The AI Crash (It's Coming)

- The future of the stock market: Battle of the bots!

- A Musk vs. Zuck cage match (No kidding)

- Bitcoin pokes its nose above $30,000

- Ukraine approaches its “Tet moment”

- A grandma’s sacrifice… and when deficits matter.

![]() The Stock Market of the Future: Battle of the Robots!

The Stock Market of the Future: Battle of the Robots!

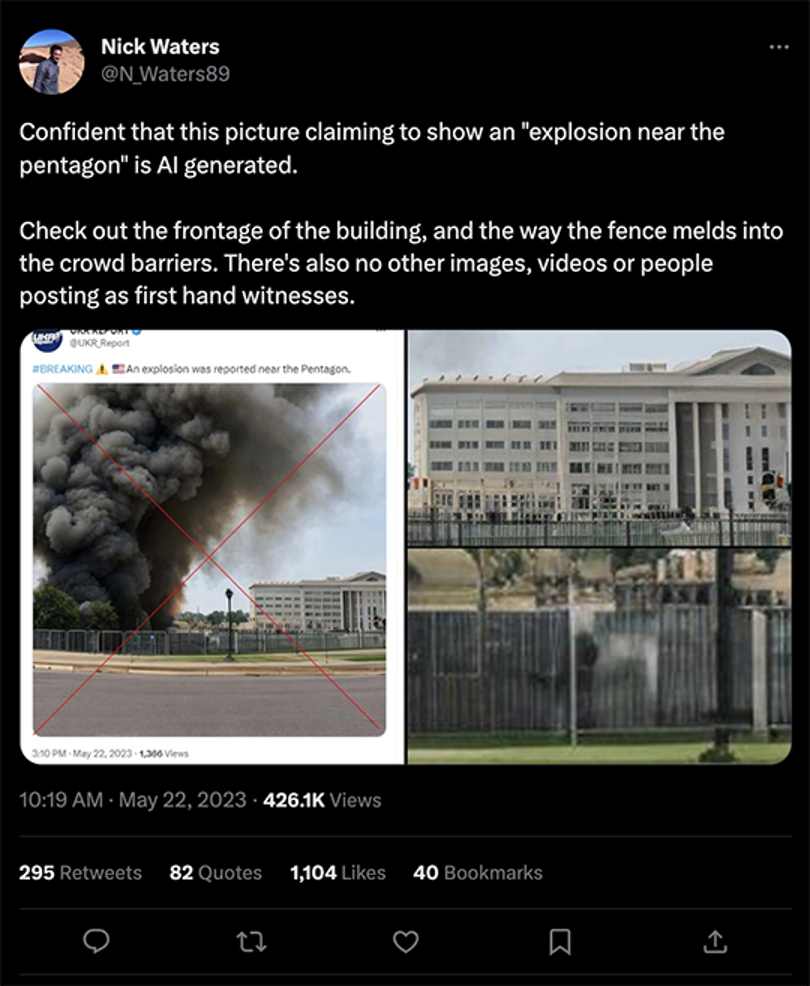

It was one month ago today that we chronicled a first — a market-moving hoax generated by AI.

It was one month ago today that we chronicled a first — a market-moving hoax generated by AI.

“A purportedly AI-generated photo of a fake explosion at the Pentagon spread rapidly on social media on Monday,” reported the New York Post, “prompting mass confusion among users and a brief sell-off in the U.S. stock market.”

Among the outlets that circulated the photo was Russia’s English-language news channel RT and the s***-stirring alt financial site Zero Hedge.

More sober-minded folk spotted the hoax in short order…

… but not before it knocked nearly 1% off the Dow Jones industrials.

Somebody somewhere made money off of that, perhaps a lot of money.

And so we’re in uncharted waters, says Paradigm macro authority Jim Rickards — “the ability of artificial intelligence (AI) robots using generative pre-trained transformer technology (GPT) to create fake news that can manipulate markets or mislead investors.

And so we’re in uncharted waters, says Paradigm macro authority Jim Rickards — “the ability of artificial intelligence (AI) robots using generative pre-trained transformer technology (GPT) to create fake news that can manipulate markets or mislead investors.

“The fake news can take the form of deepfake images, phony stories or scary headlines that cause investors to react before all the facts are known.”

For Wall Street and mainstream financial media, the Pentagon hoax was a wake-up call.

“Last month,” writes the Financial Times’ highly connected editor-at-large Gillian Tett, “the Kaspersky consultancy released an ethnographic study of the dark web, which noted ‘a significant demand for deepfakes,’ with ‘prices-per-minute of deepfake video [ranging] from $300–20,000.’

“So far they have mostly been used for cryptocurrency scams, it says. But the deepfake Pentagon video shows how they could impact mainstream asset markets too. ‘We may see criminals using this for deliberate [market] manipulation,’ as one U.S. security official tells me.”

As Jim Rickards sees it, the potential for mischief is even worse than the mainstream lets on.

As Jim Rickards sees it, the potential for mischief is even worse than the mainstream lets on.

“AI/GPT robots can flood the internet with fake stories,” he says, “designed to mislead other AI/GPT robots trained to look for words and phrases in those fake stories.

“This is a case of robots misleading other robots to disrupt markets.

“Considering that 95% of all stock trading today is fully automated (meaning that actual humans do not make the buy or sell decisions, but robots do based on keywords and limit orders), we’re quickly in a world where robots are trading stocks based on what other robots have recommended after those robots have themselves been misled by still more robots attempting to fool the former.

“Sticking to fundamentals and using buy-and-hold strategies won’t save you when a war of robot versus robot is raging on the stock exchange floor.”

![]() The Caldera Can’t Come Soon Enough

The Caldera Can’t Come Soon Enough

To the markets today — which by all rights ought to be in an outright tailspin on the heels of this item...

To the markets today — which by all rights ought to be in an outright tailspin on the heels of this item...

Yeah, that’s not fake news generated by AI.

You can read about the details anywhere. The thing that strikes your editor is how far we as a culture have fallen.

Musk and Zuck are allegedly two of the biggest faces of can-do “entrepreneurship” in the 21st century. Can you imagine John D. Rockefeller and Andrew Carnegie engaging in a cage match — or whatever the late-19th-century equivalent might have been? No, you cannot.

It’s stuff like this that makes me pine for the giant asteroid, or maybe for the Yellowstone Caldera to awaken from its slumber.

At the very least, shouldn’t there be some sort of horrified reaction in the stock market? After all, these CEOs run two of the seven companies that propped up the entire stock market for the first five months of 2023.

But no — at last check, Tesla is up a half percent on the day while Meta is pancake-flat. The major U.S. indexes are mixed — the Nasdaq up a bit, the Dow down a bit, the S&P 500 nearly unchanged at 4,366.

As for one of the other seven big performers of this year, Amazon is rebounding 3% on the heels of that FTC lawsuit we mentioned briefly yesterday. The gist of the suit was captured nicely by this headline at Reason…

As for one of the other seven big performers of this year, Amazon is rebounding 3% on the heels of that FTC lawsuit we mentioned briefly yesterday. The gist of the suit was captured nicely by this headline at Reason…

And what the hell is with all the redactions in the FTC complaint? It reads like some of the JFK assassination documents, for crying out loud…

“I can understand taking out customer names, but nothing else,” writes our former colleague Mish Shedlock, still blogging tirelessly at his MishTalk site. “This is so beyond ridiculous one has to wonder what the FTC is hiding.”

Elsewhere, gold has sunk to new three-month lows at $1,918 — while silver is down to $22.41. Crude has dropped two bucks to $70.49.

Elsewhere, gold has sunk to new three-month lows at $1,918 — while silver is down to $22.41. Crude has dropped two bucks to $70.49.

Meanwhile, there’s no shortage of economic numbers to chew on…

- First-time unemployment claims: Over 260,000 for three straight weeks now, something we’ve not witnessed since October 2021. The labor market is still tight, but it’s loosening ever so slightly

- Existing home sales: Up a meager 0.2% from April to May, prime homebuying season notwithstanding. Chalk it up to low inventory — if you’re sitting on a 3% mortgage at a time when mortgage rates are 6%, why would you sell unless you had no choice?

- Leading economic indicators: Down 0.7% in May, the 14th-consecutive monthly drop. The Conference Board figures that on this trajectory, the U.S. economy will enter recession sometime between the third quarter of this year and the first quarter of next year.

- Chicago Fed National Activity Index: This number has an uncanny knack to call recessions in real-time once the three-month moving average falls to minus 0.7. But we’re not there yet — for now, it’s still at minus 0.15.

![]() Crypto Chronicles: An Unexpected Bitcoin Milestone

Crypto Chronicles: An Unexpected Bitcoin Milestone

Well, lookee here: Bitcoin has poked its nose over $30,000 for the first time in three months. That’s about a 20% gain this week alone.

Well, lookee here: Bitcoin has poked its nose over $30,000 for the first time in three months. That’s about a 20% gain this week alone.

“Besides those who abhor the Fed’s policies, the only thing I can see that’s lifted BTC is that BlackRock successfully applied to the SEC for a Bitcoin ETF,” says colleague Sean Ring in this morning’s Rude Awakening.

The only other thing I see is a backhanded compliment from Fed chair Jerome Powell during his testimony to Congress this week.

Both of these developments are a welcome respite while Securities and Exchange Commissioner Gary Gensler carries on with his jihad against crypto — culminating most recently with the SEC’s lawsuit against Coinbase.

But Paradigm crypto evangelist James Altucher sees upside from the SEC suit: ““Everyone thinks that what the SEC is doing is a bad thing for crypto. I disagree. This is good. Why? Because it’s bringing one thing we need: clarity. Finally, we’re getting clarity.”

He has a point. As Coinbase chief legal officer Paul Grewal put it after the suit was filed, “I now at least know what it is that we are accused of.” Maybe it just took a couple of weeks for all the noise to shake out and “clarity” to start emerging.

![]() Approaching “the Tet Moment” in Ukraine

Approaching “the Tet Moment” in Ukraine

Direct from our editorial meeting yesterday to The Wall Street Journal today: “Ukraine’s forces are proceeding more slowly than planned in their offensive to retake occupied areas, President Volodymyr Zelenskyy announced.”

Direct from our editorial meeting yesterday to The Wall Street Journal today: “Ukraine’s forces are proceeding more slowly than planned in their offensive to retake occupied areas, President Volodymyr Zelenskyy announced.”

The Russo-Ukrainian war took up a major portion of the Paradigm editorial team’s Wednesday conference call. To date, the financial impact of this conflict has been substantial — everything from the highest energy prices in over a decade to a global flight out of the U.S. dollar.

From the start of the war 16 months ago, most of our team has been skeptical of the UKRAINE IS TOTALLY WINNING narrative from the White House and corporate media. Yesterday, our own Byron King told us the much-ballyhooed Ukrainian counteroffensive is in trouble — and the Ukrainian side is running out of options. Less than 24 hours later, Zelenskyy’s statement all but confirms this reality.

“Prepare for a world in which the United States and NATO have suffered massive loss of face,” Byron said, “on top of all the money down the Ukraine drain.”

It’s perhaps too soon to tease out all the financial consequences of that “loss of face”...

But it’s not too soon to start thinking about when the Ukraine war reaches its “Tet moment.”

But it’s not too soon to start thinking about when the Ukraine war reaches its “Tet moment.”

This is something I wrote about in February — the moment akin to the Tet Offensive during the Vietnam War in 1968.

The United States and South Vietnam emerged the victors of that episode… but it didn’t matter. That’s because for months beforehand, Americans had been told by their leaders that North Vietnam and the Viet Cong were incapable of launching anything on the scale of the Tet Offensive.

What is it Americans have been told for over a year now? Russia is in trouble. Putin is desperate. Ukraine will prevail.

What happens when it dawns on hundreds of millions of Americans and Brits and Europeans that they were lied to?

President Lyndon Johnson was so humiliated by Tet that two months later he decided not to run for another term. Just sayin’...

![]() The Mailbag: A Grandma’s Sacrifice… and When Deficits Matter

The Mailbag: A Grandma’s Sacrifice… and When Deficits Matter

“As a grandmother with eight low-income grandchildren, my husband and I chose to help pay our grandchildren’s college education,” writes a reader as we still get feedback on the topic of student debt.

“As a grandmother with eight low-income grandchildren, my husband and I chose to help pay our grandchildren’s college education,” writes a reader as we still get feedback on the topic of student debt.

“Approximate total spent: $450,000!

“Four chose a private, Christian college. Three chose a state college, and one chose an expensive trade school. We forfeited life dreams of traveling the world to help our family. We forfeited owning a vacation home to escape the 115 degree summer weather where we live.

“Why should I, as a widow now, be forced to pay for the college education of other people’s children?”

Dave responds: Why indeed? Especially now that there’s a good chance your single-filer status will bump you into a higher tax bracket.

I admire the sacrifice you and your late husband made on behalf of your grandchildren. Indeed, your sacrifice is even greater than you think: By footing the bill yourselves, you inadvertently supported and furthered the corrupt system that makes college education so prohibitively expensive in the first place — complete with the administrative bloat and luxury-hotel dorm accommodations.

But as I speculated a while back, we might have passed the point of “peak higher ed” in early 2022 — when students at many schools were still paying full price for crappy Zoom classes while confined to their dorm rooms, even though the entire student body was vaxxed and boosted.

It’ll be interesting to see what choices your grandchildren make for their own children a couple of decades down the line…

“The idea expressed in Tuesday’s 5 Bullets that Trump (or any other president, for that matter) should have matched spending cuts with tax cuts is laughable, at best,” a reader writes.

“The idea expressed in Tuesday’s 5 Bullets that Trump (or any other president, for that matter) should have matched spending cuts with tax cuts is laughable, at best,” a reader writes.

“The normally acceptable ‘spending cuts’ for the last 50 years has been the equivalent of a turkey baster drawing from the Pacific.

“Government doesn’t need tax dollars. They just print whatever they need, consequences be damned.

“Our massive flow of red ink that approximates the ‘budget’ of the United States would be completely unaffected by any meaningless ‘spending cuts.’ It’s a quaint idea, but it lost validity a long time ago.”

Dave responds: I take it you mean political validity and not budgetary validity. Or, heaven forfend, moral validity.

Here’s the thing: Deficits don’t matter… until they do.

Biden during his first year… Trump… Obama… even Dubya Bush… They all got away with running up the national debt because interest rates were either falling or at rock-bottom.

But now, with rising rates? The Congressional Budget Office projects Uncle Sam will pay $663 billion in interest on the national debt this year. That’s more than the entire annual budget deficit in any year before the 2008 financial crisis.

Depending on whose projections you go by, interest on the debt might be more costly than the bloated defense budget by as early as next year.

And with all of the other obligations the federal government has undertaken?

Something’s gotta give — and it’ll probably give before the end of the decade.

More about that in the weeks and months ahead. Because even as politicians on both sides of the aisle want to ignore it, I assure you the story isn’t going away…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets