“Your Money Is No Good Here”

- His bank canceled him for his opinions

- Friday market miscellany

- Can war with China be avoided? (Foxconn’s founder hopes so)

- Blackouts: For a better climate

- The sanctions still don’t “work”

![]() His Bank Cancelled Him for His Opinions

His Bank Cancelled Him for His Opinions

If you want a glimpse into how life would work under a CBDC — a central bank digital currency — just ask Nigel Farage.

If you want a glimpse into how life would work under a CBDC — a central bank digital currency — just ask Nigel Farage.

As a reminder, “CBDCs are programmable,” says Paradigm’s Jim Rickards. “They allow central banks (or regulated commercial banks) to monitor your purchases.

“In conjunction with artificial intelligence (AI), purchases and other uses of money (charitable contributions, political contributions, travel, etc.) can create a profile that identifies you as an enemy of the people as described by Joe Biden and his neo-fascist regime.

“CBDCs can also be used to freeze your account, require you to spend money at the risk of confiscation in the form of a ‘fiscal penalty’ or to impose withholding tax on professionals and independent contractors who are not currently subject to withholding.

“Still, this will not be fully implemented in the U.S. and Europe until early 2024.”

➢ For the record, however, the Federal Reserve’s FedNow system went online yesterday. Under FedNow, payments through banks and other financial institutions will clear immediately rather than sit in limbo overnight and on weekends. FedNow is also necessary infrastructure on the way to implementing a CBDC.

Britain’s most prestigious bank just closed the account of Nigel Farage because of his political opinions.

Britain’s most prestigious bank just closed the account of Nigel Farage because of his political opinions.

Farage was the face of the Brexit movement in 2016 — the successful petition that took the U.K. out of the European Union.

He got his start in the early 1980s as a commodities trader in London. In 1999, he turned to politics — winning election to the European Parliament. After the 2008 financial crisis, he became a YouTube sensation, delivering stemwinder floor speeches denouncing a corrupt financial and political system.

But it was Brexit that put him on the map — and that made him Public Enemy No. 1 among the U.K.’s power elite.

At the end of June, Farage published an Op-Ed in The Telegraph — in which he said the bank where he’d been a customer since 1980 was closing all his accounts.

No one gave him a reason — only a deadline to remove his funds.

“It is impossible to function without a bank account,” he wrote. “It should alarm everybody that a bank has the power to punish those it considers to have erred or strayed.”

An outrageous story, yes — and your editor sat on it for a couple of weeks, waiting for all the facts to sort themselves out before tackling it here in 5 Bullets.

An outrageous story, yes — and your editor sat on it for a couple of weeks, waiting for all the facts to sort themselves out before tackling it here in 5 Bullets.

Did it look suspicious? Of course. But Farage’s assertions were all there were to go on. And there might have been more prosaic explanations for the account closure.

For one thing, U.K. media reported that his account balances at the exclusive Coutts & Co. had fallen below the required minimums. To get in at the institution once known as “the Queen’s bank,” you need a minimum £3 million in savings — nearly $4 million at today’s exchange rate — or £1 million in investments and loans.

For another thing, Farage suspected he’d been labeled a “politically exposed person” — a designation British banks apply to high-profile individuals allegedly at higher risk of bribery and corruption.

But the banks routinely apply that designation just to look good to the authorities enforcing the U.K.’s heavy-handed money laundering laws. Even Britain’s current finance minister Jeremy Hunt claims he was denied an account at a different bank because he’s a “PEP.”

Three weeks later, the facts are in. “He always said the U.K. establishment was out to get him. Now Nigel Farage has the receipts,” says an article at Politico’s European site.

Three weeks later, the facts are in. “He always said the U.K. establishment was out to get him. Now Nigel Farage has the receipts,” says an article at Politico’s European site.

Farage demanded Coutts cough up any documents relevant to its decision to give him the boot. He ended up with a damning report totaling 40 pages.

More from Politico: “A briefing presented to the bank's ‘reputational risk committee’ said Farage is considered by many to be a ‘disingenuous grifter’ with ‘xenophobic, chauvinistic and racist views’ and suggests it could dump him once he paid off his mortgage and dropped below its wealth criteria.”

The briefing was replete with detail — everything from Farage’s retweet of a Ricky Gervais joke that the bank labeled transphobic to Farage’s friendship with the famously unvaccinated tennis legend Novak Djokovic.

As the report concluded, “The committee did not think continuing to bank NF was compatible with Coutts given his publicly stated views that were at odds with our position as an inclusive organization.”

Which was followed by this hilarious butt-covering disclaimer: “This was not a political decision but one centered around inclusivity and purpose.”

Here’s the good news: The disclosures were so embarrassing that the U.K.’s power elite is trying to distance itself from Coutts.

Here’s the good news: The disclosures were so embarrassing that the U.K.’s power elite is trying to distance itself from Coutts.

"This is wrong,” tweeted the Prime Minister Rishi Sunak of the Conservative Party. “No one should be barred from using basic services for their political views. Free speech is the cornerstone of our democracy."

From the Daily Mail: “Energy Secretary Grant Shapps — who has clashed bitterly with Mr. Farage before — said it was a 'disgrace.' Labour MPs have also broken cover to voice disquiet.”

For his part, Farage has been able to milk the publicity to good effect in his role as a host on the GB News channel.

Still, to Jim Rickards, it’s a cautionary tale: “This is not just a story about Nigel Farage. If they can do this to him, they will do it to you if you oppose the Biden regime. And when CBDCs arise, it will be easier than ever.”

[Full disclosure: In addition to his TV gig, Farage is the lead contributor to Fortune & Freedom, a daily e-letter published by London-based Southbank Investment Research. Southbank’s ownership has some overlap with that of Paradigm Press.]

![]() Friday Market Miscellany

Friday Market Miscellany

The National Retail Federation is warning that the supply-chain snags from a UPS strike would equal those from the early days of lockdown in 2020.

The National Retail Federation is warning that the supply-chain snags from a UPS strike would equal those from the early days of lockdown in 2020.

“You’d have supply chain disruption like we witnessed during the pandemic potentially, where you won’t be getting your deliveries,” says the NRF’s vice president of supply chain and customs policy. “So those who are relying on next-day, two-day delivery of whatever you buy online or somewhere else, potentially cannot be delivered,” he tells The Hill.

UPS accounts for a quarter of all U.S. parcel volume according to an estimate from Pitney Bowes. In the current era, a strike will be far more disruptive than the last one in 1997. The Teamsters promise they’ll walk out when their current deal expires a week from Tuesday — and no new talks are scheduled.

Again, if you haven’t already, think about the stuff you’d miss if you couldn’t get it readily in August or September — and order now.

At least some businesses are taking it seriously; In our household, we got an email this morning from a mail-order veterinary pharmacy we rely on for our aging cats, promising it’s “taking proactive measures to mitigate any potential disruptions.” (Fortunately, we’re OK for another three months already.)

But there’s no evidence of supply-chain jitters rippling through the stock market — not yet, anyway.

But there’s no evidence of supply-chain jitters rippling through the stock market — not yet, anyway.

The Nasdaq, which ended up taking a 2.1% beating yesterday, is microscopically in the green at last check — 14,075. The S&P 500 is up about a quarter percent to 4,544. The Dow is on track to finish its 10th straight session in the green, the most since 2017; the Big Board is up 57 points to 35,282.

Precious metals are stuck in the mud as the week winds down, gold at $1,960 and silver at $24.59. Crude is up nearly a buck to $76.51. Try as it might, Bitcoin can’t break decisively over $30,000.

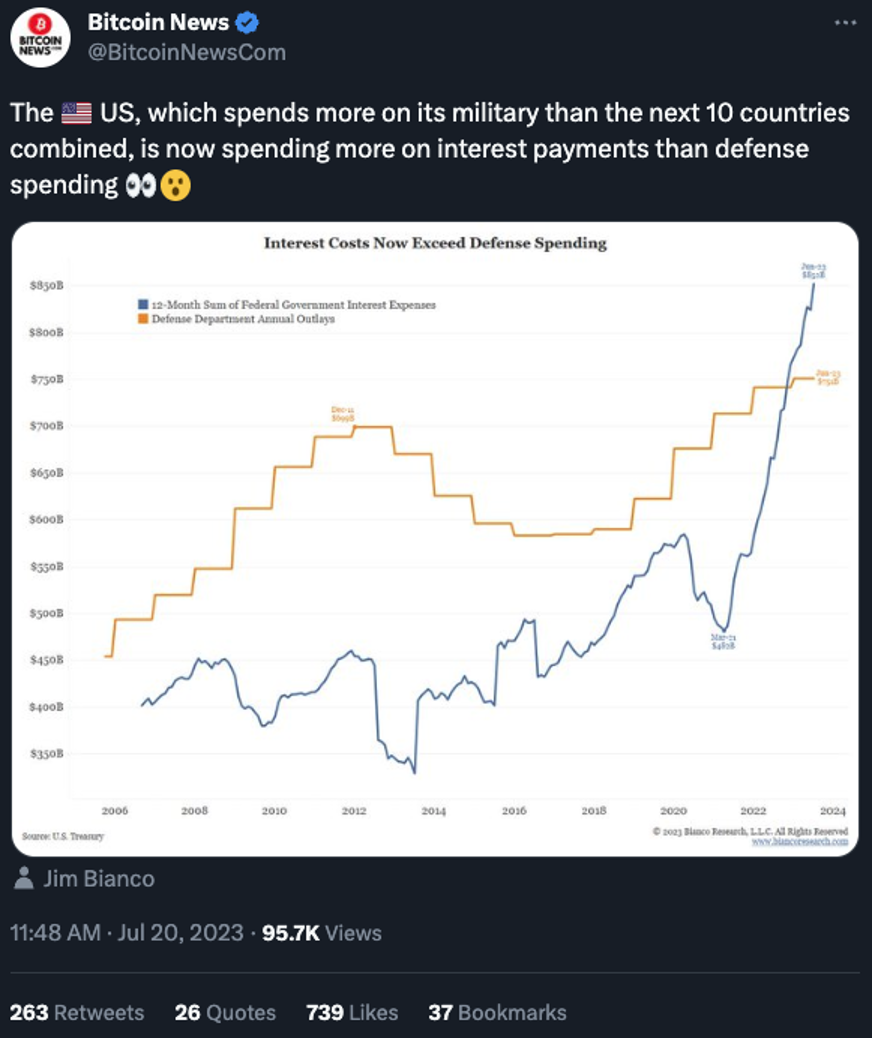

We figured this day was coming — but already?

We figured this day was coming — but already?

Yep. That chart goes back to 2006. The gold line is the official Pentagon budget. The blue line is the interest expense on the national debt. That’s what rising interest rates can do.

How times have changed. Back in 2008, a time of “normal” interest rates, Uncle Sam paid $253 billion in interest on a national debt totaling $10 trillion. But because the Federal Reserve kept its thumb on interest rates for so long, by 2016, he paid only $240 billion in interest on a national debt totaling $19 trillion!

Those days are gone. The government is now paying an average 2.76% interest on its bills, notes and bonds — the highest since 2012.

And as you can see from that blue line on the chart, interest expense over the last 12 months totals $852 billion… on a national debt totaling $32.57 trillion.

Sure, the Fed could lower interest rates again to get that blue line back under control — but then inflation would roar out of control once again.

For the time being, anyway, the Fed’s priority remains inflation — with another jump in the fed funds rate coming next week and one more likely before year-end if the economy doesn’t cool down appreciably.

![]() Can War With China Be Avoided? Foxconn’s CEO Hopes So

Can War With China Be Avoided? Foxconn’s CEO Hopes So

One of Taiwan’s top industrialists is trying to lower the temperature between Taiwan and mainland China — and maybe avert World War III between China and the United States.

One of Taiwan’s top industrialists is trying to lower the temperature between Taiwan and mainland China — and maybe avert World War III between China and the United States.

He’s Terry Gou, billionaire founder and former CEO of Foxconn — the company you probably know best for assembling Apple’s iPhone.

Foxconn is the premier example of how the Taiwanese and Chinese economies are joined at the hip: The company earns 70% of its revenue from its operations on the mainland. It is also one of the mainland’s top private employers.

Given the growing fears over a Chinese attack on Taiwan, Gou issued a plea to the Taiwanese government this week — and made sure an American audience would see it in The Washington Post.

As a reminder, the one-China policy is what’s kept the peace in the Taiwan Straits for over 40 years. The United States recognizes only one government responsible for both the mainland and Taiwan, and its capital is in Beijing. Taiwan, meanwhile, avoids the fateful step of declaring independence from the mainland.

For their part, Taiwan and the mainland came to an understanding of their own in the early 1990s. “Under the so-called 1992 Consensus,” Gou writes, “Taiwan and China agreed to accept the framework of ‘one China’ — although the parties have differing interpretations of that term — and held discussions that over the years resulted in a number of productive agreements.

“But shortly after Tsai Ing-wen became Taiwan’s president in 2016, China cited her refusal to accept Beijing’s interpretation — which includes Taiwan as part of China — as a justification to end the cross-strait talks, and they have not resumed.”

Key context: Taiwan holds presidential elections less than six months from now.

Key context: Taiwan holds presidential elections less than six months from now.

President Tsai will not run for another term; Vice President Lai Ching-te is running to succeed her, campaigning on a platform to reject the one-China framework.

Meanwhile, the opposition Kuomintang or KMT is more friendly to the mainland. Terry Gou sought the KMT’s presidential nomination earlier this year, but he lost the race in May to Hou Yu-ih, the mayor of New Taipei; Gou has thrown his support behind Hou.

“Taiwan has to take control of its destiny, strengthen deterrence capability and, at the same time, deliver an approach to peace that benefits the region and the globe, but most of all itself,” Gou writes. “It can do so only by working with China directly on the basis of the one-China framework.”

As we spelled out two months ago, the vast cross-strait trade gives Beijing every incentive to keep the peace with Taiwan. But if politicians in Washington keep pressing their luck, they’ll goad Beijing into attacking Taiwan sooner or later — just as they goaded Vladimir Putin into invading Ukraine.

That’s why Gou made sure his message would be seen inside the Beltway — even if he couldn’t come right out and say that.

![]() Blackouts — for a Better Climate!

Blackouts — for a Better Climate!

Now for a 5 Bullets public service announcement: The climate change hustlers are saying the quiet part out loud…

Now for a 5 Bullets public service announcement: The climate change hustlers are saying the quiet part out loud…

Yep, after our early warnings this spring about how the power grid is so fragile that a hot summer could result in “load shedding” across the western two-thirds of the country… we’re now being told that would be a good thing.

“Would it be easier and less expensive to limit climate change — and its deadly combination of worsening heat, fire and drought and flood — if we were willing to live with the occasional blackout?” asks Los Angeles Times staff writer Sammy Roth.

Whelp, as I said a few days ago, no one pushing the climate change hustle ever explicitly promised us, “If you like your first-world lifestyle, you can keep your first-world lifestyle.”

![]() The Sanctions Still Don’t “Work”

The Sanctions Still Don’t “Work”

The Ukraine war and Western sanctions targeting Russia top our end-of-the-week mailbag…

The Ukraine war and Western sanctions targeting Russia top our end-of-the-week mailbag…

“Those of us who read this newsletter religiously can't help from noticing how often you chastised President Biden about his handling of the Ukraine war. We heard on numerous occasions how insane his sanctions program was and how ineffective it still is.

“In the last few days, I have read and heard from other media sources how Putin has now driven his economy into the ground due to Biden's measures. Supposedly the value of the ruble is down 35%, sales of Russian cars down 99%... and on and on.

“In the interest of fair and balanced reporting, perhaps you might want to take a look at the Russian economy today and decide if Biden's plan to weaken Russia is working or not. You have access to the numbers that count and might be able to take another look as time has passed.”

Dave responds: As it happens, Jim Rickards weighed in on this very topic earlier in the week with readers of The Situation Report.

“The ruble,” he wrote, “is as strong against the dollar as it was before the war began. (It dipped slightly in recent trading but that is based on lower oil prices, not on U.S. sanctions.) Russian energy exports are near all-time highs. Russia simply sold its oil and natural gas to India and China in place of former European customers.

“The Russian economy is expected to grow 2.1% in 2023, higher than forecasts for U.S. economic growth.”

Looking at a chart of crude, the price is on the verge of breaking back above its 200-day moving average — fuel for a further rally and more revenue for the Kremlin’s kitty.

“Popping in to merely express gratitude for the unrivaled complexity and richness of information and depth of insight,” a reader gushes.

“Popping in to merely express gratitude for the unrivaled complexity and richness of information and depth of insight,” a reader gushes.

“After daily scanning 25–50 news sites...your minds are so elevated way above the rest... still we have to stay aware of the entire range of thought and spectrum of ideas to be plugged into this post-rational world we have to navigate and negotiate... in short, thanks stay healthy and safe... your audience has invested in you and we expect you to be around a long time.”

Dave responds: Well… thank you for getting the weekend off to a rousing start!

Have a good weekend,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets