“Earthquake in Bond Land”

- “Earthquake in bond land”

- The Fed is losing ground (Inflation)

- Retailers: Haves and Have-Nots

- A twisty gold saga in Dent’s Run, PA

- The three rules of real estate

![]() “Earthquake in Bond Land”

“Earthquake in Bond Land”

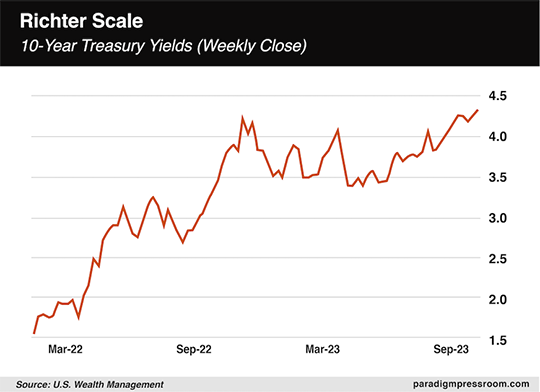

“Ten-year Treasury yields are on the jump,” says managing editor Brian Maher at Daily Reckoning. “At 3.28% in early April, 10-year Treasury yields presently vault to 4.47%.

“Ten-year Treasury yields are on the jump,” says managing editor Brian Maher at Daily Reckoning. “At 3.28% in early April, 10-year Treasury yields presently vault to 4.47%.

“A 1.19 percentage point leap may not alert or alarm you,” he says. “Yet the 10-year Treasury note generally… advances or retreats in centimeters and millimeters.”

Thus Paradigm’s macro expert Jim Rickards rightly calls this advance an earthquake in bond land.

Brian continues: “Recall, bond prices and bond yields exist in a state of antagonistic polarity. Thus today’s upswinging yields equal downswinging bond values. In the case before us, downswinging 10-year Treasury values.”

And this wild swing has everything to do with the Fed’s declaration Wednesday that its target for interest rates this year is 5.50–5.75%.

“Much of the prior decade’s ‘growth’ sprung from the Federal Reserve’s zero interest rate. In such a period bonds maintain an elevated value,” says Brian.

“Much of the prior decade’s ‘growth’ sprung from the Federal Reserve’s zero interest rate. In such a period bonds maintain an elevated value,” says Brian.

“Banks expected this period of severely depressed interest rates to run and run, [but] the bond seesaw experienced a directional swing last March.

“That is when the Federal Reserve commenced the most frenzied and dizzied campaign of interest rate increases ever hazarded,” he says.

“The banks’ long-dated bonds that had been oaken assets? They transitioned rapidly to sawdust assets in the period of rapidly elevating interest rates. The bank portfolios that stabled them endured a mighty chain-sawing. And the banks themselves began going over… felled trees in a banking forest.”

“Those bonds were way underwater,” Jim Rickards summarizes. “They were worth 80 cents on the dollar. People did the math and said if your bond portfolio is down 20% and we subtract that from your capital, you’re broke, you’re insolvent, you have no capital on a market-to market basis. So I’m getting my money out. And that triggered the run on the bank.”

Brian concludes: “These trees remain upright — for now. Yet Jim hears strange creaks and groans issuing from the forest. He fears the temporary braces are giving way. He fears a second string of bank topplings — perhaps even within weeks.”

[This message will be deleted at 11:59 EST tonight: America’s financial war is about to go nuclear… And the “doomsday countdown” has already begun. Before the crisis hits, Jim Rickards has outlined the necessary steps you should take to prepare. Everything you need to get ready is right here.]

![]() The Fed Is Losing Ground (Inflation)

The Fed Is Losing Ground (Inflation)

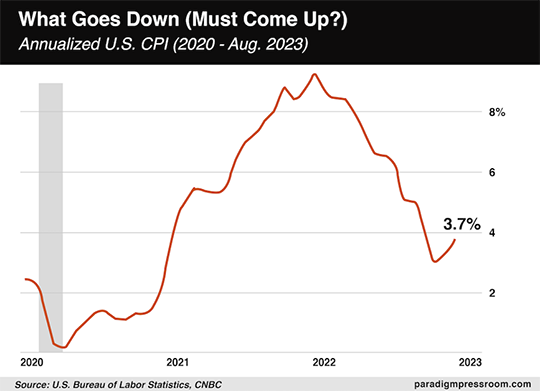

“Powell and the Fed are caught in a dilemma: Inflation is back,” says Jim, following up on Wednesday’s FOMC meeting.

“Powell and the Fed are caught in a dilemma: Inflation is back,” says Jim, following up on Wednesday’s FOMC meeting.

“It’s true that CPI inflation has come down significantly from the 9.1% level reached in June 2022,” he says, “but that progress has now gone into reverse.

“The Fed’s hard-won gains against inflation are being lost…

“The consumer price index (CPI) year-over-year was 3.0% in June… 3.2% in July … and 3.7% in August.

“Professional economists ignore the CPI headline data and look at CPI core (excluding food and energy) and super-core (excluding food, energy and housing),” Jim adds. Acceptable only if you forgo food, transportation and shelter.

“The truth is Americans spend most of their money on food, gasoline, home cooling/heating and housing. Americans don’t pay ‘super-core’ CPI. They pay headline CPI every time they go to the store or the gas station.

“At some level the Fed must know this. They are losing the battle against inflation.”

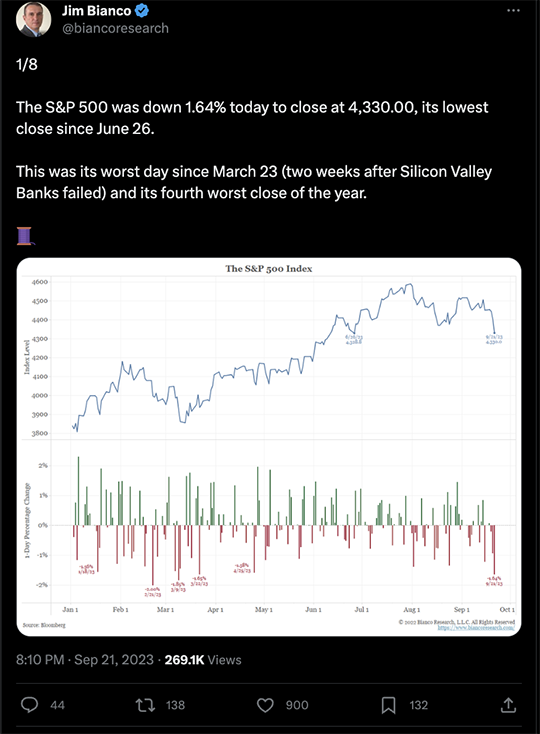

Notably, stocks lost ground Thursday…

Notably, stocks lost ground Thursday…

Today? The three major U.S. stock indexes are all in the green, with the S&P 500 up 0.45% to 4,350 and the tech-loving Nasdaq up 0.80% to 13,330. In last place, the staid Dow is up about 0.10% to 34,095.

Taking a look at commodities, oil is still stuck below $91 for a barrel of West Texas crude. As for precious metals, gold is up $7.60 per ounce to $1,927.10, by Kitco’s estimation, and silver is up to $23.60.

Crypto, too, is closing out the week in the green: At the time of writing, Bitcoin is up 0.30% to $26,670 and Ethereum is up 0.50%, just under $1,600.

![]() Retailers: Haves and Have-Nots

Retailers: Haves and Have-Nots

“A growing class divide in the U.S. economy is leading to an interesting split among retailers,” observes Paradigm’s income-investing ace Zach Scheidt.

“A growing class divide in the U.S. economy is leading to an interesting split among retailers,” observes Paradigm’s income-investing ace Zach Scheidt.

While it might not feel like it, “stocks are in a bull market,” he says. “The market is rebounding this year” — to wit, the SPDR S&P 500 ETF Trust (SPDR) is up over 13% year-to-date.

“Affluent customers are the ones who are more likely to have investments in a 401(k), IRA or other brokerage account where they're making money as stocks move higher.

“Affluent customers are also more likely to own homes. Because people aren’t selling their homes with today’s high interest rates, there's less inventory on the market, which naturally pushes home prices higher.

“Consumers who own homes are sitting there and looking on Zillow, seeing the value of their home move higher. Now, that doesn't add cash to their accounts, but it does make them feel more confident that they've got wealth building in their home.

“So they’re more comfortable spending their money, and stocks that cater to these affluent consumers are doing quite well.

“On the other hand, there are two ways inflation is hitting lower-income consumers especially hard,” Zach says.

“On the other hand, there are two ways inflation is hitting lower-income consumers especially hard,” Zach says.

“The first is housing: It costs more for a mortgage payment if you own a home, and rent prices are still very high for renters,” he says.

Second, although the price of gas is “a very small percentage of an affluent consumer’s expenses,” says Zach, “when you have a 10% month-over-month increase in gasoline, it’s a big issue for these lower-income customers.

“I'll also note that we've seen statistics showing rising credit card delinquencies. So we're already seeing this stress impact an average family's ability to pay for their day-to-day expenses.

“And these consumers have already spent down a large part of their excess savings that accumulated during the pandemic.”

Bottom line: “Because of inflation, lower-income families are struggling to make ends meet. As a result, retailers that cater to these consumers are in trouble,” says Zach.

“Meanwhile, retailers that cater to more affluent consumers are doing just fine, because these customers aren’t suffering financially,” he says. “So make sure you’re investing accordingly.”

![]() A Twisty Gold Saga in Dent’s Run, Pennsylvania

A Twisty Gold Saga in Dent’s Run, Pennsylvania

A father-son duo sued for documents that might prove the FBI searched for — and recovered — a cache of gold in 2018.

A father-son duo sued for documents that might prove the FBI searched for — and recovered — a cache of gold in 2018.

Dennis and Kem Parada of Finders Keepers LLC appealed on the basis of the Right-to-Know Law, requesting records from the Department of Conservation and Natural Resources about an FBI dig on state-owned land in the Dent’s Run area of Pennsylvania.

On March 13, 2018, Finders Keepers led the FBI to the area where they believed an 1863 shipment of Union gold on its way to the U.S. Mint in Philadelphia was lost or stolen.

The Paradas were instructed to stay in their car for much of the FBI’s excavation of the site. When they were allowed to return, all they found was a gaping hole. For his part, Dennis Parada says: “I gotta find out what happened to all that gold.”

With allegedly seven–nine tons of gold at stake, including a healthy finder’s fee for the Paradas, the AP says: “That much gold would be worth hundreds of millions of dollars today — and, assuming it was there, would almost certainly touch off a legal fight over how to divvy up the spoils.”

Last year, the feds neither confirmed nor denied the existence of the Dent’s Run gold. In addition, the FBI claimed there weren’t any records to turn over.

Last year, the feds neither confirmed nor denied the existence of the Dent’s Run gold. In addition, the FBI claimed there weren’t any records to turn over.

But after the DOJ applied some pressure, the FBI admitted, yes, there were records, including 17 video files of the excavation, but they would feel more comfortable doling out the records in dribs and drabs… over several years.

This year, however, the FBI is unequivocal: “No gold or other items of evidence were located or collected. The only items the FBI removed from the site were the equipment and supplies brought in for the dig.”

Still, “the Paradas are waiting for a judge to decide whether the FBI has to provide more information,” The Wall Street Journal says.

“The FBI insists they found nothing, but they have gone out of their way not to produce any documents that show that they found nothing,” says Finders Keepers’ lawyer Anne Weismann. “The thing about this case is stuff just doesn’t add up.”

A lotta twists and turns in this gold saga… We’ll keep you posted.

![]() The Three Rules of Real Estate

The Three Rules of Real Estate

“It’s wild to think that a trailer could ever sell for that much money,” says Montauk, New York, resident Dave Rutkowski.

“It’s wild to think that a trailer could ever sell for that much money,” says Montauk, New York, resident Dave Rutkowski.

Indeed, a “notoriously expensive Hamptons mobile home complex has yet another multimillion-dollar listing up for sale,” says The New York Post.

“Within the confines of the once-modest Montauk Shores, this unassuming three-bedroom abode is freshly for sale and looking for someone with $3.6 million to spend…

Martha Greene Real Estate LLC

“Investors and deep-pocketed surfers alike have taken notice of the 199-home community’s prime proximity to the beach in recent years, during the course of which property values have risen exponentially.

“In the past 12 months, Montauk Shores residences with headline-making prices have included a single-wide trailer seeking $1.1 million, an 800-square-foot off-market number that sold for a record $3.75 million and then a 2,150-square-foot property, which stands to shatter that if it gets the $4.4 million it’s seeking,” The New York Post recounts.

Location, location, location…

We’ll be back with another episode of the 5 Bullets on Monday. In the meantime, check out Saturday’s issue… Have a great weekend!

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets