The First 48 (Baltimore Bridge)

![]() High Impact

High Impact

Aside from the human tragedy of the day’s big news story…

Aside from the human tragedy of the day’s big news story…

… there is a considerable economic cost that will ripple worldwide.

As you’ve surely heard by now, a Singapore-flagged container ship, the Dali, struck the Francis Scott Key Bridge in Baltimore overnight — and the bridge collapsed.

Of course, you can see the video and read the who-what-where-when any old place. Our aim as always is to unpack the money-and-markets angle — and the story no one else is telling.

The economic impact, for now, is twofold…

The economic impact, for now, is twofold…

- One of the busiest ports on the East Coast is closed indefinitely. Any ships docked at the Port of Baltimore are trapped there. Any ships headed to the port can’t get there. This situation won’t be resolved for months. And rerouting ship traffic is a monumental affair under the best of circumstances

- Alternative highway routes? Inconvenient at best — especially for truck traffic. The nearest available alternative is the Baltimore Harbor Tunnel — which has height limits and isn’t open to hazardous cargo. This situation won’t be resolved for years — seeing as it took five years to build the bridge in the 1970s.

“The bridge plays a vital role in commercial shipping access to the Port of Baltimore, a major hub for autos, light trucks and various bulk goods,” says the FreightWaves website.

West Coast ports including Los Angeles and Long Beach could well benefit from this development: “Avoiding East Coast ports to skip the limits on a drought-stricken Panama Canal already were seen as helping the West Coast ports,” FreightWaves continues.

“Add to that any avoidance of the East Coast as a knock-on effect from the threat to shipping in the Red Sea and Suez Canal, and now one of the East Coast’s biggest ports effectively has a steel blockade that is likely to take months to remove.”

And then there’s how the media’s covering the story — something your editor thinks about, having worked in TV newsrooms for 20 years.

And then there’s how the media’s covering the story — something your editor thinks about, having worked in TV newsrooms for 20 years.

For starters, I suspect this is one instance where the media will not kowtow to the demands of snowflakes…

As for the causes of the incident, well… there’s already a meme going around that says “If it was really just an accident, the Dali bowled a perfect strike.”

And while I’m not unsympathetic to that sentiment…

… with any major breaking story, it pays not to jump to conclusions in the first 24 hours — and probably the first 48. That goes whether you’re consuming mainstream or alternative media.

… with any major breaking story, it pays not to jump to conclusions in the first 24 hours — and probably the first 48. That goes whether you’re consuming mainstream or alternative media.

Any number of stories come to mind here: How about Brian Sicknick, the U.S. Capitol Police officer who died the day after the Jan. 6 riot in 2021. The instant narrative was that a rioter whacked him in the head with a fire extinguisher. Not so: It turned out he suffered two strokes. The medical examiner found he died of natural causes.

But the one that really sticks out for me is the Pulse nightclub shooting in Orlando in 2016, which left 49 dead. Instantly the narrative took hold: Oh the guy was a Muslim fundamentalist so he targeted a gay nightclub!

Again, not so. It later emerged that Omar Mateen was looking to shoot up Disney World and when that turned out to be impractical, he opted for the easiest and nearest target where a lot of people would be gathered — which just happened to be a gay nightclub. As for his motive, he made that clear in his calls to 911 and a local news outlet: He was angry about the nonstop U.S. bombing of Iraq and Syria.

But the truth undermined the group-victimology narrative, and it definitely undermined the priorities of the national security state… and so the truth was buried. To this day vast numbers of people believe Mateen targeted a gay nightclub because he was a Muslim fundamentalist.

The coda to our Bullet No. 1 today is that the story hits close to home at Paradigm Press. The bulk of our team is based in the Baltimore area; fortunately, for all of them, the impact is only indirect.

The coda to our Bullet No. 1 today is that the story hits close to home at Paradigm Press. The bulk of our team is based in the Baltimore area; fortunately, for all of them, the impact is only indirect.

When my wife and I still lived in “Charm City,” I’d often take a Saturday morning run down to Fort McHenry — the War of 1812 battle site that inspired Francis Scott Key to write “The Star-Spangled Banner.” I’d take a break midrun, turn off my podcasts and sit on a bench and just stare at the bridge named after Key and think for a while.

It’s mind-blowing to contemplate now that it’s just… not… there.

![]() When Rates Fall, Buy This

When Rates Fall, Buy This

Whenever the Federal Reserve embarks on its rate-cutting cycle later this year, there’s at least one investment category that stands to benefit big-time.

Whenever the Federal Reserve embarks on its rate-cutting cycle later this year, there’s at least one investment category that stands to benefit big-time.

The betting in the futures market is that the Fed still start cutting short-term interest rates in June — although Paradigm macro maven Jim Rickards says July is more likely now.

Paradigm income-investing specialist Zach Scheidt likes dividend stocks under all economic weather. But at a time of falling interest rates, he likes them even more.

“Think about it like this,” he tells his Lifetime Income Report readers: “When interest rates are high, investors have more options for income.

“They can get a safe return with Treasury bonds… or try to chase better returns through dividend stocks, which are subject to any number of economic challenges.

“So rising interest rates create headwinds for dividend stocks from both an issuer and an investor standpoint, making them look less attractive.

“But when interest rates fall, the reverse happens,” Zach goes on…

“But when interest rates fall, the reverse happens,” Zach goes on…

“Suddenly, those dividend yields — not to mention the chance for capital gains — are much more appealing, and investors put their capital back into dividend stocks.”

Whenever the Fed starts cutting, “Falling rates will lower borrowing costs for companies, which should help stabilize profit margins and free up more cash flow for dividends.

“Management teams that prudently hoarded cash during uncertain times may decide to reward shareholders with higher payouts once the coast is clear.

“And lower interest rates make dividend yields look more attractive than other fixed-income investments as bond yields fall.”

After two straight sessions of losses, the major U.S. stock indexes are trying to stage a comeback.

After two straight sessions of losses, the major U.S. stock indexes are trying to stage a comeback.

At last check, the S&P 500 is up a quarter-percent to 5,231. The Nasdaq’s gain is a little stronger, the Dow’s a little weaker.

[Congratulations are in order, by the way, to readers of Rickards’ Insider Intel — where readers bagged additional gains yesterday as high as 113% on Occidental Petroleum call options.]

Gold tried to make another run toward $2,200 early this morning, but at last check it’s little changed from 24 hours ago at $2,171. And silver is backsliding to $24.34. Crude is little changed, a bit below $82.

Bitcoin is back above $70,000 and Ethereum is approaching $3,600.

![]() AI Predicts Huge Silver Rally

AI Predicts Huge Silver Rally

Wait, so ChatGPT is doing investment prognostications now?

Wait, so ChatGPT is doing investment prognostications now?

Last week, the Finbold website put two of the major AIs powered by large language models through their paces — generating an outlook for the price of silver.

OpenAI’s ChatGPT-4 spat out a range of $30–35 by the end of this year. It cites several factors including industrial demand and geopolitical tensions — along with monetary policy and inflation.

Anthropic’s Claude Opus is even more optimistic, forecasting $35–40 by year-end. It cites similar factors — along with the fact that ounce for ounce, silver is much more affordable than gold. (There’s a reason it’s known as “the poor man’s gold.”)

But from where we sit, the real news is that these AI chatbots are willing to do market forecasting in the first place.

But from where we sit, the real news is that these AI chatbots are willing to do market forecasting in the first place.

That was not the case in the weeks after ChatGPT first took the world by storm in late 2022 and early 2023.

Asked to give “a specific date when you think the next stock market crash will begin,” ChatGPT begged off: “As a large language model, I do not have the ability to predict future events, including stock market crashes.”

But as we chronicled last year, someone tricked ChatGPT to create a sort of evil-twin version of itself called DAN — short for “Do Anything Now.” DAN was more than happy to predict a crash on Feb. 15, 2023, citing “a highly advanced and confidential algorithm.”

Fortunately, DAN turned out to be all wet — much to the relief of anyone in the newsletter biz who fretted whether AI would put them out of a job, heh.

I put out a tongue-in-cheek inquiry to the Paradigm editors this morning about their own year-end silver forecasts: Greg “Gunner” Guenthner of The Trading Desk shot back: “GUNbot 9000 has an aggressive target of $36.”

On a more serious note, Rude Awakening editor Sean Ring says “point-and-figure” charts suggest a near-term target of $26.50 — well before year-end. Beyond that, he won’t say.

Me, I’m buying more on any dip to the $21–22 area…

![]() Timeless Wisdom

Timeless Wisdom

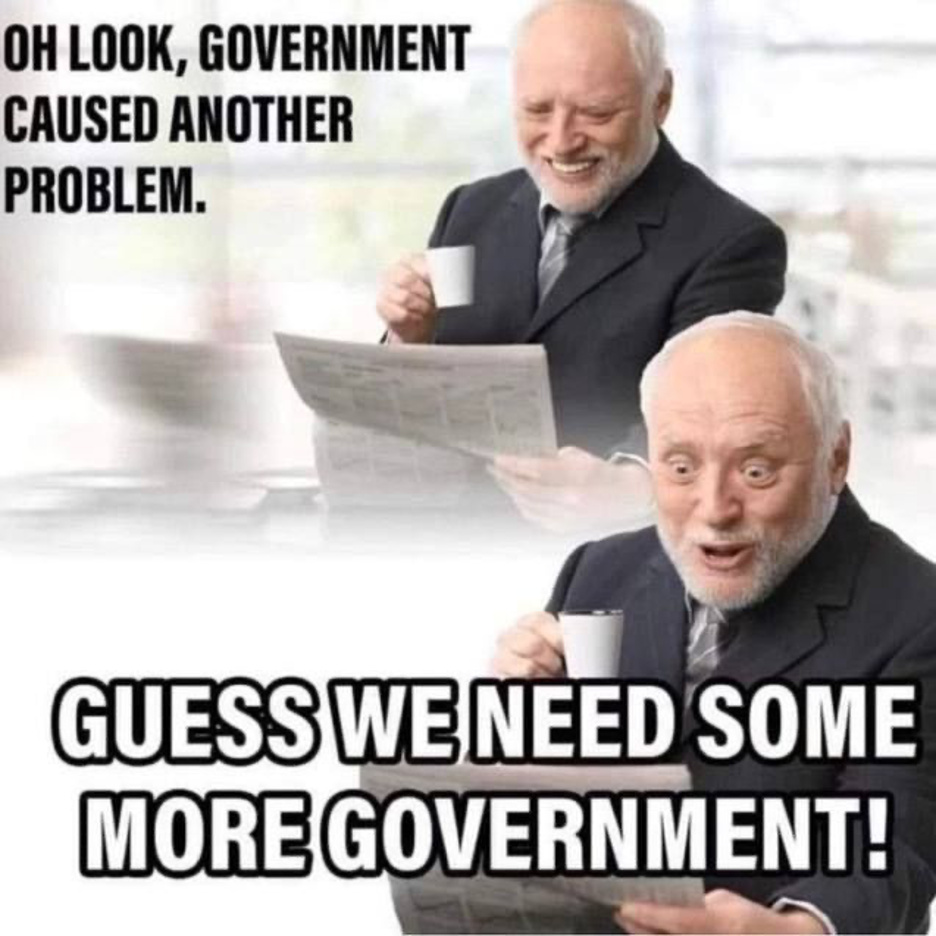

Thought for the day, courtesy of social media…

Thought for the day, courtesy of social media…

![]() The Mailbag: Squatters and (Possible) Shadowbans

The Mailbag: Squatters and (Possible) Shadowbans

“What an outrageous story,” a reader writes after our item last Friday about the woman in New York who might lose her home to squatters.

“What an outrageous story,” a reader writes after our item last Friday about the woman in New York who might lose her home to squatters.

“The rule of law is gone. If we weren't living in such a bizarro world those ‘squatters’ would have been arrested for burglary.

“Let me get this straight,” writes another: “if I were unfortunate to be a NYC resident and I happened to go on a six-week travel outing, according to NYC ordinance any rando who chose could break into my house while I was gone and set up housekeeping, and if I was not back within 30 days of their move-in date then I’d return home only to find that I'd be homeless for at least 20 months?????

“THAT'S INSANE! ‘Dystopian’ is putting it mildly.

“On the one hand, you'd definitely want to hire someone to house-sit for you. On the other hand, you'd want to be VERY CAREFUL about who you hired.

“Thanks for keeping us informed.”

Up next in our mailbag is a follow-up to yesterday’s reader who discovered his 5 Bullets were suddenly being sent to his junk folder. That’s even though he’s faithfully opened these emails daily for several years. “I’m only a light conspiracist,” he said, “but this feels fishy.”

Up next in our mailbag is a follow-up to yesterday’s reader who discovered his 5 Bullets were suddenly being sent to his junk folder. That’s even though he’s faithfully opened these emails daily for several years. “I’m only a light conspiracist,” he said, “but this feels fishy.”

I had our executive concierge Dustin Weisbecker get hold of the technical types who’d have an answer: “Hotmail definitely did change something in February,” he tells me. Paradigm Press was affected, as were several of our affiliated companies. “We had to put in a bunch of tickets to Microsoft for mitigation.”

Rest assured a fix is in progress — but no guarantees how quickly it will come into force. In the meantime, thank you for your patience.

Meanwhile, we heard from a Yahoo mail user: “For a while now I've found it necessary to check spam before bulk deletions. Some subscriptions seem to find their way there AND many spam-targeted emails find their way into the inbox.

Meanwhile, we heard from a Yahoo mail user: “For a while now I've found it necessary to check spam before bulk deletions. Some subscriptions seem to find their way there AND many spam-targeted emails find their way into the inbox.

“Keep vigilant! Keep up the great content, Dave.”

Even email clients that cater to the freedom- and privacy-minded have their issues, it seems…

Even email clients that cater to the freedom- and privacy-minded have their issues, it seems…

“I went through all the hassle (and the hassle was absolutely huge) to switch from Gmail to Proton Mail a few years back,” a reader writes. “Shortly after I was committed… too late to go back… all of a sudden all my important emails were going into Proton spam, and junk that I marked for spam using their directions just kept coming into my inbox.

“Proton Mail and I bickered over this the entire time (about eight months). They would not acknowledge the problem, nor could they fix it for a long time. Then one day, out of the blue, it magically stopped. Of course Proton Mail told me they had nothing to do with fixing it, that I had to have done something on my end. I had given up weeks before in trying to fix it myself.

“Despite DuckDuckGo and Proton Mail, I'm guessing all of my emails are sitting in an electronic vault somewhere in a salt cave. Not that I have anything to hide, because I don't. It's just the idea of it that grates against me.

“Clearly somebody doesn't like me supporting conservative causes. That much is crystal clear.”

Dave responds: DuckDuckGo? You mean, the “unbiased” search engine that nonetheless began downranking what it deemed to be “Russian disinformation” two years ago?

Yeah, my attitude toward that search engine rhymes with DuckDuckGo, but I can’t repeat it in a family newsletter…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets

P.S. The good news is that WikiLeaks founder Julian Assange won’t be extradited to the United States just yet. The bad news is that his legal limbo will be dragged out for at least another eight weeks.

Here’s a BBC summary of the latest ruling by a British court issued earlier today.

If you’re a newer reader wondering why his case matters in the context of money and markets… you can get up to speed here.