Socialism Rising

![]() Socialism Rising

Socialism Rising

The discourse about the economy during the presidential campaign has been downright insipid. Which is why I haven’t seen fit to address it in these pages — until today, as Kamala Harris prepares to formally accept her party’s presidential nomination tonight.

The discourse about the economy during the presidential campaign has been downright insipid. Which is why I haven’t seen fit to address it in these pages — until today, as Kamala Harris prepares to formally accept her party’s presidential nomination tonight.

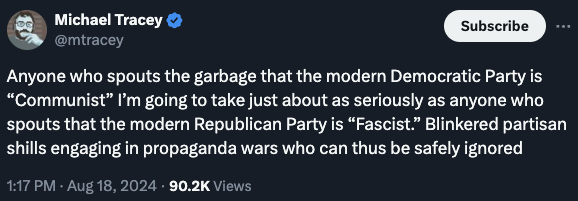

As our favorite political reporter puts it…

Word.

Look, there’s no doubt that price controls are a terrible idea. (We haven’t really tackled that matter in this space because you can read about it anywhere including The Wall Street Journal’s editorial page. Our mission is to seek out “the story no one else is telling.”)

But the concept is not communist or even socialist, for God’s sake. The last widespread experiment with price controls in this country was implemented by President Richard Nixon — one of the most ardent anti-communists of the Cold War era.

➢ And yes, they were a disaster. Nixon’s price controls were why there were gas lines — not the ee-vil Ay-rabs.

The comedian and podcaster Dave Smith elaborates: “Do you really believe these tools of big banks, weapons manufacturers and giant pharmaceutical companies are going to abolish private property?

“I’m against these psychopaths as much as anyone, but let’s call them what they are: corporatists. Tools of big business, who use big government to rig the system against the people on their behalf.”

Which brings us to the problem with the word “socialism” these days:It means whatever the person using it wants it to mean.

Which brings us to the problem with the word “socialism” these days:It means whatever the person using it wants it to mean.

We don’t see anyone using it in the classic sense of the term — state ownership of the means of production. Not even self-described socialist Bernie Sanders proposes nationalizing whole industries — as happened in, say, Great Britain just after World War II.

So the people who use the term favorably usually mean a European welfare-state system of free or heavily subsidized health care, higher education and so on.

Given the disaster of crony-capitalist health care and higher ed in this country — with high and rising costs that far outstrip the overall inflation rate — it’s little wonder this brand of “socialism” is catching on, especially with young adults.

➢ Statistical history: In late 2019, a poll revealed 70% of millennials were willing to vote for a socialist. 2019 was also the year when demographers said millennials surpassed boomers as the largest living adult generation!

![]() Which Way, America? The Nordics — or Argentina?

Which Way, America? The Nordics — or Argentina?

The most vocal self-described “democratic socialists” point to the Nordic countries as a model to follow. If only we Americans were so lucky!

The most vocal self-described “democratic socialists” point to the Nordic countries as a model to follow. If only we Americans were so lucky!

“I think that countries like Denmark and Sweden do very well,” Sanders told an audience in Iowa while campaigning during the 2020 election cycle.

Around that same time, a JPMorgan Chase analyst named Michael Cembalest took a deep dive into the policies and economic performance of Sweden, Norway, Denmark and Finland. Just for kicks, he threw in the Netherlands, too. He analyzed data from the World Bank, the Organization for Economic Cooperation and Development and other groups.

Cembalest concluded that relative to the United States, those five governments have stronger protections of property rights and exert less control over private enterprise.

Cembalest concluded that relative to the United States, those five governments have stronger protections of property rights and exert less control over private enterprise.

“While Nordic countries have higher taxes and greater redistribution of wealth, Nordics are just as business-friendly as the U.S. if not more so,” he wrote. “Examples include greater business freedoms, freer trade, more oligopolies and less of an impact on competition from state control over the economy.”

Nor is Cembalest alone in his assessment. Up until 2020, the World Bank issued annual rankings of how easy it is to start a business — a vital measure given the evidence that new businesses are the key to job creation.

In the final edition of these rankings, the United States came in a pitiful 55th. All five of the countries Cembalest studied ranked higher. (New Zealand was No. 1 — while four former Soviet republics ranked in the top 10!)

“Sweden in fact is pretty much as ‘capitalistic’ as is the United States,” economist Deirdre McCloskey wrote for National Review in 2019.

“Sweden in fact is pretty much as ‘capitalistic’ as is the United States,” economist Deirdre McCloskey wrote for National Review in 2019.

“In many fields,” a Swedish diplomat told her, “we have more private ownership compared to other European countries and to America. About 80% of all new schools are privately run, as are the railroads and the subway system.”

Nor is there a bailout culture, McCloskey pointed out: “When Saab Autos began its descent into bankruptcy, no Swede suggested that the government give the company billions on the security of its worthless stock. When Volvo became a Chinese company, no Swede objected. Compare the determination of the Bush and Obama administrations in proudly capitalist America to socialize General Motors and Chrysler — Chrysler for the second time.”

➢ Since McCloskey wrote her assessment, Swedish leaders famously resisted conventional wisdom about COVID in 2020 and — heaven forfend! — allowed commerce to proceed more or less as usual. Sweden’s excess death rate during the pandemic was among the lowest in Europe — and less than half that of the United States.

In fact, one of Kamala Harris’ most radical proposals looks nothing like the Nordic countries.

In fact, one of Kamala Harris’ most radical proposals looks nothing like the Nordic countries.

Last week, the Harris campaign made it known that it stands foursquare behind Joe Biden’s 2025 budget blueprint — including a 25% “billionaire tax” on the income of those who claim more than $100 million in assets.

Strictly speaking, the proposal is to tax unrealized capital gains — that is, the gains one accrues on a stock or other asset before selling it. (Colleague Sean Ring unpacks it in further detail in today’s Rude Awakening. Warning: His rhetorical approach is less measured than mine!)

The point here is that this scheme is a variant on a longtime soak-the-rich goal of a wealth tax.

But here’s the problem. “The Nordic countries tried direct wealth taxes,” wrote Charles Lane in The Washington Post five years ago; “all but Norway abandoned them because of widespread implementation problems.”

Meanwhile, “The Nordic countries’ use of co-pays and deductibles in health care may be especially eye-opening to anyone considering Sanders’ Medicare-for-all plan… His plan offers an all-encompassing, government-funded zero-co-pay, zero-deductible suite of benefits, from dental checkups to major surgery — which no Nordic nation provides.”

➢ Harris had her own Medicare-for-all variant during the 2020 primaries — including a 4% surtax on income over $100,000. Where she stands now on this score is a mystery.

So here’s our biggest fear: The American-style “socialists” will get their way, and we’ll end up with the worst of all worlds.

So here’s our biggest fear: The American-style “socialists” will get their way, and we’ll end up with the worst of all worlds.

We’ll have the Nordics’ high taxes and wealth redistribution piled on top of America’s red tape and increasingly sketchy private-property protections.

What country might that look like? Cembalest went back to the data. He looked for a toxic stew of high tax rates, high government spending, heavy hiring-and-firing regulations, routine state interventions in markets and limits on capital inflows and outflows.

“I couldn’t find any country that ticked all these democratic socialist boxes, but I did find one that came close: Argentina.”

Since 1900, Argentina has experienced the biggest relative decline in people’s standard of living anywhere in the world. Crises, devaluations, bank closures — they’ve been a matter of routine.

For the last eight months, the new president Javier Milei has been imposing a sort of shock therapy. But undoing 120 years of mismanagement is no small task — and whether everyday folks have the patience to endure the withdrawal pangs remains to be seen.

We’ll leave it there today as far as “socialism” goes. I’m sure I’ve managed to offend everyone — Trump supporters for questioning their comfortable conceits, Trump critics for daring to say anything disparaging of the anti-Trump candidate. But your future prosperity rides on these issues… and I’ve always been an equal-opportunity offender…

![]() Inside Info… or Sheer Incompetence?

Inside Info… or Sheer Incompetence?

Here we go again with the “Super Users” of economic data.

Here we go again with the “Super Users” of economic data.

“At least three banks managed to obtain key payroll numbers Wednesday,” reports Bloomberg, “while the rest of Wall Street was kept waiting for a half hour by a government delay that whipsawed markets and sowed confusion on trading desks.”

As we mentioned at the end of yesterday’s edition, the Bureau of Labor Statistics issued revisions to the monthly job numbers from April 2023–March 2024. Monthly job growth of 242,000 turns out to be more like 174,000.

The numbers were supposed to be posted at 10:00 a.m. EDT — but they weren’t. So analysts from Mizuho Financial Group, BNP Paribas and Nomura Holdings telephoned the agency and got the numbers that way.

“Anger quickly mounted,” says Bloomberg, “as word spread across Wall Street that the BLS had begun giving out the numbers over the phone. A scramble ensued, with other firms and media outlets, including Bloomberg News, trying to obtain the figures, too.”

It doesn’t appear as though the BLS was doing anyone any special favors — not this time, anyway. (We’ve chronicled much skeevier instances in the past.) “The whole thing reeks of incompetence,” the head of a money-management shop tells Bloomberg.

“For its part, the BLS says only that it’s notified the Labor Department’s Office of the Inspector General,” presumably for further investigation.

By the way, the details behind the revisions are even worse than the headline number.

By the way, the details behind the revisions are even worse than the headline number.

The downward revisions cut across nearly all industries and sectors — with a couple of noteworthy exceptions.

Whatever job growth occurred during those 12 months was “even more dependent on government and education/health care than thought,” says Ryan Sweet of Oxford Economics.

In other words, the only growth came in the least productive and most parasitic corners of the economy. Just swell.

Sweet also concludes that hiring is "still strong but less than that needed to keep up with growth in the working-age population."

Yep. As we’ve long noted, it takes 150,000–200,000 new jobs each month just to keep up with population growth.

![]() The “Rotation” Is Alive And Well

The “Rotation” Is Alive And Well

For the record: Even with the stock market approaching all-time highs, the Magnificent 7 names are underperforming.

For the record: Even with the stock market approaching all-time highs, the Magnificent 7 names are underperforming.

“You already know the Mag 7s have dominated since the market bottomed out in late 2022,” Greg Guenthner reminds his Trading Desk readers this morning.

“But they are beginning to lose their grip this quarter. According to BMO Capital Markets data, the Mag 7s are up 1.4% in Q3, while the rest of the S&P 500 is up 3.8%.”

Compare that with the previous quarter, when the Mag 7 rose 17% — while the other 493 stocks in the index actually slipped about 1%.

“This is a positive development for the bull market,” Gunner says. The “rotation” out of the giant tech-adjacent names and into other sectors that the Paradigm analysts began spotting about six weeks ago? It’s alive and well.

“We want to see the rally broaden out! The more stocks participating, the better!”

That said, the major averages are digesting their recent gains today. The S&P 500 is down about two-thirds of a percent at 5,586.

That said, the major averages are digesting their recent gains today. The S&P 500 is down about two-thirds of a percent at 5,586.

Meanwhile, “Mr. Slammy” seems bound and determined to prevent gold from notching another weekly close over $2,500. At last check, the bid is down over $30 to $2,481. Silver is in danger of slipping back below $29.

Crude is rebounding from a brutal sell-off dating back to Aug. 13. At last check a barrel of West Texas Intermediate is up over a buck and back above $73.

After several failed attempts, Bitcoin appears to have burst through the $60,000 barrier.

![]() Silver!

Silver!

We leave you with some silver eye candy today, courtesy of the good folks at Incrementum AG in Europe who compile the annual “In Gold We Trust” report…

We leave you with some silver eye candy today, courtesy of the good folks at Incrementum AG in Europe who compile the annual “In Gold We Trust” report…

Tomorrow we’ll be back with an extended mailbag section to make up for the lack of a mailbag most of this week — catch you then!