An Out-of-Nowhere Crypto Rally

![]() The Next Crypto Surge (Underway Now)

The Next Crypto Surge (Underway Now)

Don’t look now, but Bitcoin sits at its highest level in nearly three months.

Don’t look now, but Bitcoin sits at its highest level in nearly three months.

A sharp rally coincided with the opening of the stock market in the United States this morning. At last check, the flagship crypto is over $67,000 for the first time since late July.

Sooner or later, Bitcoin is set to burst through its March 2024 record over $73,000. Certainly that’s the case if history is any guide.

A few weeks after that March peak came the every-four-years “halving” event — in which the rewards from Bitcoin mining are cut in half.

After a halving, it takes twice as much computing power to generate the same quantity of new Bitcoin. This is what’s built into the Bitcoin algorithm to keep its supply strictly limited — unlike U.S. dollars and other fiat currencies that governments can print willy-nilly.

Typically, Bitcoin and the rest of the crypto space rally strongly in the 15–18 months after a halving.

Here’s another way to look at this four-year cycle, recently posted on Xwitter…

On Friday, Paradigm’s top crypto analyst Chris Campbell wrote of an “upcoming surge” that “could be massive, a movement that will likely catch many off guard.”

On Friday, Paradigm’s top crypto analyst Chris Campbell wrote of an “upcoming surge” that “could be massive, a movement that will likely catch many off guard.”

As a senior analyst for our crypto-and-AI authority James Altucher, Chris offered several items of supporting evidence.

For starters, “Bitcoin reserves on exchanges are hitting levels we haven’t seen in six years, signaling that more people are holding their Bitcoin rather than selling it. Historically, when reserves drop, we often see a significant price increase.”

Chris also points us to research showing that more people are using crypto now than were using the internet in 1997. Given what happened with internet growth after 1997, that’s a very promising trajectory.

Oh, and returning to the aforementioned four-year cycle? What else happens every four years along with Bitcoin halvings? U.S. presidential elections. The pattern is uncanny…

The surge appears to be underway this morning. And it’s probably just the beginning.

![]() A Fed Pause? Already?!

A Fed Pause? Already?!

The Federal Reserve has no choice but to cut interest rates again next month — even if it risks rekindling the fires of inflation.

The Federal Reserve has no choice but to cut interest rates again next month — even if it risks rekindling the fires of inflation.

That’s the assessment of Paradigm’s Zach Scheidt after poring over the recent inflation and job numbers. Both came in “hotter than expected.”

“A strong labor market and reigniting inflation are definitely a concern for the Fed going forward,” Zach says. “The Fed doesn’t want to cut rates too quickly into a strong economy because that could reignite inflation even further.”

But as for the chatter you might be seeing in the media? About the Fed pausing rate cuts after starting on a new rate-cutting cycle only last month? Forget it.

As Zach puts it, “You can’t put the cat back in the bag once it’s out.”

“Of course, these numbers are cause for concern with the Fed, but generally speaking, the Fed doesn’t like to start something and then stop immediately. It wouldn't be a good look for the Fed if they did because it would show they are out of touch with reality.

“So for credibility's sake, I think the Fed will continue to cut by a small amount in November and December.”

Maybe that’s what the stock market’s been sniffing out as the major indexes hover near all-time highs.

Maybe that’s what the stock market’s been sniffing out as the major indexes hover near all-time highs.

Those indexes are taking a breather today — the S&P 500 down a quarter percent to 5,844. But the momentum is still to the upside. Paradigm chart hound Greg Guenthner sees “what is beginning to feel like an inevitable year-end melt-up.”

To be sure, “We’ll get our fair share of pullbacks and gut checks… But the scales are tipping in favor of the bulls — that much is clear.”

Once more we’ll point out how resilient the stock market looks in spite of a rallying dollar. The U.S. dollar index (DXY) now sits over 103 — levels last seen in early August. The rebound off 100 in late September has been relentless. Any other time that might prove to be a drag on stocks — but not now.

Likewise, gold is hanging in there despite that dollar strength — the bid up $11 today to $2,660. Gold has spent all of October over $2,600 — a healthy consolidation after a furious run-up from July through September.

![]() Market Manipulations? (Oil Today)

Market Manipulations? (Oil Today)

If it’s thrills-n-chills you’re looking for in the markets today, it’s in crude — a barrel of West Texas Intermediate down 5% on the day and about to break below $70.

If it’s thrills-n-chills you’re looking for in the markets today, it’s in crude — a barrel of West Texas Intermediate down 5% on the day and about to break below $70.

Perhaps it helps that, according to The Washington Post, Israel does not plan to hit Iran’s oil industry whenever it launches an attack on Iran sometime before U.S. Election Day.

In addition, OPEC has once more slashed its forecast for crude demand growth — both for the rest of this year and 2025.

But it’s hard not to look at a move like today’s and wonder if a “hidden hand” is at work.

But it’s hard not to look at a move like today’s and wonder if a “hidden hand” is at work.

The market for oil futures has been used to mask a host of manipulations for more than three decades.

The veteran oil industry journalist Jim Norman documented these manipulations extensively in his 2008 book The Oil Card.

Modern oil futures as we know them began trading in New York in 1983 — only months after President Reagan signed National Security Decision Directive 66. Under NSDD-66, Washington began colluding with Saudi Arabia to drive down oil prices. Objective: Make Soviet oil exports dirt-cheap and bankrupt the Evil Empire.

One of the leading global oil traders in the 1970s quickly became one of the biggest players in the nascent oil futures market. Transworld Oil, controlled by John Deuss, accounted for up to 30% of NYMEX oil trade — most of it on the short side, betting prices would fall. Deuss had long-rumored ties to the CIA… and it was CIA chief William Casey who did much to implement NSDD-66.

Crude traded around $30 a barrel at the time NYMEX oil futures began trading in 1983. By the late '80s, oil was in a range between $12–22. The Berlin Wall came down in 1989.

Made possible in part by cheap oil...

[Photo reproduced by Wikimedia Commons user Lear 21]

More manipulations took place as oil climbed relentlessly during the early 2000s.

More manipulations took place as oil climbed relentlessly during the early 2000s.

The geopolitical objectives had shifted: High oil prices would act as a brake on Chinese economic growth. And the Commodity Futures Modernization Act of 2000 would help make it happen. The law "would eventually turn the oil futures market from mainly a zero-sum risk-hedging and price-discovery vehicle into a quasi-securities market," wrote Mr. Norman.

"The price of oil is now less dependent on the actual supply and demand for 'wet' barrels than on the huge sums of money pouring into NYMEX futures from the pension and other investment funds, tacitly enabled and encouraged by U.S. regulators. Daily oil volumes on the NYMEX now dwarf global physical oil consumption."

Indeed, there may be as many as 100 "paper barrels" of oil trading for each barrel of the real thing.

Indeed, there may be as many as 100 "paper barrels" of oil trading for each barrel of the real thing.

"The volumes are far, far out of whack with any reasonable need to hedge physical supply/demand risk," Norman told your editor during a 2013 interview. "The amount of funds needed to dramatically influence crude prices would be 'chump change' compared with the sums needed in the debt and equity markets."

The motivation for today’s plunge? It’s tempting to speculate that the aim is a quick drop in gasoline prices ahead of Election Day, the better to benefit the Democrats.

But that seems a little too obvious, no? Besides, at $3.20 a gallon, the national average for regular unleaded is already 40 cents cheaper than it was a year ago…

![]() Power Struggle: Big Tech vs. Homeowners

Power Struggle: Big Tech vs. Homeowners

With AI consuming ever more of the electric grid, a strange power struggle is emerging in Ohio — pitting Big Tech and state utility regulators on one side, versus the power company and consumers on the other.

With AI consuming ever more of the electric grid, a strange power struggle is emerging in Ohio — pitting Big Tech and state utility regulators on one side, versus the power company and consumers on the other.

The story begins in May when the state’s big power utility — AEP Ohio — issued a proposal to the state’s utility regulator, setting financial requirements for anyone who wanted to connect a data center to the power grid.

The terms included 10-year contracts and an agreement to pay for at least 90% of the electricity they request.

That seems like a reasonable demand considering that AEP would have to build out additional capacity to accommodate the data centers. How much? AEP says it currently has 600 megawatts set aside for data centers in central Ohio, but it’s had inquiries from customers seeking 30 gigawatts — a staggering 50X increase.

Big Tech did not like these terms. At all. Said Amazon over the summer: “AEP Ohio should not single out data centers as the sole cause of — or solution to — the problem of capacity constraints."

An outfit called the Data Center Coalition — made up of Amazon, Google, Microsoft and Facebook among others — was even more forceful: "If AEP Ohio’s unprecedented proposal is adopted, Ohio will send a clear signal to the data center industry that AEP Ohio’s territory is closed for business."

This month, the Data Center Coalition issued its own proposal to the regulators.

This month, the Data Center Coalition issued its own proposal to the regulators.

The details are extremely hazy. Here’s how The Columbus Dispatch tried to make sense of it: “The settlement includes creating long-term commitments for customers that use large amounts of electricity. It also calls for a PUCO [Public Utilities Commission of Ohio] investigation to alleviate near-term system capacity constraints in central Ohio at a faster pace and lower the cost of new transmission.”

A lot of mumbo jumbo. But AEP doesn’t like it, nor does PUCO’s staff. The state-appointed consumer watchdog, Ohio Consumers’ Counsel Maureen Willis, had no trouble cutting through the confusion.

“While business growth in Ohio is a good thing,” she says, “residential utility consumers — who already pay exorbitant transmission costs — should not be forced to subsidize utility investment for data centers operated by multibillion-dollar companies.”

We’ll be watching this case closely. If the Data Center Coalition gets its way, look for similar efforts in other states — pushing demand higher, raising prices for homeowners and maybe even running the risk of planned blackouts. Stay tuned…

![]() An Encouraging Word

An Encouraging Word

“I for one thank you for your daily missives — keep it up,” says a reader who writes in from time to time. “Don't let those that disagree with you get the best of you.

“I for one thank you for your daily missives — keep it up,” says a reader who writes in from time to time. “Don't let those that disagree with you get the best of you.

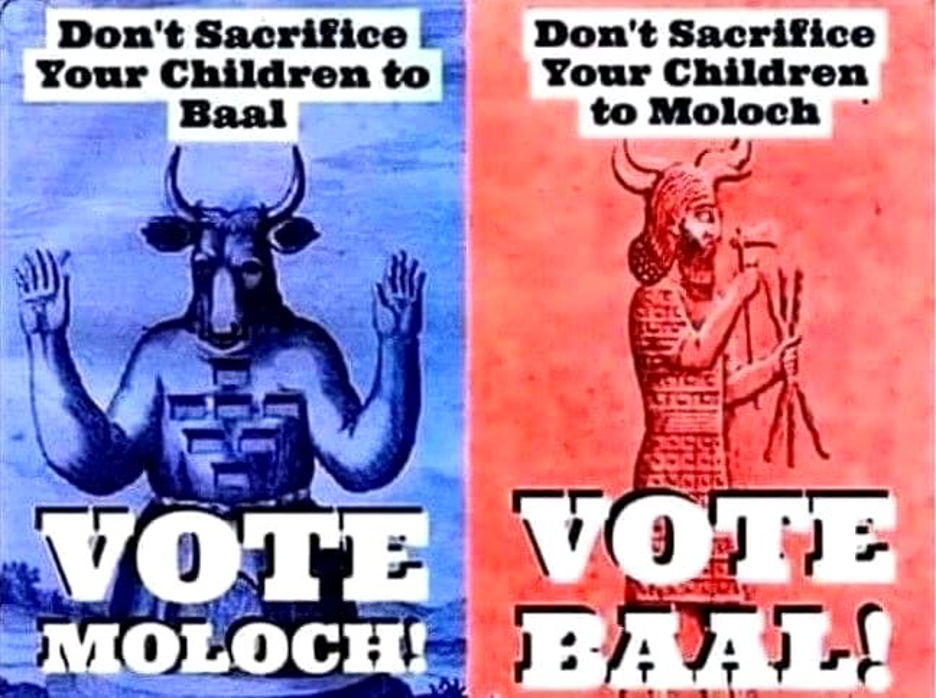

As far as the voting argument, people can vote for whomever they want — that's their right. However, I agree with Richard Maybury and plan on NOT voting for either major party candidate. To me, voting for either one would be throwing away my vote. Out of over 330 million people in this country, those two are the best we can do?

“Thanks again Dave. I look forward to seeing the daily FREE 5 Bullets and don't plan on canceling any of my subscriptions. KEEP UP THE GOOD WORK!”

Dave: An oldie but a goodie…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets