A Tie Vote for President

![]() If the Presidential Election Is TIED (More Likely Than You Think)

If the Presidential Election Is TIED (More Likely Than You Think)

We’re already thinking beyond the stupid debate tonight. Ponder this possibility — a tie vote in the Electoral College.

We’re already thinking beyond the stupid debate tonight. Ponder this possibility — a tie vote in the Electoral College.

It can happen — 269-269, neither candidate reaching the 270 threshold.

It very nearly happened in 2020. As we mentioned shortly after Election Day, the race came down to fewer than 43,000 total votes in Arizona, Georgia and Wisconsin.

Trump victories in those three states would have resulted in an Electoral College tie — sending the vote to the House of Representatives for the first time since 1824.

We’ll let that thought sink in for a moment — because here’s something even more mind-bending.

We’ll let that thought sink in for a moment — because here’s something even more mind-bending.

When the vote goes to the House, the members do not vote individually. They vote as state delegations.

So think about a 2020 tie scenario. As you’ll recall, Democrats retained control of the House and Nancy Pelosi kept her title of speaker. But when it came to the 50 state delegations, Republicans had a razor-thin edge of 26. Trump would have won a second term.

Such an outcome is easily within the realm of possibility this year.

Such an outcome is easily within the realm of possibility this year.

“Imagine, for example, that (among battleground states) Harris wins NV, AZ and GA while Trump wins PA and MI. Poof! We’re tied at 269 to 269,” demographer Neil Howe writes at his Substack site.

So then the House would vote state by state: “Trump would be heavily favored to win such a vote,” Howe writes, “unless the Democrats enjoy a tidal victory in the House elections (which by assumption would be unlikely, since in that case Harris would have won in the Electoral College).”

Of course, getting from here to there would be some mighty rough sledding. In states where the popular vote is close, the final tallies would probably be contested right up until the Electoral College meets on Dec. 17. And control of the 50 House delegations might still be up for grabs when they count the electoral votes on Jan. 6.

Who would be making decisions in the White House after Jan. 20?

Market volatility much?

Then again, it’s an open question who’s making decisions in the White House now — and the S&P 500 is still within 3.2% of its all-time highs. Just sayin’...

In any event, if you subscribe to a Jim Rickards publication, you won’t want to miss his post-debate hot takes tomorrow. We’ll be posting an exclusive discussion with Jim on the Paradigm Press YouTube channel. We encourage you to subscribe to the channel at this link — we’ll send you an email notice as soon as the interview is up.

[And if you don’t subscribe to a Jim Rickards publication, you might want to sit this one out; I have a feeling it might skew more polemical than financial…]

![]() You Gotta Be Kidding (Inflation)

You Gotta Be Kidding (Inflation)

Ahead of the release of the official inflation numbers tomorrow, elite media are already taking a victory lap on behalf of the Federal Reserve.

Ahead of the release of the official inflation numbers tomorrow, elite media are already taking a victory lap on behalf of the Federal Reserve.

“It’s hard for investors to adjust to the notion that inflation could soon undershoot the Federal Reserve's 2% target. But they should,“ writes Reuters business columnist Jamie McGeever.

“Warning signs are flashing that the biggest risk for markets and policymakers is not ‘higher for longer’ inflation, but the virtual disappearance of price pressures.

“Falling short-term average inflation metrics, slumping commodities prices, a softening labor market and cooling wage pressures are all pointing one way: disinflation.”

To be clear, disinflation means prices are still rising — just not as fast as before.

Going by the official numbers, the gallop of 9% inflation in mid-2022 has slowed to a 2.9% trot now. The consensus of Wall Street economists says the August number due for release tomorrow will ring in at 2.6% — clearing the way for the Fed to cut short-term interest rates next week.

But make no mistake: The historical evidence suggests we’re not headed back to sustained sub-2% inflation — the kind we experienced during the 2010s — anytime soon.

But make no mistake: The historical evidence suggests we’re not headed back to sustained sub-2% inflation — the kind we experienced during the 2010s — anytime soon.

Yes, the “disinflationary” trend might continue for a while. Paradigm’s Jim Rickards says we might even tip into deflation — where prices actually fall — by late 2025.

But it won’t last. As we’ve been saying for over a year now, once inflation sails beyond a certain threshold, it takes an average 10 years to get back to “normal” 2% levels.

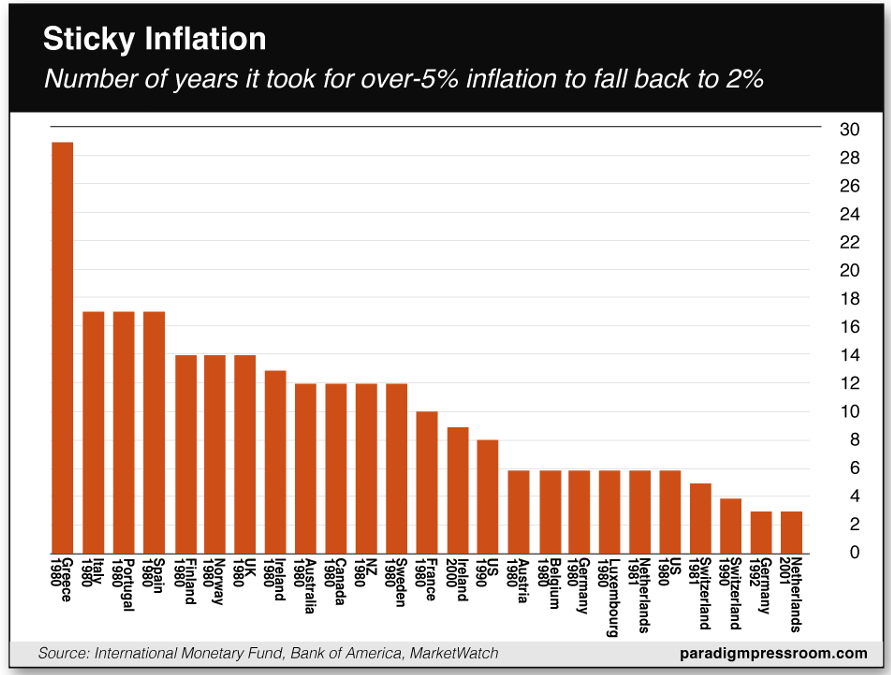

Burn this chart into your brain (and click to enlarge): It’s two dozen inflationary episodes in developed economies going back over 40 years.

You’ll notice there are two inflationary episodes from the United States in there: It took six years to get the inflation of the early 1980s back under control… and eight years for the more mild inflation of the early ’90s to return to 2%.

If history is any guide, we won’t be back to 2% inflation until at least 2028 and probably later. Got gold?

![]() Oil Manipulations… But What’s the Aim?

Oil Manipulations… But What’s the Aim?

The big mover in the markets today is oil — down nearly 4% and in danger of cracking below $66.

The big mover in the markets today is oil — down nearly 4% and in danger of cracking below $66.

A barrel of West Texas Intermediate hasn’t been this cheap since May of last year. There’s no obvious news catalyst we can see.

It’s at this moment we’ll remind you that crude has been a thoroughly manipulated market since the time that modern-day oil futures began trading in 1983 — a process described by the oil-industry journalist Jim Norman in his 2008 book The Oil Card.

"The price of oil is now less dependent on the actual supply and demand for 'wet' barrels than on the huge sums of money pouring into NYMEX futures from the pension and other investment funds, tacitly enabled and encouraged by U.S. regulators,” Norman wrote. “Daily oil volumes on the NYMEX now dwarf global physical oil consumption."

As Norman documents, it’s frequently people in Washington pulling the strings for geopolitical ends — costlier oil to stick it to China, cheaper oil to stick it to Russia (and before that, the Soviet Union).

We see internet chatter suggesting that this time it’s domestic political considerations at work — i.e., to keep a lid on gasoline prices before the election. But the evidence, such as it is, is unconvincing…

Elsewhere the markets are mostly quiet while the release of the inflation numbers loom in less than 24 hours.

Elsewhere the markets are mostly quiet while the release of the inflation numbers loom in less than 24 hours.

At last check, none of the major U.S. stock indexes has moved more than a third of a percent. Gold continues to hover just over $2,500; silver is comfortably over $28. Bitcoin is back within sight of $57,000.

Most of the big bank stocks are deep in the red despite the banks getting yet another special favor from the Federal Reserve: The Fed “has cut a proposed increase to capital requirements for the largest U.S. banks by more than half after a backlash from the industry and politicians,” says the Financial Times.

Something to remember the next time the banks start racking up huge losses 2008 style — and they will, one of these days…

![]() The Elephant In the Small Business

The Elephant In the Small Business

There’s a political subtext to the main economic number of the day that no one other than this e-letter seems willing to broach.

There’s a political subtext to the main economic number of the day that no one other than this e-letter seems willing to broach.

The National Federation of Independent Business is out with its monthly Small Business Optimism Index. At 91.2, the headline number tumbled 2.5 points in August — wiping out all of July’s unusually big gain.

“The mood on Main Street worsened in August, despite last month’s gains,” says NFIB Chief Economist Bill Dunkelberg. “Historically high inflation remains the top issue for owners as sales expectations plummet and cost pressures increase. Uncertainty among small-business owners continues to rise as expectations for future business conditions worsen.”

All of which is surely true. But we saw this drop coming — for reasons Mr. Dunkelberg does not mention.

All of which is surely true. But we saw this drop coming — for reasons Mr. Dunkelberg does not mention.

As we said a month ago, the NFIB’s membership tends to lean Republican. The big jump in July coincided with a vibe at the time that Donald Trump would coast to reelection over Joe Biden. (Remember that?) The vibe was surely different a month later.

If it’s more useful data you’re looking for, there’s a portion of the survey in which respondents describe their profit picture.

It’s terrible — worse than COVID now, though not worse than the aftermath of the 2008 financial crisis.

There’s also the part of the survey where respondents identify their single most important problem. Inflation remains in the lead, cited by 24%. But “quality of labor” is close behind at 21%. The labor shortage might be easing, but good help is still hard to find.

Taxes are in third place, cited by 13%. Everything else is in single digits.

![]() Mailbag: Goodbye

Mailbag: Goodbye

“It is easy to take facts out of context to paint whatever negative picture fits your bias,” writes an aggrieved reader after yesterday’s Bullet No. 2.

“It is easy to take facts out of context to paint whatever negative picture fits your bias,” writes an aggrieved reader after yesterday’s Bullet No. 2.

“Antoni quotes the Bureau of Labor Statistics on the hiring of 700,000 health care workers and you refer to this segment along with government employment as ‘the least productive and most parasitic corners of the economy.’

“Let’s put this into context: During the same period of time 200,000 health care workers quit their jobs. Of the 55 million Americans 65 and older 1.3 million live in nursing homes and 800,000 reside in assisted living (whose employees are included in health care statistics) and 4.1 million people will turn 65 years of age this year alone. It is at this time that health challenges become more acute and more doctor visits and hospital stays are required.

“If you were doing any research you would know that it has become harder to get an appointment to see a doctor. Even with these 700,000 new hires health care is understaffed, not overstaffed.

“You are not qualified to determine how many people are required to deliver responsive, attentive health care.

“I hope the next time you or a member of your family receive medical attention, especially life saving care you’ll remember to apologize for claiming this is ‘the least productive and most parasitic corner of the economy’.

“While it is true that some areas of government have ballooned to an unjustifiable size it is lubricious to claim all of government is among ‘the least productive and most parasitic corners of the economy’.

“I turned to Paradigm Press with the expectation that I would benefit from insightful monthly investment advice for a modest monthly fee. What I have been receiving is multiple daily sales pitches for ‘free’ tips that require additional subscriptions and obvious Republican political posturing.

“I’m done with you. CANCEL my subscription and take me off of your mailing list.”

Dave responds: Oh dear, where to begin…

In the first place… The figures are hard to pin down but the Perplexity AI engine suggests as many as 40% of U.S. “health care” jobs have nothing to do with delivering care to patients.

They’re paper-pusher jobs — processing claims, billing and coding, etc. They are, to use an indelicate term, “bull**** jobs” — administrative bloat that’s unique to America’s ruinously expensive crony-capitalist health care system.

So yes, the U.S. health care system is indeed a parasitic arrangement that, left unaddressed, will sooner or later bankrupt the federal government — and make it nearly impossible to get treatment for chronic diseases in the manner to which we’ve become accustomed.

To the extent that acute care is hard to come by these days… well, you might want to take that up with the legions of health care workers who walked away from their profession rather than submit to a federal mandate that they take a COVID jab that didn’t work as advertised — and for which they had no legal recourse if they had a bad reaction. (How many? Here, the figures are impossible to pin down because it’s not in anyone’s interest to quantify the phenomenon.)

As for the government itself… Uncle Sam’s annual budget has exploded from $4.45 trillion pre-COVID to $6.94 trillion now. That’s a staggering 56% increase.

Theoretically the dramatic jump starting in 2020 was intended to deal with COVID. But the budget keeps going up and up and up even though the pandemic is over. Amazing how that works, right? And you can’t chalk it up to the proverbial “waste, fraud and abuse.”

Which means we’re never going back to pre-pandemic “normal” federal spending levels under either Harris or Trump — and no one at ABC will see fit to bring up the subject tonight. We are so screwed…

Anyway, of course, we will comply with your wishes. Under ordinary circumstances I’d say we’re sorry to see you go — but in this case, not so much.