Addicted to China

- Is that a periodic table in your pocket?

- As good as it gets: Inflation

- One of the “highest-probability plays” of the summer

- The luckiest son-of-a-gun in Kentucky

- A new spin on “eat ze bugs”

![]() The Periodic Table Hits the Highway

The Periodic Table Hits the Highway

“You may recall from chemistry class... there are 118 elements in the periodic table,” says Paradigm’s Harvard-trained geologist and mining expert Byron King.

“You may recall from chemistry class... there are 118 elements in the periodic table,” says Paradigm’s Harvard-trained geologist and mining expert Byron King.

“Now, here’s the question: How many of those elements are in your smartphone, meaning your iPhone, Samsung or whatever else you carry?

“Think about it,” Byron urges.

“OK, try 63, according to a chemistry professor acquaintance at MIT who went to the trouble of figuring it all out.

“If your iPhone or Samsung has 63 elements in it, it’s fair to say that a modern EV is also right up there; likely, even more, when it’s all said and done.

“When we get into the critical materials of an EV, especially things like lithium and graphite, and certainly rare earths — for these items right now, the supply chains mostly pass through China…

“When we get into the critical materials of an EV, especially things like lithium and graphite, and certainly rare earths — for these items right now, the supply chains mostly pass through China…

- “For example, lithium is mined in Australia, Argentina, Africa and other places. But China has built out its lithium processing industry for over 20 years and today dominates the unavoidable end-stage level of lithium-ion production.” In fact, Byron estimates China controls 90% of the lithium-refining industry

- “Or consider graphite,” he says, “also essential to lithium-ion batteries. Again, well over two-thirds of global production comes out of China. And again, it’s a long story of China planning ahead, beginning in the 1990s. With a series of five-year plans, China focused industrial development on graphite, anticipating a global shift toward batteries and electrification

- “China built an entire rare earth elements (REE) ecosystem, from minerals and mines to end-use magnets. And today, depending on how you calculate things, China controls 80–90% of global REE output and about 95% of REEs critical to EV motors and lighting systems.”

Adding insult to injury, just days before Janet Yellen’s Beijing visit last week, China announced it would be restricting access to two critical metals.

Adding insult to injury, just days before Janet Yellen’s Beijing visit last week, China announced it would be restricting access to two critical metals.

Namely, starting in August, China will require a permit to purchase gallium (Ga) and germanium (Ge) — respectively, atomic numbers 31 and 32.

Not to be confused with the 17 rare earth elements, “germanium is a hard, grayish-white metalloid, which is defined as having properties of metals and non-metals, while gallium is a soft, silvery metal,” says MarketWatch.

“Both are produced as byproducts of some base-metals production such as zinc, and both are used in computer chips” — and what is an EV without computer chips? — “solar panels and… military applications.”

The Critical Raw Materials Alliance says China produces about 80% of the world’s gallium and 60% of the world’s germanium.

As for the geopolitical implications of China’s decision, Byron comments at MarketWatch: “This is no bouquet of flowers for Janet. The timing and symbolism could not be more clear to just about everybody in Asia, if not the rest of the world,” he says.

As for the geopolitical implications of China’s decision, Byron comments at MarketWatch: “This is no bouquet of flowers for Janet. The timing and symbolism could not be more clear to just about everybody in Asia, if not the rest of the world,” he says.

According to MarketWatch: “The move follows U.S. export restrictions on advanced semiconductors and chip-manufacturing equipment to China, which are aimed at preventing American technology from boosting China’s military power.”

Although it might appear China has the upper hand, Beijing’s action is “a high-risk/high-loss play,” says Sandeep Rao of Leverage Shares, providing “ample impetus to diversify away from reliance on Chinese production,” he says. India and Brazil, for instance, are “strong contenders for diversification targets.

“There should be enough supply in the near term,” Rao adds, “while manufacturers review the effects of these curbs, choose other materials or diversify away from China.”

Byron says: “The long and short is that China has a 30-year head start on the rest of the world in terms of built-out industrial capacity, in everything from mines to mills, processing, refining, smelting and end-products. Plus, China has entire armies of trained engineers in every field you can name.

Byron says: “The long and short is that China has a 30-year head start on the rest of the world in terms of built-out industrial capacity, in everything from mines to mills, processing, refining, smelting and end-products. Plus, China has entire armies of trained engineers in every field you can name.

“So can the West catch up?” he wonders. “Or put another way, will the West — and the auto industry in particular — find a way out of this quandary in supply chains?”

Byron, who recently attended the Critical Minerals Institute conference in Toronto, describes himself as hopeful. “We’re starting to see the beginning of new thinking,” he says, “and even more important, we have new investments in people and plants.”

We’ll have more to say on that score in the weeks ahead… Stay tuned.

![]() What if Inflation Is as Good as It Gets?

What if Inflation Is as Good as It Gets?

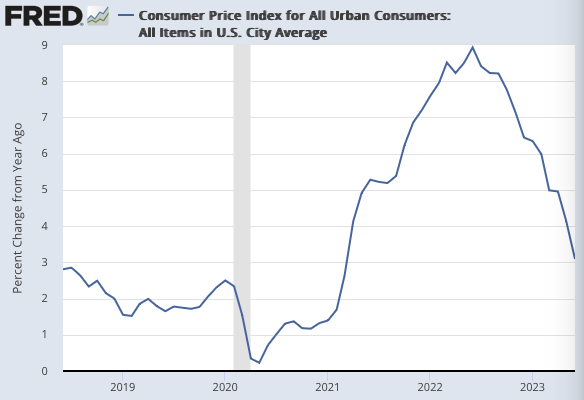

The Labor Department issued the June consumer price index this morning. The reading was cooler than expected: up 0.2% month-over-month.

The Labor Department issued the June consumer price index this morning. The reading was cooler than expected: up 0.2% month-over-month.

Hence, the year-over-year inflation rate is now 3.0% — down considerably from a scorching 9.1% last year… when we had record-high gas prices. (So yeah, the number is going to climb down in tandem with gas prices!)

Experts we follow outside the Paradigm sphere — including Jim Bianco and Greg Weldon — point out that those statistical “base effects” will start to go away with next month’s report… Meaning, Wall Street might be celebrating prematurely.

In terms of being unfashionably early to the party today, the techie Nasdaq is up 1.20%, just 70 points under 14,000. As for the S&P 500, the index is up 1% to 4,485 while the stolid Dow is up 0.85% to 34,555.

Checking on commodities, oil’s joining the rally: up 1.20% to $75.73 for a barrel of West Texas Intermediate. And precious metals are catching a bid; notably, silver is up about 4% to $24.20 and gold is up 1.30% to $1,961.90 per ounce.

Finally, the crypto market is in the green. Bitcoin’s up 0.80% to $30,800 and Ethereum’s up 1.5% to $1,900.

![]() One of the “Highest-Probability Plays” of the Summer

One of the “Highest-Probability Plays” of the Summer

“The amount of crude oil in storage is right in the middle of what we would normally expect this time of year,” says Paradigm’s income-investing ace Zach Scheidt.

“The amount of crude oil in storage is right in the middle of what we would normally expect this time of year,” says Paradigm’s income-investing ace Zach Scheidt.

“This tends to signal that oil prices will remain relatively stable in the short term, because supply and demand are fairly evenly matched,” he says.

But when it comes to gasoline — as well as jet fuel and diesel — it’s a different story. “Gasoline inventories are well below the average levels from years past. And Economics 101 tells us that when there’s a shortage of an important commodity, prices naturally rise.

“It's easy to see how gasoline prices could quickly rise,” he says, “while crude oil prices will likely be relatively stable in the near term.

“And this sets up a very unique opportunity for investors…

“Energy investors often talk about the crack spread for a barrel of oil,” Zach says. “This spread measures the profit an oil refiner can expect to receive from turning a barrel of oil into usable fuel.

“Energy investors often talk about the crack spread for a barrel of oil,” Zach says. “This spread measures the profit an oil refiner can expect to receive from turning a barrel of oil into usable fuel.

“When oil prices are low and gasoline prices are high, this crack spread widens,” he notes. “That's because an energy refiner can buy thousands of barrels of oil at a low price and then sell refined products like gasoline and diesel fuel at higher prices.

“Today's environment — with plenty of crude oil available, and not enough gasoline for sale — is a perfect setup for energy refiners.

“As we enter earnings season, I expect a number of these refiners to report profits that beat expectations, driving their stock prices higher,” says Zach.

“As we enter earnings season, I expect a number of these refiners to report profits that beat expectations, driving their stock prices higher,” says Zach.

“One of the best ways to play this opportunity is to buy shares of the VanEck Oil Refiners ETF (CRAK), an exchange-traded fund that invests in a handful of energy refiner stocks. You'll get a diversified basket of refiners that should all benefit from this dynamic of available oil and limited gasoline.

“Keep in mind, each year the fund pays an annual dividend,” he says. “So if you hold your position through mid-December, you'll receive a generous dividend payment alongside any gains from CRAK trading higher.”

Zach’s key takeaway? “This is one of the highest-probability plays that we could see this summer.”

![]() A Bumper Cash Crop

A Bumper Cash Crop

“A Kentucky man got the surprise of his life while digging in his field earlier this year: a cache of over 700 coins from the American Civil War era,” says an article at Live Science.

“A Kentucky man got the surprise of his life while digging in his field earlier this year: a cache of over 700 coins from the American Civil War era,” says an article at Live Science.

Alongside a sprinkling of silver coins, 95% of the “Great Kentucky Hoard” includes hundreds of gold coins circa 1840–1863.

Courtesy: GovMint.com

Courtesy: GovMint.com

In a video posted on YouTube, as the unidentified farmer unearths the treasure, he says: “This is the most insane thing ever: Those are all $1 gold coins, $20 gold coins, $10 gold coins.”

In fact, the rarest of the buried coins — the 1863-P $20 1-ounce gold Liberty coin — can fetch six figures at auction… The Kentucky cache includes 18 of these rare coins.

As you might expect, the anonymous (and fortunate!) farmer is auctioning the “Great Kentucky Hoard” at GovMint.com, in case you’re interested.

Also, for any aspiring treasure hunters out there, many Kentuckians are rumored to have buried federal coins to preserve them from the encroaching Confederate army.

“James Langstaff left a letter saying he had buried $20,000 in coins on his property in Paducah, William Pettit buried $80,000 worth of gold coins near Lexington, and Confederate soldiers quarantined for measles reportedly stole payroll and hid it in a cave in Cumberland Gap,” Live Science reports.

“None of these caches has ever been recovered.” Time to dust-off the metal detector?

![]() A New Spin on “Eat Ze Bugs”

A New Spin on “Eat Ze Bugs”

“KUDOS!” says a recent contributor. “I am SO appreciative of the carbon capture story you shared Monday. I am pretty well-read and informed, but I am confident I would not have known about this without you sharing it.

“KUDOS!” says a recent contributor. “I am SO appreciative of the carbon capture story you shared Monday. I am pretty well-read and informed, but I am confident I would not have known about this without you sharing it.

“You concluded with ‘to be continued.’ Please let us know if anything changes. THAT STORY IS JACKED-UP!”

As luck would have it, we do have an update from an eyewitness in Minnesota…

“There’s been a Minnesota Public Utilities Commission comment period on how to handle Summit Carbon. There is actually an environmental group opposing them!

“There’s been a Minnesota Public Utilities Commission comment period on how to handle Summit Carbon. There is actually an environmental group opposing them!

“Summit is in bed with ethanol plants and is also lying about what economic benefits it will bring to the areas where these pipes are going to be installed.

“Summit has a billboard saying they will create hundreds of new jobs when, in reality, all the pipelines will be remotely monitored (from Iowa) and there will be only a handful of employees for onsite purposes.

“The pipes will be pressurized higher than any known major pipe system in the U.S., and all that concentrated CO2 is such a hazard. It requires new training for medical and EMT personnel, which Summit claims they will provide to local communities.

“This is all new technology that has never been done before, dealing with high pressures and CO2. So this part of the country has become one big experiment for something that doesn't need to be done.”

Speaking of grand experiments, the final contributor today recaps our outing of the tyrannical forces behind the so-called green revolution…

“Reading about the ‘sacrifices’ that are expected of us to solve the climate ‘crisis,’ I am reminded of a scene from a childhood movie: Pixar's A Bug's Life (1998),” says an apparently young-ish contributor?

“Reading about the ‘sacrifices’ that are expected of us to solve the climate ‘crisis,’ I am reminded of a scene from a childhood movie: Pixar's A Bug's Life (1998),” says an apparently young-ish contributor?

“Hopper (voiced by Kevin Spacey), the leader of the villainous grasshopper gang, explains why they must return to collect their periodic tribute from the community of ants that the gang has been terrorizing:

“‘You let one ant stand up to us, then they ALL might stand up. Those puny little ants outnumber us 100-to-one, and if they ever figure that out, there goes our way of life! It's not about food; it's about keeping those ants in line.’

“Just substitute the word ‘climate’ for the word ‘food’ and you have a nice summary of the power elite's agenda.

“Thanks for publishing your daily quick hits of stories that I won't get from Fox, NBC, the Times or the Post.

“I often don't like what I read, but it's better than being in the dark.”

Emily responds: Well then. Mission accomplished… Take care!

Best regards,

Emily Clancy

Paradigm Pressroom’s 5 Bullets