A “Bidenomics” Backfire

- “It’s the economy, stupid”

- Good help: Predictably hard to find

- Clean, dependable (undercapitalized) energy

- Follow-up file: Ethereum and moving the wealth “goalpost”

- Hope, prayer and precious metals

![]() “It’s the Economy, Stupid”

“It’s the Economy, Stupid”

Team Biden really stepped in it with the first ad of its $25 million re-election ad campaign: We would call it a rare misstep, but…

Team Biden really stepped in it with the first ad of its $25 million re-election ad campaign: We would call it a rare misstep, but…

The TV and digital ad — called “Fought Back” — puzzlingly concentrates on the U.S. economy; specifically, applauding the virtues of “Bidenomics.”

A try-hard “Morning in America” vibe

“Despite some encouraging economic trends — unemployment is low, inflation seems to be tamed — polling shows that Americans' overall perception of the economy is sour,” says an article at Axios. (We take issue with the bit about “tamed” inflation, but moving on.)

In one late-September poll, for instance, “44% of voters said they're worse off financially under Biden — the most for any president since Ronald Reagan in 1986.”

Now, Democrats are getting hot-under-the-collar about using the “B word” in the first place. (Again, Bidenomics.)

“I've never understood why you would brand an economy in your name when the economy hasn't fully recovered yet,” groused Jill Biden’s former spokesman, Michael LaRosa.

“I've never understood why you would brand an economy in your name when the economy hasn't fully recovered yet,” groused Jill Biden’s former spokesman, Michael LaRosa.

Nevertheless, last month, “Biden gave a speech on Bidenomics in Prince George's County, Maryland, in which he said: ‘For the first time in a long time, we've climbed out of our great economic crisis. It's beginning to work for working people.’

“Biden's messaging has been geared toward working-class Americans. He joined the UAW picket line [in] Michigan, and spoke to blue-collar workers in Philadelphia on Labor Day.”

Courtesy: X

Joe Biden and a clearly enthusiastic crowd…

“But so far, the message isn't resonating — especially among the working-class Americans he's trying to win over,” says Axios. “Polling indicates that college-educated voters are generally satisfied with the state of the economy, but voters living paycheck to paycheck are disillusioned.”

All of which points to an idea we’ve been platforming since, at least, the pandemic: The disconnect between Washington/Wall Street/the Fed and the real economy.

Or, as economist James Galbraith summarizes: “Whatever stories Americans are told about the strength of the economy under President Joe Biden, they are not going to be persuaded to look past the issue of their own living standards.”

[You’re invited: Jim Rickards is teaming up on a special “Bidenomics Survival Project” with one of America's leading computer programmers, data scientists and income experts.

Designed to show how you could extract thousands of dollars upfront, from stocks you already own — and EVEN stocks you don’t own — week after week… without buying any new stocks, bonds or options.

The event is absolutely FREE to attend, we just ask you to register in advance, before TOMORROW at 7 p.m. ET. To instantly register for the “Bidenomics Survival Project,” click here now.]

![]() Good Help: Predictably Hard to Find

Good Help: Predictably Hard to Find

Small-business sentiment has been in the dumps for 21 straight months — judging by the latest Small Business Optimism Index from the National Federation of Independent Business.

Small-business sentiment has been in the dumps for 21 straight months — judging by the latest Small Business Optimism Index from the National Federation of Independent Business.

The headline number slipped from 91.3 in August to 90.8 in September. This figure has been mired below its 49-year average continuously since the start of 2022.

“Owners remain pessimistic about future business conditions, which has contributed to the low optimism they have regarding the economy,” says the NFIB’s chief economist, Bill Dunkelberg. “Sales growth among small businesses has slowed and the bottom line is being squeezed, leaving owners few options beyond raising selling prices for financial relief.”

Thus, inflation is the top-of-mind concern among small-business owners, followed by a shortage of quality labor.

We kick off today’s market notes with a reminder — which Paradigm analyst Dan Amoss posted to our editorial Slack channel…

We kick off today’s market notes with a reminder — which Paradigm analyst Dan Amoss posted to our editorial Slack channel…

For what it’s worth, we’ve long cast a sideways glance at the traditional 60/40 portfolio — and more on precious metals in our mailbag section below.

At present, go figure, the three major U.S. stock indexes are in the green. The tech-heavy Nasdaq is in the lead, up 0.85% to 13,600 while the S&P 500 (+0.65%) and Dow (+0.40%) are at 4,365 and 33,745 respectively.

Glancing at commodities, the price of crude is down almost 1% to $85.56 for a barrel of West Texas Intermediate. Precious metals are also (surprisingly?) in the red. According to Kitco, gold is down 0.30% to $1,855 per ounce while silver is down 0.45% to ultra-low $21.60.

Crypto also is flailing at the time of writing, with Bitcoin down 0.50% to $27,460 and Ethereum down 0.20% to $1,575.

![]() Clean, Dependable (Undercapitalized) Energy

Clean, Dependable (Undercapitalized) Energy

“Higher energy prices have made it more expensive to fuel our vehicles and power our homes,” says Paradigm’s science-and-technology expert Ray Blanco. “We’ve all felt the pinch.

“Higher energy prices have made it more expensive to fuel our vehicles and power our homes,” says Paradigm’s science-and-technology expert Ray Blanco. “We’ve all felt the pinch.

“Tesla CEO Elon Musk believes electricity production will need to double worldwide if electric vehicles become dominant,” Ray notes. “So we need more electricity to power these new vehicles, but it also needs to be cheap.

“However, rather than clear a path for increased traditional energy production, the Biden administration has invested in alternative energy technologies, usually referred to as ‘green energy,’” he says.

“In August 2022, Biden signed the Inflation Reduction Act of 2022 (IRA). Among other things, the poorly named law allocated $391 billion in spending for climate-change-fighting green energy initiatives, including energy sources like wind and solar along with the grid energy storage necessary to improve the performance of these intermittent, unreliable sources of electricity.

“But all of these energy sources emit carbon dioxide into the atmosphere, which is believed to be causing an environmental catastrophe on the planet (a view to which I do not subscribe),” he says.

“There is an alternative: The energy locked in the nucleus of the atom is available. Not only is nuclear power the most concentrated source of energy yet harnessed for human use, it also distinguishes itself by not producing greenhouse gasses.”

“There is an alternative: The energy locked in the nucleus of the atom is available. Not only is nuclear power the most concentrated source of energy yet harnessed for human use, it also distinguishes itself by not producing greenhouse gasses.”

Plus, unlike the requirements for so-called renewable technologies, nuclear power doesn’t rely on unpredictable sunshine and wind. “But what we have, sadly, is a shortage of common sense and a lack of long-range planning,” says Ray.

“If not for anti-nuclear advocates, we might be generations ahead of where we are now in terms of nuclear technology,” he says.

“The result? While the U.S. has built 93 nuclear plants, power generation peaked in 2012. Now, that power is finally starting to come online.

“Things are starting to change,” Ray says. “The great enemy of the day is carbon dioxide — the supposed driver of climate change. The solution is clean nuclear energy.”

![]() Follow-up File: Ethereum and Moving the Wealth “Goalpost”

Follow-up File: Ethereum and Moving the Wealth “Goalpost”

Update #1: “Generally speaking, regulators are becoming more comfortable with [crypto],” says Paradigm editor and crypto specialist Chris Campbell.

Update #1: “Generally speaking, regulators are becoming more comfortable with [crypto],” says Paradigm editor and crypto specialist Chris Campbell.

Last week, VanEck launched the VanEck Ethereum Strategy ETF (EFUT). “When you buy an Ethereum future, you are entering into a contract to buy or sell Ethereum at a specified price on a future date, rather than buying the asset itself,” says Chris. It’s primarily “for people who want to trade and speculate on short-term price movements.”

To be fair, so far, investor enthusiasm for the EFUT has been underwhelming. But VanEck’s Kyle DaCruz says: “We continue to see the long-term vision of [Ethereum]... We think this ETF [is] another great first step in providing access to investors and exposure to Ethereum futures.”

Then there’s the “Grayscale case against the SEC,” Chris adds. “Long story short, the judge flat-out told the SEC they had no good reason to deny Grayscale from converting their Bitcoin fund into a spot ETF.

“The judge’s reasoning: You’ve already approved a Bitcoin futures ETF in the past. If that’s OK, why isn’t a spot ETF?’

“A spot ETF directly holds crypto as its underlying asset,” says Chris. “When you invest in a spot ETF, you’re indirectly purchasing that asset. This move also lends more regulatory certainty to crypto as an asset.

“So far, the SEC” — and SEC chair Gary Gensler — “have won ZERO cases out of three. (Their lawsuit against Coinbase is still pending.)” More encouraging news? “Four members of Congress sent a letter to Gensler, asking him to approve spot Bitcoin ETFs.

“Another thing happened recently that will go down in crypto history…

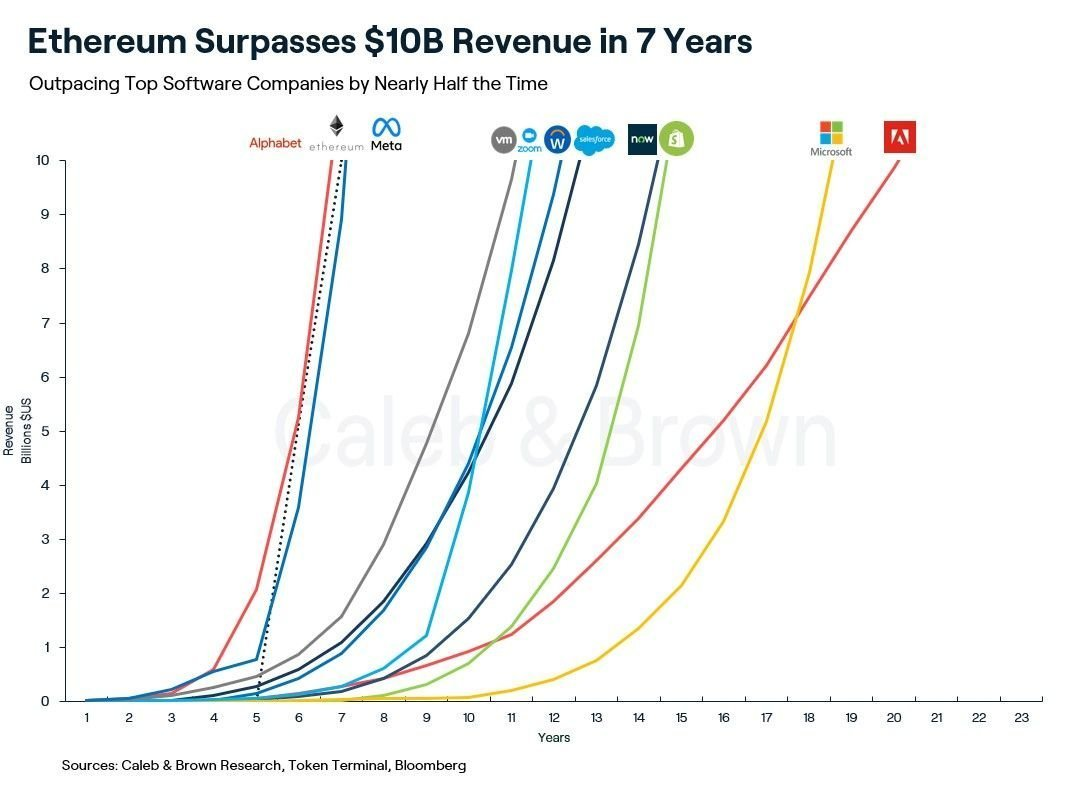

“Ethereum surpassed $10 billion in revenue in seven years,” Chris notes.

“Ethereum surpassed $10 billion in revenue in seven years,” Chris notes.

“Compare this with Big Tech. Ethereum outpaced most software companies, some in less than half the time.

“[Alphabet] Google is the ONLY company that reached $10 billion in revenue in less time than Ethereum.

“Since the beginning, we’ve argued that the Ethereum ecosystem will mature and become a force to be reckoned with,” says Chris. “We stand by that prediction.

“Everything we’re seeing — especially in the past few months — points in that direction,” he says. Plus: “It’s ‘Uptober.’

“Historically, October has been bullish for crypto,” he explains. “It’s also true that in many lackluster years, sentiment has flipped in October. Will it happen this time? We don’t know. But we are seeing some positive indicators.”

So positive, in fact, Chris says: “If you’re looking to hone in on cryptos and more — things we’re most excited about in Q4 and beyond — check out the latest offer from my colleague James Altucher.”

Update #2: Last year, NFL wide receiver Tyreek Hill declined a job offer from the New York Jets. The reason? “State taxes,” he said.

Update #2: Last year, NFL wide receiver Tyreek Hill declined a job offer from the New York Jets. The reason? “State taxes,” he said.

Instead, Hill signed a contract with the Miami Dolphins, saying: “I had to make a grown-up decision.” And by playing football in the Sunshine State, he saved himself $2.7 million in NJ state and local taxes — to say nothing of the Dolphins’ current 4-1 record (or the Jets’ 2-3 record).

All around, Mr. Hill made a prudent decision, especially so since some politicians, including Rep. Alexandria Ocasio-Cortez (D-NY), want to move an altogether different “goalpost” for taxpayers in the Empire State.

“Bemoaning ‘violent budget cuts’ at New York City agencies,” The Wall Street Journal says, “Rep. Alexandria Ocasio-Cortez and her ideological allies are calling on the city and state to ‘fund resources for all New Yorkers’ by raising taxes on the top 5% of New Yorkers.

“Considering the left’s prior focus on ‘the 1%,’ this is a major development,” WSJ says.

“Considering the left’s prior focus on ‘the 1%,’ this is a major development,” WSJ says.

Indeed, AOC and her ilk aren’t alone, as our managing editor, Dave Gonigam, reported Team Biden is expanding the definition of wealthy. “The IRS just said [we] consider the floor for ‘high income’ to be $200K, not $400K,” Dave noted two weeks ago.

Whereas the top 1% of earners in New York starts just shy of $1 million in annual adjusted gross income, the top 5% “begins a little above $250,000 — translating into married couples making $127,000 each.”

The WSJ article concludes: “Gov. Kathy Hochul has thus far resisted this and other calls for economically destructive tax hikes, even as she grapples with looming budget shortfalls.

“And while New Yorkers haven’t widely objected to past calls to ‘tax the rich,’ that may change now that so many have been invited into the category.”

Which brings us full circle to tax-unfriendly environments and pro athletes…

It’ll be interesting to see if professional teams in low-tax states wind up stacked with talent… while other states just get burned.

![]() Mailbag: Hope, Prayer and Precious Metals

Mailbag: Hope, Prayer and Precious Metals

“From what I have gleaned doing secondhand research, your tips (re: barter and Silver/Gold Eagles) are good ones!

“From what I have gleaned doing secondhand research, your tips (re: barter and Silver/Gold Eagles) are good ones!

“When TSHTF, society rapidly devolves into black markets and ruthless pragmatism.

“Store owners and their employees would learn, rather quickly I think, to accept precious metals as payment (if they want to remain in business and feed their families).

“Customers with high-quality bullion will probably get ushered to a preferred checkout lane.

“The same cashier’s scale that weighs your produce might be useful for gold and silver as well.

“There’s more: Think about the accompanying chaos and mayhem, and need to protect oneself just to go shopping and get home safely.

“Let’s hope and pray that we never live in such interesting times,” he says. “But IMHO we should learn everything we can from those who did and survived.”

Agree: Hope and pray… On that sobering note, we conclude today’s 5 Bullets. And join us tomorrow for a fresh episode. Take care!

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets

P.S. Hope, prayer, precious metals… and preparedness. Luckily, you’ve still got time to act.

Owning physical gold and silver through the Hard Assets Alliance gives you liquidity and stability, knowing you are buying only the highest-quality bullion.

Hard Assets Alliance allows you to buy and take delivery with exceptionally low costs. Or with a single click, you can buy and store your metal in your choice of five audited vaults worldwide.

It’s the hands-down easiest way to get started with precious metals, including a FREE account.

Once you’ve completed the short account-opening process, you’ll be able to shop for the type of bars and coins you want to buy right away.

You’ll see all of our inventory and be able to make an informed decision at this pivotal moment.

Click now to protect your wealth and family today.

[Full disclosure: Several years ago, our firm invested in Hard Assets Alliance. So you can assume that we get a percentage of any competitively low fees you might pay.]