The Truth About Gold IRAs

- Buyer beware (Gold IRAs)

- Inflation in retreat (but still elevated)

- Jeffrey Epstein, JPMorgan Chase… and jaw-dropping allegations

- Swept under the rug: SBF’s campaign contributions

- This bullet is brought to you by the letter X

![]() Buyer Beware (Gold IRAs)

Buyer Beware (Gold IRAs)

“I did a little bit of research, but evidently not enough,” says Ed DeSanto. “When I found the invoice, it was a big shock.”

“I did a little bit of research, but evidently not enough,” says Ed DeSanto. “When I found the invoice, it was a big shock.”

DeSanto is 65, described by The Washington Post as “a semi-retired Florida medical coder and an avid right-wing radio fan.”

In 2019, he responded to an ad from an outfit called American Hartford Gold Group. “If you listen to those radio shows,” he says, “they play those commercials all the time.” He took a $100,000 lump-sum payout from his pension and sank it into a gold IRA from Hartford.

As the paper reports, “DeSanto’s $100,000 investment netted him just $53,000 worth of gold and silver, according to a Post analysis of his invoices — meaning the coins had been marked up 92% over the value of the metal. DeSanto blames himself.”

Our Bullet No. 1 today is part public service announcement, part cautionary tale.

Our Bullet No. 1 today is part public service announcement, part cautionary tale.

DeSanto’s ill fortune is an extreme example that turns up in a lengthy Washington Post expose of the “gold IRA” industry that advertises extensively in conservative media.

The journalism here is pretty solid — even if, of course, it’s laced with an attitude of Look how easily these gullible MAGA blue-hairs can get rooked!

Most of the contempt, however, is directed where it belongs — at the skeevy operators (and their celebrity endorsers) who may or may not be running afoul of the law, but who without a doubt are “ethically challenged.”

“Over the past decade,” says the article, “more than 30 customers in 20 states have sued a dozen gold IRA companies… Federal regulators have sued four companies — two in the past year alone — claiming investors were systematically charged as much as triple the coins’ value.

“None of the cases has gone to trial; some are still pending. Of those that have been resolved, most have settled or been sent to arbitration, where outcomes are not made public. The companies have not admitted wrongdoing in any of the cases and say their customers have been adequately informed of the details of their purchases.”

What seems to be going on here is a new variation on an old trick.

What seems to be going on here is a new variation on an old trick.

More than a decade ago, when Glenn Beck was still in the Fox News stable, he’d rant for a few minutes about the state of the economy, beautifully teeing up the commercial that followed from a company called Goldline International.

I remember reading about Goldline’s schtick at the time and I was appalled. California prosecutors described it like this: You’d call the number, thinking you were going to buy plain-old bullion coins at a teensy premium over their metal value. But the salesperson on the other end of the line would give you a song-and-dance about how “Well, you know, bullion coins could easily be confiscated by the government, and you don’t want that to happen, now, do you?”

From there the customer was steered into more costly collector coins — which, because the IRS classifies them as collectibles, presumably would not be subject to confiscation.

For this bait-and-switch, Goldline paid $4.5 million to settle the charges without admitting wrongdoing.

Fast-forward to the present: The weird new trick strikes me as even more sordid.

Fast-forward to the present: The weird new trick strikes me as even more sordid.

It seems customers are steered into “bespoke” bullion coins minted exclusively for the companies that sell them. They have minimal value beyond the metal content, but they’re frequently sold to the customer for commissions of 33% or higher.

This arrangement is even more lucrative for the dealers: Back then, at least they had to pay a premium themselves to acquire collector coins before marking them up further to sell retail. Now, once they’ve ponied up for minimal production costs, it’s pure profit. Just detestable.

Herewith, a consumer buyer’s guide if you want to pursue precious metals for an IRA (or, for that matter, outside an IRA)...

Herewith, a consumer buyer’s guide if you want to pursue precious metals for an IRA (or, for that matter, outside an IRA)...

- Before you go shopping, check the spot price of gold or silver that day. That’s the only way you’ll have a benchmark for whether you’re getting a good deal or not

- In general, stick to coins that come from a government mint, like U.S. Eagles, Canadian Maple Leafs and South African Krugerrands

- If you opt for generic bars or generic silver rounds anyway, make sure the dealer offers them for less than coins from a government mint. The marketplace puts a greater value on coins with a government imprimatur; rightly or wrongly, they’re perceived as more trustworthy

- As soon as anyone tells you that you can take possession of metal held inside an IRA, run like hell. To be clear, I’m not aware any of the dealers identified in the Post article make that promise. But just so there’s no doubt, any metal you hold inside a tax-advantaged retirement account must be held by the account’s custodian — unless you relish tangling with the IRS and paying a huge unexpected tax bill

- And just for the record, collectible coins cannot be held in an IRA at all. Goldline didn’t sell them for IRAs, but the Post story left that distinction unclear. And don’t mess around with collectibles in the first place until you’ve got your bullion stash. (For years, our Jim Rickards has recommended a 10% gold bullion allocation in your portfolio.)

This is only a thumbnail sketch. Our friends at Hard Assets Alliance have put together a more comprehensive guide called The Three Most Common Gold IRA Traps and How to Avoid Them.

Hard Assets Alliance is Paradigm Press’ preferred metals dealer. We knew the principals even before they opened up shop in 2012. And once they proved they could do right by our customers, our firm took the next step and acquired a stake in Hard Assets Alliance in 2018.

As such — in the interest of full disclosure — Paradigm will collect a small cut once you fund your account. But rest assured Hard Assets Alliance charges among the lowest premiums in the business. Shop around and see for yourself. Then check out Hard Assets Alliance and get started with your gold IRA.

[Of course, they can also help you out if you want to hold metal outside an IRA.]

![]() Inflation in Retreat (but Still Elevated)

Inflation in Retreat (but Still Elevated)

The Federal Reserve’s preferred measure of inflation has retreated to its lowest level since October 2021.

The Federal Reserve’s preferred measure of inflation has retreated to its lowest level since October 2021.

“Core PCE,” as it’s known, had spent six months oscillating between 4.6–4.7%. The June reading, out this morning, has pulled back to 4.1%.

To be sure, that’s still far above the Fed’s 2% inflation target — but it’s finally moving in the right direction again.

[As always, with any official inflation figure, any resemblance to your own cost of living is purely coincidental.]

The Fed is looking for signs that it’s raised short-term interest rates high enough so that inflation will finally start coming down on its own — aka, the “terminal rate.” This number today is perhaps the first encouraging sign — and right on the heels of this week’s rate hike.

Also encouraging is the University of Michigan’s consumer sentiment survey. We couldn’t care less about this report except for the fact the Fed pays close attention to part dealing with inflation expectations.

Here, survey respondents expect 3.4% inflation over the next year and 3.0% over the next five years. Those numbers are also above the 2% target, but the Fed’s main concern is that the numbers don’t rise — and they’re not. In Fed-speak, inflation expectations are “well anchored.” That too is another sign that the Fed has reached its terminal rate.

Still, much can change between now and the Fed’s next decision on interest rates — which doesn’t come till Sept. 20.

Meanwhile, the U.S. stock market is rebounding after registering late-day losses yesterday.

Meanwhile, the U.S. stock market is rebounding after registering late-day losses yesterday.

The S&P 500 is up nearly 1% to 4,578 — once again, a level last seen in early April of last year. The Dow’s gains are weaker — about a half percent to 35,460. The Nasdaq’s gains are stronger — up 1.6% to 14,281.

Precious metals are trying to climb up off the mat after yesterday’s takedown. Gold has recovered to $1,957, silver to $24.24. For the moment, crude has inched back below $80.

Try as it might, Bitcoin just can’t get back above $30,000. For the moment, anyway, it’s not moving in tandem with soaring tech shares the way it used to.

Try as it might, Bitcoin just can’t get back above $30,000. For the moment, anyway, it’s not moving in tandem with soaring tech shares the way it used to.

“I’m not ready to bury crypto just yet,” Paradigm chart hound Greg Guenthner wrote earlier this week. “But I do think it’s approaching its last chance to wake up and participate in the broad market rally. If we don’t see a big rip soon, those June lows near $25K [Bitcoin] are in play.”

![]() Jeffrey Epstein, JPMorgan Chase… and Jaw-Dropping Allegations

Jeffrey Epstein, JPMorgan Chase… and Jaw-Dropping Allegations

Court papers filed this week allege that JPMorgan Chase “actively participated in [Jeffrey] Epstein’s sex-trafficking venture from 2006 until 2019.”

Court papers filed this week allege that JPMorgan Chase “actively participated in [Jeffrey] Epstein’s sex-trafficking venture from 2006 until 2019.”

OK, we’ll give you a moment to catch your breath there. Cynic that I am, even I was caught off guard.

Then we need to back up for a moment: Last month, we told you how JPM settled out of court with Epstein’s accusers for $290 million. The accusers’ suit claimed that JPM routinely looked the other way when it came to Epstein’s ongoing sexual predation because he kept bringing in a slew of new wealthy clients.

So… there’s still another outstanding civil suit against JPM pertaining to Epstein, this one filed by the government of the U.S. Virgin Islands. It’s set to go to trial in October.

“The U.S. Virgin Islands filed hundreds of pages of new court documents on Monday and Tuesday,” report Pam Martens and Russ Martens at Wall Street On Parade.

One of those documents asks the court for summary judgment — as in an instant ruling without a full trial — and states “there is no genuine dispute that JPMorgan actively participated in Epstein’s sex-trafficking venture from 2006 until 2019.”

Thorough as the Martenses are with their reporting, they neglect to note that JPM supposedly dumped Epstein as a client in 2013. But now we’re told the bank continued to “actively participate” in his sex trafficking right up until the year he died in custody?

As the kids spell it these days, “Woah.”

Oh, but there’s more in these documents — like the huge wads of physical cash changing hands.

Oh, but there’s more in these documents — like the huge wads of physical cash changing hands.

As the Martenses write, “The U.S. Virgin Islands’ attorneys cite… internal emails at JPMorgan Chase showing that employees at the bank were aware of Epstein’s ‘[c]ash withdrawals… made in amounts for $40,000–80,000 several times a month’ while also being aware that Epstein paid his underage sexual assault victims in cash.”

Hmmm… As you might be aware, federal law requires banks to report all cash transactions over $10,000 to the U.S. Treasury.

Up until 2019, the IRS had a nasty habit of seizing the bank accounts of small-business owners the agency accused of “structuring” cash deposits to get around the $10K reporting requirement. Among the people targeted were a dairy farmer in Maryland, a restaurant owner in Iowa and a convenience store owner in North Carolina.

But to paraphrase the late George Carlin… it’s a big club, and small-business owners ain’t in it.

Epstein clearly was. According to the Virgin Islands’ attorneys, “Between September 2003 and November 2013, or approximately 10 years, JPMorgan handled more than $5 million in outgoing cash transactions for Epstein — ignoring its own policy discouraging large cash withdrawals….”

What’s more, the papers allege JPM also handled the bank accounts of “all the girls and women publicly alleged in 2006 to be recruiters, accomplices or victims.” Well, that’s one way to ensure the transfers of hush money from Epstein’s account would be as seamless as possible.

“It is becoming critically important,” the Martenses writes, “that the U.S. Virgin Islands actually bring its case to trial in a public courtroom and not fold like another cheap suit by accepting a pile of tainted money from JPMorgan Chase.”

We shall see: The trial is set to begin Monday, Oct. 23.

![]() Swept Under the Rug: SBF’s Campaign Contributions

Swept Under the Rug: SBF’s Campaign Contributions

It’s a helluva week when Sam Bankman-Fried makes two appearances in this e-letter.

It’s a helluva week when Sam Bankman-Fried makes two appearances in this e-letter.

Alas, this latest development isn’t nearly as funny as SBF’s plans to buy an island in the South Pacific where he and his fellow “effective altruists” would ride out the end of civilization.

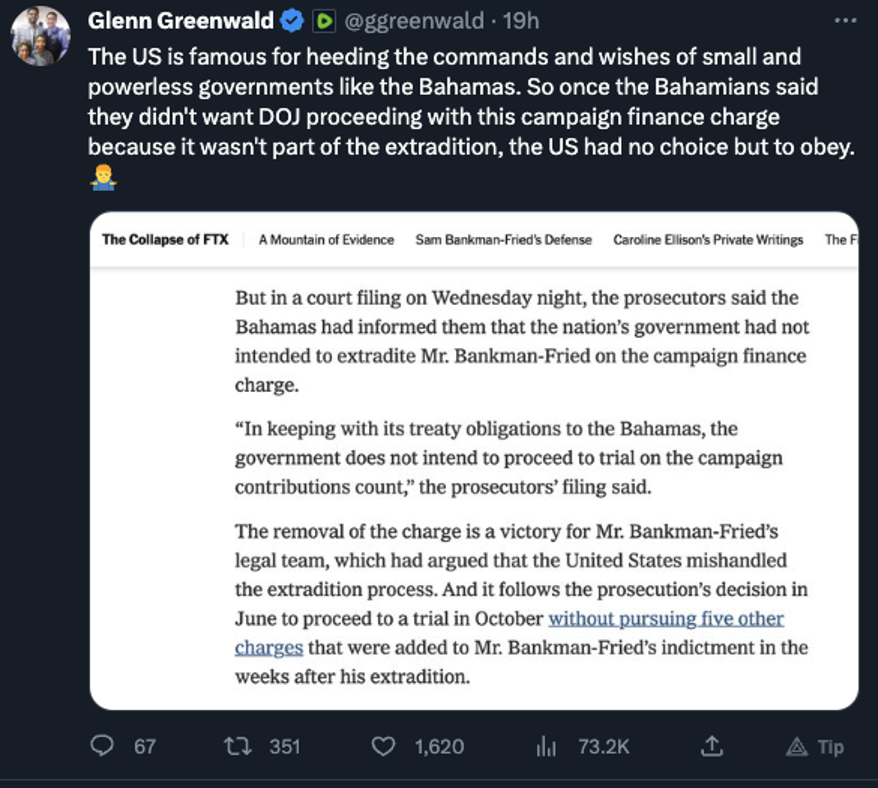

Federal prosecutors have dropped a charge they tacked onto his case in February — the one accusing SBF of skirting the limits on federal campaign contributions by reporting some of those contributions “in the name of another person.”

The feds justify this move on the theory that the government of the Bahamas never agreed to this charge when it approved SBF’s extradition.

Yeah, pull the other one…

Here’s the thing: Remember how the vast majority of the $40 million in contributions he made during the 2022 campaign cycle went to Democrats?

Well, last November — when he was still in the Bahamas hiding from the law — he made a fascinating claim in a YouTube interview.

“All my Republican donations were dark,” he said. “The reason was not for regulatory reasons. It’s ’cause reporters freak the f*** out if you donate to Republicans — they’re all super liberal.”

Now, none of the shady stuff will come to light — whether it was intended for Ds or Rs. Amazing how that works, isn’t it?

SBF goes to trial on the original fraud charges Monday, Oct. 2. October is setting up to be an interesting month for trials in the financial world…

![]() This Bullet Is Brought to You by the Letter X

This Bullet Is Brought to You by the Letter X

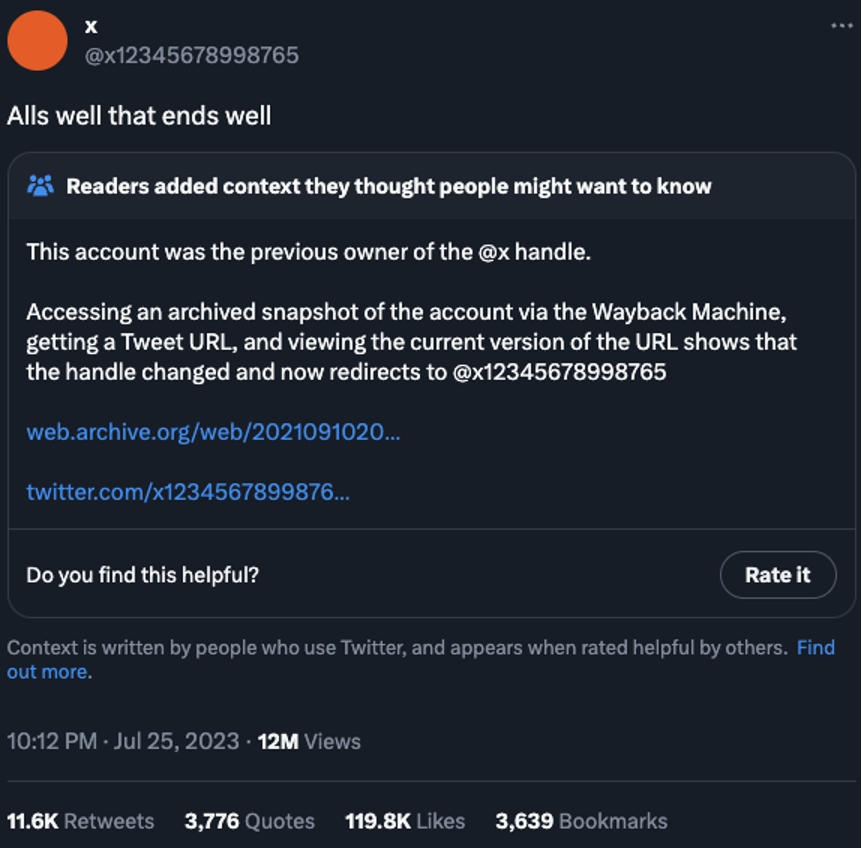

We haven’t had much to say this week about Twitter’s bizarro rebrand as “X”... but ya gotta feel for Mr. Gene X. Hwang of San Francisco.

We haven’t had much to say this week about Twitter’s bizarro rebrand as “X”... but ya gotta feel for Mr. Gene X. Hwang of San Francisco.

Hwang, a professional photographer, got himself a Twitter account in 2007 — about a year after the platform’s launch. At that point, no one had yet claimed the handle @x — so Hwang took it for himself.

Fast-forward 16 years and Hwang reads the news about the rebrand. He figures his handle’s days are numbered.

Indeed, he was put on notice Tuesday morning, only hours before the rebrand was made official: "[I] got an email basically saying they are taking it," he tells the Mashable website.

No outreach from Elon Musk, no compensation, no nothing.

“Musk's company is within its right to take the username,” Mashable points out. “Barring trademark issues, users don't have rights to specific handles according to most social media companies' terms of service.”

For the time being, Hwang tweets from a username the company generated for him…

He says he might switch to something a little less cumbersome — well, assuming it’s not already taken.

OK, one more hot take on the rebrand…

OK, one more hot take on the rebrand…

Heh…

Have a good weekend,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets