Apple Doesn’t Usually Do This…

![]() Apple Ventures Into Uncharted Territory

Apple Ventures Into Uncharted Territory

“Apple has been many things in its history, but it has rarely been called a ‘disruptor,’” says Paradigm’s tech-sector authority Ray Blanco.

“Apple has been many things in its history, but it has rarely been called a ‘disruptor,’” says Paradigm’s tech-sector authority Ray Blanco.

When you think about it, it’s true.

Rewind to when the late Steve Jobs announced the launch of the iPhone on Jan. 9, 2007. (Yes, that’s 17 years ago now. You’re old. Well, so am I.)

He announced three new products — “an iPod, a phone, an internet communicator.” He said it several times, several slightly different ways. And then he said, “Are you getting it? These are not three separate devices. This is one device. And we are calling it iPhone.”

We think of it as revolutionary today. But really, there was nothing revolutionary at all about putting a music player, phone and web browser in a single box. The iPhone was preceded by the BlackBerry and the Palm Treo, among other devices.

It was Jobs’ genius to put it in a slick, user-friendly package that made it a must-have gadget.

Same deal with the introduction of the iPod music player a few years earlier. It was preceded by the Diamond Rio and Sony’s Vaio. You don’t remember them because the iPod totally eclipsed them as soon as it was introduced in late 2001.

But come Friday, Apple will do something disruptive — and it promises to be just as lucrative as the iPhone and the iPod before it.

But come Friday, Apple will do something disruptive — and it promises to be just as lucrative as the iPhone and the iPod before it.

So says Paradigm’s venture capital and hedge fund veteran James Altucher.

See, after the iPod’s launch in 2001, AAPL’s share price exploded 2,500% by 2010.

Then in 2010, James forecast that AAPL would become the first company with a $3 trillion market cap.

That seemed like an insane projection at the time. AAPL’s market cap was under $300 billion. But sure enough, the value of Apple grew tenfold in just over a decade — touching $3 trillion in early 2022.

And James sees the same 10X opportunity starting with a major announcement Apple is making this Friday at 10:00 a.m. EST.

Only this time, you won’t make the big money by buying AAPL shares.

No, this time the opportunity lies elsewhere — and James is one of the very few to pinpoint it.

If you want to be in the know, James invites you to his Apple Market Disruption Event this Thursday at 7:00 p.m. EST. If you missed out on the chance to 10X your money buying AAPL in 2010, you won’t want to miss this exclusive briefing. Access is FREE — here’s the signup link.

![]() The Start of Something Big

The Start of Something Big

It’s as if the stock market is on the edge of something big right now — maybe good, maybe bad, but big regardless.

It’s as if the stock market is on the edge of something big right now — maybe good, maybe bad, but big regardless.

As mentioned yesterday, five of the “Magnificent 7” stocks report their earnings this week. Up first after the closing bell today is Microsoft and Google parent Alphabet. Also this week come Amazon, Facebook parent Meta and the aforementioned Apple.

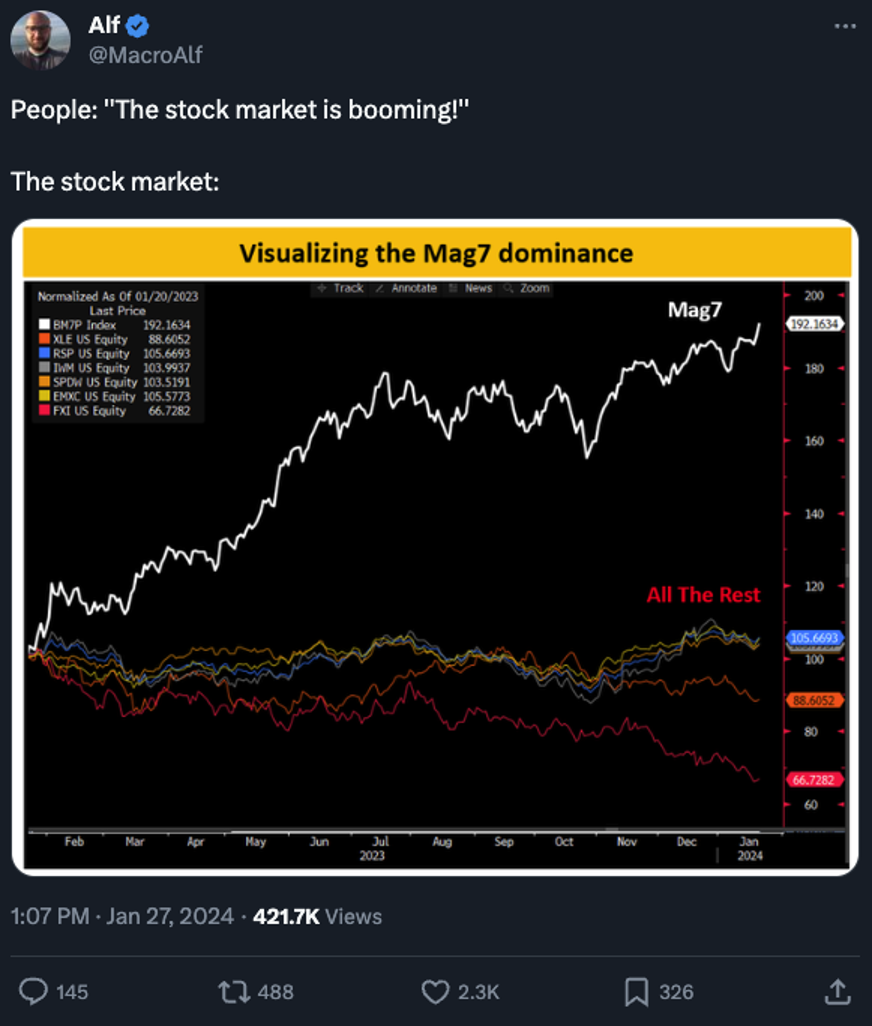

Reminder: It’s been the Mag 7 propping up the rest of the stock market for the last year…

Meanwhile, the Federal Reserve begins two days of meetings today. At the conclusion tomorrow, the Fed will issue its latest policy statement. No one expects a change to the benchmark fed funds rate, but Mr. Market will parse every word, pause and wheeze emanating from Fed chair Jerome Powell for clues about when rate cuts might begin later this year. Will it be in March? Or not until May? Or even later?

And then come the monthly job numbers on Friday — which could conceivably throw the Fed’s plans, whatever they might be, into a cocked hat.

So even with the S&P 500 setting another record close yesterday, a certain skittishness pervades Wall Street.

So even with the S&P 500 setting another record close yesterday, a certain skittishness pervades Wall Street.

“Just how much higher can the major averages stretch before they run out of steam and reverse?” asks Paradigm trading pro Greg “Gunner” Guenthner. “And… are we already seeing some cracks in this rally’s foundation?”

Gunner proceeds to answer his own question: “There’s no need to get your bear suits out of storage. I’m not thinking that we’re about to see the beginnings of a major secular downtrend. I do, however, think we could be in for a rocky few weeks leading up to the March rate decision.

Here, the past might be prologue: “If election year seasonality plays out, the majority of this year’s gains will be logged late in the year. But the first half will bring choppier, sideways action. That could also include a 5–10% pullback (or two!).”

Ahead of the market-moving catalysts starting with GOOG’s earnings release later today, the major indexes are in the red — if not by much.

Ahead of the market-moving catalysts starting with GOOG’s earnings release later today, the major indexes are in the red — if not by much.

The S&P 500 is a mere five points below yesterday’s record close at 4,922. The Dow is ruler-flat at 38,321. The Nasdaq is down less than a half percent at 15,559.

Precious metals have rallied modestly in the last 24 hours — gold to $2,033 and silver just over $23.

Crude continues to hold over $75, as it has since last Thursday, amid the elevated tensions in the Middle East. Gasoline prices are up a nickel in the last week, according to AAA. Word to the wise…

Bitcoin is over $43,000 for the first time since Jan. 13 — when the euphoria over federal approval of the Bitcoin ETFs was wearing off.

No, we don’t have anything to say about the Neuralink brain-chip implant. Our policy around here is that if we don’t have something unique (or at least something snarky) to say about a topic, we leave it be. Maybe some other time…

![]() Lights out in Germany

Lights out in Germany

“Germany is shrinking and deindustrializing. You can thank the Greens,” Jim Rickards writes his Strategic Intelligence readers.

“Germany is shrinking and deindustrializing. You can thank the Greens,” Jim Rickards writes his Strategic Intelligence readers.

The German economy shrank 0.3% last year, according to official statistics released a few days ago.

“As early as the mid-1990s, Germany fell victim to the Green New Scam,” Jim writes by way of background. “Former Chancellor Angela Merkel spent 14 years closing almost every coal-fired and nuclear power plant in Germany. She relied on cheap Russian natural gas to fill the gap while Germany went about building windmills and solar module panels to supply ‘renewable’ energy in the future.”

The scheme has blown up spectacularly in the last two years. Wind and solar are intermittent energy sources, dependent on breezes and sunshine. They can’t furnish the “baseload” power to keep power plants running reliably. Meanwhile the sabotage of the Nord Stream pipelines — likely at the hands of NATO or its Ukrainian allies — slowed the flow of Russian gas to a trickle.

“The result has been much higher energy costs for German industry,” Jim continues, “including its two biggest export sectors: chemicals and automobiles.

“The result has been much higher energy costs for German industry,” Jim continues, “including its two biggest export sectors: chemicals and automobiles.

“Industry has responded by outsourcing (I recently purchased a ‘German’ sports sedan and learned the engine was built in Hungary. I’m fine with that, Hungarians are smart and productive. But someone in Germany lost a job.)

➢ Bonus points: The International Monetary Fund is out this morning with its updated projections for 2024 economic growth in about a dozen major countries. Among the highlights — Germany growing an anemic 0.5% while Russia is set to grow 2.6%.

![]() JFK and the Fact-Checkers

JFK and the Fact-Checkers

And now a follow-up to my edition from November titled “From JFK to Jeffrey Epstein.”

And now a follow-up to my edition from November titled “From JFK to Jeffrey Epstein.”

Around the same time as I published that issue to coincide with the 60th anniversary of the JFK assassination, a popular 10-part podcast launched with the straightforward title Who Killed JFK?

Researched and hosted by Rob Reiner and Soledad O’Brien, diving deep into the work of the Assassination Records Review Board, Who Killed JFK? shreds the official narrative that the president was done in by a “lone nut” named Lee Harvey Oswald.

Instead, they assert Oswald was a patsy set up by a faction of top CIA and military officers, including the notorious CIA operative James Jesus Angleton.

That said, “the names of the shooters and the men behind them is less important than the reason it happened,” Reiner says toward the conclusion of the final episode.

“JFK represented progress. He wanted to move us away from nuclear annihilation and toward peace. Instead it prompted a coup that profoundly changed history.”

He went there. He called it a “coup.” And astoundingly, the mainstream “fact-checkers” aren’t calling him out on it — the way the mainstream has routinely piled on the claims of Oliver Stone and JFK’s nephew, Robert F. Kennedy Jr.

He went there. He called it a “coup.” And astoundingly, the mainstream “fact-checkers” aren’t calling him out on it — the way the mainstream has routinely piled on the claims of Oliver Stone and JFK’s nephew, Robert F. Kennedy Jr.

What gives?

Well, it helps that Reiner and O’Brien are both liberals who remain in good standing with the power elite — unlike Stone and RFK Jr.

Nonetheless, it’s passing strange that the legions of mainstream fact-checkers have held their tongues with Who Killed JFK?

“You can tell Reiner and O’Brien have the facts on their side because of the silence of the fact-checkers,” writes Jefferson Morley — the journalist who’s been fighting the CIA for release of JFK documents for over two decades.

PolitiFact and FactCheck.org have both kept their silence — because “to affirm Reiner and O’Brien’s findings would have broad political implications,” Morley writes at his Substack page.

You think there’s a lack of trust in “the system” now? It would be multiplied many times over if the gatekeepers and fact-checkers issued a “mostly true” verdict that JFK was done in by a coup. What would that say about the history of the “deep state” in the six decades since?

“Such a finding, these organizations may fear, will help Trump in his authoritarian project in 2024,” Morley continues. “It might be taken as an endorsement of RFK Jr.’s statements and a rebuke to his many critics in the media.

“So there’s a political incentive for many not to talk about the new JFK facts.”

Kudos to those of all political persuasions who are talking about the new facts anyway, damn the consequences.

![]() “Fear-Based Marketing” and “Low Values”

“Fear-Based Marketing” and “Low Values”

“Please remove me from this email list,” says the first item in today’s mailbag.

“Please remove me from this email list,” says the first item in today’s mailbag.

“The inclusion of content that invoked former first lady Michelle Obama to invoke horror and fear was quite the low-value decision. Thank you.”

We got a not-unrelated missive a few weeks ago. I’d been saving it for the right time. Today’s as good a time as any…

“While I have always enjoyed Jim Rickards’ insights,” this individual writes, “I have to say that the constant barrage of ‘fear of loss’ marketing campaigns via email absolutely make it clear to me that you are not value-driven.

“While I have always enjoyed Jim Rickards’ insights,” this individual writes, “I have to say that the constant barrage of ‘fear of loss’ marketing campaigns via email absolutely make it clear to me that you are not value-driven.

“Fear-based marketing is a scourge on liberty. Fear is the enemy of a free people. Please rethink your marketing. Everytime I get an email from you, I feel irritated. Is that your goal? Because I'm not the only one.”

Dave responds: First, I can’t resist sharing a meme I ran across a day or two ago…

Now, in all seriousness…

A critic might point out the newsletter biz has always run on fear, long before the internet came along.

I’ve previously cited Roger Babson’s warnings that the Roaring Twenties were destined to end in tears… and Harry Browne’s warnings that a “fiat” dollar with no tie to gold would unleash a torrent of inflation, ravaging the stock market throughout the 1970s.

Both of those predictions were “fear-based,” no doubt — but they both had the virtue of being right.

More to the point, those predictions did not exist in a vacuum. They were accompanied by something to do — actions to take to safeguard one’s wealth, one’s family, one’s future.

That’s still the ethos of our business. It’s not good enough to, say, scream into the ether about the dangers of a CBDC or central bank digital currency. Any rando on the web can do that and pay the bills by accepting ads on the side of the page for “male enhancement” supplements or whatnot. The reader comes away from such an experience feeling only depression or outrage or both.

But when Jim Rickards issued his “Biden Bucks” warning in mid-2022, he did something much more demanding.

But when Jim Rickards issued his “Biden Bucks” warning in mid-2022, he did something much more demanding.

By asking readers upfront for their money in exchange for information, he had to deliver high-quality information — a full-blown solution set enabling the reader to stand up to the tyranny of a CBDC.

That’s the whole idea behind his “Asset Emancipation” plan — giving the reader the tools to secure and even grow his or her wealth while hiding it safely from government surveillance and control.

So if you blanch at “fear-based” messages, you need to understand that at the end of the day our aim is to empower the reader — to give the reader a shot at a wealthier and freer existence than would be possible otherwise.

I’ll give the last word today to Paradigm Press publisher Matt Insley: “Contrarian ideas are often scary — and sometimes they come true.

“Should you hide in a pillow fort? Or should you enlighten yourself about potential threats to your wealth?”

Think hard about how you answer that question…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets