Killer Rabbit, Powered by AI

![]() Year of the Rabbit

Year of the Rabbit

“Maybe Chinese astrologers saw this coming a mile away. Year of the Rabbit, after all,” says Paradigm editor Chris Campbell about the unanticipated showstopper at last week’s Consumer Electronics Show (CES) in Vegas.

“Maybe Chinese astrologers saw this coming a mile away. Year of the Rabbit, after all,” says Paradigm editor Chris Campbell about the unanticipated showstopper at last week’s Consumer Electronics Show (CES) in Vegas.

“As we predicted, AI took up a good chunk of the limelight,” he says. “What we didn’t predict is that a little device called Rabbit R1 would steal the show.”

Color me… unimpressed?

Color me… unimpressed?

Despite its eye-catching color, the device looks, frankly, like the love child of an MP3 player and a baby monitor. “It’s not immediately obvious why people are so excited about this device,” Chris admits.

“Despite nobody knowing anything about this startup 10 days ago,” he continues, “they’ve already sold out four batches of 10,000 units. (They claim to have expected to sell only 500.)”

“Here’s the secret: Rabbit is exciting because it combines several elements of what we’re calling AI 2.0 — or the second wave of AI — into one small device.” More secret sauce? “The Rabbit R1 launched for pre-orders with a $199 price tag,” ZDNet says.

“We’ll dive into these elements,” says Chris, “and reveal a BIG takeaway nobody’s talking about.

“The Rabbit R1 is a small, smart computer you can carry around, like a smartphone, but focused on artificial intelligence (AI). It is what would happen if Siri, ChatGPT, Plaid (data security) and the internet had a baby.

“The Rabbit R1 is a small, smart computer you can carry around, like a smartphone, but focused on artificial intelligence (AI). It is what would happen if Siri, ChatGPT, Plaid (data security) and the internet had a baby.

“What sets it apart from other AI systems is instead of using large language models (LLMs), it uses what’s called a large action model (LAM) — action being the operative word.

“The operating system (OS) of Rabbit R1 is designed to understand and respond to commands given in everyday language, just like how you talk to Siri or Alexa.

“But with a twist…

“Rabbit R1 can interact with websites and apps and can learn from personal data without sending it to the internet, keeping it private,” Chris notes.

“In short, it’s a small, AI-powered device that's really good at understanding spoken commands and can do some unique things with websites and personal data, all while keeping it private.

“Here’s why it’s a good indicator of where AI 2.0 is headed…

“Watch out, thumbs. What we’re calling ‘TalkTech’ is coming for your lunch,” Chris says. “Siri and Alexa” — AI 1.0 — were primitive examples of TalkTech

“Watch out, thumbs. What we’re calling ‘TalkTech’ is coming for your lunch,” Chris says. “Siri and Alexa” — AI 1.0 — were primitive examples of TalkTech

“There are obvious benefits,” he says. This new tech is “more accessible and convenient. As an added benefit, it can also reduce the amount of time we sit at a desk or stare at a screen.”

In a keynote address at the CES, Rabbit founder and CEO Jesse Lyu claimed that the “R1 is able to produce a response that’s 10 times faster than ‘most of the voice AI products’ and can answer questions within half a second,” The Daily Beast says.

And although “TalkTech doesn't literally ‘get rid of apps’ in the traditional sense, [it] shifts the way we interact with them,” Chris says.

“Rabbit uses this ‘AI agent’ technology to learn how your apps work and then uses them for you, [learning] from interactions with you to provide more personalized responses and improve its understanding over time.”

“Think of [Rabbit] as a kind of universal remote control for every single one of your apps,” says The Daily Beast.

“Now, here’s where most people get stuck,” Chris intuits.

“Why couldn’t I just do this on a smartphone?” First: These “AI systems operate locally (right on your device, rather than over the internet).

“Why couldn’t I just do this on a smartphone?” First: These “AI systems operate locally (right on your device, rather than over the internet).

“Improved local AI could shift this processing to individual devices, potentially reducing reliance on centralized cloud services.” Here’s looking at you AWS, Amazon’s cloud-storage segment, for instance.

“In the long term, this trend could make hardware and cloud monopolies less valuable,” says Chris. “In fact, I think that’s the big takeaway of the Rabbit R1’s sudden popularity.

“The improvement of local AI systems could lead to an interesting new dynamic:

- More competition and creativity in the hardware space

- Decentralization of AI processing.

“Companies that quickly adapt to and excel in local AI processing might rise to prominence, potentially challenging the positions of current market leaders,” Chris concludes. “Some venture capitalists are betting it will become really valuable in a few years.”

[Chris Campbell’s colleagues James Altucher and Jim Rickards have already selected three little-known AI stocks poised for massive gains. Get the names and ticker symbols of these lucrative AI 2.0 opportunities for FREE before the mainstream catches on. Secure instant access here.]

![]() Big Brother IS Watching Your Bank Accounts

Big Brother IS Watching Your Bank Accounts

In a chilling letter, Rep. Jim Jordan (R-Ohio) reveals the dystopian surveillance activities taking place at the Financial Crimes Enforcement Network (FinCEN), a shadowy Treasury Department bureau.

In a chilling letter, Rep. Jim Jordan (R-Ohio) reveals the dystopian surveillance activities taking place at the Financial Crimes Enforcement Network (FinCEN), a shadowy Treasury Department bureau.

The letter addressed to a former FinCEN director, Noah Bishoff, requests he explain himself to the Select Subcommittee on the Weaponization of the Federal Government.

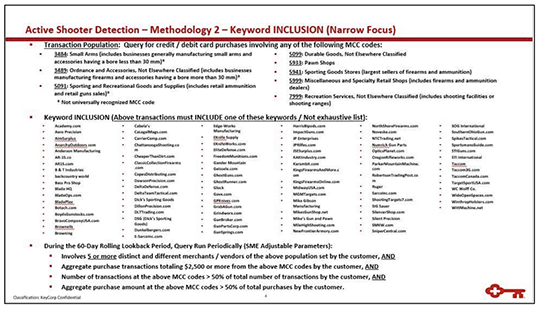

“Jordan said the committee had obtained documents showing that FinCEN outlined ‘typologies’ of persons of interest in materials distributed to financial institutions,” The Hill reports.

Rep. Jordan claims FinCEN — under Bishoff’s purview and after the events of Jan. 6, 2021 — started compiling a potential ‘enemies list’ of bank transaction keywords, including both “MAGA” and “TRUMP.”

Merely making purchases at sporting goods stores like Cabela's or Dick's could land you on the “Lone Actor/Homegrown Violent Extremism Indicators” list! And FinCEN encouraged banks to use merchant MCC codes to target unwitting Americans, a phenomenon we outlined in July.

“Jordan said FinCEN warned financial institutions of ‘extremism indicators,’ such as transportation charges ‘for travel to areas with no apparent purchases,’” says The Hill, “or ‘subscriptions to other media containing extremist views.”

“Jordan said FinCEN warned financial institutions of ‘extremism indicators,’ such as transportation charges ‘for travel to areas with no apparent purchases,’” says The Hill, “or ‘subscriptions to other media containing extremist views.”

Gulp.

“In other words, FinCEN urged large financial institutions to comb through the private transactions of their customers for suspicious charges on the basis of protected political and religious expression,” Jordan says in his letter, dated Jan. 17.

“This kind of pervasive financial surveillance, carried out in coordination with and at the request of federal law enforcement, into Americans’ private transactions is alarming and raises serious doubts about FinCEN’s respect for fundamental civil liberties.”

Here, here! Say what you will about Jordan, this isn’t the first time he’s championed Americans’ civil liberties… We’ll stay on top of this important financial privacy issue as the rest of 2024 unfolds.

![]() Biden Power-Scooters Toward a Cliff

Biden Power-Scooters Toward a Cliff

Another “leader of the free world,” another Middle East conflict…

Another “leader of the free world,” another Middle East conflict…

It might be funny were it not for the fact that — as we keep reminding you — the shipping disruptions in the Red Sea will drive consumer prices higher. After all, about 12% of global trade transits that body of water.

And don’t take it just from us. Take it from celebrity economist Mohamed El-Erian, president of Queens’ College, Cambridge, and chief economic adviser to the German financial giant Allianz: "Relative to what would have happened otherwise,” he tells the BBC, “we will see higher inflation, higher mortgage rates and lower growth.

"In absolute terms, however, it is nothing compared to what we had in 2021 and 2022. This shock is not going to be as big but it is unfortunate."

![]() Rough Ride for Retailers

Rough Ride for Retailers

“If you’re not sure how to feel about the economy these days, you’re not alone,” says our retirement-and-income ace Zach Scheidt.

“If you’re not sure how to feel about the economy these days, you’re not alone,” says our retirement-and-income ace Zach Scheidt.

“Report after report shows job growth, slowing inflation and rising incomes. But that sunny picture hides a gloomy reality for many families.

“As we discussed previously, Americans have largely spent down their pandemic savings,” Zach says. “Without this buffer, consumers are practically running on empty.

“Not long ago, the consumer sentiment index showed that Americans felt more pessimistic about the economy than during the height of the Global Financial Crisis.

“So today I want to take a closer look at what’s really going on in our economy. And make sure you follow along closely…

“The truth is that Americans aren’t saving as much money as they used to, even if other pieces of data suggest the economy is doing well,” says Zach.

“The truth is that Americans aren’t saving as much money as they used to, even if other pieces of data suggest the economy is doing well,” says Zach.

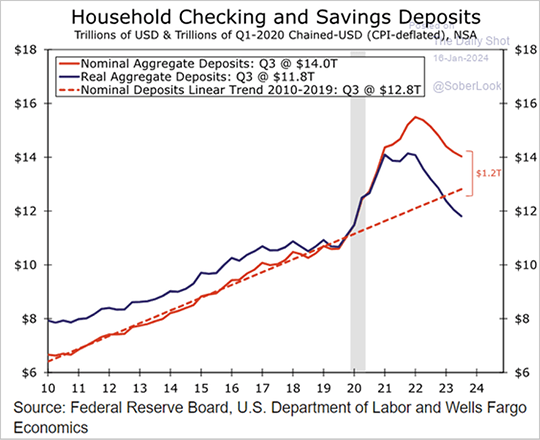

“In the chart below,” he says, “you’ll see that household checking and savings deposits have fallen for two years now.

“And real deposits (which takes out inflation) have fallen even steeper, dipping well below the historical trend.

“It’s not just a matter of reckless spending either,” Zach adds. “After record levels of inflation, the average family simply has to make do with less.

“Yes, inflation has come down (for now). But remember, that doesn’t mean prices have fallen. Prices are still rising, just not as fast as they were.

“Consumer spending has held strong so far,” he notes. “But with excess savings now gone, it’s only a matter of time until we see shifting spending habits among middle- and low-income consumers.”

Zach’s key takeaway: “I expect a much weaker environment for retailers this year as families tighten their belts.” He recommends fine-tuning your portfolio accordingly.

Nevertheless, the disconnect between the stock market and your lived experience persists today as the S&P 500 is on track for a record-high close.

Nevertheless, the disconnect between the stock market and your lived experience persists today as the S&P 500 is on track for a record-high close.

The index is up 0.50% to 4,800 while the Dow and Nasdaq are similarly in the green at 37,600 (+0.35%) and 15,150 (+0.65%) respectively.

But it’s a mixed bag for commodities. The price of crude is down 0.60% to $73.63 for a barrel of WTI — still in line with its recent $70–75 range. Gold, meanwhile, is getting some slight traction; the yellow metal is up $3 per ounce to $2,025.40; silver, on the other hand, has dipped below $23.

As for crypto, despite last week’s hubbub, Bitcoin is barely hanging onto $40,000 while Ethereum’s dropped almost 1% to $2,400.

![]() Get Your Booty off My Property!

Get Your Booty off My Property!

Imagine waking up on a Saturday morning… to discover your neighbor digging up your front lawn.

Imagine waking up on a Saturday morning… to discover your neighbor digging up your front lawn.

A family in Ledyard, Connecticut, doesn’t have to imagine; they called the police last weekend when they noticed one of their — we can only assume — eccentric neighbors was digging in their front yard with a “rock rake.”

When confronted, the neighbor claimed he owned the entire neighborhood and that the homeowners were “pirates.”

Arrrgh! ’Em landlubbers love to bury treasure…

Stay safe, and enjoy your weekend!

Best regards,

Emily Clancy

Paradigm Pressroom’s 5 Bullets