AI, Nukes and Gold

![]() On This Day in History…

On This Day in History…

If you’re old enough, you might’ve looked at the calendar yesterday and thought Oh yeah, it’s V-E Day.

If you’re old enough, you might’ve looked at the calendar yesterday and thought Oh yeah, it’s V-E Day.

In the first few years after the conclusion of World War II, American schoolkids would gather for assemblies on May 8 to mark the Allied victory in Europe.

In Russia, it’s known simply as Victory Day and it’s marked on May 9 — since Nazi Germany’s surrender came into effect just after midnight Moscow Time.

And it’s still a very big deal, celebrated with a lavish military parade…

As I wrote on this occasion in 2015, Americans just can’t relate to the Russian experience in World War II.

The U.S. dead numbered just over 400,000, about 0.3% of the population. The Soviet dead numbered 27 million, 14% of the population. About 70% of those Soviet deaths were ethnic Russians.

Of every 100 Soviet boys who graduated from high school in 1941, only three came home in 1945.

In recognition of that sacrifice, there was a time — as recently as the Clinton and Dubya Bush years — that U.S. presidents would venture to Moscow to join in the commemoration.

Obviously those days are over. On Monday the Kremlin announced it will hold drills “in the immediate future” simulating the use of tactical nuclear weapons against NATO forces.

Obviously those days are over. On Monday the Kremlin announced it will hold drills “in the immediate future” simulating the use of tactical nuclear weapons against NATO forces.

Kremlin spokesman Dmitry Peskov said Moscow essentially has no choice in light of recent statements by Western leaders — the French president talking about sending ground troops to Ukraine, and the British foreign secretary saying Ukraine is at liberty to use British-supplied weapons to strike inside Russian territory.

As I mentioned in January, the editors of the Bulletin of the Atomic Scientists have their famous “Doomsday Clock” set at 90 seconds to midnight — suggesting that we’re closer to nuclear Armageddon now than we ever were during the Cold War.

![]() What’s Bad for World Peace Is Great for Gold

What’s Bad for World Peace Is Great for Gold

It’s no coincidence that gold has rallied to record levels at a time of unprecedented nuclear risk, according to Paradigm’s macroeconomics authority Jim Rickards.

It’s no coincidence that gold has rallied to record levels at a time of unprecedented nuclear risk, according to Paradigm’s macroeconomics authority Jim Rickards.

For the background, we need to rewind to a moment in 1983 when Armageddon was nearly unleashed — an incident most Americans still don’t know about.

At a time when tensions were already sky-high, the United States and its NATO allies conducted a war game code-named Able Archer 83. “This war game was to practice a nuclear strike on the Soviet Union,” says Jim.

“It turned out that the U.S. was rehearsing a nuclear first strike at the same time as the KGB was looking for evidence of a nuclear first strike. Able Archer 83 provided the KGB with more than enough reason to suspect the U.S. was indeed preparing for a first strike under cover of a war game.”

At the time, the Soviets relied on a primitive form of AI called VRYAN — the Russian acronym for Sudden Nuclear Missile Attack.

“VRYAN’s AI output on relative U.S. strength,” Jim says, “was compounded by massive U.S. intelligence failures regarding Soviet intentions. U.S. intelligence analysts assumed that the future would resemble the past, and that Soviet alerts were really propaganda designed to halt the U.S. deployment of Pershing II intermediate-range nuclear missiles in Europe.

“U.S. intelligence analysts were also guilty of what’s called mirror imaging: the belief that because you know your own intentions, your opponents must share your view. In this case, the U.S. assumed that because they had no intention to launch a first strike, the Soviets must understand that intention and would therefore have no cause for concern. In fact, the Soviets had the opposite view based in part on VRYAN AI output.

“The world came extremely close to World War III and a nuclear holocaust as a result of this sequence of events and misperception of intentions,” says Jim.

“The world came extremely close to World War III and a nuclear holocaust as a result of this sequence of events and misperception of intentions,” says Jim.

It was only because cooler heads prevailed on both sides — a Soviet lieutenant colonel and an American lieutenant general — that Armageddon was averted.

To our point today: “While there were mutual suspicions and certain inferences by U.S. and Soviet intelligence,” Jim says, “the information above was not fully understood by either side at the time of the escalation.

“On the U.S. side, it was not until the 1990 publication of a study entitled The Soviet War Scare by the President’s Foreign Intelligence Advisory Board (PFIAB) that something like the full story was revealed.”

In that document — originally classified above TOP SECRET — there’s a passage about how the American side assessed the KGB’s intelligence collection…

Throughout the early 1980s, VRYAN requirements were the No. 1 (and urgent) collection priority for Soviet intelligence, and subsequently, some East European services as well. They were tasked to collect… Monitoring of the flow of money and gold on Wall Street as well as the movement of high-grade jewelry, collections of rare paintings and similar items. (This was regarded as useful geostrategic information.)

Did you catch the bit about gold in there?

Did you catch the bit about gold in there?

Jim spells it out: “Inside a 34-year-old U.S. intelligence assessment of 45-year-old KGB collections in relation to a potential nuclear war is a directive to track the movement of gold as a leading indicator of nuclear attack.”

Jim isn’t altogether surprised: “From 2004–2010, I was co-director of a CIA effort called Project Prophesy that looked at capital markets activity as an early warning of an enemy attack.

“Gold was one of the valuable assets that was on our list of items to track. The idea was that if a general or political leader had advance information about an attack, they would convert their wealth to gold in safekeeping in order to financially survive the fallout…

“Today the world is closer to nuclear war than at any time since the Able Archer scare in 1983. Gold is once again on the move.”

Indeed, it’s up about 28% in only seven months — from $1,830 in early October to $2,330 this morning. Every prediction of a pullback the last month or so has come up short.

“Is this a coincidence?” Jim asks. “Hardly. A close correlation of huge gains in gold with serious threats of nuclear war is exactly what one should expect.”

This is one circumstance in which you might wish for the gold price to retreat. Unfortunately with the saber-rattling between Moscow on one side and Washington and Brussels on the other, Jim concludes “the rally we’ve seen since last October is just getting started.”

![]() Copper: Steady Supply, Exploding Demand

Copper: Steady Supply, Exploding Demand

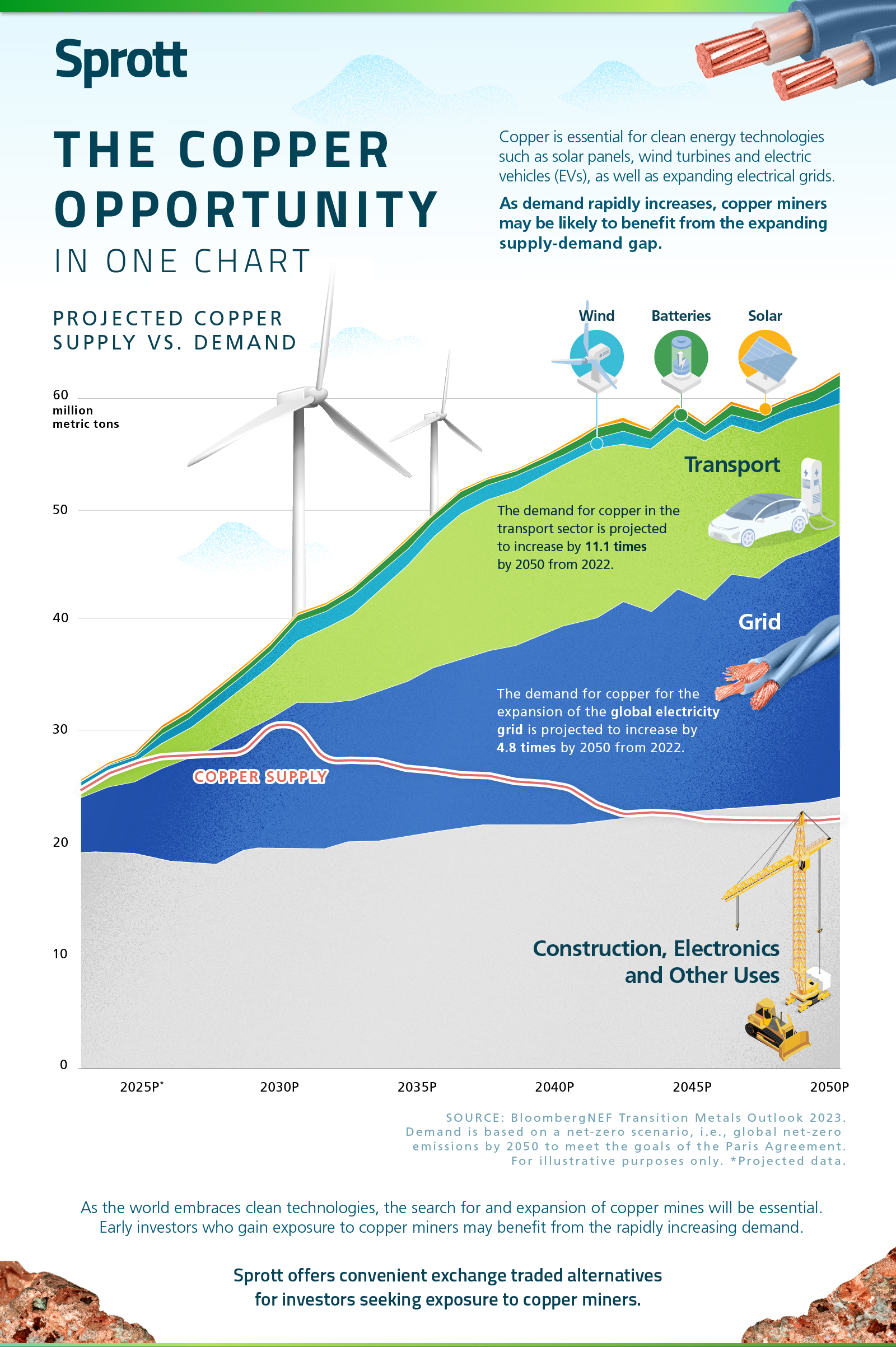

At $4.42 a pound, copper isn’t far from its $5 record in 2022… and the natural-resource pros at Sprott Inc. believe it has much higher to go.

At $4.42 a pound, copper isn’t far from its $5 record in 2022… and the natural-resource pros at Sprott Inc. believe it has much higher to go.

Feast on this infographic Sprott put out recently (you can click to enlarge…)

To be sure, Sprott is “talking its book” here — pushing its new Sprott Copper Miners ETF (COPP), launched about two months ago.

Hmmm… COPP has an expense ratio of 0.65%. Its top holding is the mining giant Freeport-McMoRan, comprising 22.1% of the portfolio. The No. 2 and 3 holdings make up another 20% of the total.

Compare and contrast with the best-known copper ETF — the Global X Copper Miners ETF (COPX). The expense ratio is identical. COPX’s portfolio is less concentrated, the biggest holding making up only 5.5% of the total.

With only two months’ performance to go on, the two ETFs track each other closely — with COPP holding a slight edge. We report, you decide. [Disclosure: Your editor has been dollar-cost averaging into COPX since 2021.]

Funny this should happen on a day when gold is front-and-center in these 5 Bullets, but precious metals are the most exciting corner of the market today.

Funny this should happen on a day when gold is front-and-center in these 5 Bullets, but precious metals are the most exciting corner of the market today.

The aforementioned $2,330 bid on gold is up more than 22 bucks from late yesterday. And silver’s up nearly 3%, back above $28.

Those moves come despite the U.S. dollar holding steady against other major currencies. As we’ve mentioned a few times recently — probably not enough! — the dollar might be looking strong against the euro, yen, etc.… but gold is looking strong against everything.

As for stocks, it’s a quiet day for the major U.S. averages — all modestly in the green. The S&P 500 sits just above 5,200.

Crude is quiet at $79.23. Ditto Bitcoin at $62,452.

One economic number of note: First-time unemployment claims for the week gone by totaled 231,000 — the highest since last August. That’s only one week and one indicator — but combined with the weaker-than-expected April job numbers issued last Friday, it suggests the labor market is tightening ever so slightly.

![]() Great Moments in Labor Relations

Great Moments in Labor Relations

I dunno, this doesn’t seem like such a hot idea?

I dunno, this doesn’t seem like such a hot idea?

“Air traffic controllers in France have been given the right to turn up to work three hours late after the government abandoned plans to force them to report for work on time,” reports the Daily Mail.

In reality, the deal simply affirms what’s already standard operating procedure, as the U.K. Express reports…

The controllers are said to earn up to [$116,000] a year and often only work 75% of the 32 hours a week they are contracted for.

There are claims some actually go on holiday or head off skiing when they are scheduled to be working.

One told Le Parisien newspaper he often checked in with colleagues on how busy air traffic was before he set off for a 9 a.m. shift - and if it was quiet he went back to bed until 11.

Another said managers didn’t mind so long as people were ‘contactable’ in case of a problem — but added ‘sometimes we’ve found ourselves calling guys who were abroad.’

The deal comes after the union threatened to strike just before the Paris Olympics starting in late July. That’s bargaining power…

![]() Mailbag: Bitcoin ETFs

Mailbag: Bitcoin ETFs

“Dave, shortly after the SEC gave its blessing to Bitcoin ETFs, you listed those that you thought were good/bad,” a reader writes. “Could you please just send me the date you published this in ‘The 5’? I file all of them for later reference.

“Dave, shortly after the SEC gave its blessing to Bitcoin ETFs, you listed those that you thought were good/bad,” a reader writes. “Could you please just send me the date you published this in ‘The 5’? I file all of them for later reference.

“Love ‘The 5,’ as it will always be to me — and keep up the great work that you and Emily do.”

Dave responds: Just in case others are curious, we’ll tackle the question here.

We published a summary of Chris Campbell’s analysis in our Jan. 22 edition; the full list was reserved for paying members of Altucher’s Early-Stage Crypto Investor.

The major takeaway: Among the 11 Bitcoin ETFs launching that month, Chris concluded the best in class was the Fidelity Wise Origin Bitcoin Fund (FBTC).

Among the big mainstream names, Fidelity’s leadership has demonstrated a long-term commitment to and interest in crypto — having taken up Bitcoin mining in 2014. And the fees won’t cut into your returns too badly; indeed, they’re still waived altogether through July. [More disclosure: I took a position in FBTC a few days after publishing Chris’ analysis.]

Chris believes the ideal way to hold crypto is in a hardware wallet — but seeing as the IRS doesn’t allow that in a 401(k) or an IRA, an ETF is the only choice if you want Bitcoin exposure in your retirement account. Good luck!

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets