3.125

![]() At Last: Mainstream Wakes up to Bitcoin Halving

At Last: Mainstream Wakes up to Bitcoin Halving

“I expect that we’ll see a lot of coverage of the halving by traditional media over the next week,” says Paradigm’s crypto evangelist James Altucher.

“I expect that we’ll see a lot of coverage of the halving by traditional media over the next week,” says Paradigm’s crypto evangelist James Altucher.

If James sounds a little weary at the prospect, that’s because he’s still coming down from his Countdown to the 4th Boom event last night — and he’s fed up with Johnny-come-lately media that’ve just realized that Bitcoin is days away from the “halving” event that will permanently change the game throughout the cryptocurrency space.

“CNBC will invite cryptocurrency experts to talk about their expectations,” James sighs. “The Wall Street Journal will publish articles.”

But it’s not all bad: “The media circus from the halving is the cherry on top that will create new demand for Bitcoin, just as supply experiences a massive reduction from the halving.”

One more time, we should back up and revisit what this halving thing is all about.

One more time, we should back up and revisit what this halving thing is all about.

Every four years, give or take, a programming feature of Bitcoin kicks in. The rewards from Bitcoin mining are cut in half. This scheme was built into Bitcoin from the beginning by the mysterious “Satoshi Nakamoto” back in 2008.

The idea is to keep a built-in cap on Bitcoin’s quantity — a feature notably missing from government-issued fiat currencies.

“The biggest immediate impact of halving is on miners,” says James. “Miners receive a regular distribution for their contribution to maintaining the Bitcoin blockchain.

“Currently, miners receive a reward of 6.25 Bitcoin for every block of the blockchain that they mine. Beginning sometime around next Saturday, this reward will get cut in half to 3.125 Bitcoin.

“As a result of the halving, miners will earn fewer Bitcoins from here on out. Fewer Bitcoins earned means fewer Bitcoins for miners to sell.

“The logic is as follows: Miners are some of the largest sellers of Bitcoin on the exchanges. Miners typically need fiat currencies (i.e. dollars/euros/yen/etc.) to pay their operating expenses like rent, electricity and machine maintenance. In order to pay these expenses, they are constantly selling as much Bitcoin as necessary to cover their costs.

“However, once the halving occurs, miners will naturally have fewer Bitcoin available to sell.

“If you’re familiar with the concept of supply and demand, you already know where I’m going with this,” James continues.

“If you’re familiar with the concept of supply and demand, you already know where I’m going with this,” James continues.

“A shortage of Bitcoins with stable (or increasing) demand will push the price up. Halving will continue to take place every four years until 2140 when all 21 million Bitcoins are finally produced. At that point, no new Bitcoins will be created.

“The last time the halving occurred was in the middle of the pandemic/global recession. In the days and weeks leading up to the last halving, the price of Bitcoin surged. This was despite the fact that people had other things on their minds and many people were just hearing about cryptocurrency for the first time.”

As James spelled out last night, this halving event — the fourth to date — is like no other. Wall Street firms launched Bitcoin ETF products back in January — making Bitcoin far more accessible to institutional investors ranging from hedge funds to university endowments.

And while Bitcoin obviously stands to benefit in the weeks and months to come, Bitcoin halvings typically drive much bigger gains in other cryptos. James made the case for six of them last night — even naming the ticker of one of them.

![]() The Oil Price: What, Me Worry?

The Oil Price: What, Me Worry?

After Iran’s drone/missile attack on Israel — the first direct attack on the Jewish state launched by the Islamic Republic since the mullahs took power in 1979 — the price of oil is…

After Iran’s drone/missile attack on Israel — the first direct attack on the Jewish state launched by the Islamic Republic since the mullahs took power in 1979 — the price of oil is…

… the lowest it’s been in nearly two weeks.

For real. Checking our screens, a barrel of West Texas Intermediate fetches $84.39.

To be sure, this could be a classic “buy the rumor, sell the news” reaction. The rumor was rampant for days, after all — ever since an Israeli airstrike on the Iranian consulate in Damascus, Syria.

Then again, the oil price also suggests an Israeli counterstrike is not imminent. At the moment, it appears Israel’s war cabinet is split on what to do next and when.

For all the crowing in Tel Aviv (and Washington) about how most of the attack was fended off this weekend, it came at a cost of over $1 billion. How much would it cost to fend off another attack now that Tehran has a better idea of Israel’s vulnerabilities?

Here’s the thing. Six months into the Gaza war, Gaza is smashed to bits but much of Hamas is still intact. Thus, Prime Minister Benjamin Netanyahu ordered the consulate attack two weeks ago.

“What Bibi now wants,” writes James Carden at The American Conservative, “is to provoke a wider war in order to bring the U.S. in and place American power in the service of his long-held dream of striking Iran.”

The oil price definitely does not reflect that risk this morning…

Nor does the gold price reflect the risk — up less than 1% on the day to $2,357 after “Mr. Slammy” showed up on Friday to make certain there’d be no weekly close over $2,400.

Silver, on the other hand, is up nearly 3% as we write to $28.61.

![]() Stocks Pop, Then Drop

Stocks Pop, Then Drop

At the start, the stock market action today was even more counterintuitive than what we’re seeing in crude.

At the start, the stock market action today was even more counterintuitive than what we’re seeing in crude.

The major averages jumped to start the day despite a red-hot retail sales number — up 0.7% in March, far beyond the “expert consensus” on Wall Street. If you back out auto sales (notoriously volatile month to month) and gasoline sales (rising prices skew the sales number higher), the jump was even higher, 1.0%.

Consumers spending like there’s no tomorrow will do nothing to dissuade the Federal Reserve from keeping interest rates “higher for longer.” Most of the time, that’s a drag on Wall Street — but the Dow opened 300 points higher.

As the day wore on, for whatever reason, the Dow surrendered nearly all of that gain, now sitting a hair below 38,000. The S&P 500 and the Nasdaq are in the red.

Two of the “Magnificent 7” names are stumbling today: Apple is down three-quarters of a percent after estimates that global iPhone shipments fell 10% in the first quarter.

And while Wall Street often greets news of job cuts by mashing the “buy” button, that’s not the case with Tesla today. TSLA is slashing 10% of its global workforce, roughly 14,000 people; the share price is down nearly 4%.

The ever-present “inflation fears” are driving bond yields higher, with the 10-year Treasury nearly 4.64%, the highest since early November.

![]() “A General Lack of Tax Literacy”

“A General Lack of Tax Literacy”

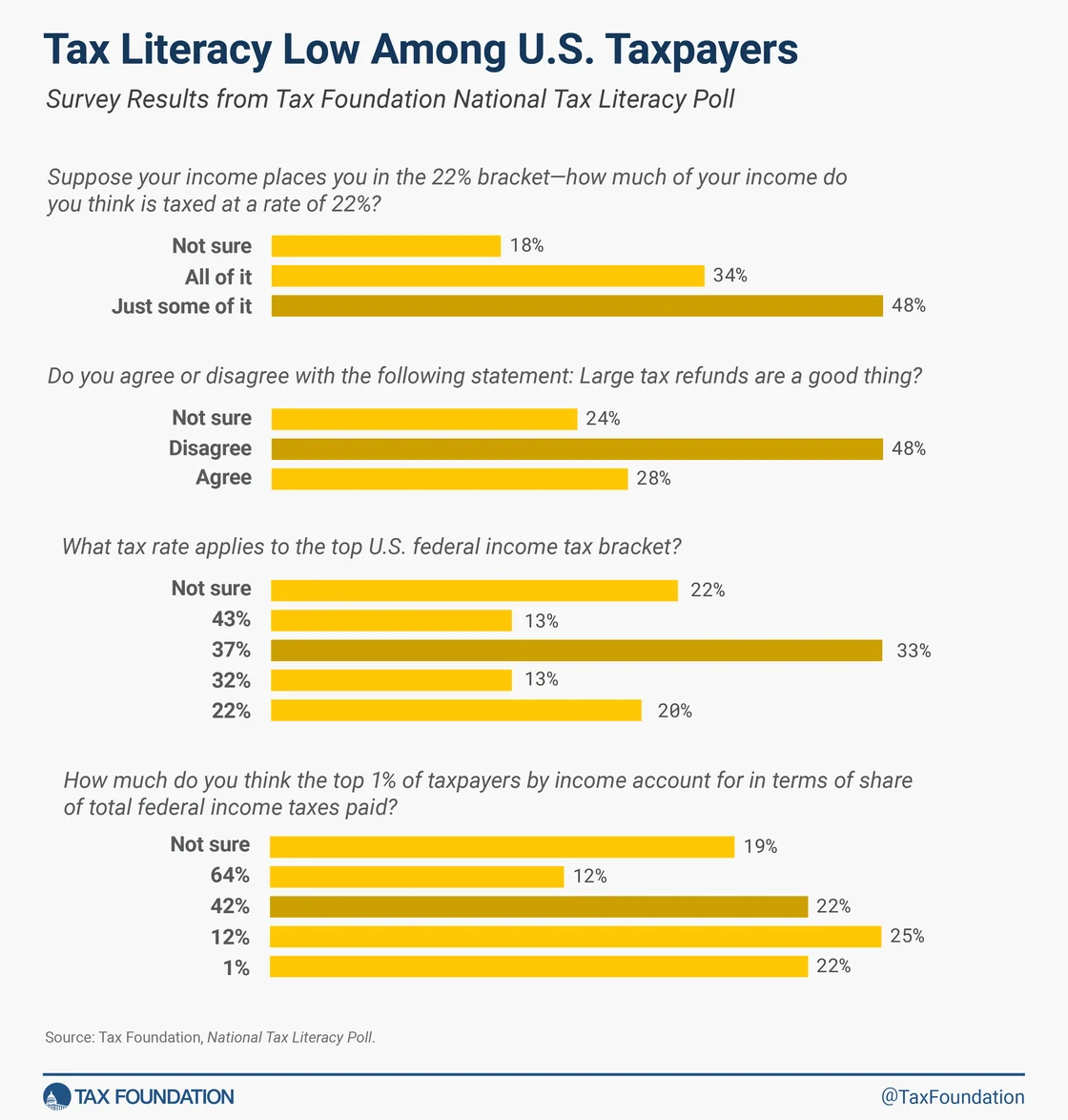

On this Tax Day 2024, a staggering number of Americans know shockingly little about how the tax code works.

On this Tax Day 2024, a staggering number of Americans know shockingly little about how the tax code works.

The good folks at the Tax Foundation recently commissioned a poll of more than 2,700 U.S. taxpayers of diverse income levels and political persuasions.

And gawd, are the results depressing: “The poll results reveal a general lack of tax literacy among U.S. taxpayers,” says a Tax Foundation press release. “Over 61% of respondents did not know or were not sure of basic tax concepts related to income tax filing. And over half of respondents did not know how tax brackets work.”

Here are the highlights, or lowlights as the case may be — with the correct answers highlighted in a darker color.

On the bright side, there’s the 48% on that second question who got it right: Maybe personal finance gurus are finally drumming it into folks that a big tax refund is nothing more than an interest-free loan that you extend to Uncle Sam.

But oh man, only 48% have a basic grasp of how tax brackets work — and, by extension, the concept of marginal tax rates. Thus, the following head-scratcher result from the poll: “71% support lowering the top income tax rate, yet 54% of respondents want high earners to pay more in taxes.”

But let’s not be too hard on everyday folks. As Albert Einstein supposedly said, “The hardest thing in the world to understand is income taxes.” And that’s coming from the guy who developed the theory of relativity!

(The quotation is likely authentic, seeing as the source was his own tax adviser.)

![]() Mailbag: Civil War

Mailbag: Civil War

“Your issue on the topic of Civil War 2.0 is more thoughtful than the extremists on both sides wishing for Civil War 2.0 to occur,” a reader writes after our single-topic deep dive on Friday, keyed to the release of the movie Civil War.

“Your issue on the topic of Civil War 2.0 is more thoughtful than the extremists on both sides wishing for Civil War 2.0 to occur,” a reader writes after our single-topic deep dive on Friday, keyed to the release of the movie Civil War.

“It’s great reading the history of other countries in how they dealt with their chaos. While it is a concern and we should have enough supplies (i.e., food, water, gold, ammo, etc.), it’s also important to have a support system to rely on in case of emergencies. Many of my friends and family are Catholic and we have good relations with our next-door neighbor.

“Having over 300 million Americans of different races, ethnicities, religions, creeds, etc., without a single unifying culture to unite all, will eventually lead to conflicts. And that’s what we’re seeing now. Especially with woketardness, critical race theory and a rejection of American values of individual liberty, personal responsibility and free enterprise.

“Keep up the great work and hopefully this buildup of conflict eventually dies down for the better.”

“I found the analysis of a second civil war enlightening but also missing a major consideration of division,” writes another.

“I found the analysis of a second civil war enlightening but also missing a major consideration of division,” writes another.

“We can call it red versus blue, but the comparisons you cited were religion versus religion and ethnicity versus ethnicity.

“The U.S. suffers an urban versus rural divide. Houston and Austin are not iconic red metropolises, Illinois is no anti-gun blue progressive land — that's Chicago. Virginia is not just the D.C. metroplex. Washington and Oregon are run by Seattle and Portland, Nevada by more liberal Las Vegas.

“One side controls centralized populations and ports, one side controls lands and production. That's a different animal when you talk about siege, isolation or infrastructure damages. Give me a county or Zip code map and this scenario gets uglier yet!”

Dave responds: As I pointed out Friday — maybe not vigorously enough — a state-by-state map doesn’t tell the whole story about 2020, or now. On this CNN map, you can click on an individual state and mouse over to see county-by-county results.

But if you want a really deep dive, The New York Times broke it down precinct-by-precinct for much of the country.

Let’s just say I found it to be an intriguing tidbit of “open source intel” about my own neck of the woods in a swing state — especially the comparisons with 2016.

As it turns out, the movie Civil War is as apolitical as such an animal could be — no “predictive programming” to speak of.

As it turns out, the movie Civil War is as apolitical as such an animal could be — no “predictive programming” to speak of.

The movie debuted in select cities Thursday night and among the early viewers was Mike Shelby — a former Army intelligence guy who now heads up Forward Observer, a private intelligence outfit geared toward a patriot/prepper audience.

“There’s no reference to political parties or ideology,” he writes. “In short, we don’t even know why the civil war is being fought, and that’s certainly by design. Further, the ‘Western Forces’ consist of California and Texas, which are strange bedfellows. And none of the other regions are apparently involved in the war…

“This movie could have been extremely political. It could have been released on Jan. 6. The plot could have included an army drawn from Texas to southern Virginia invading Washington, D.C. It could have been about scary fascists fighting for a Trump-like politician and democracy-loving good guys who prevail over evil at the very end. But it was none of those things…

“The movie doesn’t offend anyone’s political sensibilities. It’s just another daft Hollywood thriller aiming for mass commercial appeal to make the studios lots of money — which it should because the film, if nothing else, was entertaining.”

My wife and I still probably won’t watch. She doesn’t much care for on-screen violence, even if there’s redeeming artistic value — i.e., the 2022 German remake of All Quiet on the Western Front.

And the redeeming artistic value here seems dubious at best: Shelby says Civil War is merely “like most other Hollywood roller coaster movies with bad plots that are hyped for commercial success.” Pass…