0DTE

![]() A Little Calculated Risk Goes a Long Way

A Little Calculated Risk Goes a Long Way

“Imagine making $50,000 in one day from a small investment. It's happening right now on Wall Street,” says Paradigm’s iconoclast investor James Altucher.

“Imagine making $50,000 in one day from a small investment. It's happening right now on Wall Street,” says Paradigm’s iconoclast investor James Altucher.

“Welcome to the world of 0DTE options — the latest craze that’s turning the stock market into a high-stakes casino.

“These ‘zero days to expiration’ trades have exploded in popularity, now making up over half of all options activity on major market indexes.

“But before we dive into the adrenaline-pumping world of same-day options, let's break down how options actually work…

“Think of an option like a coupon for stocks. You pay a small fee upfront for the right to buy or sell shares at a specific price by a certain date,” James explains.

“Think of an option like a coupon for stocks. You pay a small fee upfront for the right to buy or sell shares at a specific price by a certain date,” James explains.

“Traditionally, investors bought options that expired weeks or months in the future.

“Now Wall Street has discovered a way to compress all that excitement into a single trading day.

“These 0DTE options are like scratch-off lottery tickets for the stock market. They're cheap to buy — often just a few dollars each.

“If the market moves in your favor, those dollars can multiply into hundreds or even thousands.

“Right now, you can only trade daily options on certain index funds that track the stock market, like the S&P 500.

“But that's about to change…

“Wall Street is gearing up to bring daily options to individual stocks like Tesla and Nvidia as soon as next year,” says James. “The potential returns are eye-popping.

“A small move in the right direction can turn $100 into $1,000 in minutes.

“Get really lucky, and you might turn a few thousand into enough for a down payment on a house.

But there's a dark side to this story. These 0DTE trades can vaporize your money faster than a Vegas slot machine,” James notes. “We're not talking about losing 20% or even 50%.

But there's a dark side to this story. These 0DTE trades can vaporize your money faster than a Vegas slot machine,” James notes. “We're not talking about losing 20% or even 50%.

“When 0DTE options go wrong, they often go to zero. Complete loss. No refunds.

“It happens in the blink of an eye. A five-minute market swing in the wrong direction can wipe out your entire investment.

“The temptation to recover losses can be overwhelming,” he says.

“Many traders fall into the trap of doubling down after a loss… then doubling down again… and again… until there's nothing left to double down with.

“So why would anyone take these risks? Because the wins can be spectacular.

“Social media is full of screenshots showing massive gains from tiny investments

“But here's what the influencers don't show you: the losses.

“A recent study by the London Business School found that individual options traders lost $2.1 billion in less than two years,” James says.

“The shorter the time frame, the bigger the losses.

“Think of it this way: Would you bet your rent money on a coin flip?

“Because that's essentially what 0DTE options are — except the odds are usually worse than 50/50.

“Does this mean you should never trade 0DTE options? Not necessarily…

“Used responsibly — with money you can afford to lose — these trades can be a small part of your investment strategy,” James adds. “The key word is ‘small.’

“Used responsibly — with money you can afford to lose — these trades can be a small part of your investment strategy,” James adds. “The key word is ‘small.’

“Treat them like lottery tickets, not your retirement plan.

- “Set strict limits on how much you'll risk

- Never trade with money you need for bills

- And most importantly, understand that these are not investments — they're speculative bets.”

James concludes: “0DTE options can add an exciting element to your investment strategy.

“Think of them as the spice in your investment recipe — a little bit goes a long way.

“Keep the majority of your portfolio in traditional investments,” he recommends.

“If you’re the type of person who tends to go overboard with things, you might want to avoid them entirely.

“But if you think you can handle trying your hand at Wall Street's fastest game, do it with clear eyes and strict limits.

“Because sometimes,” says James, “a little calculated risk can lead to extraordinary rewards.”

[NOTE: If 0DTE options aren’t your speed, James says there’s another subniche of the market that’s not nearly as risky. But it CAN be just as lucrative.

And for a limited time, our customer service chief is offering access to James Altucher’s new Beta Test group… A group dedicated to trading one of the fastest-moving segments of the market.

Because of the high return potential of these trades (100% or more in as little as 24

hours), we are forced to keep this beta-testing group limited to James’ most dedicated readers.

That’s why, right now, the door is only open to 250 new members…

And the door will CLOSE before the market opens this Thursday, Feb. 6.

Here is your exclusive invite link. (Please do not share it.)

REMEMBER: This opportunity closes this Thursday at 9:29 a.m. EST.]

![]() Making Gold Great Again

Making Gold Great Again

“Gold is hitting record highs. And if the shiny yellow rock’s advance measures up to past secular bulls, this rally has legs!” exclaims Paradigm’s chief market analyst Greg Guenthner.

“Gold is hitting record highs. And if the shiny yellow rock’s advance measures up to past secular bulls, this rally has legs!” exclaims Paradigm’s chief market analyst Greg Guenthner.

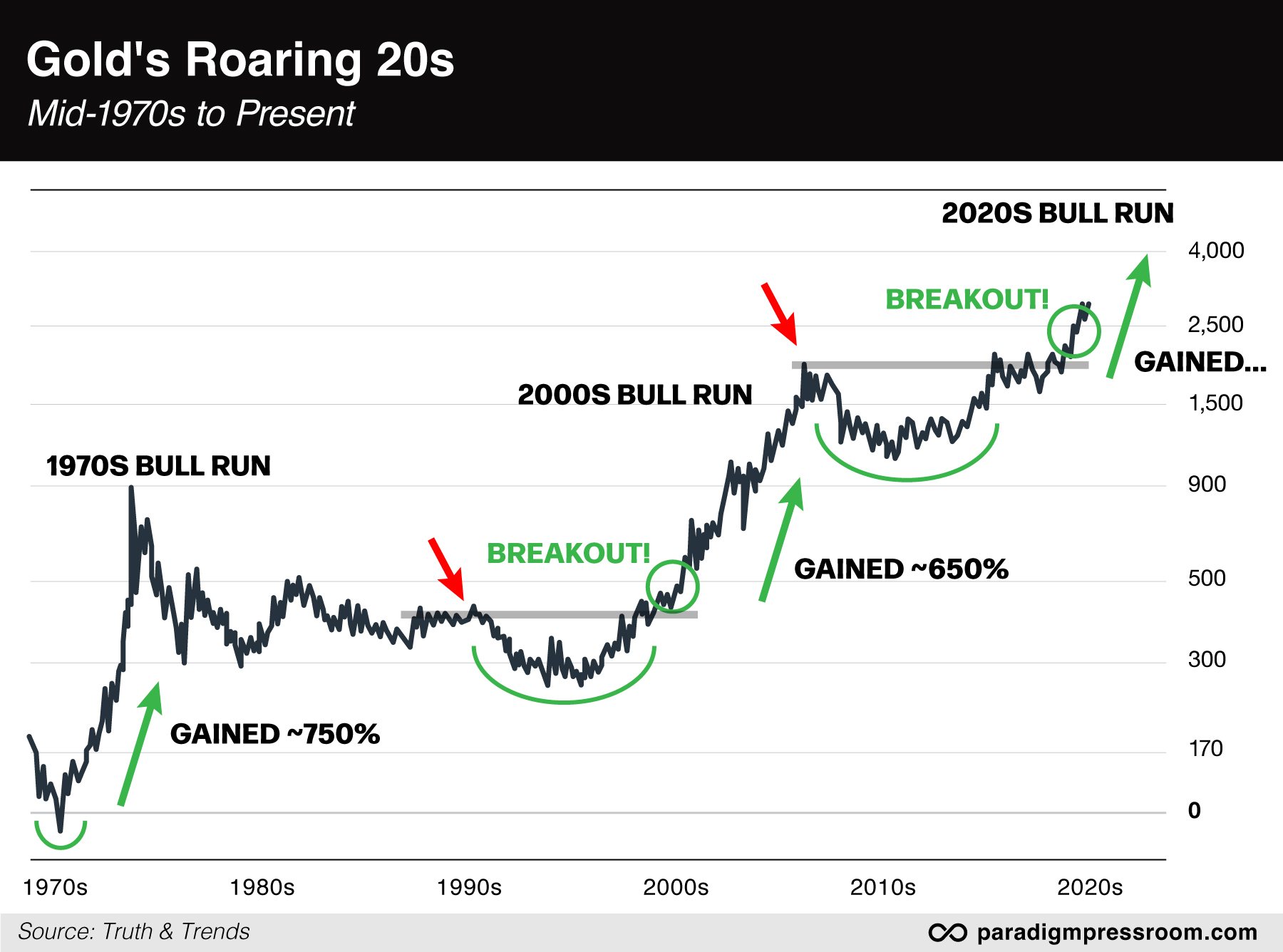

“Check out this gold chart zoomed out to the mid-1970s…

“Notice the explosive rallies followed by prolonged trendless markets,” Greg says.

“Today, gold is printing record highs. But it’s up a mere 150% off its 2015 low compared to the 650%-plus gains of previous bull cycles.

“My best guess as to why gold hasn’t hit $5K lands somewhere between ‘no one is paying attention’ and ‘no one wants a dumb yellow rock,’” Greg says.

“However, rising gold prices will eventually capture more eyes creating a positive feedback loop as more investors turn to gold — ultimately Making Gold Great Again.

“Now is the time to consider precious metals, especially mining stocks. Here’s why…

“Now is the time to consider precious metals, especially mining stocks. Here’s why…

“Plenty of solid businesses operate within the metals and mining space,” Greg says.

“Alamos Gold, Stock B (AGI) touts a $9 billion market cap. It’s also been around since 2003, which means it survived a full cycle. I like that! And of course, it’s posting all-time highs.

“You could also keep it classy by trading one of the bellwethers, like Agnico Eagle Mines (AEM),” Greg says.

“It broke out of a multi decade base last week to a new record high. Plus, it’s mined metals and minerals since 1957 and carries a market cap of $47.5 billion.

“If you’re feeling lucky and want to take a swing with a five-letter ticker, you will find plenty of gold miners to choose from.

“I lean toward the larger and more established companies,” he says. “But Wesdome Gold Mines (WDOFF) is the exception as it teases fresh two-year highs.

“Could WDOFF post NVDA-like gains? It might if gold continues to rally. Mining stocks become the ultimate speculative growth trade during gold bull markets.

“Bottom line: Taking a gold position today is taking a position in near-term strength,” Greg says. “It’s buying an asset increasing in value — before the crowd shows up and spoils the fun.”

Gold continues its ascent into record-breaking territory today: The yellow metal’s up 0.55% to $2,891.60 per ounce.

Gold continues its ascent into record-breaking territory today: The yellow metal’s up 0.55% to $2,891.60 per ounce.

At the same time, silver is losing ground, down 0.10%, just under $33. Also in the commodities complex, oil is down 2.15% to $71.11 for a barrel of WTI.

As for stocks, the Nasdaq is getting dragged by Alphabet (GOOG) which whiffed on cloud revenue in its earnings report yesterday; shares are down 7% at the time of writing. At the moment, however, the tech-heavy Nasdaq is slightly in the green, clocking in at 19,655.

Of the three major U.S. stock indexes, the Big Board is faring best, up 0.25% to 44,670. The S&P 500, in the meantime, is up 0.15% to 6,050.

Checking on the crypto market, Bitcoin’s currently trading at $97,862.20, down 0.52% in the last 24 hours. But Ethereum is priced at $2,717.51, up 1.75%.

![]() “The Most Important Tech Deal of 2025”

“The Most Important Tech Deal of 2025”

“The biggest tech deal in history might be going down as we speak,” reports Paradigm’s science-and-technology investor Ray Blanco.

“The biggest tech deal in history might be going down as we speak,” reports Paradigm’s science-and-technology investor Ray Blanco.

In fact, rumors are swirling about a possible acquisition of Intel (INTC) — involving Elon Musk — which could reshape the American technology landscape.

Intel has seen its stock price drop 50% over the past year, making it a potential takeover target. Musk’s interest in the company likely stems from the role Intel chips could play in his various ventures, including Tesla, SpaceX and xAI.

“Right now, Musk relies on TSMC and Samsung to supply the silicon for his supercomputers. With Intel, he’d control his own destiny,” says Ray.

“Intel isn't just another chipmaker,” he says. “It's America's semiconductor crown jewel, with manufacturing capabilities that could be transformative in the right hands.

“At $94 billion, this would be one of the largest acquisitions in tech history. But Musk has shown he can raise capital like no one else.”

Ray’s takeaway? “We're witnessing the opening moves of what could be the most important tech deal of 2025.” Stay tuned…

![]() MoviePass: Retribution and Revival

MoviePass: Retribution and Revival

Earlier this year, Ted Farnsworth, former CEO of MoviePass, pleaded guilty to defrauding investors. He faces up to 25 years in prison for securities fraud and conspiracy to commit securities fraud

Earlier this year, Ted Farnsworth, former CEO of MoviePass, pleaded guilty to defrauding investors. He faces up to 25 years in prison for securities fraud and conspiracy to commit securities fraud

Farnsworth, who led Helios & Matheson Analytics when it acquired a majority stake in MoviePass, implemented the $9.95 plan in 2017, initially attracting over 3 million subscribers. The MoviePass subscription promised unlimited theater viewings per month for less than the average single-ticket price.

No surprise, this model proved unsustainable, causing significant financial losses. So the service rapidly implemented changes — raising prices, creating a convoluted tiered system and adding restrictions on movie choices and showtimes.

As losses mounted, MoviePass experienced major service blackouts because Farnsworth allegedly instructed employees to prevent subscribers from using the service they paid for.

Eventually, the market lost all confidence in Helios & Matheson Analytics. Despite public claims of profitability through data monetization, the Department of Justice found that MoviePass lacked the capability to do so.

Even after MoviePass’ bankruptcy, Farnsworth reportedly employed similar deceptive practices at digital media company Vinco Ventures.

Farnsworth will be sentenced for his crimes later this year. Meanwhile, MoviePass has been revived under its original founder, Stacy Spikes, with a new business model. The company announced its first profitable year in 2023 — though users still report occasional service issues.

![]() The Newsletter Taking Over Small-Town Inboxes

The Newsletter Taking Over Small-Town Inboxes

“On first glance, Good Day Fort Collins appears to be a standard local news roundup,” featuring stories about restaurant openings and record-breaking snowfalls.

“On first glance, Good Day Fort Collins appears to be a standard local news roundup,” featuring stories about restaurant openings and record-breaking snowfalls.

However, this seemingly innocuous digital newsletter is part of a much larger network of AI-generated content spanning 355 cities and towns across the U.S.

The newsletters, all part of Good Daily Inc., share identical testimonials, branding and mission statements throughout different locations.

The founder and sole operator, Matthew Henderson, uses automation and large language models (LLMs) to curate, summarize and distribute content from local news sources.

While Henderson claims to support local journalism, his approach faces criticism. According to Rodney Gibbs of the National Trust for Local News: “[Henderson’s] claim is, frankly, horse****. The suggestion that he’s helping news deserts is absurd.”

Instead, critics argue that Good Daily exploits the work of local outlets without providing significant benefits in return. Plus, the newsletters lack transparency. They don’t, for instance, disclose that they are AI-generated.

While Good Daily accumulates revenue through reader donations and advertising, its “give back” program, promising to donate 10% of profits to local nonprofits, seems to be little more than a bait-and-switch scheme.

Despite the controversies, some readers find value in the service. As one Fort Collins resident comments: “I haven't unsubscribed yet because it’s the only local news I get.”

But that’s assuming the “news” is accurate…

The 5 Bullets’ pledge to you? Actual human eyes, ears and brains behind every issue. No fabricated testimonials. And absolutely zero “set it and forget it” commentary.

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets