

“Nvidia's rise from gaming graphics to AI dominance has been nothing short of spectacular,” Paradigm’s AI authority James Altucher wrote his Altucher Investment Network readers earlier this month.

“Their H100 chip is the gold standard for AI computing. It's the engine powering ChatGPT and countless other AI applications.”

But James says that success comes at a price — for Nvidia’s customers.

“Tech giants are feeling the pinch of what industry insiders call the ‘Nvidia tax.’ These sky-high chip costs are eating into profits.

“But it's not just about money,” James goes on. “There's a growing unease in Silicon Valley. What if Nvidia gains too much control? What if they become the gatekeepers of AI progress?”

“But it's not just about money,” James goes on. “There's a growing unease in Silicon Valley. What if Nvidia gains too much control? What if they become the gatekeepers of AI progress?”

Thus, James says a “silicon rebellion” is in progress — and he names the rebels one by one…

- “Microsoft, once content to ride Nvidia's coattails, is now crafting its own AI chip. They call it Maia. Will it be the giant slayer they hope for?

- “Google's not sitting idle either. Their Tensor Processing Units (TPUs) — which they’ve been gradually developing over the course of a decade — are gaining ground. Even Apple, fashionably late to the AI party, is using Google’s chips to train its models

- “Amazon, determined to cut its Nvidia dependence, has unleashed Trainium and Inferentia. These custom chips aim to power AWS, the backbone of countless AI startups

- “Not to be outdone, Meta is pouring billions into its own chip dreams. Zuckerberg knows the future of the metaverse may depend on it.”

That’s four of Nvidia’s “Magnificent 7” brethren.

“Even China's tech giants are joining the fray,” James adds. “Huawei's new Ascend 910C chip is sending shock waves through the industry. It's a direct challenge to Nvidia on Chinese soil.”

No, it’s not the end for NVDA. The reason: “Building chips is hard. Really hard,” says James.

No, it’s not the end for NVDA. The reason: “Building chips is hard. Really hard,” says James.

“Big Tech’s software prowess doesn't guarantee hardware success. Just ask Google about their smartphone adventures.

“These challengers bring fresh ideas to the table. But they're also playing catch-up. Nvidia's lead isn't just in hardware — it's in software, developer tools and ecosystem. That's a tough trifecta to beat.

“Tech companies face a tricky balancing act. They're both Nvidia's customer and competitor. Push too hard on in-house chips and they might lose preferential access to Nvidia's latest and greatest.”

Too, there’s the fact that the tech giants have poured billions into AI — and investors are getting anxious about the payoff.

“Tech companies that cut AI investment budgets risk becoming sidelined as their competitors gain ground… in the biggest technology trend since the formation of the internet. The question is whether they can withstand investor pressure to either cut costs or show results before investors threaten to pull the plug.”

So what does that mean for NVDA — with just over 24 hours before its earnings release?

So what does that mean for NVDA — with just over 24 hours before its earnings release?

As noted here yesterday, James is still long NVDA in Altucher’s Investment Network.

He recommended NVDA last September. In June, he recommended selling half of that position for a gain of 183% — and letting the rest ride. That “hold” recommendation for the other half of the position remains in place.

James isn’t exactly looking for the exits yet, but he readily acknowledges that “for investors, this is a high-stakes game of tech roulette. Nvidia's still the safe bet for now. Their lead is real, and their profits are eye-watering.

“But the winds of change are blowing. Smart money is hedging its bets.”

This is, in fact, an ideal time for NVDA investors to lay on a hedge. Call it “Nvidia insurance.”

This is, in fact, an ideal time for NVDA investors to lay on a hedge. Call it “Nvidia insurance.”

A negative reaction to NVDA’s numbers will reverberate far and wide. But you don’t have to sell everything to cover a downside that might not even materialize.

You can stay long NVDA, you can stay long the tech sector, you can stay long the stock market — but going into NVDA’s earnings tomorrow, you might want to consider protective measures against a sudden downdraft.

We’re talking about a small trade, maybe 1% of your holdings — $500 of a $50,000 portfolio.

If the trade goes against you, you lose a little. But if it goes your way, you reel in a small fortune — more than enough to overcome the losses elsewhere in your portfolio.

![]() Gold’s Next Surge

Gold’s Next Surge

Gold has spent the last week oscillating near record highs around $2,500, but “I expect gold to continue to surge,” Paradigm’s Zach Scheidt tells his Income Alliance readers.

Gold has spent the last week oscillating near record highs around $2,500, but “I expect gold to continue to surge,” Paradigm’s Zach Scheidt tells his Income Alliance readers.

“Traders are more confident that the Fed will cut interest rates beginning with the next meeting in mid-September.

“As a reminder, lower rates in the U.S. make the dollar weaker… it takes more weak dollars to buy stuff… since gold is priced in dollars, the dollar price of gold is now trending higher.”

With gold having lagged the inflation rate for much of the 2020s, “gold has a long way to go to catch up with inflation.

“While gold doesn’t always keep up with inflation on a day-to-day basis, over a long period of time, the precious metal has a strong history of preserving wealth against inflation.

“So it stands to reason that as the Fed starts to become more dovish, gold is in the early innings of what could be a multiyear bull market.”

Zach’s forecast at the start of the year for $3,000 gold by year-end might not pan out. But having started the year barely over $2,000, its progress has been remarkable — and it’s not over.

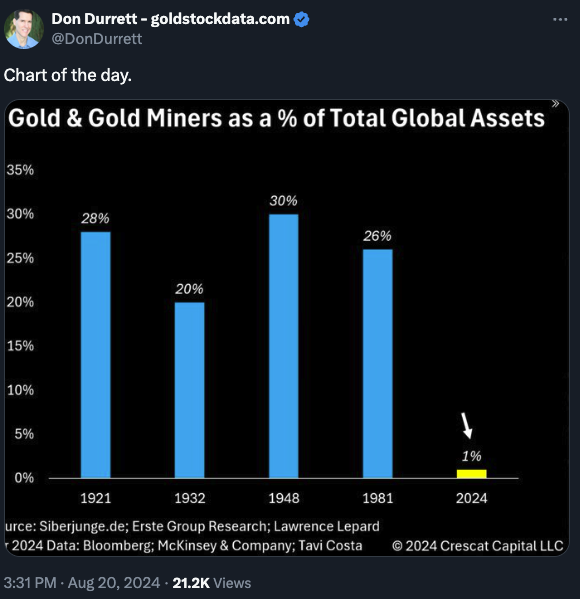

Meanwhile, here’s one of our occasional reminders that compared with times gone by, gold is massively undervalued and underowned relative to stocks, bonds and everything else…

Meanwhile, here’s one of our occasional reminders that compared with times gone by, gold is massively undervalued and underowned relative to stocks, bonds and everything else…

As we check our screens, gold is down ever so slightly at $2,510 and silver’s unchanged at $29.85.

As for stocks, the major U.S. averages are treading water. At 41,161, the Dow is down ever so slightly from its record close yesterday. The S&P 500 and Nasdaq are flat.

As for stocks, the major U.S. averages are treading water. At 41,161, the Dow is down ever so slightly from its record close yesterday. The S&P 500 and Nasdaq are flat.

Crude is giving up a major portion of yesterday’s gains as the Middle East looks quiet for the moment. A barrel of West Texas Intermediate is down 2% and back below $76.

Bitcoin is down in the last 24 hours, but at $61,688 it’s holding the line on $60K once again.

After Nvidia’s earnings tomorrow, the next scheduled event that could be market-moving is Friday’s release of “core PCE,” the Federal Reserve’s preferred measure of inflation.

![]() Censorship Update I: Zuck Fesses Up

Censorship Update I: Zuck Fesses Up

For the record: Mark Zuckerberg says he’s learned his lesson.

For the record: Mark Zuckerberg says he’s learned his lesson.

Zuck has issued a written acknowledgement that the Biden White House “pressured” Facebook to censor Americans who didn’t buy into the official narrative about COVID — and that Facebook caved to that pressure.

To be sure, this isn’t the first time Zuck has broached the subject. Last year, he offended his fellow elites when he said that during COVID time, “the establishment… asked for a bunch of things to be censored that, in retrospect, ended up being more debatable or true.”

Zuck has now elaborated in a letter addressed to House Judiciary Committee Chair Jim Jordan (R-Ohio): “In 2021, senior officials from the Biden administration, including the White House, repeatedly pressured our teams for months to censor certain COVID-19 content, including humor and satire, and expressed a lot of frustration with our teams when we didn’t agree.”

Zuck is soft-soaping it: Here’s a March 2021 email we’ve cited previously — written by White House aide Rob Flaherty to an unnamed Facebook contact: “We are gravely concerned that your service is one of the top drivers of vaccine hesitancy — period. We want to know how we can help, and we want to know that you’re not playing a shell game with us when we ask you what is going on.

“I believe the government pressure was wrong and I regret that we were not more outspoken about it,” Zuck continued. “We’re ready to push back if something like this happens again.”

“I believe the government pressure was wrong and I regret that we were not more outspoken about it,” Zuck continued. “We’re ready to push back if something like this happens again.”

Zuck’s pledge will likely be put to the test.

For one thing, we’ll remind you that in June the Supreme Court (including two of the three Trump appointees) gave its blessing to this conduct on the government’s part.

And for another thing: If you haven’t heard, the White House has resumed offering free COVID tests — at the same time as the fear porn is being ramped up about COVID, West Nile, bird flu and the rebranded mpox. (Evidently the power elite wants to keep its options open.)

In addition, Zuck’s letter also fessed up that aw gee, maybe we shouldn’t have censored the Hunter Biden laptop story three weeks before Election Day 2020.

“It’s since been made clear that the reporting was not Russian disinformation,” Zuck says in the letter, “and in retrospect, we shouldn’t have demoted the story. We’ve changed our policies and processes to make sure this doesn’t happen again…”

Fascinating. This hot take from crypto pundit Nic Carter goes too far…

… but clearly Mr. Zuckerberg has had some sort of touching-a-hot-stove moment that lingers in his memory.

![]() Censorship Update II: Green Light for RFK Jr. Lawsuit

Censorship Update II: Green Light for RFK Jr. Lawsuit

Speaking of the rotten Supreme Court censorship ruling: Robert F. Kennedy Jr. will get a chance to challenge it head on.

Speaking of the rotten Supreme Court censorship ruling: Robert F. Kennedy Jr. will get a chance to challenge it head on.

Strictly speaking, the court did not rule in favor of the Biden administration in Murthy v. Missouri as much as it copped out of deciding the case at all.

The justices said none of the plaintiffs had “standing.” That is, the plaintiffs could not demonstrate they were personally harmed by what the government did. There was no smoking-gun email that said, Take down this individual’s post or else.

Yeah, well, there is such a smoking-gun email when it comes to RFK Jr. and his posts about COVID jabs. And in Kennedy v. Biden he’s fighting the Biden administration on the Supreme Court’s own terms.

Last week, a federal judge in Louisiana granted standing to RFK Jr. — applying the Supreme Court’s standing analysis.

The case has a loooong way to go — but chalk up this ruling as an early victory against the censorship industrial complex.

As long as we brought up RFK Jr.…

As long as we brought up RFK Jr.…

When he endorsed Donald Trump for the presidency last week, Trump promised to “establish an independent presidential commission on assassination attempts if reelected,” according to the Axios site. “Trump said he’ll task the commission with releasing all of the remaining documents pertaining to the assassination of former President John F. Kennedy.”

As I wrote last year, the JFK assassination marked the moment when Americans’ trust in “the system” first began to erode. Vietnam, Watergate, Iraq, the 2008 financial crisis, the COVID circus — ultimately you can trace it all back to the mistrust engendered in 1963. It’s been building ever since.

Trump’s pledge begs the question of why he didn’t release the documents in 2017 when the law commanded him to do so at that time.

According to Judge Andrew Napolitano, Trump told him in 2021 that “if they showed you what they showed me, you wouldn't have released it either.”

Yeah, I’m sure a bipartisan blue-ribbon panel will get to the bottom of it now. Like, you know, the Warren Commission.

The truly sick thing is that no one will hold Trump’s feet to the fire on this promise. Corporate media doesn’t want to dig up too many Establishment skeletons. And conservative media is too afraid that a challenging question to Trump will undermine his support.

And with that pox-on-everyone note, we turn to the mailbag…

![]() Mailbag: “It Is Better To Wait for Self-destruction”

Mailbag: “It Is Better To Wait for Self-destruction”

In response to my “Somehow I Touched a Nerve” edition on Friday, a reader writes: “That’s good. I have nerve damage, so it’s perversely refreshing.

In response to my “Somehow I Touched a Nerve” edition on Friday, a reader writes: “That’s good. I have nerve damage, so it’s perversely refreshing.

“I actually tested as a skeptic thought profile. When it comes to politics, ‘a pox on both their houses.’ ‘Both sides are corrupted.’

“‘Follow the money’ (what’s the motivation) is almost never wrong.

“I’ve given up on trying to persuade others. Tell the truth, and let the chips fall where they may.

“You may lose a few unthinking readers, but those of us with actual critical thinking skills: You won’t. I DO appreciate your equal criticism of both sides. Keep it up.”

Another reader writes with the subject line, “Two recommendations for election reporting.”

"When conflicted between two choices, take neither."

And the other is Nassim Nicholas Taleb in The Bed of Procrustes: “For Seneca, the Stoic sage should withdraw from public efforts when unheeded and the state is corrupt beyond repair. It is wiser to wait for self-destruction.”

I don’t know whether Taleb would apply Seneca’s maxim to the present U.S. election… but Seneca does reinforce my conviction that there’s no voting our way back to “normal” — however you might define it.

Whoever wins in 2024, the dollar loses for the rest of the 2020s. Got gold? (Or Bitcoin, if that’s your jam?)