Maxed Credit Card. Now What?

- Conundrum: Weak data, strong growth

- It’ll be a blue Christmas

- Financial cancellation (by any other name)

- London’s ESG nonsense and insensibility

- Do you want BBQ sauce with that?

![]() Conundrum: Weak Data, Strong Growth

Conundrum: Weak Data, Strong Growth

“I don’t buy into the Wall Street ‘Goldilocks’ or ‘soft landing’ scenarios,” Paradigm’s macro expert Jim Rickards contends.

“I don’t buy into the Wall Street ‘Goldilocks’ or ‘soft landing’ scenarios,” Paradigm’s macro expert Jim Rickards contends.

In fact, there are so many strikes against these conclusions, including:

- “Inverted yield curves (a bet on much lower interest rates)

- Negative swap spreads (indication of bank balance-sheet constraints)

- Tightening credit standards

- Reduced commercial lending

- Distress in commercial real estate (CRE)

- Declining industrial output

- Contracting world trade

- Trade disruptions (from the Ukraine war)

- Bubble-type valuations on the stock market.”

Plus, “many more” red flags — the list could go on and on.

“So where’s the recession?” Jim asks. “There isn’t one… right now.

“So where’s the recession?” Jim asks. “There isn’t one… right now.

“GDP growth in the second quarter of 2023 is a revised 2.1%,” he says. “That’s not stellar, but it’s in line with the 2.2% we averaged during the long, weak recovery of 2009–2019.

“The Atlanta Fed projects growth for the third quarter of 2023 of 5.9%. That’s off the charts and similar to the kind of growth we saw from 1983–1986 during the Ronald Reagan recovery.”

All to say, by one of the most common definitions of a recession — “two quarters of negative growth” — we’re technically not there yet.

[Nevertheless, citing James Poterba, president of the recession-calling body, the National Bureau of Economic Research (NBER), the definition of recession is more squishy than that. “A recession is a period of broadly dispersed decline in economic activity that lasts for a protracted period and is of substantial depth,” he says. “So it’s depth, diffusion and duration — the three Ds.”]

“Still, facts are facts,” Jim notes. “How do we reconcile recession warning signs with hard data showing strong growth?”

Well, one key driver behind the economy’s “strong growth” narrative simply isn’t sustainable.

Among American households, credit card debt rose to a record high during the second quarter this year.

Among American households, credit card debt rose to a record high during the second quarter this year.

Flabbergasted? Yeah, we didn’t think so.

Since the pre-pandemic days of 2019, Americans have opened 70 million new credit card accounts. (Meaning, per U.S. Census Bureau data from 2021, more than half of all U.S. households opened a new credit card in the past four years.)

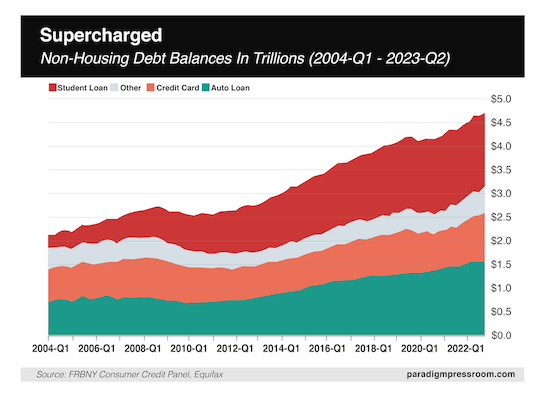

According to the New York Fed’s Liberty Street Economics blog: “Credit card balances saw the largest increase of all debt types — $45 billion — and now stand at $1.03 trillion, surpassing $1 trillion in nominal terms for the first time.”

“After a sharp contraction in the first year of the pandemic, credit card balances have seen seven quarters of year-over-year growth. The second quarter of 2023 saw a brisk 16.2% increase from the previous year, continuing this strong trend.”

Yet in another sense, it’s an alarmingly weak trend. But that’s not the way out-of-touch New York Fed economists see things: “American consumers have so far withstood the economic difficulties of the pandemic and post-pandemic periods with resilience.”

Well…

“These are not just expenditures, they’re balances,” Jim emphasizes,“meaning consumers spent the money but can’t pay off the balance.”

“These are not just expenditures, they’re balances,” Jim emphasizes,“meaning consumers spent the money but can’t pay off the balance.”

To Jim’s way of thinking, this situation creates three problems: “The first is when you use up your credit line, there’s no more left,” he says. “Spending can come to a screeching halt.”

Second, per LendingTree’s monthly survey, “the average credit card interest rate in America today is 24.37%.” So Jim wonders, “If you can’t afford to pay down principal, how on Earth do you pay principal plus almost 25% interest?”

And as it happens, the N.Y. Fed bloggers propose another household-budget monkey wrench as we move into the final months of 2023. “Rising [credit card] balances may present challenges for some borrowers, and the resumption of student loan payments this fall may add additional financial strain for many student loan borrowers.”

Which leads to Jim’s third point: “When debtors walk away and just default on their credit card,” he adds, “that’s when bank earnings and stock valuations get whacked. Banks respond by tightening credit further.”

Jim’s conclusion today? “Yes, growth is high at present, but there’s good reason to believe the drivers of growth are rapidly hitting the end of the line. Many economic analysts — myself included — have pointedly and consistently warned about an economic recession, which could be severe.

“Goldilocks is a nice fairy tale,” he says, “but it’s not a good description of the economy today.”

![]() It’ll Be a Blue Christmas

It’ll Be a Blue Christmas

“As we start looking forward to the holiday season, this year is shaping up to be a challenging one for retailers, thanks to three key factors I'm watching carefully,” says our income-investing ace Zach Scheidt.

“As we start looking forward to the holiday season, this year is shaping up to be a challenging one for retailers, thanks to three key factors I'm watching carefully,” says our income-investing ace Zach Scheidt.

“First, consumers are prioritizing experiences over tangible goods. This is a trend left over from the pandemic,” he notes. “After buying lots of ‘stuff’ while cooped up, consumers are now more interested in paying for experiences like trips, attractions or even dining out.

“A second concern is the resumption of student debt payments” (see above) — “this could take a major bite out of discretionary spending this fall,” says Zach. “Unless a new reprieve is granted, student loan payments will resume in October, affecting nearly 44 million Americans.

“These borrowers collectively owe more than $1.6 trillion” — see chart above — “so this will certainly cause a drag on household budgets and sentiment as families worry about these long-term liabilities.

“Finally, we're seeing a pickup in credit card delinquency rates. And this is a major concern for both retailers and the financial institutions that issue these revolving loans.”

Zach adds: “The stock market tends to look ahead… As traders see key themes emerging, they place bets ahead of the headlines. The best way I know to do this is to buy in-the-money put contracts on key retail stocks before the companies announce weak holiday spending,” he says.

“I've got my eye on a few vulnerable stocks and will likely set up some new aggressive trades over the next few weeks.” We’ll keep you posted…

Scanning the market today, the tech-heavy Nasdaq is performing best, up 0.60% to 14,030. At the same time, the Dow and S&P 500 are up 0.10% and 0.40% respectively.

As for commodities, crude’s up about 0.15% to $81.30 for a barrel of West Texas Intermediate. It’s a precious metals mixed bag, however: Gold is up 0.30% to $1,943.40, according to Kitco, while silver is down, but still hanging tough above $25.

Finally, we report on the crypto market — Bitcoin ($27,160) and Ethereum ($1,700) are both getting hammered, down about 2%.

![]() Financial Cancellation (By Any Other Name)

Financial Cancellation (By Any Other Name)

“Operation Chokepoint” targeted controversial businesses… “Operation Chokepoint 2.0” targeted crypto… Herecomes “Operation Chokepoint 3.0.”

“Operation Chokepoint” targeted controversial businesses… “Operation Chokepoint 2.0” targeted crypto… Herecomes “Operation Chokepoint 3.0.”

We at The 5 (Bullets) first highlighted the “diabolical” dangers of the original Obama-era operation in 2014 by which the feds impeded legal businesses — regardless of their moral standing — weaponizing banks and payment services against them.

Former Attorney General Eric Holder: The decider in “Operation Chokepoint”

Former Attorney General Eric Holder: The decider in “Operation Chokepoint”

Then, in February this year, Paradigm editor Chris Campbell noted Team Biden ramping up what Chris called “Operation Chokepoint 2.0,” using a “litany of federal agencies” to take aim at crypto — “all designed to stifle the crypto space and starve it of banking access,” according to pundit Nic Carter.

“Now, it seems, we're witnessing a 3.0 version,” says Chris, “one that's even harder to pin down. And this time, the crosshairs are focused on… precious metals?”

“Now, it seems, we're witnessing a 3.0 version,” says Chris, “one that's even harder to pin down. And this time, the crosshairs are focused on… precious metals?”

In Chris’ home state of Ohio, for instance, a regional bank canceled a coin dealer’s six bank accounts and credit cards. “The bank even went so far as to close his wife’s and kid’s accounts, too,” says Chris.

Courtesy: YouTube

Courtesy: YouTube

Bank cancels this criminal mastermind

“I don’t think the banks like this type of business,” the coin dealer says. “I don’t know what they think we’re doing here because everything's 100% legitimate.” The dealer also mentions the same bank closed the accounts of other coin dealers he knows.

“But why?” Chris asks. “Are banks targeting gold and silver shops specifically… or are they going after cash-based businesses, which gold and silver shops tend to be?

“It’s true, these days banks are more hesitant to regularly accept large amounts of cash. Plus, shops dealing in cash are riskier: They need extra insurance, there are costs of depositing and security issues.

“Of course, there’s also the ongoing trend that specific people — from Canadian truckers to Nigel Farage — have been blacklisted from financial services.

“Speculation is rife,” Chris says, but the issues sit squarely in Paradigm’s wheelhouse (the war on cash, precious metals manipulation and, most recently, financial cancellation).

“Whatever the case, the lines between responsible governance, prudent oversight and downright meddling have never been more smudged,” Chris concludes. “Will this sequel, if it emerges, be another act of financial-chokeholds-as-policy tool?”

It, he says, is “a tale worth tracking closely.”

![]() London’s ESG Nonsense and Insensibility

London’s ESG Nonsense and Insensibility

Incensed Londoners are targeting traffic cameras after new ESG legislation levies fines against drivers of older vehicles.

Incensed Londoners are targeting traffic cameras after new ESG legislation levies fines against drivers of older vehicles.

This week, sweeping “Ultra Low Emissions Zone” rules went into effect in the U.K.'s capital city.

“London's plan, known as the ULEZ, levies a 12.50 pound (about $16) daily charge on most gas cars and vans built before 2006 and on pre-2015 diesel vehicles,” Associated Press notes.

“Introduced in central London in 2019, it was expanded in 2021 to the city's inner suburbs. From Tuesday it covers all of Greater London, including the sprawling outer suburbs where more than half the city's 9 million people live.

“Critics say it's a cash grab that will penalize suburban residents who depend on their cars for work and essential travel,”AP says.

Protest organizer Nick Arlett adds: “The cameras are going to keep coming down. People are angry.”

Protest organizer Nick Arlett adds: “The cameras are going to keep coming down. People are angry.”

Besides the obvious, why the animus against traffic cams?

The cameras in question “work by scanning your vehicle's number plate and checking if it is compliant or not within the low emission zone,” says the Hampstead & Highgate Express. Presumably, they track and/or levy fines as well.

“I have no money to pay the fines, I have no money to replace my car,” says Anna Austen who depends on her 15-year-old vehicle to shuttle her kids to school and herself to work.

“It’s going to make poor people poorer.”

Indeed, Ms. Austen… But you have something in common with a British author who shared your last name: Sense and Sensibility. Something sorely lacking among London’s political elites.

![]() Famous Last Words

Famous Last Words

“What’s the big whoop with a name like Big Wick’s?” says Texas Monthly. “Ask barbecue sauce manufacturer Wicker’s Food Products (WFP), headquartered in Hornersville, Missouri, and founded in 1947.”

“What’s the big whoop with a name like Big Wick’s?” says Texas Monthly. “Ask barbecue sauce manufacturer Wicker’s Food Products (WFP), headquartered in Hornersville, Missouri, and founded in 1947.”

In January, the company filed a lawsuit against Texas couple Wes and Sarah Wicker who sell “a mesquite-smoked jalapeno glaze under the brand name Big Wick’s.”

This isn’t the first time we’ve covered branding wars in the state of Texas; in 2018, it was a logo showdown between Buc-ee’s convenience stores and Choke Canyon BBQ…

One of these things is NOT like the other… Buc-ee’s prevailed

One of these things is NOT like the other… Buc-ee’s prevailed

In the current branding litigation: “WFP is demanding a name change and seeking all profits the Wickers have made on their product, plus attorney’s fees and compensation for damages from ‘immediate and irreparable harm and injury to Plaintiff, and to its goodwill and reputation.’”

Sheesh.

The kicker? In 2019, a WFP employee assured the Wicks: “We aren’t going to sue you over it or anything, so don’t worry about that.”

Heh, I guess the Wicks of the Lone Star State should have adhered to Missouri’s state moniker: “Show me.”

Take care! We’ll be back with another round of 5 Bullets tomorrow…