Gun Controllers’ Financial Ruse

- Backdoor gun control, leveraging the financial system

- An embarrassed IRS changes its home-visit policy

- Wall Street takes a drag of hopium

- Ancient gold coins, lost forever?

- A newer reader (with a familiar concern)

![]() Backdoor Gun Control, Leveraging the Financial System

Backdoor Gun Control, Leveraging the Financial System

We inserted a cliffhanger of sorts in the middle of yesterday’s 5 Bullets.

We inserted a cliffhanger of sorts in the middle of yesterday’s 5 Bullets.

We did a brief update about the fate of British politico and pundit Nigel Farage’s bank accounts… linked it to the “de-banking” of the Canadian truckers protesting COVID vaccine mandates last year… and cited our own Jim Rickards.

“If it's happening in Canada and the U.K., you can be certain it's happening in the U.S.,” Jim said.

“There are many U.S. examples, including recent Biden regulations that require Mastercard and Visa to put gun purchases in a separate reporting code. Prior to this, they used to lump them in with ‘sporting goods’ or ‘recreation’ along with fishing poles and tents.”

As Jim told his Strategic Intelligence readers last week, “This is a backdoor way of getting to a national gun registry.”

And the backdoor is through the financial system. Thus, it’s fair game for our 5 Bullets today.

We begin — of necessity — with a brief exploration of the credit card system’s plumbing.

We begin — of necessity — with a brief exploration of the credit card system’s plumbing.

Every retailer is assigned a “merchant category code.” As Wikipedia explains rather eloquently, “MCCs are assigned either by merchant type (e.g., one for hotels, one for office supply stores, etc.) or by merchant name (e.g., 3000 for United Airlines) and is assigned to a merchant by a credit card company when the business first starts accepting that card as a form of payment.

“The same business may code differently with different credit cards, and different sections or departments of a store may code differently.”

How are MCCs used? Among other things, “to determine the interchange fee paid by the merchant, with riskier lines of business paying higher fees,” and “by credit card companies to offer cash back rewards or reward points, for spending in specific categories.”

But yes, the government has its grubby mitts in MCCs too. The IRS uses them to determine whether a payment is for “services” (reportable) or for “merchandise” (not reportable).

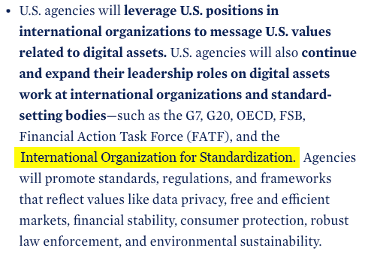

MCCs are developed by an outfit called the International Organization for Standardization — which goes by the abbreviation ISO.

MCCs are developed by an outfit called the International Organization for Standardization — which goes by the abbreviation ISO.

ISO is a nongovernmental organization based in Switzerland that sets uniform standards in all manner of industries — from manufacturing to agriculture, technology to health care.

That said, ISO is subject to political influence from Washington.

In fact, ISO’s name turns up in a “fact sheet” issued by the White House last September — which was following up on the March 9, 2022, executive order laying the groundwork for a central bank digital currency, or in Jim Rickards’ parlance, “Biden Bucks.”

Also last September, ISO approved a new MCC specifically for firearms retailers.

Also last September, ISO approved a new MCC specifically for firearms retailers.

Previously, they fell under the MCC for sporting goods stores or miscellaneous retail.

Why the change?

ISO acted at the urging of New York-based Amalgamated Bank — the biggest union-owned bank in the United States. Its majority owner is Workers United, which represents 86,000 workers in a half-dozen or so industries.

Workers United, in turn, is an affiliate of SEIU, the Service Employees International Union — an enormous fundraiser for Democratic politicians, spending $150 million in 2020.

Amalgamated Bank boasts on its website that it’s “proud to partner with many organizations creating a safer society and we are using our voice to set the industry standard so that all financial institutions can help keep their communities safe from gun violence.”

And more to the point…

“Backers of the firearm retailer MCC have made clear that their goal is to use the code to enact further gun control through a public-private partnership,” according to a recent web post from the NRA-ILA — the National Rifle Association’s Institute for Legislative Action.

“Backers of the firearm retailer MCC have made clear that their goal is to use the code to enact further gun control through a public-private partnership,” according to a recent web post from the NRA-ILA — the National Rifle Association’s Institute for Legislative Action.

“Amalgamated Bank noted that they intend to create a software algorithm that will use the MCC ‘to report suspicious activity and illegal gun sales to authorities.’

“The contours of what would be deemed ‘suspicious activity’ have not been articulated. As those purchasing firearms from retail establishments already undergo an FBI National Instant Criminal Background Check System (NICS) check, such ‘suspicious activity’ would be aimed at otherwise lawful gun sales.”

But the end goal was spelled out in a New York Times article from last fall: “Banks could then either allow [the flagged] transactions, or block them and file suspicious activity reports with the Treasury Department’s Financial Crimes Enforcement Network, which would ideally also create a system to quickly forward that information to local law enforcement and the FBI.”

“Collecting firearm retailer financial transaction data amounts to surveillance and registration of law-abiding gun owners,” asserts the NRA-ILA.

“Collecting firearm retailer financial transaction data amounts to surveillance and registration of law-abiding gun owners,” asserts the NRA-ILA.

After ISO issued the new MCC, Republican attorneys general in 24 states lodged a protest — loudly enough that Visa, Mastercard and American Express paused their implementation of the code last March.

For now, the battle has moved to the state level.

For now, the battle has moved to the state level.

Lawmakers and governors in seven states — Texas, Florida, Montana, West Virginia, Idaho, Mississippi and North Dakota — have enacted legislation either forbidding or discouraging use of the firearm-retailer MCC.

California, on the other hand, is looking to mandate it. If legislation passes, other “blue” states might well follow suit.

So then what? The credit card providers, according to Adam Skaggs of the Giffords Law Center to Prevent Gun Violence, “will then either have to figure out how to have a patchwork approach to this.” And if that’s not feasible, Skaggs tells the Payments Dive website “there will be increasing pressure on Congress on federal financial regulators to step in.”

Which is probably just the way the Biden administration wants it. The White House has cleverly orchestrated affairs in a way that its fingerprints aren’t evident — relying instead on friendly special interests like Amalgamated Bank and the Giffords Center to bring pressure to bear.

We’ll stay on top of this important financial privacy issue as the rest of 2023 unfolds.

![]() An Embarrassed IRS Changes Its Home-Visit Policy

An Embarrassed IRS Changes Its Home-Visit Policy

Staying with the broad theme of financial privacy and government intimidation…

Staying with the broad theme of financial privacy and government intimidation…

As we mentioned earlier this year, on the very day independent journalist Matt Taibbi was testifying to Congress about online censorship… the IRS paid a call on his home, leaving a note behind.

“The initial note,” Taibbi recalled, “instructed me not to call for four days, a tactic I later heard was sometimes used by field agents to rattle taxpayers.”

Taibbi notified House Judiciary Committee chair Jim Jordan… and Jordan wrote the IRS a letter basically asking, “WTF?”

Yesterday, the IRS announced it will end “most” unannounced home visits. They will continue only for “unique” cases — typically involving taxpayers who are at least $100,000 in arrears.

Taibbi’s visit pertained to a three-year-old discrepancy — the upshot of which was that he was owed money.

“[M]y impression is there may be a broader pattern of using the IRS to investigate a range of politically irritating people, one that probably still needs looking into,” Taibbi tells National Review. “But this is a good step.”

![]() Wall Street Takes a Drag of Hopium

Wall Street Takes a Drag of Hopium

The Federal Reserve has begun one of its every-six-weeks policy meetings… and the betting on Wall Street is that the Fed will pull off the proverbial “soft landing.”

The Federal Reserve has begun one of its every-six-weeks policy meetings… and the betting on Wall Street is that the Fed will pull off the proverbial “soft landing.”

“A strong majority of business economists now say the odds of the U.S. entering a recession in the next 12 months are 50% or less,” says a Bloomberg story citing a survey by the National Association for Business Economics.

That assessment may turn out to be correct — but it hinges on the Fed “pivoting” to rate cuts sooner rather than later.

The background: Nearly every Fed rate-raising cycle since World War II — there’ve been 13 of them — has ended in a recession.

According to research from Financial Sense Wealth Management, the only three exceptions occurred in the mid-1960s, the mid-1980s and the mid-1990s. Each of those times, the Fed reversed course and started cutting rates almost immediately after a series of increases.

This year, the Fed still isn’t done raising; futures traders assign a 99% probability the Fed will raise at the conclusion of this week’s meeting tomorrow.

As we’ve said for much of this month… inflation still isn’t under control and it might well start accelerating again before year-end. Between this week’s meeting and the next one on Sept. 19–20, there will be two more monthly inflation readings.

So at this point, future Fed policy is, to borrow an overused term from the previous decade, “data dependent.”

A bet on a pivot and a soft landing? Way premature.

In the meantime, the major U.S. stock indexes are once again in the green today — if barely. The S&P 500 is up five points to 4,559 — another level last seen in early April 2022.

In the meantime, the major U.S. stock indexes are once again in the green today — if barely. The S&P 500 is up five points to 4,559 — another level last seen in early April 2022.

Crude is up again, now over $79 for the first time in three months. Precious metals are staging a modest rebound — gold at $1,963 and silver at $24.67 — as the U.S. dollar index is flat at 101.4.

For the record: With only a week remaining before UPS drivers go on strike, the company and the Teamsters will resume contract talks today for the first time since July 5.

For the record: With only a week remaining before UPS drivers go on strike, the company and the Teamsters will resume contract talks today for the first time since July 5.

As a reminder, the National Retail Federation warns the supply-chain disruptions from a strike would equal those of the lockdowns in spring 2020. And Michigan-based Anderson Consulting Group pegs the cost of a 10-day strike at $7 billion — including $4.6 billion in losses by UPS customers, $1.1 billion in lost worker wages and an $816 million hit to UPS’ bottom line.

None of that is priced into the stock market at the moment…

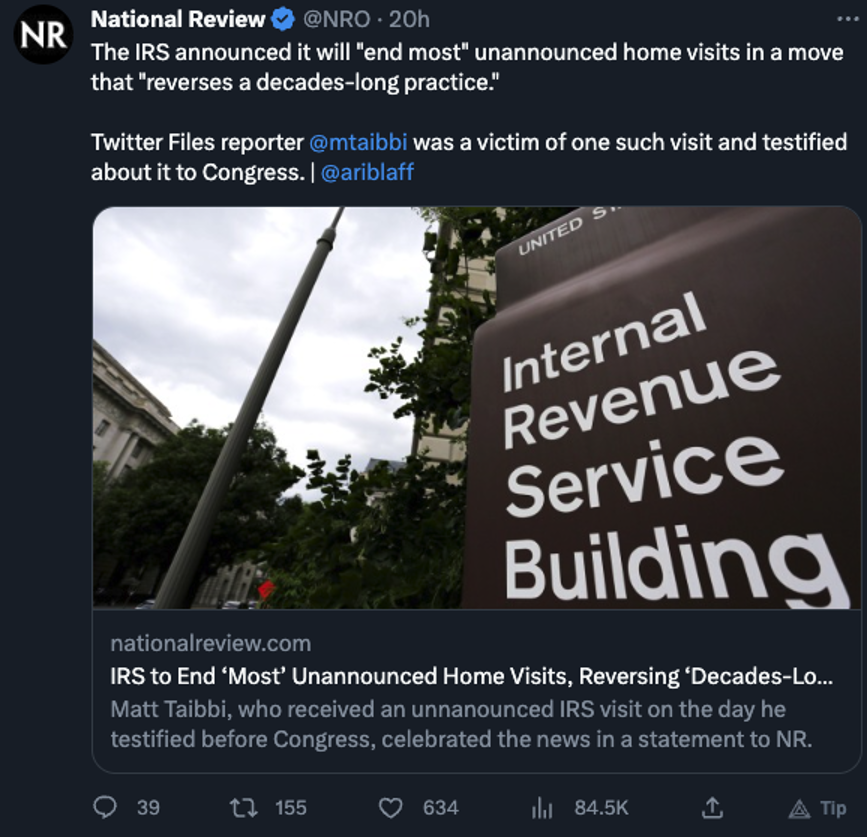

In light of the “2024 campaign wild cards” we spotlighted in yesterday’s edition, we’re compelled to note the following development after we hit the “send” button…

In light of the “2024 campaign wild cards” we spotlighted in yesterday’s edition, we’re compelled to note the following development after we hit the “send” button…

When even The New York Times’ White House correspondent feels compelled to mention this on Twitter — or X or whatever the hell it’s called now — that’s a milestone.

Feels like the long knives might be coming out for Joe Biden. We’ll leave it there for today…

![]() Ancient Gold Coins, Lost Forever?

Ancient Gold Coins, Lost Forever?

All thievery is wrong… but whoever did this deserves a special place in hell.

All thievery is wrong… but whoever did this deserves a special place in hell.

“Investigators looking into the theft of hundreds of ancient gold coins from a German museum have found lumps of gold that appear to have resulted from part of the treasure being melted down,” reports The Associated Press.

We took note when the break-in happened last November in Bavaria. It was a sophisticated job, the thieves cutting the phone and internet lines to the museum in Bavaria. It didn’t help that there was no guard on duty.

Gone were 483 Celtic coins dating to around 100 BC. Archaeologists fretted the thieves might simply melt the coins for their bullion value.

That turns out to be the most likely scenario now that four suspects are in custody and the investigation continues.

“The deputy head of Bavaria’s state criminal police office, Guido Limmer, told reporters in Munich that authorities have examined 18 lumps of gold that were recovered this week,” says the AP. “Each is believed to be the result of four coins being melted down, and Mr. Limmer said that the non-standard alloy largely matches that of the treasure, though further analysis is ongoing.”

Sheesh. As we said last year, the coins were worth $1.68 million — while the melt value was only $263,000.

Then again, it’s not as if they could be sold off intact without arousing suspicion. What a crying shame…

![]() A Newer Reader, a Familiar Concern

A Newer Reader, a Familiar Concern

To the mailbag, and a newer reader’s variation on the old “I like your firm’s work, but…”

To the mailbag, and a newer reader’s variation on the old “I like your firm’s work, but…”

“I have been a subscriber for many months now — I forget the exact date but at least six months. I really value the information, which is why I became a subscriber.

“My primary feedback, though, is about the approach of marketing and the volume of emails and bulletins I get on a daily basis. I do not have sufficient funds for additional investing, and I am not terribly computer literate; thus, I am simple in my needs.

“I get tired of the approach of pushy energy and communications to take advantage of the great investment tips and strategies. I have listened to the lengthy videos covering these tips, and while they have good info I am not in a position to invest, nor pay the extra that is often included for the special offers. I get aggravated enough to cancel my subscription early.

“I have no idea if this marketing approach works on your end, and I understand you primarily serve those that are investing on a regular basis. I am merely trying to be a vigilant learner and prepare for what’s coming as best I can. If there is any way to take me off some of the pushy stuff, I would truly appreciate that. If not, I will continue to delete one or more a day without reading, and likely cancel my subscription at the end of my year period.

“I do appreciate your open door to feedback and your hard work to bring us up-to-date financial information. Thank you for your dedication and expertise.”

Dave responds: Thank you for your courteous note. It deserves a courteous reply.

First of all, you can always contact our customer care team and ask that the volume of emails be dialed back — here’s a handy web form.

We do market aggressively; as I mentioned most recently last month, we don’t rely on outside advertisers or on shady deals with publicly held companies to tout their stock. So the vast majority of our revenue comes from the subscription fees of readers like you.

Feedback like yours is important; if enough people write in with a similar complaint, that’s a sign that perhaps we need to recalibrate our approach.

Back when I worked in TV newsrooms in pre-internet days, an old boss told me that for every one person who called in to complain about something, there were 10 more just as upset who didn’t. I think it’s still a good rule of thumb!

So thank you for your patronage. And we do hope at some point the guidance you get from your paid publication will enable you to invest and to profit!

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets