Today’s Issue Is Not About Politics

![]() “Trump-Proofing” Impacts Hundreds of Companies

“Trump-Proofing” Impacts Hundreds of Companies

Within the last 10 days or so, a new catchphrase has been making its way through Washington, D.C., and Wall Street.

Within the last 10 days or so, a new catchphrase has been making its way through Washington, D.C., and Wall Street.

Near as we can tell, its first appearance was about a month ago. But we daresay it was Paradigm Press macroeconomics maven Jim Rickards who made it a thing.

During a podcast interview on April 24, Jim was describing attempts by the Biden administration to undercut the Trump agenda in the event of a Trump victory come November.

“This is Trump-proofing,” he said. “Against the fact that Trump might win, they will tie his hands in advance.”

Less than two weeks later, the term has made its way to the front page of today’s Wall Street Journal…

Less than two weeks later, the term has made its way to the front page of today’s Wall Street Journal…

The article describes “a behind-the-scenes scramble” by senior Biden aides “to Trump-proof as many regulations as they can…

“In April, government agencies finalized nearly three dozen economically significant regulations, more than during any single month of Biden’s presidency, according to the George Washington University Regulatory Studies Center. New policy announcements from the White House are being rolled out multiple times each week on issues ranging from tighter environmental rules to new restrictions on noncompete agreements.”

Before we go any further, a cautionary note if you’re a newer reader. We are not taking a political stance here in Bullet No. 1 by tackling this subject matter.

Before we go any further, a cautionary note if you’re a newer reader. We are not taking a political stance here in Bullet No. 1 by tackling this subject matter.

Rather, we’re talking about a phenomenon that could impact the investment prospects of hundreds of publicly traded companies — for worse or sometimes for better. All we’re doing here today is sussing out cause and effect.

At the heart of the matter is something called the Congressional Review Act of 1996. Without getting too deep in the weeds, this law allows a president to nix regulations issued by his predecessor.

At the heart of the matter is something called the Congressional Review Act of 1996. Without getting too deep in the weeds, this law allows a president to nix regulations issued by his predecessor.

George W. Bush used it once in 2001. No one used it again until Donald Trump used it 16 times in 2017–18. Joe Biden used it three times in 2021.

To get ahead of the possibility Trump will use it next year, the Biden administration is aiming to cement a host of new regulations into place by the end of this month. Under this 1996 law, acting now rather than later would effectively prevent Trump from undoing those regulations in 2025.

The impact of this month’s “Trump-proofing” push cuts across a host of industries. A short list follows…

The impact of this month’s “Trump-proofing” push cuts across a host of industries. A short list follows…

Environmental regulations are the most numerous. “The EPA issued four separate regulations to cut pollution from coal and new natural-gas-fired power plants,” says the Journal. “The rules will force utilities to control emissions of carbon dioxide, mercury and other airborne toxic chemicals, wastewater and coal ash stored in ponds… The EPA also issued new final clean-water regulations.”

Meanwhile airlines will be impacted by a new Department of Transportation rule requiring automatic cash refunds to passengers whose flights are cancelled.

Not all these impacts would be negative to companies’ bottom lines. The health insurance industry stands to benefit from new rules at Health and Human Services allowing up to 100,000 immigrants access to federal health care subsidies.

Granted, the Congressional Review Act of 1996 comes into play only under unusual circumstances. See, a president can undo his predecessor’s regulations only with supporting legislation. So as a practical matter, that can happen only if the same party controls the White House and both houses of Congress — to wit, the Republicans in early 2001 and 2017 and the Democrats in 2021.

Anyway, that’s the story. “Trump-proofing” is all over the corporate media this week, but it didn’t catch on until Jim Rickards uttered it a few days ago on the Steve Bannon podcast. Just one more way our team aims to stay ahead of the curve.

“In just the past few weeks,” Jim updated his Strategic Intelligence readers yesterday, “Biden has finalized 59 rules and proposed 37 others.”

All of the Paradigm editors will be on watch for the impact of these rules on the sectors they cover. Stay tuned.

[Editor’s note: In the meantime, Jim is keen to introduce you to a one-of-a-kind investment strategy that helps you capitalize on the stock market’s ups and downs. It’s proven to generate gains of 52% in 4 days... 85% in 6 days... even up to 188% in 2 days.

And you can put this strategy to work every week. Jim invites you to learn more about this investment blueprint from the hedge fund pro who developed it — just follow this link to get started.]

![]() Social Security’s “Reprieve”

Social Security’s “Reprieve”

According to a new estimate, the Social Security trust fund has more life in it than previously thought: It won’t be drained in 2034 after all. It’ll be 2035 instead. Hooray?

According to a new estimate, the Social Security trust fund has more life in it than previously thought: It won’t be drained in 2034 after all. It’ll be 2035 instead. Hooray?

The new estimate comes from the Social Security program’s trustees. The revised outlook comes with the job market holding up better than expected — thus, more people are paying payroll tax for the time being.

To be clear, 2035 is not the date when the program collapses. But it is the date that all of the program’s current surplus will be depleted — forcing a benefit cut of at least 17%, likely more.

As I’ve said for several years now, there’s nothing about Social Security that can’t be fixed with some combination of higher taxes and a higher retirement age. It would still be a Ponzi scheme in the sense that revenue coming in the door from working-age folks goes out the door instantly to retirement-age folks… but it would be a sustainable Ponzi scheme for another 50–75 years.

It says something about the priorities of “the uniparty” that it can spend $95 billion of money the government doesn’t have to help provoke World War III in Ukraine, Israel and Taiwan… but can’t come to terms on shoring up Social Security. Oh well.

By the way, the same report says the Medicare trust fund will be drained by 2036. That’s an outright fiction: Medicare is already dead-ass broke, with less than half of its revenue coming from payroll tax and premiums paid by beneficiaries. But that’s a story for another day…

Assuming you’re reliant on the stock market to fund a portion of your retirement, you’re marginally better off this morning than you were yesterday.

Assuming you’re reliant on the stock market to fund a portion of your retirement, you’re marginally better off this morning than you were yesterday.

All the major U.S. indexes are in the green at last check, with the S&P 500 up a quarter of a percent at 5,193.

For perspective, that’s about 1.2% below the record close set at the end of March. “We haven’t reclaimed the all-time high,” colleague Sean Ring writes at today’s Rude Awakening, — “but that’s when we can get excited. Above 5,255, and we’re off to 6,000.”

Precious metals continue to consolidate, gold at $2,314 and silver at $27.30. Crude trades at $78.25, the lowest since mid-March. Bitcoin sits a shade below $64,000.

![]() The Cost of “Clean” Electricity

The Cost of “Clean” Electricity

Folks in Missouri are starting to learn exactly what it will cost to mothball coal-fired electric power plants.

Folks in Missouri are starting to learn exactly what it will cost to mothball coal-fired electric power plants.

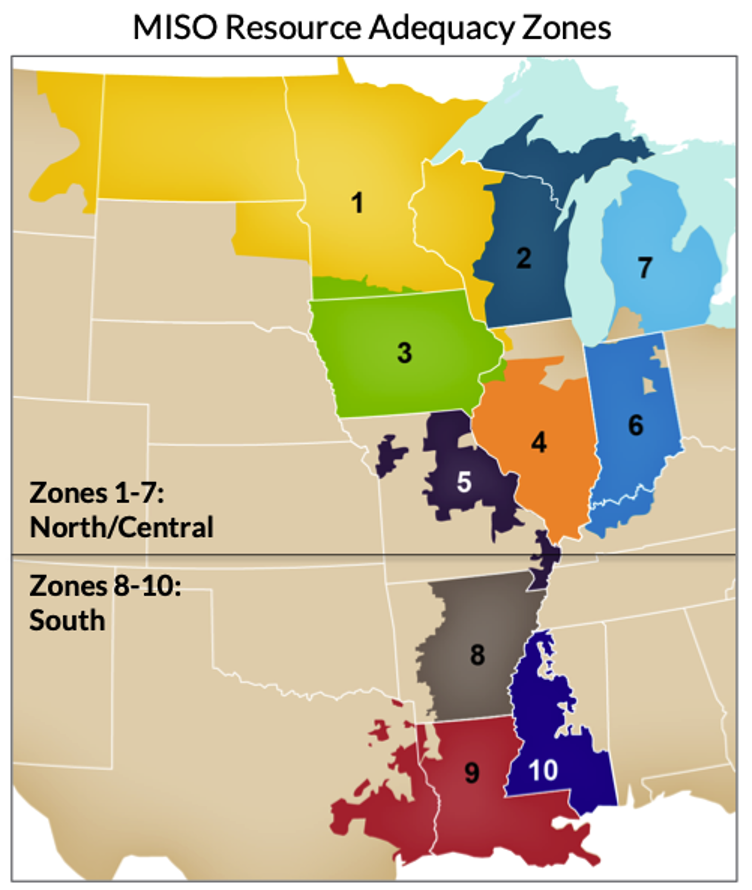

MISO — the regional grid operator responsible for a large swath of the country stretching from Minnesota south to Louisiana — recently issued a “planning resource auction,” spelling out the cost of grid capacity for the year starting June 1.

“MISO’s auction,” according to E&E News, “is an indicator of whether there is adequate power supply in specific regions within the grid operator’s 15-state footprint. Higher prices are a signal that more capacity is needed.”

The headline number is bad enough — with costs roughly tripling to $30 per megawatt per day next fall and $34.10 in spring 2025.

But that’s just the average. In MISO’s Zone 5 — covering a swath of Missouri including St. Louis — prices will jump from between $10–15 per megawatt per day to $719.81 — a 48x increase.

With the retirement of coal-fired power plants, there’s just not enough power to serve this area. Thus, supply and demand are doing their thing to price.

Of course, Missouri regulators won’t let all of this increase feed through to residential and business customers… but it’s another warning that something’s got to give: Coal and nuke plants are being retired… new solar and wind capacity isn’t enough to pick up the slack… and this is at a time of rising EV usage and AI’s insatiable and growing appetite for electricity.

And yes, that affects not only cost but reliability: Later this month the North American Electric Reliability Corporation will issue its “Summer Assessment” of the U.S. grid’s soundness in the event of a big heat wave.

Given the forecasts for “above normal” temperatures this summer, we’re going to watch this one closely. Corporate media will blow off the story, but we’ll make sure to bring it your way…

![]() Where Nachos Cost $180…

Where Nachos Cost $180…

Seems it’s not just the lower and middle classes experiencing food inflation these days…

Seems it’s not just the lower and middle classes experiencing food inflation these days…

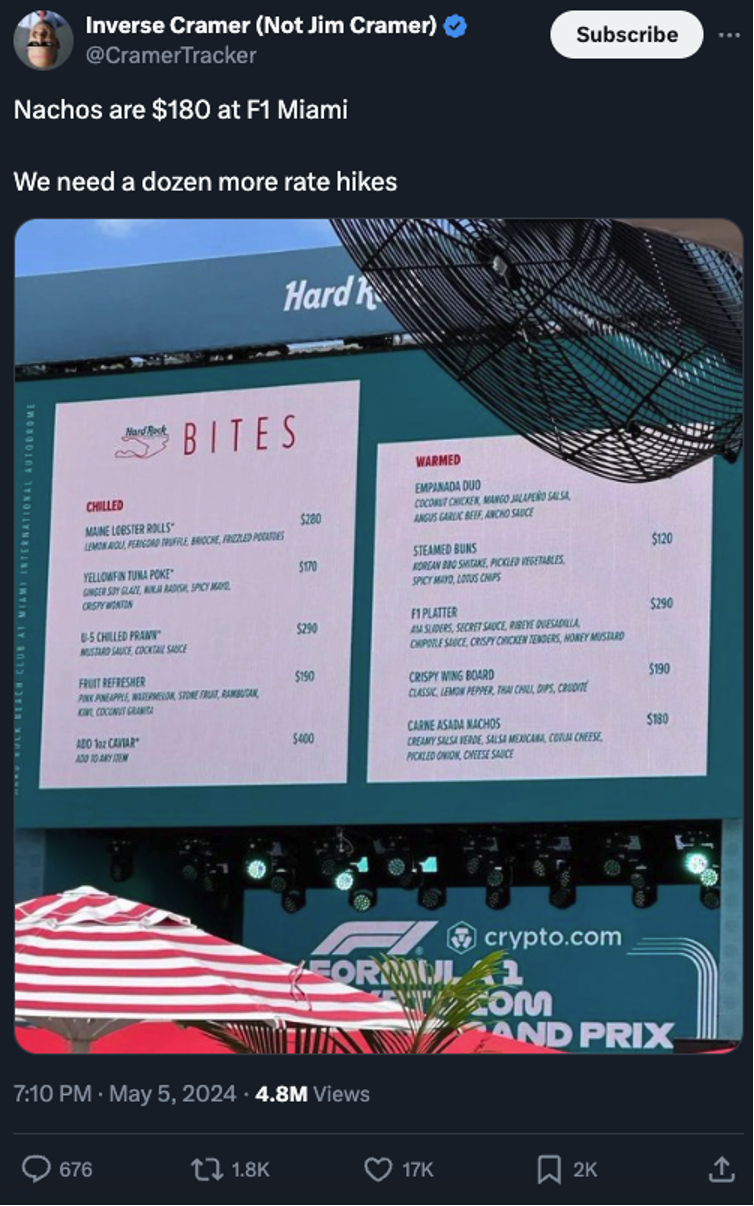

Hard Rock Stadium in Miami was the grandstand site for Formula 1’s Miami Grand Prix over the weekend.

The concessions were juuuust a little pricey. As The Sun reports, and as several tweets confirm, nachos went for $180… a fruit platter for $190… lobster rolls for $280. The cheapest bottle of white wine went for $190.

OK, yes, this was the VIP section. But as one fan joked, “Only Travis Kelce can afford this” — and indeed the Kansas City Chiefs tight end was in attendance.

More than one tweet demanded the Federal Reserve raise interest rates to choke off rampant inflation. Yeah, good luck with that…

![]() Mailbag: War Is No Joke

Mailbag: War Is No Joke

“You made a joke of the war in Ukraine,” a reader writes, “but tens of thousands of Ukrainians are suffering and dying, sometimes touched in ways hard to imagine.

“You made a joke of the war in Ukraine,” a reader writes, “but tens of thousands of Ukrainians are suffering and dying, sometimes touched in ways hard to imagine.

“Please watch this video about one city that was occupied at the beginning of the war and then tell me, or better yet tell them, they are a laughing matter.

“I am a new member of Paradigm but I’m disappointed by this publication.”

Dave responds: We assume you’re writing about last Wednesday’s edition, but… where’s the joke?

Perhaps there’s irony that Kyiv’s bar scene is thriving — but wars have unpredictable ways of altering the flows of money. You’re offended we pointed it out?

No, we find no humor in the fact that Western leaders are content to feed young (and, increasingly, middle-aged and old) Ukrainians into a meat grinder in the name of power politics and “weakening” Russia (the secretary of defense said that)... or Washington fighting the war “to the last Ukrainian” (Republican Sen. Lindsey Graham said that)... or American leaders viewing the war as “a very good bargain” for the United States (a State Department official said that).

Our mailbag thread on the subject of place names continues to have legs…

Our mailbag thread on the subject of place names continues to have legs…

“Thought it was pretty ironic that a reader chose to mention the song ‘Istanbul (Not Constantinople)’ — since the powers-that-be in that land have apparently *just* figured out that the name ‘Turkey’ has dubious connotations and therefore the country’s official name in English shall henceforth be spelled ‘Türkiye’… For real?

“I mean, English doesn’t even use umlauts! But I suspect the name will still be pronounced as before, regardless of the spelling (heh). Just wondering if The 5 will conform to the new guidelines?”

Dave responds: In general, we hew to Associated Press guidelines, and as far as the AP is concerned it’s still “Turkey.” Of course, in the present day and age, one must pick and choose which guidelines to follow most closely.

There is one usage of umlauts in English — The New Yorker when it uses words like “naïve” or “coördinate” — although the magazine’s editors insist it’s not an umlaut but rather a diaeresis. Can’t wait for them to use “reëlection” this fall…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets