The IRS Expands Its Target List

- The IRS defines down “high income”

- Another day, another $150 oil prediction

- Epstein: The most brazen cover-up yet

- Next step in India’s cashless-society gambit

- The Mailbag: Rickards and Ukraine (Cont’d)

![]() The IRS Defines Down “High Income”

The IRS Defines Down “High Income”

So yeah, you never really believed the IRS was going to limit its stepped-up enforcement efforts to people with incomes over $400,000, right?

So yeah, you never really believed the IRS was going to limit its stepped-up enforcement efforts to people with incomes over $400,000, right?

That was the promise last year when the misnamed “Inflation Reduction Act” beefed up the IRS’ budget by $80 billion and provided for 87,000 new IRS hires.

Actually, as we pointed out at the time, even the promise taken at face value was disingenuous. Treasury Secretary Janet Yellen said the new funding “shall not be used to increase the share of small business or households below the $400,000 threshold that are audited relative to historical levels.”

The word share was doing some heavy lifting there. In other words, the percentage of under-$400K earners subject to audit would not rise — but the overall number of under-$400K earners sure as hell would, because the total number of audits would rise.

Even Congress’ own number-crunchers acknowledged at the time that at least 78% of the new revenue raised from underreported income would likely come from folks making under $200,000 a year. At most 9% would come from those making over $500,000.

But it’s even worse than we anticipated then: The IRS just said To hell with Janet Yellen’s promises, we consider the floor for “high income” to be $200K, not $400K.

But it’s even worse than we anticipated then: The IRS just said To hell with Janet Yellen’s promises, we consider the floor for “high income” to be $200K, not $400K.

The Treasury Department employs an IRS watchdog with the title “Treasury Inspector General for Tax Administration,” or TIGTA.

TIGTA issued a report a month ago that pointed out, "The IRS' current default definition of high-income taxpayers is $200,000 and above."

Under the Tax Reform Act of 1976, the IRS must publish annual data on individual tax returns reporting incomes of $200,000 or higher. By 2005, $200K became the agency’s formal benchmark for “high-income taxpayers.”

Says the TIGTA report: "The current examination coding scheme uses $200,000 as a main threshold even though it is no longer a reasonable standard for high earners given inflation since 2005.”

Word. Even using the government’s own skeevy inflation yardstick, $200K then is 312K now.

TIGTA’s recommendation: The IRS should square up its definition of “high income” with that of the Treasury Department and the White House. "At a minimum, the IRS should accept the Treasury secretary's $400,000 directive as the new high-income floor on which IRS leadership can focus enforcement efforts."

In response, the IRS told the inspector general to go pound sand: “We do not agree,” said IRS deputy commissioner Douglas O’Donnell.

In response, the IRS told the inspector general to go pound sand: “We do not agree,” said IRS deputy commissioner Douglas O’Donnell.

“[A] static and overly proscriptive definition of high-income taxpayers for purposes of focusing on income levels above which taxpayers have unique and varied opportunities for tax would serve to deprive the IRS of the agility to address emerging issues and trends."

The gist of that long sentence is that “tax collectors want to continue using the phrase ‘high-income’ in as slippery a way as they please without being pinned to any specific definition,” writes J.D. Tuccille at Reason.

“Who is a ‘high-income earner’? Maybe somebody earning over $400,000, or maybe you if it's your lucky day.”

We conclude our Bullet No. 1 with the same warning we issued just over a year ago: Under the Inflation Reduction Act, most of the new revenue generated by the IRS’ stepped-up enforcement efforts will come from the shakedown of small-business owners and the self-employed — folks who aren’t W2 employees and can be more easily nailed for inflating deductions and (especially) underreporting income.

After all, their incomes simply aren’t high enough that they can access the sort of tax-minimizing techniques available to “the 1%” — which is really the top 0.01%.

➢ Footnote: The IRS’ new enforcement resources will not be affected by the “partial government shutdown” that’s likely to start this weekend.

![]() Another Day, Another $150 Oil Prediction

Another Day, Another $150 Oil Prediction

On the heels of JPMorgan Chase’s outlook for $150 oil in the “near to medium term”... the CEO at one of the top U.S. shale drillers agrees.

On the heels of JPMorgan Chase’s outlook for $150 oil in the “near to medium term”... the CEO at one of the top U.S. shale drillers agrees.

Continental Resources chief Doug Lawler told Bloomberg TV yesterday that without new production, “you’re going to see $120–150.” Absent policies encouraging new drilling, “you’re going to see more pressure on price.”

Lawler points out what we’ve pointed out before: For all the bounty of U.S. shale oil in the last decade, most of the major shale formations like North Dakota’s Bakken and Texas’ Eagle Ford are now in decline… and the one remaining elephant, the Permian Basin in Texas, is operating on borrowed time.

Checking our screens, crude is back above $90 a barrel this morning.

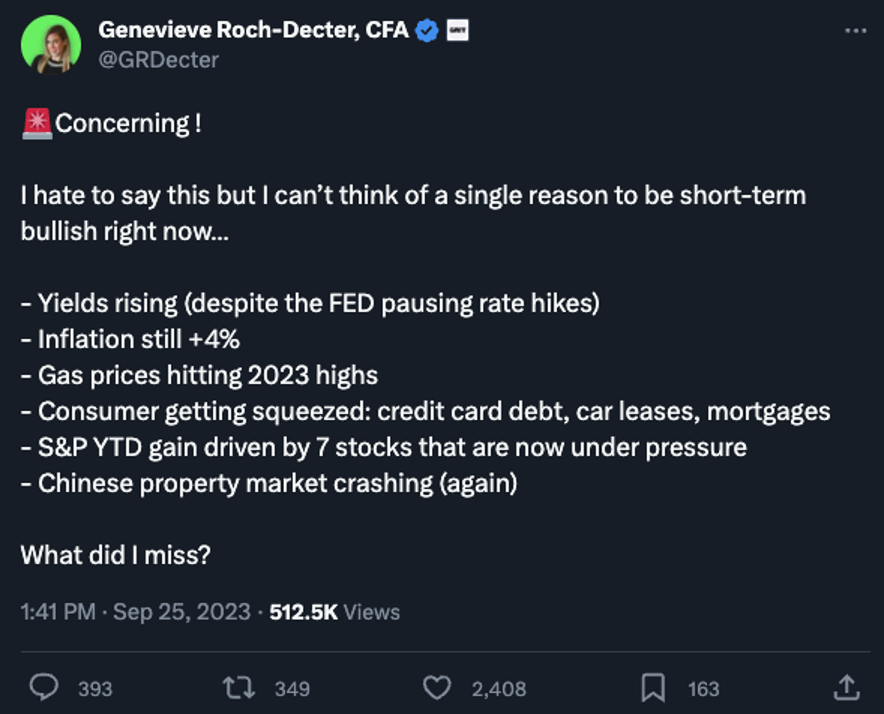

Meanwhile, the U.S. stock market is sinking fast. Again.

Meanwhile, the U.S. stock market is sinking fast. Again.

All the major U.S. indexes are down at least two-thirds of a percent. The S&P 500 is down nearly 1%, back below 4,300 for the first time since early June. Another 100 points lower and the index will be at its 200-day moving average.

The mainstream is trying to chalk up the drop to a couple of middling economic numbers out today: New home sales for August rang in less than expected and so did consumer confidence as measured by the Conference Board.

More likely, we suspect, is a confluence of rotten longer-term trends…

At least the “earthquake in bond land” is settling down for the time being: The yield on a 10-year Treasury note has backed off a bit to 4.54%.

Gold is resilient for the moment, above $1,900. But silver can’t recover from a whacking it got yesterday, still below $23.

![]() Epstein: The Most Brazen Coverup Yet

Epstein: The Most Brazen Coverup Yet

We now know what it costs to cover up the worst of JPMorgan Chase’s dealings with Jeffrey Epstein, and it’s a pittance — $75 million or 0.18% of JPM’s revenue last quarter.

We now know what it costs to cover up the worst of JPMorgan Chase’s dealings with Jeffrey Epstein, and it’s a pittance — $75 million or 0.18% of JPM’s revenue last quarter.

A bit of background: In June, JPM settled out of court with Jeffrey Epstein’s accusers for $290 million. Their lawsuit claimed JPM routinely looked the other way when it came to Epstein’s sex trafficking because of all the wealthy new clients he kept bringing in.

But there was a separate lawsuit brought against JPM by the government of the U.S. Virgin Islands, set to go to trial next month. And this morning brings word that that suit has also been settled, for $75 million.

About $30 million will go to Virgin Islands charities, $25 million to Virgin Islands law enforcement (supposedly to combat sex trafficking) and $20 million to cover Virgin Islands government’s attorney fees.

JPM admits no wrongdoing, saying only it “deeply regrets” its 15-year relationship with Epstein. Virgin Islands Attorney General Ariel Smith calls the settlement “an historic victory for survivors and for state enforcement,” yada yada.

Before they go too far down the memory hole, we want to remind you about the bombshell Epstein documents the Virgin Islands government submitted pre-trial.

Before they go too far down the memory hole, we want to remind you about the bombshell Epstein documents the Virgin Islands government submitted pre-trial.

The papers allege that JPM didn’t just look the other way — but that it “actively participated in Epstein’s sex-trafficking venture from 2006–2019.”

Which is even more shocking than it sounds, because JPM supposedly dumped Epstein as a client in 2013.

The documents also reveal huge wads of physical cash changing hands — up to $80,000 a pop, several times a month, while the bank was well aware that Epstein paid off his victims in cash. Over a 10-year period, JPM handled more than $5 million in outgoing cash transactions.

As you might know, federal law requires banks to report all cash transactions over $10,000 to the U.S. Treasury. How compliant was JPM with this requirement?

Well, now we’ll never know.

Reacting to these revelations in July, Pam Martens and Russ Martens wrote the following at their Wall Street on Parade site: “It is becoming critically important that the U.S. Virgin Islands actually bring its case to trial in a public courtroom and not fold like another cheap suit by accepting a pile of tainted money from JPMorgan Chase.”

Too late.

![]() Follow-up File: The Next Step In India’s Cashless-Society Gambit

Follow-up File: The Next Step In India’s Cashless-Society Gambit

India is taking its next step toward becoming a cashless society — not that the media are portraying it that way.

India is taking its next step toward becoming a cashless society — not that the media are portraying it that way.

“India’s highest value banknote will be withdrawn in less than a week,” says Bloomberg — “and there’s still almost 240 billion rupees ($2.9 billion) worth of the notes in circulation.”

Over the last four years, the Reserve Bank of India wound down printing of the 2,000-rupee note — worth about $24 at today’s exchange rate.

Then in May, the central bank served notice that all 2,000-rupee notes would have to be turned in at a bank by the end of September.

“Data collected from major banks indicates that about 87% of the banknotes received by lenders was in the form of deposits,” says the Euronews site, “while around 13% was exchanged for other denominations.”

But as of yesterday about 7% of the notes were still in people’s pockets. If folks hold onto them after that, they can still exchange them — but they’ll have to explain why they couldn’t meet the deadline.

The end of the 2,000-rupee note is the latest step in Prime Minister Narendra Modi’s shock therapy begun in 2016 — an immediate ban of all 500- and 1,000-rupee notes in circulation.

The end of the 2,000-rupee note is the latest step in Prime Minister Narendra Modi’s shock therapy begun in 2016 — an immediate ban of all 500- and 1,000-rupee notes in circulation.

Immediately, hundreds of millions of people who transacted only in cash were all but forced to adopt electronic payments via low-end smartphones — with all the tracking and taxing that comes with it.

A few weeks later, Modi acknowledged the long-term endgame: “We can gradually move from a less-cash society to a cashless society.”

Ominous stuff if you’re familiar with central bank digital currencies, or in Jim Rickards’ parlance, “Biden Bucks.” We’ve been onto the Indian chapter of this story from the beginning: We published a comprehensive review earlier this year.

![]() The Mailbag: Rickards and Ukraine (Cont’d)

The Mailbag: Rickards and Ukraine (Cont’d)

“I want to add my 2 cents to the commenter concerning Jim Rickards’ analysis of the war in Ukraine,” writes a retired U.S. Marine colonel.

“I want to add my 2 cents to the commenter concerning Jim Rickards’ analysis of the war in Ukraine,” writes a retired U.S. Marine colonel.

“My problem is that he has consistently been supporting the narrative that Ukraine doesn't have a chance and that Russia will eventually win. You don't have to be a Ukrainian booster to find fault with this position. You don't have to disagree that Ukraine has been suffering losses either.

“But I think the analysis from the Institute for the Study of War has been the most objective. Full disclosure, I have supported them for over 10 years.

“Yes it is a slow slog, but there is progress for Ukraine and the possibility of isolating Crimea. Regaining all the invaded space may be a bridge too far, but this is not a good situation for Russia and Putin going forward. Both countries have a manpower problem for different reasons.

“The real challenge is how to make peace when Ukraine is in for the long haul and Putin could lose everything if he retreats.”

Dave responds: The Institute for the Study of War? The outfit founded by one of the Kagans? The outfit that has Bill Kristol and Joe Lieberman and David freaking Petraeus on its board? Hard pass…

To be sure, Jim’s assessments are among the most emphatic out there — as forceful in their skepticism of Ukrainian fighting strength as figures like Douglas Macgregor and Scott Ritter.

In the fullness of time, those assessments might turn out to be premature. Much of the time, this conflict looks like an ugly war of attrition comparable to the Western Front in World War I or the Iran-Iraq War of the 1980s.

The difference, of course, is that neither of those conflicts was a proxy conflict between the two nuclear-armed superpowers.

Which leaves us with a completely different historical analogy that’s much more alarming…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets