The Secret History of Time Change

- The truth about time change

- Jobs: It’s all downhill from here

- Gold is a hot commodity

- Moving back in with the parents (It’s nothing new)

- EVs and BS: The debate continues!

![]() The Truth About Time Change

The Truth About Time Change

"Frequent and uncoordinated time changes cause confusion, undermining economic efficiency,” wrote economist Allison Schrager in The Atlantic a decade ago.

"Frequent and uncoordinated time changes cause confusion, undermining economic efficiency,” wrote economist Allison Schrager in The Atlantic a decade ago.

“There's evidence that regularly changing sleep cycles, associated with daylight saving, lowers productivity and increases heart attacks."

As part of a maddening twice-yearly ritual... most of us will change our clocks this weekend, returning to standard time from daylight saving time.

And so we beg your indulgence for one of our occasional DST rants. There’s a personal motivation here — DST gets harder and harder on your editor as the years go by — but there’s no shortage of economic angles as well.

Cato Institute senior fellow Scott Lincicome highlighted a few of them in 2021, denouncing DST as “an onerous state time mandate detrimental to public health and safety, manipulated by corporatists, supported by a handful of childless insomniac socialites and based on so-called ‘science’ debunked decades ago.”

Tell us how you really feel, Mr. Lincicome!

To begin with, any claims of energy conservation are fanciful.

To begin with, any claims of energy conservation are fanciful.

A little over 15 years ago, those claims were put to the test in the most scientifically rigorous manner possible.

Up until 2006, most of Indiana’s 92 counties observed year-round standard time — in sync with New York during the winter and Chicago during the summer. Then the Hoosier state’s legislature opted for conformity.

In 2010, researchers from Yale and the University of California, Santa Barbara concluded the energy saved by less indoor lighting during the summer months was offset by an increase in the use of heating and air conditioning. Indeed, daylight saving time contributed to a 1% jump in electricity use.

An earlier study came to a similar conclusion. “The policy,” Lincicome wrote, “cost Indiana households an extra $9 million per year, plus annual ‘social costs of increased pollution emissions that range from $1.7–5.5 million’ — costs that the authors predict are likely even higher in other parts of the United States.

“Indeed, DST’s net energy drain is probably even bigger today, as it’s been extended into November (thus raising heating/cooling costs) while electricity savings from keeping the lights off have shrunk because today’s light bulbs are more efficient (and thus cheaper to keep on).”

“The policy also imperils Americans’ health and safety,” Lincicome continued.

“The policy also imperils Americans’ health and safety,” Lincicome continued.

“For starters, the semiannual time change results in all sorts of maladies in the days thereafter: car crashes and pedestrian deaths; workplace injuries; heart attacks and strokes; depression; and ‘adverse medical events’ because of ‘human error.’ (Mental note: Don’t get hurt/sick on time-change weekends.)”

In 2020, the American Academy of Sleep Medicine, in conjunction with a host of other medical groups, published a position paper in the Journal of Clinical Sleep Medicine.

Their recommendation — adoption of year-round standard time. That’s what would be “best aligned with human circadian biology and has the potential to produce beneficial effects for public health and safety.”

Alas, we’re at the mercy of special interests — and have been ever since DST was adopted outside of wartime with passage of the Uniform Time Act of 1966.

Alas, we’re at the mercy of special interests — and have been ever since DST was adopted outside of wartime with passage of the Uniform Time Act of 1966.

Contrary to myth, that wasn’t done for the benefit of farmers. Indeed farmers “now had an hour less of morning light to milk their cows and get goods ready for market,” wrote Michael Downing in his 2005 book Spring Forward: The Madness of Daylight Saving Time.

Rather, the mid-1960s change was the doing of Big Oil — which benefited from higher gasoline consumption during the longer evenings.

But the history doesn’t end there. Lincicome again: “The gas and fuel industries were then joined by the golf, home improvement and barbecue/patio industries to lobby for the 1986 expansion of DST from six to seven months, because each industry gained hundreds of millions in additional sales revenue each year.”

Finally in 2005, seven months of DST became the current eight — “driven,” writes Lincicome, “by the National Association of Convenience Stores (NACS) and U.S. candymakers, each of which wanted Halloween to occur during DST because it boosted candy and, again, gasoline sales.”

Most years, there’s legislation in Congress that would do away with time change, but it never seems to go anywhere. That’s just as well because the legislation would put the nation on year-round DST.

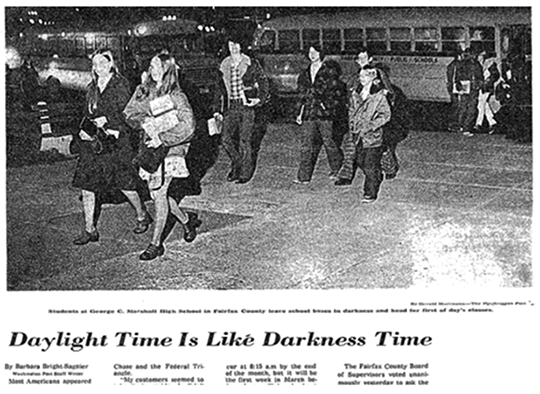

Maybe you don’t remember, but the country already tried this in the ’70s — and everyone hated it because kids were going to school in the dark. Here’s a clipping from The Washington Post, Jan. 8, 1974…

Maybe you don’t remember, but the country already tried this in the ’70s — and everyone hated it because kids were going to school in the dark. Here’s a clipping from The Washington Post, Jan. 8, 1974…

Amid overwhelming public pressure, Congress repealed year-round DST just in time for the darkest months of the 1974–75 school year.

As noted above, the sleep researchers say year-round standard time is the way to maximize the available daylight in winter without the jarring effect of time change. But that would make too much sense, right?

![]() Jobs: It’s All Downhill From Here

Jobs: It’s All Downhill From Here

The job market is finally showing signs of cooling off.

The job market is finally showing signs of cooling off.

It being the first Friday of the month, the government is regaling us with the October employment numbers. The wonks at the Bureau of Labor Statistics conjured a mere 150,000 new jobs for the month — less than the 179,000 expected by the typical Wall Street economist.

In years gone by, 150,000 was considered the baseline — the bare minimum necessary to keep up with population growth. Granted, some of those jobs will come back in next month’s report now that the autoworker strike is over — about 30,000.

That said, the September and August numbers were revised down.

The official unemployment rate ticked up to 3.9%. The “U-6” rate — which includes part-timers who want to work full time and people who’ve given up looking for work in the past year — rose to 7.2%. That’s the highest since early last year.

As has been the case for the last 15 years, Mr. Market views these numbers not through the prism of Is the economy healthy? but rather What does it mean for Fed policy?

As has been the case for the last 15 years, Mr. Market views these numbers not through the prism of Is the economy healthy? but rather What does it mean for Fed policy?

On the theory that a cooling labor market makes it more likely the Federal Reserve really is done with its rate-raising cycle… the major U.S. stock indexes are all in rally mode.

The S&P 500 is up nearly 1% to 4,357 — all told, an impressive rebound from last week’s close of 4,117. Paradigm trading pro Alan Knuckman says if the index can clear 4,400 soon, a return to the late-July highs near 4,600 would follow.

Today’s rally comes despite the biggest company in the world laying an egg with its quarterly numbers. Apple beat Wall Street expectations on earnings — but also reported its fourth-straight quarter of falling sales. As we write, AAPL shares are down 1.5% on the day.

The bond market is taking the job numbers a little differently than the stock market. Here the interpretation seems to be Uh oh, incoming recession.

The bond market is taking the job numbers a little differently than the stock market. Here the interpretation seems to be Uh oh, incoming recession.

Hot money flows into bonds when people get antsy about the future of the economy — prices higher, yields lower. At last check, the yield on a 10-year Treasury note is down to 4.54%, the lowest since late September. October’s 5% levels — the highest since 2007– look like a distant memory, at least for now.

Crude is set to end the week under $82. At this price, almost no one seems to think the Israel-Hamas conflict will spill into other parts of the Middle East. Paradigm’s Jim Rickards begs to differ; we’ll go in depth about that next week.

Crypto seems little moved by the conviction of FTX co-founder Sam Bankman-Fried: Bitcoin continues to hold the line on $34,000. (It took the jury less than five hours to find him guilty on all seven counts. Yes, he plans an appeal.)

The spot price of gold popped over $2,000 after the job numbers came out, but it’s since pulled back to $1,992. Silver has rallied past $23 again.

Speaking of gold…

![]() Gold Is a Hot Commodity

Gold Is a Hot Commodity

We have a couple of loose ends about gold to tie up before the week winds down…

We have a couple of loose ends about gold to tie up before the week winds down…

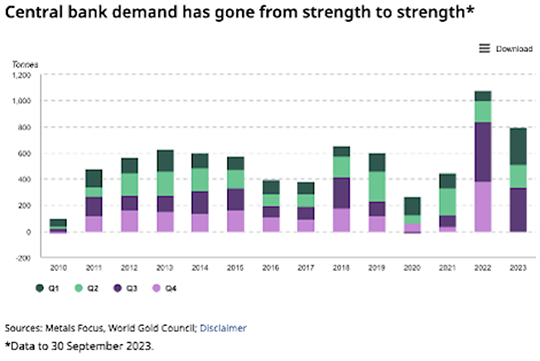

First, colleague Sean Ring at TheRude Awakening happened upon an even better chart depicting gold purchases by central banks. We reproduce it here verbatim…

Note that through the first nine months of 2023, central bank gold purchases are already the second-highest on record, exceeded only by last year’s totals.

Second, the ongoing financial turmoil in China is driving demand not just for gold — but for mining stocks.

“China's biggest index provider launched on Wednesday two gold-linked stock indexes to cash in on surging demand for exposure to the safe-haven metal amid a slump in the local real estate market and volatile global markets,” reports the Reuters newswire.

Included in these indexes are the big North American names like Newmont and Barrick.

"The indexes offer a new method beyond traditional strategies," reads a statement from China Securities Index Co. "It provides the market with more tools to invest in the gold business, and can help households better manage their wealth."

The new indexes come on the heels of China’s first gold-miner ETFs last month. "Gold is the brightest asset at the moment,” says Shihua Duan, general manager at Shanghai Changer Investment Management Consulting — “promising much better returns than Chinese property or the broad stock market.”

![]() Moving Back in With the Parents (It’s Nothing New)

Moving Back in With the Parents (It’s Nothing New)

Sign of the times: Nearly half of the 18–29 set is living with their parents.

Sign of the times: Nearly half of the 18–29 set is living with their parents.

That’s the conclusion of a new Harris Poll conducted for Bloomberg News: “COVID-19 lockdowns in 2020 drove the share of young adults living with parents or grandparents to nearly 50%, a record high,” says Bloomberg.

The number is down now — but not much.

“These days, about 23 million, or 45%, of all Americans ages 18–29 are living with family, roughly the same level as the 1940s, a time when women were more likely to remain at home until marriage and men too were lingering on family farms in the aftermath of the Great Depression…”

“Moving out and living on your own is often seen as a marker of adulthood. But dealt an onerous set of cards — including pandemic lockdowns, decades-high inflation, soaring student debt levels and a shaky job market — young people today are increasingly staying put.”

This phenomenon is no surprise if you’re familiar with Strauss-Howe generational theory. What’s old is new again.

This phenomenon is no surprise if you’re familiar with Strauss-Howe generational theory. What’s old is new again.

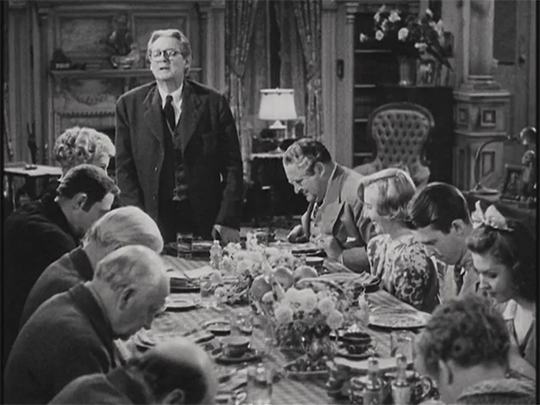

In both 1997’s The Fourth Turning and 2023’s The Fourth Turning Is Here, the authors remind us that multigenerational households abounded amid the crisis era of the Great Depression and World War II.

“Multigenerational families living together in old Victorian homes — an image popularized in Frank Capra movies like Mr. Smith Goes to Washington and You Can't Take It With You — was a much-discussed reality of the Great Depression,” Neil Howe reminds us in a 2019 essay.

What’s old is new again (You Can’t Take It With You, Columbia Pictures, 1938)

In the present day, the Harris Poll finds there’s no stigma attached to young adults living with the parents: “Almost 90% of surveyed Americans say people shouldn’t be judged for moving back home,” Bloomberg says. “It’s seen as a pragmatic way to get ahead, the survey of 4,106 adults in August showed.”

Especially with housing as unaffordable as it is now, no?

![]() EVs and BS: The Debate Continues!

EVs and BS: The Debate Continues!

“I think you got a Tesla fanboy emailing you. Good luck reasoning with one of those,” a reader writes — as our dialogue over the cost of operating an electric vehicle continues to keep our mailbag lively.

“I think you got a Tesla fanboy emailing you. Good luck reasoning with one of those,” a reader writes — as our dialogue over the cost of operating an electric vehicle continues to keep our mailbag lively.

“Hi. I have an EV (late-model Tesla 3 if you must know) and live in SoCal (not South Dakota). I also own a German four-banger turbo. That four-banger gets about 33–34 mpg (highway). My Tesla (long range) on the highway gets about 200 miles per full charge (listed range is 350; it ain't close to that).

“When I bought the car, based on electric rates, I did the math and figured out that gas’s and EV's daily operating costs break even at about $7 per gallon. Where'd this guy get $0.10 a kwh, is a mystery to me. Not in California, unless he's got solar (but what did that cost?).

“The four-banger cost me $50K-ish. The Tesla cost $67K-ish, minus $10K for self-driving: $57K. So the difference was $7K at the start. How many gallons and how many miles does that pay for?

“That $50K included all maintenance and everything for eight years. So the maintenance cost on these two cars is about the same for eight years, except that I replace the tires on the Tesla more often and will have to replace collapsed drivetrain components if they break in that eight years. And the build quality are night and day better in the four-banger.

“The Tesla registration fees are also double that of the four-banger; so are the insurance rates (although the Tesla is two years newer).

“So not counting how much the Tesla was subsidized, I think, at best, it's a wash or more expensive to run the Tesla.

“And oh, when I bought my Tesla, Tesla charging stations in my local area charged $0.21 kwh. Now it's $0.58 kwh.

“The only reason I drive the Tesla is that although it's a $25K car I paid $67K for, it gives me access to the carpool lane and I'd rather drive a POS into the ground than my beloved four-banger.”

“Reading about ‘range anxiety’ for EV owners, the movie Apollo 13 comes to mind,” writes our next correspondent — “the part where the astronauts are cutting power to systems to get down to 2 amps so they can have enough to dock with the main capsule.

“Reading about ‘range anxiety’ for EV owners, the movie Apollo 13 comes to mind,” writes our next correspondent — “the part where the astronauts are cutting power to systems to get down to 2 amps so they can have enough to dock with the main capsule.

“When it is below 0 degrees for days and days here in east Idaho I don't want to power down to make it to a charging station!

“Love the 5!”

“Hey Dave, the EV cost-of-operation hubbub over the last few days brings to mind a question,” writes our last correspondent.

“Hey Dave, the EV cost-of-operation hubbub over the last few days brings to mind a question,” writes our last correspondent.

“Is Byron or any other Paradigm-ite still bullish on the polymetallic nodule industry? I know the sea greenies are pushing back against harvesting the nodules, just as tree huggers are pushing back against land mining.

“Something's gotta give if EVs and the green agenda are to survive long term; wet or dry, the metals for battery making have to come from somewhere. The lower the supply of raw materials for battery production gets, the higher the cost of EVs will go.”

Dave responds: Ray Blanco is all over it. “Deep-sea mining is a relatively energy-efficient process,” he wrote Wednesday in Technology Profits Daily, “considering that polymetallic nodules occur above the surface of the ocean floor.”

As you point out, any objections to the practice have to overcome the fact that mining for these metals on land is at least as problematic — probably more.

It’s a story with a long arc. We’ll stay on top of it.

Have a good weekend,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets