The Circus Is Coming to Town

- Jim Rickards’ 2024 election cheat sheet

- Oil soaring… and diesel dwindling

- Flustered over Farage: U.K. establishment is red-faced

- SBF was ready for the end of the world

- Does anyone take Cramer seriously anymore?

![]() Jim Rickards’ 2024 Election Cheat Sheet

Jim Rickards’ 2024 Election Cheat Sheet

God help us, we’re less than six months away from the Iowa caucuses now — and less than five weeks away from the first presidential primary debate.

God help us, we’re less than six months away from the Iowa caucuses now — and less than five weeks away from the first presidential primary debate.

“I live in New Hampshire,” says Paradigm Press macroeconomics maven Jim Rickards — “where the candidates are already dropping by at local clubs, churches and TV studios to meet and speak to the voters.” More’s the pity…

Seriously, though, does the typical campaign cycle affect the economy and investor portfolios?

Seriously, though, does the typical campaign cycle affect the economy and investor portfolios?

“In the short run,” he says, “probably not. Voters are pretty good at seeing through the posturing and opportunism and waiting until the smoke clears before deciding that a particular candidate or policy will materially affect their asset allocations.

“At the same time, policies matter. No one can deny the impact of tax policy, Fed appointments, regulatory policies, budgets, the green new scam and many other choices made by political leaders. Voters may not be getting too exercised yet, but they are watching.”

Jim approaches the 2024 campaign cycle with the credibility of having called the two big election shocks of 2016 — passage of the Brexit referendum in the United Kingdom and Donald Trump’s victory in the United States.

Obviously, it’s much too soon to make a final call…

… But it’s not too soon to entertain some outlier scenarios — the improbable but entirely possible.

… But it’s not too soon to entertain some outlier scenarios — the improbable but entirely possible.

In the most recent issue of Strategic Intelligence, Jim entertained several of those possibilities. “Most analysts dismiss these scenarios because the likelihood of any one of them occurring is quite low.

“What they miss is that if you have 10 scenarios each with a 10% chance of occurring, the odds of one of them happening are 100%. That’s why one should expect the unexpected.”

So let’s dive into some far-out possibilities that could sneak up out of nowhere — and potentially throw markets for a loop.

What if the Democratic incumbent Joe Biden is not his party’s 2024 nominee?

What if the Democratic incumbent Joe Biden is not his party’s 2024 nominee?

There’s a laundry list of things that could knock him out of contention — led by his advancing age and the potential for a scandal even the Establishment media couldn’t ignore.

“His obstacles,” says Jim, “include failing health and possible death, impeachment, removal from office under the 25th Amendment and further revelations of criminal wrongdoing by Biden himself and his crime family. Get ready for a wild ride over the next year including a possible President Kamala Harris and a primary challenge from California Gov. Gavin Newsom.”

What if the former president and Republican front-runner Donald Trump is not his party’s 2024 nominee?

What if the former president and Republican front-runner Donald Trump is not his party’s 2024 nominee?

On Friday, a federal judge in Florida tentatively set Trump’s trial on charges of mishandling classified documents — May 20 of next year. Basically she split the difference between prosecutors, who wanted to go to trial late this year, and Trump’s lawyers, who wanted to put it off until 2025.

The timing is such that Trump can campaign vigorously during the primaries and caucuses — most of them will be over by May.

But as you might be aware, there’s a distinct possibility of another federal case against Trump — on charges that he somehow instigated the Capitol riot of Jan. 6, 2021. What if that case races up the docket and disrupts his primary plans?

And what if there’s a speedy conviction in either case? If he loses at trial, “independents and moderate women voters will treat it as the last straw,” says Jim, “and find themselves unable to support a convicted felon.

“Trump does not have the mental and physical problems of Biden (at least not yet), but his legal problems are more immediate. Biden may be under investigation, but Trump is under indictment. A conviction will finish Trump despite recourse to appeals and promises of self-pardons if elected.”

What if Democratic dark horse Robert F. Kennedy Jr. catches on?

What if Democratic dark horse Robert F. Kennedy Jr. catches on?

RFK Jr. has a funny way of enraging the Democratic Party’s dominant center-left Obama-Clinton-Biden wing — which gives him a certain measure of appeal across the political spectrum. With Biden’s “unfavorables” in polling data on the high side, RFK Jr. is commanding near 20% support in the Democrats’ primary race.

“A 20% polling result is not fringe,” Jim points out. “It’s a direct threat to Biden.”

Here’s the wacky thing: The Democratic establishment has decreed that South Carolina hold the first primary of 2024 next February — seeing as the Palmetto State cemented Joe Biden’s position as the front-runner in 2020. But it’s actually written into state law in New Hampshire that the Granite State hold the nation’s first primary — and no politico in New Hampshire, Democrat or Republican, is willing to let that go.

By all indications, New Hampshire will stick to its guns — and Biden will refuse to campaign there. RFK Jr. might well pull out a victory. “Even the biased media,” says Jim, “can’t ignore that.”

What if Florida governor and fallen GOP idol Ron DeSantis revives his stumbling campaign?

What if Florida governor and fallen GOP idol Ron DeSantis revives his stumbling campaign?

“Given Trump’s unfavorability ratings and pending criminal cases,” says Jim, “and the fact that Trump does not have a strong lead over Biden, it’s far too soon to write off DeSantis.”

That’s even though deep-pocketed Republicans like hedge fund giant Ken Griffin and activist investor Nelson Peltz are having second thoughts about DeSantis, at least according to this morning’s Financial Times.

But much hinges on Trump’s fortunes in court: “If Trump’s legal problems do not handicap him,” says Jim, “it’s hard to see how DeSantis can displace Trump in the Republican field. If Trump is convicted of crimes or if his trials reveal serious wrongdoing… Republicans may turn rapidly to DeSantis as a party savior.”

What if California Gov. Gavin Newsom makes a move among the Democrats?

What if California Gov. Gavin Newsom makes a move among the Democrats?

“Newsom will not challenge Joe Biden directly,” says Jim, “but he is ready to pounce if Biden dies or if Democratic leaders force Biden out of the race either because of health or the growing bribery and corruption scandal.”

Already Newsom is campaigning on behalf of Biden in select states — which of course helps to boost his own profile. You know, just in case…

What if Sen. Joe Manchin (D-West Virginia) runs independent or third party?

What if Sen. Joe Manchin (D-West Virginia) runs independent or third party?

There’s a well-moneyed outfit called No Labels that seeks to offer a third choice. Not much of a choice, seeing as the co-chair of the organization is former Sen. Joe Lieberman.

Manchin spoke recently to a No Labels conference. He’s been something of a thorn in the Democrats’ side in recent years. And he’s been cagey about whether he plans to run for his seat again in 2024.

We won’t run down the history of third-party candidacies here — or how they could potentially affect the 2024 race — except to entertain one more outlier possibility…

What if the campaign of the leftist philosopher and academic Cornel West has an impact — real or perceived?

What if the campaign of the leftist philosopher and academic Cornel West has an impact — real or perceived?

“West draws on Marxism in his philosophic teachings,” says Jim, “but also looks to populism, Christianity and Transcendentalism for inspiration. He is the ultimate long-shot candidate.”

But Democrats are already enraged by his presence in the race. They blame Green Party candidate Jill Stein (along with “the deplorables” and “the Russians” of course) for handing the election to Trump in 2016.

Their ire is misplaced: In no state did Stein win enough votes to tip the election to Trump… and even if she did, there was no guarantee that every one of Stein’s votes would have gone to Hillary Clinton in Stein’s absence.

But that’s the fury of the power elite whenever someone upsets their apple cart.

Bottom line: “This will be a volatile and surprising election cycle,” says Jim.

Bottom line: “This will be a volatile and surprising election cycle,” says Jim.

“Some of the surprises will offer excellent investment opportunities. Some will not treat investors kindly.”

But Jim and his team will stay atop all of them in Rickards’ Strategic Intelligence. If you want to keep up with his analysis and recommendations as soon as they’re published — and not wait to see excerpts in these 5 Bullets — you owe it to yourself to subscribe.

![]() Oil Soaring — and Diesel Dwindling

Oil Soaring — and Diesel Dwindling

The big mover in the markets today is oil — now at a three-month high.

The big mover in the markets today is oil — now at a three-month high.

At last check, a barrel of West Texas intermediate is up $1.63 to $78.70 And that’s despite a bit of dollar strength today; the U.S. dollar index is up a fifth of a percent to 101.29.

Nearly all of the Paradigm experts — who typically agree on little — agree that energy prices are headed higher for the balance of 2023. It’s already been profitable this morning for readers of The Profit Wire; Alan Knuckman recommended call options on HF Sinclair Inc. four weeks ago and they’ve already returned a 50% gain.

“On the next dollar dive, crude breaks out above $80,” says Alan.

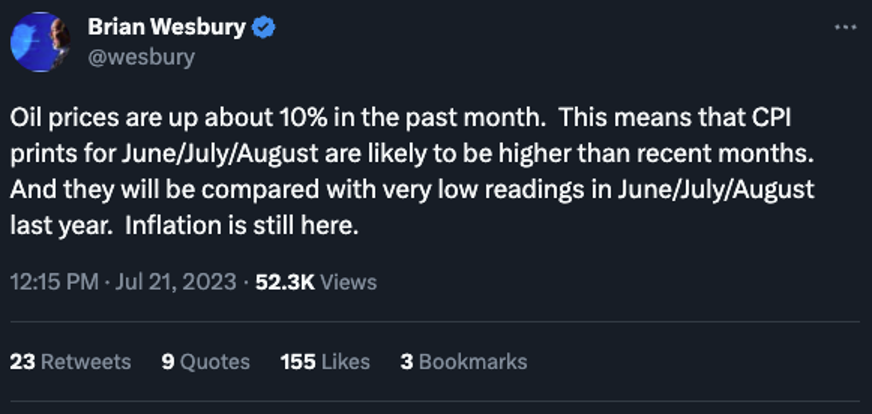

Meanwhile, here’s another reminder that the 3.0% official inflation reading we got this month will be as good as it gets…

To the list of problems you hadn’t started worrying about yet, there’s the possibility of diesel shortages.

To the list of problems you hadn’t started worrying about yet, there’s the possibility of diesel shortages.

“U.S. inventories of diesel and other distillate fuel oils have failed to replenish significantly,” reports the Reuters newswire, “despite a downturn in manufacturing and freight activity that has so far lasted eight months.”

According to the Energy Department’s weekly inventory data, distillate stockpiles are 15% below the 10-year average for this time of year.

Granted, that’s better than the situation a year ago at this time — when inventories were 19% below the 10-year seasonal average. But apart from last year, we’re still looking at the lowest inventories for this time of year since 2004.

Equally worrisome, “there is not much scope for rebuilding depleted diesel stocks by running refineries harder, shifting them away from producing gasoline or drawing down diesel inventories in other regions of the world,” says Reuters. U.S. refineries are running at 94% of maximum capacity — the highest rate since 2015.

While distillates are used for home heating oil in the Northeast, “U.S. distillate consumption and inventories are both closely geared to the business cycle since more than three-quarters of distillate fuel oil is consumed by trucking firms, railroads and manufacturers.”

Yup. If the UPS strike can be resolved quickly and if the economy doesn’t slow down appreciably… distillate stocks might well dwindle to critically low levels. We’ll stay on top of the situation…

Elsewhere in the markets, stocks are rallying modestly — the S&P 500 up 0.4% to 4,554.

Elsewhere in the markets, stocks are rallying modestly — the S&P 500 up 0.4% to 4,554.

Precious metals are quiet, gold at $1,960 and silver at $24.42. Bitcoin is in danger of sinking below $29,000 for the first time in over a month.

The big economic numbers of the day are the “flash PMIs” — which once again show a shrinking factory sector in July (below 50 at 49.0) and an expanding services sector (above 50 at 52.4).

![]() Flustered Over Farage: U.K. Establishment Is Red-Faced

Flustered Over Farage: U.K. Establishment Is Red-Faced

Wow, the British establishment really is embarrassed over the way Nigel Farage was financially canceled.

Wow, the British establishment really is embarrassed over the way Nigel Farage was financially canceled.

As you saw in our No. 1 bullet on Friday, the prestigious bank Coutts told the voluble ex-leader of the U.K. Independence Party that it was closing his accounts.

Farage subsequently demanded — and got — internal communications from Coutts proving the bank’s execs simply didn’t like his “xenophobic, chauvinistic and racist views.”

We mentioned how politicians from both the ruling Conservative and opposition Labour parties say Coutts went too far. The head of Coutts’ parent firm, NatWest Group, has apologized to Farage.

Today, the U.K. government’s “Economic Secretary to the Treasury” Andrew Griffith sent a letter to the bosses of 19 banks, asking them to meet with him soon.

Today, the U.K. government’s “Economic Secretary to the Treasury” Andrew Griffith sent a letter to the bosses of 19 banks, asking them to meet with him soon.

Griffith said recent reports of “client de-banking” had “raised significant concern in both Houses of Parliament”... and that the government will “take the action necessary” to safeguard lawful speech.

“The latest government response,” reports the BBC, “comes after the Treasury announced plans to subject U.K. banks to stricter rules over closing customer accounts. Banks will have to explain why they are closing accounts, and they will have to give a notice period of 90 days before closing an account, to allow people more time to appeal against the decision.”

As it happens, Farage knows our own Jim Rickards. “He's brilliant with a great sense of humor,” says Jim. “The accusations in the Coutts dossier are garbage.”

Jim wants to see actions, not words, before he’s convinced the U.K. government is serious. Combined with the saga of the Canadian truckers last year, Farage’s tribulations are ominous indeed.

“If it's happening in Canada and the U.K., you can be certain it's happening in the U.S.,” Jim says.

“There are many U.S. examples, including recent Biden regulations that require MasterCard and Visa to put gun purchases in a separate reporting code. Prior to this, they used to lump them in with ‘sporting goods’ or ‘recreation’ along with fishing poles and tents.”

We’ll have more to say on that subject tomorrow…

![]() SBF Was Ready for TEOTWAWKI

SBF Was Ready for TEOTWAWKI

Oh look, there’s been a Sam Bankman-Fried sighting and… what?!

Oh look, there’s been a Sam Bankman-Fried sighting and… what?!

As a quick refresher, SBF was the co-founder of the crypto exchange-turned-fraud scheme known as FTX. He awaits trial in New York come October.

As a further refresher, SBF was an advocate of “effective altruism” — which basically meant he wanted to make as much money as quickly as possible so he could channel it toward whatever he deemed a worthy cause (including the $37 million he shoveled to mostly Democratic candidates during the 2022 election cycle).

Well… newly filed court papers indicate that as part of his magnanimous vision, he wanted to buy the island nation of Nauru — so that he and his comrades in the effective altruism “movement” would have a place to flee in case of an extinction-level event or other end-of-the-world-as-we-know-it occurrence.

It’s right there in a memo penned by an official with SBF’s foundation as well as SBF’s brother — “to purchase the sovereign nation of Nauru in order to construct a ‘bunker/shelter’ that would be used for some event where 50–99.99% of people die [to] ensure that most EAs [effective altruists] survive.”

How big of him!

Nauru, population 11,000 and about a third of the land area of Manhattan, lies 2,800 miles northeast of Australia. The country also — heh — gained a reputation in the 1990s for money laundering.

Exactly where SBF was going to obtain the funds for this project the memo did not say. Then again, given the allegations of how his firm pilfered customers’ money, maybe no one wanted to put that in writing?

![]() Does Anyone Take Cramer Seriously Anymore?

Does Anyone Take Cramer Seriously Anymore?

Speaking of the end of the world as we know it…

Speaking of the end of the world as we know it…

Once again, proof that The Babylon Bee is still good for a chuckle once in a while…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets