Dollars, Dollars Everywhere

- The dollar shortage is back

- Oil is up another 60% from here?!

- How are those Russian sanctions working out?

- See something, say… er, never mind

- Rickards on Ukraine: “Ridiculous,” says a reader

![]() The Dollar Shortage Is Back

The Dollar Shortage Is Back

We start the new week by returning to a conundrum we’ve explored now and then over the years — the global dollar shortage.

We start the new week by returning to a conundrum we’ve explored now and then over the years — the global dollar shortage.

If you’re a newer reader — or even if you’re not — you might be scratching your head: A dollar shortage? When the Federal Reserve has conjured all this new money into existence?

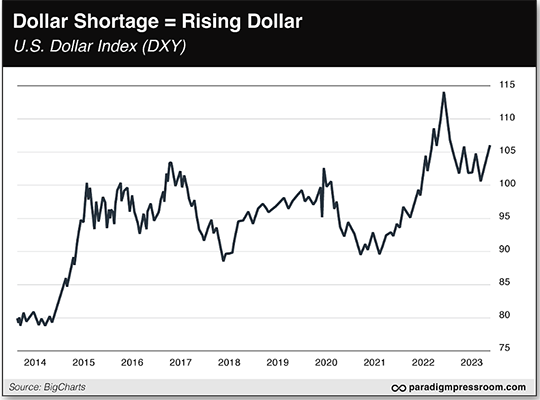

But yes — there’s a dollar shortage. You can see it on a chart of the U.S. Dollar Index — measuring the dollar against a basket of six other developed-market currencies — over the last decade.

From lows near 80 at this time in 2013, the index sits at nearly 106 today. What looked like a breakdown below 100 a few weeks ago turned out to be a head fake.

“The driver of USD strength for the foreseeable future is a global dollar shortage and a mad scramble for liquidity among large central banks,” says Paradigm Press macro maven Jim Rickards.

“The driver of USD strength for the foreseeable future is a global dollar shortage and a mad scramble for liquidity among large central banks,” says Paradigm Press macro maven Jim Rickards.

“This dollar shortage was behind the collapse of Credit Suisse on March 19, 2023. It is behind the collapse of the yuan today.”

Here’s the thing about the $7 trillion the Fed has created since the global financial crisis of 2008: “Almost all of the Fed ‘money printing’ came in the form of payments to bond dealers to purchase U.S. Treasury securities,” Jim explains.

“The Fed does create that money from thin air. But once the Fed sends the money to the dealers to pay for the bonds, the dealers send it right back to the Fed in the form of interest-bearing ‘excess reserves.’

“That money doesn’t go anywhere and it doesn’t do anything. It just sits on the dealer balance sheets as a cash equivalent and sits on the Fed’s balance sheet as a liability. It does not get lent and it does not get spent. It does the economy no good. It’s just an accounting entry that inflates both Fed and dealer balance sheets.

“The money that matters is not created by the Fed,” Jim goes on.

“The money that matters is not created by the Fed,” Jim goes on.

➢ As a reminder, “Eurodollars” is a term encompassing any sort of dollar-denominated account in foreign banks and foreign branches of U.S. banks — anywhere in the world, not just Europe. It’s not related to the euro currency.Both these flavors of loans and deposits are turning sour: “The domestic lending business is shrinking even as commercial real estate and credit card defaults are on the rise.

“The situation in the Eurodollar markets is even more severe. Major central banks like the ECB, Bank of Japan, Bank of England and People’s Bank of China don’t print dollars — they print whatever domestic currency is used in their country.

“Part of the reason for tightness in the Eurodollar market is a scarcity of the highest-quality collateral — U.S. Treasury bills — needed to support $1 quadrillion in derivatives positions. (FYI, $1 quadrillion = $1,000 trillion).

“Once you understand what’s going on behind the curtain in the Eurodollar market,” Jim concludes, “it’s clear that the dollar will get stronger (for now) against all major currencies because of extreme demand for dollars to support local currencies (a losing battle), pay dollar-denominated debt (good luck) and lend to local banks to support their short dollar positions (too late).”

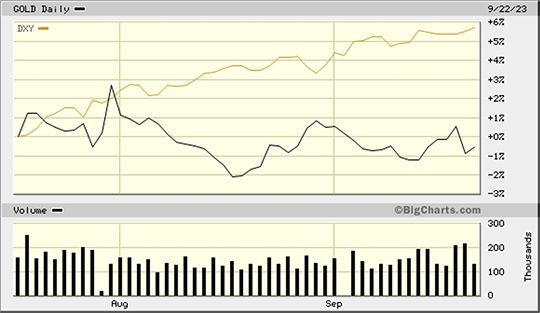

All else being equal, dollar strength translates to gold weakness. But all else is not equal, not now.

All else being equal, dollar strength translates to gold weakness. But all else is not equal, not now.

As you can see in the chart above, the Dollar Index went on a tear starting in mid-July — bouncing off the 100 level and approaching 106 now.

That’s a steep move in a short amount of time. In the face of that dollar strength, gold has mostly moved sideways — up or down no more than 2% and just below breakeven this morning.

Whenever the dollar shortage starts to ease — and it won’t last forever — that dollar strength will go into reverse.

At that point, nothing will be holding gold down. The Midas metal will decisively break out over $2,000, never to look back.

As you likely know, Jim Rickards recommends keeping 10% of your portfolio in physical gold. If you already have your full gold allocation, you’ll want to consider the “backdoor” gold play that Jim spent several months researching — an opportunity so compelling he commissioned a video crew to follow him to the desert.

That said, the window of opportunity is about to slam shut: For reasons beyond our control, this offer expires at midnight tonight — and it will never reopen.

![]() Oil up Another 60% From Here?!

Oil up Another 60% From Here?!

You think oil is expensive now? Wait till it returns to record levels near $150.

You think oil is expensive now? Wait till it returns to record levels near $150.

As a new week begins, a barrel of West Texas Intermediate has dipped just below $90. But a new report from JPMorgan Chase anticipates a return to $150 “over the near to medium term.”

Oil’s all-time record was $147 in the summer of 2008 — just before the global financial crisis went critical. Adjusted for inflation, that would be $208 today.

The JPM analysts aren’t looking for a number that high — but a move from $90 to $150 would still be huge. And their report cites many of the same factors we’ve been telling you about in recent months — especially Saudi Arabia’s production cap.

“Our analysis reveals that the oil S&D [supply and demand] gap can only be met by Saudi spare capacity,” says the report. But the Saudi princes aren’t obliging — they’re sticking to their plans for production cuts through the end of this year.

Here’s the thing the analysts point out: Energy stocks haven’t caught up to the recent jump in crude prices. “While energy equities have lagged the sharp move in oil prices since June (oil up 30%, Stoxx 600 Oil & Gas Index up about 10%), we are turning bullish once again on the global energy complex.”

Oil and gas ETFs abound if you want to capture the upside: One to consider is the Invesco Dynamic Energy Exploration & Production ETF (PXE).

“Late-September trading is in full effect right now as the averages struggle to get off the mat,” Greg Guenthner tells his Trading Desk readers this morning.

“Late-September trading is in full effect right now as the averages struggle to get off the mat,” Greg Guenthner tells his Trading Desk readers this morning.

In other words, the stock market is struggling mightily. “Friday’s action was telling,” says Greg. “No buyers showed up late in the day despite oversold conditions. When the dust settled, the S&P was down almost 3% on the week — its third consecutive week in the red.” [Not bad, however, for Greg’s readers — collecting gains from put options on trendy tech names.]

“It’s possible that we see a weak relief rally that leads to additional downside into October. In fact, the next market bounce will offer a lot of information regarding the health of this year’s uptrend and how we will trade heading into the end of the year.”

In the meantime, the major U.S. indexes start a new week marginally in the red. At 4,316 the S&P 500 is no better off now than it was in June 2021.

The “earthquake in bond land” continues — prices lower, yields higher. The yield on a 10-year Treasury note is up to 4.52%, another level last seen in 2007.

Precious metals are losing ground, gold at $1,915 and silver at $23.05. Bitcoin’s rally of recent days had no staying power, but the flagship crypto continues holding the line on $26,000.

![]() How Are Those Russian Sanctions Working Out?

How Are Those Russian Sanctions Working Out?

At the risk of repeating ourselves, the G7 nations’ “price cap” scheme on Russian oil is an utter failure.

At the risk of repeating ourselves, the G7 nations’ “price cap” scheme on Russian oil is an utter failure.

Even the mainstream has to admit it now: “Russia has succeeded in avoiding G7 sanctions on most of its oil exports,” says the Financial Times, “a shift in trade flows that will boost the Kremlin’s revenues as crude rises toward $100 a barrel.”

Last December, the G7 governments capped the price of Russian oil at $60 a barrel. The way they were going to enforce that cap was to deny Western insurance, financing and shipping to any buyers who paid more.

Yeah, it’s not working out: The FT has analyzed private-sector shipping and insurance records and concluded that “almost three-quarters of all seaborne Russian crude flows travelled without western insurance in August.” As recently as this spring, it was only half.

“The rise implies that Moscow is becoming more adept at circumventing the cap,” says the paper. Well, yes, but it also implies that Moscow’s oil customers in China and India are perfectly capable of making alternative arrangements.

You can sense the disappointment reading between the lines of the story: “While Russia’s oil sector is still facing several significant challenges, including claims of shortages in its domestic refined fuels market and a dip in export volumes overall, the figures still suggest more oil revenues will be flowing into the Kremlin’s war chest.”

In fact, Moscow is sufficiently flush that it’s been able to top up its gold stash.

In fact, Moscow is sufficiently flush that it’s been able to top up its gold stash.

The Central Bank of Russia began drawing down its gold reserve in early 2023 to settle international transactions and cover budget deficits.

But in its most recent figures, the central bank reports it added three metric tons to its gold stash during August. That brings the total to 2,333 metric tons, or about 75 million troy ounces — right where it was at the start of the year.

With that, Russia’s gold reserve is back to where it was at the beginning of 2023.

As Jim Rickards is keen to remind us, Russia’s gold reserve as a percentage of its economy is the biggest in the world. And with Russia taking over the chairmanship of the expanded BRICS constellation of nations next year, the stage is set for the group to announce plans for a gold-backed trading currency at its 2024 conference.

BRICS 11 Are Playing the Long Game happens to be the title of Jim’s talk at this year’s Paradigm Shift Summit, set for a week from tomorrow in Las Vegas. Keep up with these 5 Bullets next week for full coverage of our exclusive gathering.

![]() See Something, Say — Er, Never Mind

See Something, Say — Er, Never Mind

Did you know it’s national “See Something, Say Something” day?

Did you know it’s national “See Something, Say Something” day?

Yep, the environment of fear and suspicion that the federal government has been ginning up ever since the 9/11 attacks in 2001 now have their own dedicated day.

It seems to have some competition, however, for the attention of the business community: Today is also (among other things) World Pharmacists Day, National Comic Book Day and National One-Hit Wonder Day. Somehow, we don’t imagine many businesses are putting “See Something, Say Something” placards in their front window.

The state of New Jersey, however, is a different matter…

“New Jersey has been accused of sparking terror fears and confusing residents,” reports the Daily Mail, “with a new statewide 'see something, say something' roadway campaign.”

Starting this month, New Jersey’s Office of Homeland Security and Preparedness took over the electronic signs that dot the Garden State’s interstate highways. “Our 'See Something, Say Something' initiative bolsters the state's security efforts,” claims a statement, “and plays a key role in helping to identify threats and to prevent attacks.”

So far, it seems people are ignoring it — or taking it in a way the authorities didn’t intend. A few social media hot takes as aggregated by the Daily Mail…

- “Hmmmmm… what do they know that we don’t know??”

- “Wonder why they thought this was necessary”

- “I wondered what’s going on we aren’t told about”

- “I love having an anxiety disorder and driving through New Jersey and seeing ‘SUSPECT TERRORISM?’ in yellow lights over every major highway”

- “Fear mongering plain and simple.”

Took long enough, but it seems as if a critical mass of Americans has caught on to the whole racket.

The slogan “is nothing more than the government’s way of indoctrinating ‘we the people’ into the mindset that we’re an extension of the government and, as such, have a patriotic duty to be suspicious of, spy on and turn in our fellow citizens,” writes John Whitehead of the Rutherford Institute.

Instead, at least some folks are casting more suspicion on the government than on their fellow citizens. As it should be in a free country, right?

![]() Rickards on Ukraine: “Ridiculous,” Says a Reader

Rickards on Ukraine: “Ridiculous,” Says a Reader

“OK, this is getting ridiculous!” a reader writes after Jim Rickards’ take on Ukraine a week ago today.

“OK, this is getting ridiculous!” a reader writes after Jim Rickards’ take on Ukraine a week ago today.

The reader challenges many of Jim’s claims therein, including 300,000 Ukrainian dead and 200,000 wounded.

“Most credible military experts agree that Russia is simply not capable of such major sustained offensives (it has not been able to take or keep any significantly important city in the past 19 months…. running out of ammo, ordnance and missiles — thus going begging hat in hand to Kim Jong Un…)

“Yes, Ukraine has been guilty of exaggerating Russian body counts, too…. masking its own losses and equipment failures, etc. But this is war — what did you expect?

“Sorry, but Mr. Rickards has ‘zero’ credibility at this point…. Maybe he should stick to financial stuff — and scaring the audience into buying things…

“Thanks for letting me rant.”

Dave responds: To be clear, Jim has a lot of contacts in the intelligence community and the military — folks who cringe at the Ukraine-is-totally-winning narrative but who have few outlets for disseminating what they see as ground truth.

If you want independent corroboration, there’s this from Johns Hopkins professor Michael Vlahos, speaking last night on John Batchelor’s syndicated radio show: “A Ukrainian official announced that in the last year and half of war, an extra 500,000 disabled people have been added to the roster of disabled people in Ukraine — 80% of them are military, meaning 400,000 disabled soldiers. And if my sense of the casualty ratio in the war is correct, and I think it is, then that means you have at least 400,000 dead because the wounded-in-action to killed-in-action is about 1:1.”

But let’s just stick with the “official” numbers: Last month, mainstream media citing U.S. officials reported 70,000 Ukrainian dead.

That’s more losses in 18 months than the United States suffered over eight years in Vietnam. And Ukraine’s prewar population was about one-fifth that of the United States’ in 1970.

(And U.S. officials had the temerity to say that Ukrainians had become “casualty averse”!)

Even if Jim’s claims are over-the-top, the fact remains that the narrative in Western media is misleading at best, delusional at worst.

Only rarely does reality slip through, as when Newsweek gave space last week to Afghanistan whistleblower and retired Army Lt. Col. Daniel L. Davis, now with the Defense Priorities think tank.

“A sober, accurate analysis of Ukraine's nearly completed summer offensive,” he writes, “reveals that the heroic sacrifice Ukraine continues to make is producing little to no meaningful progress toward the objective of evicting Russia from Ukraine's territory.”

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets