You Might Be an “Extremist,” Feds Say

![]() Financial Surveillance… and Cancellation

Financial Surveillance… and Cancellation

“Prudent citizens should react to this news as if they saw a convicted burglar prowling outside their house taking photographs,” writes the incomparable James Bovard in the New York Post.

“Prudent citizens should react to this news as if they saw a convicted burglar prowling outside their house taking photographs,” writes the incomparable James Bovard in the New York Post.

We pick up this morning where we left off with Bullet No. 2 on Friday — chilling revelations of the federal government’s efforts at financial surveillance in the three years since the Capitol Hill riot on Jan. 6, 2021. The details turn up in a new report from the House Judiciary Committee, chaired by Rep. Jim Jordan (R-Ohio).

It’s not just that the feds were encouraging banks to use terms like “Trump” or “MAGA” to flag certain transactions — although that was definitely happening.

The Treasury Department’s Financial Crimes Enforcement Network (FinCEN) stretched its “suspicious behavior” definition, warning banks to track “‘extremism’ indicators that include ‘transportation charges, such as bus tickets, rental cars or plane tickets, for travel to areas with no apparent purpose,’ or ‘the purchase of books (including religious texts),’” the House committee reported.

If you bought a gun or ammo since 2021, Team Biden bureaucrats may have automatically classified you as a “potential active shooter.”

“Much of the absurdity begins with entitling federal bureaucrats to arbitrarily define ‘extremism,’” Bovard goes on.

“Much of the absurdity begins with entitling federal bureaucrats to arbitrarily define ‘extremism,’” Bovard goes on.

“In Washington, anyone who doesn’t worship government is considered an extremist.

“Why else would the official trigger list include people who shopped at Cabela’s or Dick’s Sporting Goods?

“The latest revelations are another leap toward total financial surveillance.”

And it’s just a small step from financial surveillance to financial cancellation…

The internet’s most visible outpost for free expression has come under attack — as has its third-party payment service.

The internet’s most visible outpost for free expression has come under attack — as has its third-party payment service.

We’re talking about Substack — the platform that offers writers a chance to connect with readers via emailed newsletters, often via paid subscription.

Thousands of writers from across the ideological spectrum have used Substack to come to the fore since its launch in 2017.

In recent years, it’s attracted top-shelf names like ex-Rolling Stone writer Matt Taibbi and Pulitzer Prize winner Seymour Hersh — journalism luminaries fed up with the hive-mind limitations of corporate media. Even Bill Bonner, the founder of Paradigm Press’ parent company, finds Substack to be the most amenable platform to reach his considerable following now.

The attack began in earnest in November, when The Atlantic published an article titled, “Substack Has a Nazi Problem” — zeroing in on a handful of fringe writers with tiny audiences.

By last month, it had become “a thing” on the left…

As you see from the headline, Substack’s founders stuck to their free-speech guns. As long as writers don’t say Go burn down this person’s house tomorrow, Substack won’t interfere.

Over the holidays, a raft of liberal Substack writers — led by Casey Newton with 200,000 subscribers — performatively announced they were leaving for other platforms.

“It’s very clear to see why this is happening now, of all times,” says the anonymous Substack writer operating under the pen name “Simplicius the Thinker.”

“It’s very clear to see why this is happening now, of all times,” says the anonymous Substack writer operating under the pen name “Simplicius the Thinker.”

“Just as Substack may have owed its initial popularity to the trench-war surrounding the 2020 election, J6 and COVID, Substack likewise stands to be at the center of what is certainly going to be an unprecedented, controversial and dangerous historical firestorm later this year, and early next.”

With big-name heterodox writers like Taibbi, Hersh, Alex Berenson and Naomi Wolf in its stable, “Substack gives succor to dissidents viewed as grave dangers to the establishment, and they cannot allow Substack to remain unfettered going into the critical end of 2024 cycle,” Simplicius says.

“That is why the attack had to come now, to begin seeding the groundwork to try and discredit and eventually dismantle one of the last remaining free speech bastions on the internet.”

Shortly after the first of the year, Simplicius himself was threatened with suspension by Substack’s merchant and payment processor — Stripe.

Shortly after the first of the year, Simplicius himself was threatened with suspension by Substack’s merchant and payment processor — Stripe.

“My account was being placed ‘in review’ and was scheduled for ‘suspension’ — or what appeared to be termination — lest I provide some details. Nothing of the sort has ever happened to my account before…

“This was an attack straight to the root — bypassing Substack itself and going directly to the payment process, which would effectively deplatform me from everything, as Stripe has ‘conveniently’ risen to be the exclusive merchant for many or most top platforms, including BuyMeaCoffee and Twitter/X. To be deplatformed from Stripe would be the instant nullification of all those other accounts, as they do not offer any alternatives besides Stripe…

“I was immediately made wary of the nature of the attack on me when Stripe’s requests became increasingly erratic and inconsistent. There were at least four sets of follow-up requests, each contradicting or having no relation to the previous.”

You can read the whole story here. Suffice for our purposes to say Stripe closed the matter with no explanation and Simplicius still has his Stripe account. For now.

And so, it is a cautionary tale in early 2024: “It’s a very real reminder that the plug can be pulled at any time and that we’re all ‘on the clock’ here,” Simplicius writes.

And so, it is a cautionary tale in early 2024: “It’s a very real reminder that the plug can be pulled at any time and that we’re all ‘on the clock’ here,” Simplicius writes.

On the other hand, “when you realize you could be the first Substacker in history to be entirely cut off at the merchant bank level, it means you’re really living rent-free in the heads of some powerful archons.”

Key point: There’s no evidence of government pressure in this instance — which is at the core of the Missouri v. Biden case the U.S. Supreme Court will take up soon.

Rather it might be an online mob that struck fear into Stripe management: Casey Newton, the aforementioned liberal writer with the big following who left Substack at the end of last year, inquired with Stripe what it was doing about Substack’s “Nazi problem.” (He got no response.)

Newton said he was doing so “in the spirit of journalistic inquiry.” Yeah, right.

In any event, you can count on us to stay abreast of further developments on the free speech and financial deplatforming front. The year is young…

![]() Biden’s New Phase of the “Forever War”

Biden’s New Phase of the “Forever War”

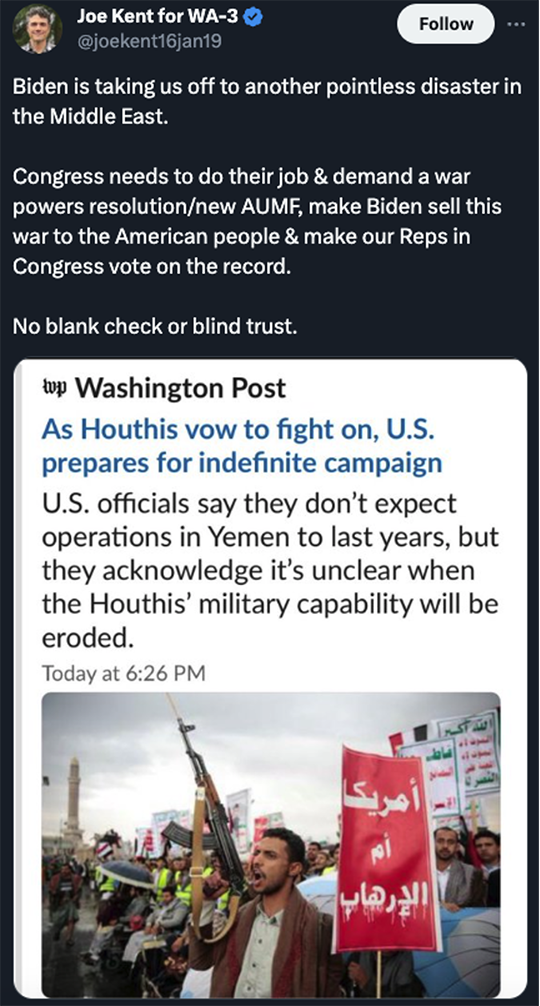

In case you missed it over the weekend, the Biden administration has committed U.S. forces to a new open-ended “forever war” in the Middle East.

In case you missed it over the weekend, the Biden administration has committed U.S. forces to a new open-ended “forever war” in the Middle East.

Two days after perhaps the most fatuous remark of Joe Biden’s presidency — “Are they [U.S. airstrikes] stopping the Houthis? No. Are they gonna continue? Yes” — the White House is doubling down on the insanity.

“The Biden administration is crafting plans for a sustained military campaign targeting the Houthis in Yemen,” says The Washington Post, “after 10 days of strikes failed to halt the group’s attacks on maritime commerce.”

For how long, you ask? “Officials say they don’t expect that the operation will stretch on for years like previous U.S. wars in Iraq, Afghanistan or Syria. At the same time they acknowledge they can identify no end date or provide an estimate for when the Yemenis’ military capability will be adequately diminished.”

How reassuring!

As a reminder, trade through the Red Sea is sharply curtailed for as long as Washington offers unconditional support to Israel and the Houthis harass global shipping as an act of solidarity with the Palestinians of Gaza. We’re talking 12% of global goods shipments and 10% of global oil shipments.

Thus, it’s safe to say there’s now a firm floor under the price of oil.

Thus, it’s safe to say there’s now a firm floor under the price of oil.

A barrel of West Texas Intermediate has traded below $70 now and then since mid-2021 — but never for long.

Now, for as long as Washington carries out a low-grade bombing campaign in the region — with the ever-present threat of escalation — $70 will form a solid base for the oil price.

Checking our screens this morning, it’s up nearly two bucks, blowing past $75.

After notching a record close on Friday — the first in over two years — the S&P 500 is pushing still higher today.

After notching a record close on Friday — the first in over two years — the S&P 500 is pushing still higher today.

At last check, the index is up a third of a percent to 4,855. The other major U.S. indexes are likewise in the green, if not dramatically.

Treasury yields are pulling back a bit, the 10-year note just under 4.1%. Gold is holding its own at $2,023 but silver’s getting whacked — down 44 cents to $22.16. Bitcoin is holding the line on $40,000.

![]() Apple AWOL on AI as Vision Pro Launch Approaches

Apple AWOL on AI as Vision Pro Launch Approaches

Apple is a company at a crossroads — 11 days before the launch of its much-ballyhooed Vision Pro headset.

Apple is a company at a crossroads — 11 days before the launch of its much-ballyhooed Vision Pro headset.

At $193.34 this morning, AAPL’s share price has a firm ceiling of just under $200. Last week, Apple was overtaken by Microsoft as the biggest company in the world measured by market cap.

Apple’s AI strategy? It’s a mystery. “Recent news suggests Apple might be a bit behind the eight ball when it comes to AI compared to competitors,” says Paradigm tech authority Ray Blanco.

The company is relocating its Siri voice assistant AI team from San Diego to Austin. Workers unwilling to move will get the heave-ho. “The change sounds like a major shakeup to me, and doesn’t exactly inspire confidence.”

Which leaves Vision Pro as the next thing that could move the needle.

Which leaves Vision Pro as the next thing that could move the needle.

“When the company revealed the product last year,” Ray says, “demos led to some rave reviews about the device’s capabilities.

“But demos aren’t real life… Producing a comfortable and useful mixed-reality and virtual-reality experience isn’t easy to do. The computer processing power required for high resolution, low-latency visuals via an MR/VR headset are notoriously high; moreover there are sensor and visual display issues the industry is still working on.

“Maybe Apple will end up hitting it out of the park with the Vision Pro. The company has a reputation for not necessarily being first to market with a new type of consumer device.

“It does, however, have a reputation for achieving best-in-class, or near best-in-class, performance and user experience when it does.” And at a premium price — in this case, $3,500.

Even if Vision Pro doesn’t move the needle for Apple, there’s a handful of Apple suppliers and vendors that stand to make fortunes — and deliver their investors substantial returns.

More about that in the days ahead. Watch this space…

![]() Bitcoin ETFs: Which Is Best in Class?

Bitcoin ETFs: Which Is Best in Class?

The Paradigm crypto team has sifted through the near-dozen new Bitcoin ETFs to identify best in class.

The Paradigm crypto team has sifted through the near-dozen new Bitcoin ETFs to identify best in class.

Approved by the Securities and Exchange Commission on Jan. 10 — just as our crypto evangelist James Altucher predicted — there are 11 Bitcoin ETFs competing for investors’ attention.

Many are issued by stalwarts of the financial industry (BlackRock, Franklin Templeton). Some are issued by upstarts (Bitwise Asset Management).

Paradigm’s senior crypto analyst Chris Campbell issued a deep-dive report to our Early-Stage Crypto Investor readers on Friday. “Though Bitcoin isn’t a part of our official portfolio,” he wrote, “we know many ESC members are curious about the ETFs and their implications.”

We’ll cut to the chase: Chris’ conclusion is that “the Fidelity Wise Origin Bitcoin Fund (FBTC) seems like the best candidate for investors seeking exposure to Bitcoin in their retirement accounts.”

His rationale? Fidelity is a respected name in asset management. Relative to its peers, Fidelity’s leadership has demonstrated a long-term commitment to and interest in crypto (Fidelity took up Bitcoin mining in 2014). And the expense ratio won’t cut into your returns too badly: “Fidelity has generally been competitive in its fee structure,” says Chris. And the fee will be waived altogether through July.

“Personally,” he adds, “I think owning crypto that you have the option to hold yourself is the way to go.” That is, real crypto that you can transfer to a hardware wallet like Trezor or Ledger.

But that’s not an option in a 401(k) or an IRA — just as you can’t hold precious metals inside a retirement account if they’re stashed in a home safe. Thus, Chris concludes, “being able to get easy exposure to crypto is a game-changer.”

![]() Mailbag: Dark Landlords

Mailbag: Dark Landlords

“I listened to Dave's video on the Dark Landlords,” a reader writes after we spotlighted the latest Paradigm Press YouTube video on Saturday.

“I listened to Dave's video on the Dark Landlords,” a reader writes after we spotlighted the latest Paradigm Press YouTube video on Saturday.

“I completely agree that this is a major factor in home price inflation and that it's been underreported or misunderstood. I've been talking about it for years and the only reason I knew about it was from reading The 5.

“At the end of the video Dave mentioned he didn't see any legislation or actions being taken to remedy this situation. I know most of the gains have already been made but forcing these Dark Landlords to sell these properties and placing a cap on how many they can own seems to me like a good start. What are Dave's thoughts on the End Hedge Fund Control of American Homes Act?

“Love The 5!”

Dave responds: Well, this is a very recent development — thanks for bringing it to my attention.

Introduced last month by Sen. Jeff Merkley (D-Oregon), S.3402 promises to “impose an excise tax on hedge fund taxpayers that own a certain number of single-family residences in excess of a specified amount.” The revenue would go into a fund that would “provide grants for down payment assistance to taxpayers purchasing a single-family residence.”

I’d have to look into it more thoroughly. Obviously on the surface it looks like another liberal do-gooder scheme. On the other hand, there’s no putting the toothpaste back in the tube with the sweetheart deals the feds cut with hedge-fund and private-equity types in 2012 — and there needs to be some sort of redress…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets

P.S. Media alert: The Paradigm Press editors are all over Fox Business today.

Moments ago, Neil Cavuto debriefed our trading pro Alan Knuckman about what’s next for stocks with the S&P 500 at record levels.

Then during the 2:00 p.m. EST hour, Charles Payne will be joined by our macro maven Jim Rickards in New Hampshire on the eve of the primary election there.