Better Than NVDA

![]() 2024’s Best-Performing Stock Is Not What You Might Think

2024’s Best-Performing Stock Is Not What You Might Think

As stellar as Nvidia’s share-price performance has been this year… it’s not the best performer in the S&P 500.

As stellar as Nvidia’s share-price performance has been this year… it’s not the best performer in the S&P 500.

No, that title goes to Vistra Corp.

NVDA is up 200% year-to-date. (We’ll talk more about its earnings release in Bullet No 3.) But VST is up 320%.

And what is Vistra, you ask?

It was founded only eight years ago — emerging from the ashes of an outfit that landed in Chapter 11 bankruptcy called Texas Competitive Electric Holdings.

Today, depending on which yardstick you use, it’s the biggest generator of electric power in the country. Through subsidiaries like TXU Energy and Dynegy, it supplies homes and businesses alike.

Obviously, that’s not the whole story. A boring utility stock doesn’t generate 320% gains inside of 12 months.

More than any other company, Vistra has ridden the wave of a trend we’ve been harping on all year — the prodigious demand that AI is placing on a fragile U.S. power grid.

More than any other company, Vistra has ridden the wave of a trend we’ve been harping on all year — the prodigious demand that AI is placing on a fragile U.S. power grid.

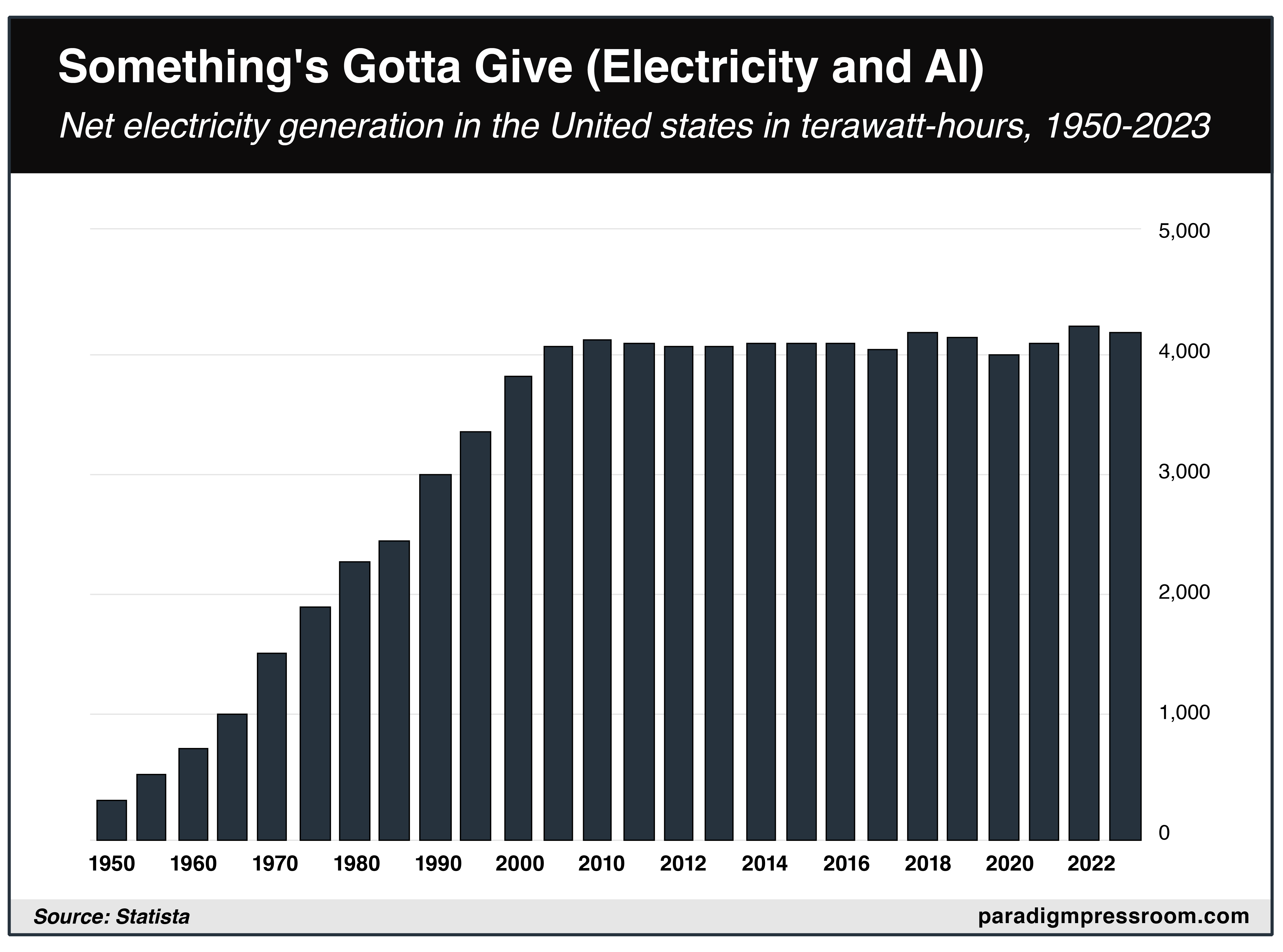

We’ll re-up a chart we shared over the summer — showing how the grid’s capacity hasn’t grown in over a decade.

At the start of this year, the International Energy Agency forecast that because of AI, data centers would account for 8% of all electric demand by the end of the 2020s — an 8X increase from early-2024 levels.

Wall Street has convinced itself that with a diverse portfolio of power sources — running the gamut from nuclear to coal to natural gas to solar — VST can achieve the best of all possible worlds. It can grow its capacity and furnish the always-on juice that AI needs without spending gobs of money on new plant and equipment.

Is Wall Street right? Who knows? It doesn’t matter to anyone who’s held onto VST shares during 2024. They’re very happy with their 320% gains, thank you very much.

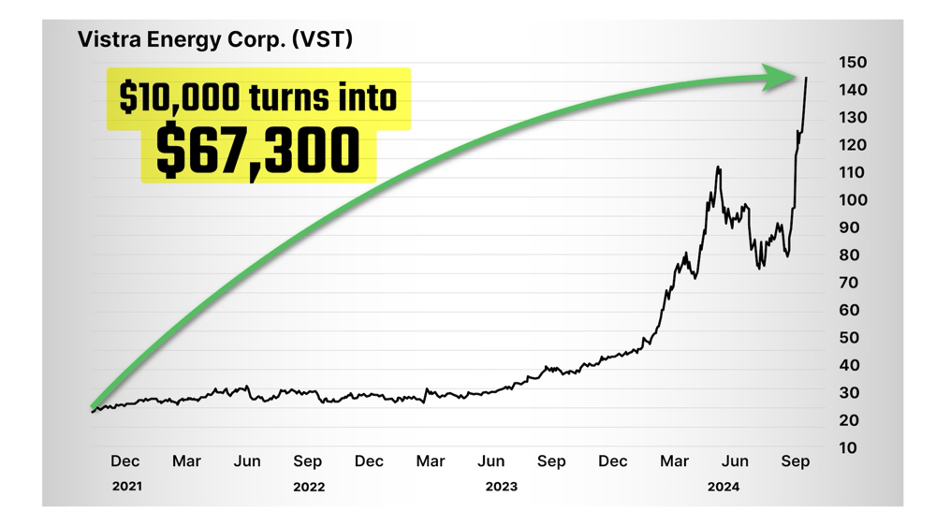

Here’s the thing: The potential for VST’s explosive performance was evident well before the first of this year — provided you knew where to look.

Here’s the thing: The potential for VST’s explosive performance was evident well before the first of this year — provided you knew where to look.

In fact, it was already evident in late 2021.

A stake of $10,000 invested back then would be worth over $67,000 now. And that’s not using options — just plain-vanilla VST shares.

An obscure chart pattern emerging in late 2021 was the tip-off — a pattern that can pinpoint the exact moment a stock is about to explode higher.

And this wasn’t a one-shot deal. This pattern was evident in every one of the top 10 performing stocks of 2024.

This pattern was brought to our attention by an ex-Wall Street pro who refused to play by Wall Street’s rules. Over the course of his career, he earned the nickname “The Maverick.”

This coming Tuesday morning, you’ll have a chance to meet The Maverick and learn all about how to put his know-how to work in your portfolio.

Join The Maverick for a live event next Tuesday, Nov. 26 at 10:00 a.m. EST and he’ll show you why the next 60 days will unlock massive and repeatable returns just like the VST example. Click here and we’ll save you a seat.

![]() Is Bitcoin a Safety Trade Along With Gold?

Is Bitcoin a Safety Trade Along With Gold?

Once more, gold is fulfilling its role as a safety valve when geopolitics goes off the rails.

Once more, gold is fulfilling its role as a safety valve when geopolitics goes off the rails.

On the heels of Washington’s green light for Ukraine to fire ATACMS missiles into Russia, Moscow has fired an intercontinental ballistic missile into Ukraine. The Financial Times tells us that until now, “no ICBM had been recorded as being used in conflict.”

On the one hand, an ICBM with a range of over 3,700 miles is overkill. On the other hand, this ICBM didn’t carry a nuclear warhead — and thank God for that. Seems like a calculated gambit by Moscow to retaliate without prompting an overreaction from the West.

Even so… the “escalation” dynamic is such that the betting markets are assigning a not-insignificant probability to a nuke going off somewhere in the world before year-end…

And with that, the gold price is now up over $100 in a week. At $2,667, it’s no worse than it was in late September — when $2,667 was a record high.

And with that, the gold price is now up over $100 in a week. At $2,667, it’s no worse than it was in late September — when $2,667 was a record high.

Gold’s bounce-back this week has come despite continued strength in the dollar relative to other major currencies: The U.S. dollar index now sits near 107, equaling its late-2022 highs.

Alan Knuckman — our eyes and ears at the Chicago options exchanges — says the next level to watch with gold is $2,675 — less than 10 bucks away.

That’s because $2,675 marks the halfway point between its late-October highs and its mid-November lows. Once gold breaks through that halfway point, it’ll be up, up and away again — with the next target a clean $3,000.

Too soon to say for sure, but maybe Bitcoin’s rally to record levels is also a flight-to-safety play?

Too soon to say for sure, but maybe Bitcoin’s rally to record levels is also a flight-to-safety play?

Yeah, yeah, we know about the news that the incoming Trump administration is looking to create some sort of crypto office within the White House.

But if younger generations look upon Bitcoin as digital gold — with a store-of-value role that other cryptos don’t necessarily have — perhaps Bitcoin is something of a fear trade right now, just like gold?

Whatever the case, the momentum is taking on a life of its own. Bitcoin trades for over $97,000 this morning — up from less than $90,000 a week ago.

As our resident crypto evangelist James Altucher said in this space on Election Day, a Trump win would set the stage for a rally to $95,000. “But markets have a funny way of gravitating toward round numbers,” he added. “In this case, that's $100,000.”

Almost there…

![]() Is That All There Is?

Is That All There Is?

The reaction to the most-anticipated earnings report of the quarter is… remarkably muted.

The reaction to the most-anticipated earnings report of the quarter is… remarkably muted.

Nvidia delivered its numbers after the closing bell yesterday. They beat the vaunted Wall Street analyst estimates on both revenue and earnings. Indeed earnings nearly doubled.

But rather than a whoo-party-time rally… or a buy-the-rumor-sell-the-news reaction… NVDA shares are oscillating within a fairly narrow range, down 1.4% as we write.

“The options market was pricing in a big move higher or lower,” Greg Guenthner writes his Trading Desk readers. “That doesn’t look like it’s going to happen… bad news for anyone betting on big volatility today.”

Perhaps one factor behind the meh reaction is NVDA’s rising costs. At least that’s what Jim Rickards’ senior analyst Dan Amoss surmises: “The biggest news from the call is gross margins are guided to the low 70%s from the current 75%,” he tells us — as production of the new high-end Blackwell chips continues to ramp up.

“The consensus gross margin is 73–74% over the next few quarters and that may fall a few percentage points. Engineering around all the constraints (networking, memory, latency) is challenging.”

The other “Magnificent 7” stock making news today is down 6% after a late-night smackdown from the feds.

The other “Magnificent 7” stock making news today is down 6% after a late-night smackdown from the feds.

The news broke last night after many folks in the Eastern Time zone had already gone to bed: As part of its ongoing antitrust case against Google, the Justice Department is asking a court to order the company to sell off its Chrome browser.

According to one tech-industry research firm, Chrome controls two-thirds of the global browser market. (The other one-third of us swore off Google’s privacy-compromising bloatware long ago.)

Google will surely fight this in court — but it probably can’t count on the Trump administration dropping the case. As the aforementioned Dan Amoss reminds us on the Paradigm Slack channel this morning, The Donald is well aware that Google’s YouTube is in the vanguard of the censorship-industrial complex.

With the Mag 7 names struggling, perhaps it’s not surprising that the Nasdaq is the laggard among the major U.S. stock indexes today — down a quarter-percent at last check, unable to reclaim 19,000.

With the Mag 7 names struggling, perhaps it’s not surprising that the Nasdaq is the laggard among the major U.S. stock indexes today — down a quarter-percent at last check, unable to reclaim 19,000.

Instead, it’s Papa Dow’s turn to take the baton — up nearly 1% and back within about 200 points of the 44,000 level. The S&P 500 is up a third of a percent at 5,936.

“The Trump Stock Euphoria Starts to Fade,” is The Wall Street Journal’s hot take. Which might be true.

At the same time, it could be equally true that the market simply shot up too far, too fast in the days after Election Day. But you can’t make a click-baity headline out of that…

![]() A Very Strange “Bribery” Indictment

A Very Strange “Bribery” Indictment

What, exactly, is the Justice Department’s rationale for prosecuting the Indian billionaire Gautam Adani?

What, exactly, is the Justice Department’s rationale for prosecuting the Indian billionaire Gautam Adani?

As this morning’s Wall Street Journal tells it, Adani is accused of “orchestrating a massive bribery scheme to pay off Indian government officials to secure lucrative solar-energy supply contracts.”

See, this is how it works when you presume to be “the economic policeman of the planet,” as France’s finance minister once described the United States: You prosecute people overseas for bribing their own government officials.

To be sure, the indictment also accuses Adani of “misrepresenting” his firm’s anti-bribery and anti-corruption practices to its American investors and lenders.

But that begs the question of whether those investors and lenders believe Adani hoodwinked them. Really, are there any Americans claiming to be victims here?

There’s nothing in the indictment to that effect — which suggests that overzealous prosecutors are using “misrepresentation” as a ruse to go after Adani for other reasons they won’t yet disclose.

I dunno, maybe it’s just me. But if you’re in Washington, D.C... and your status as “the world’s sole superpower” is hanging by a thread… and the nation-state that’s home to one out of six humans on Earth is deftly playing off Washington against Beijing and Moscow…

… well, it’s probably a dumb idea to prosecute the second-richest guy in that country on a flimsy pretext, especially when he’s besties with the guy who’s been prime minister for over 10 years now.

In other words, the indictment will almost surely drive New Delhi closer to its BRICS comrades. Which presumably is not what the American power elite wants?

Just sayin’...

![]() Mailbag: When Theology Meets Policy

Mailbag: When Theology Meets Policy

After a few days’ pause, readers are once again pushing back as I question the “America First” bonafides of the early Trump appointees.

After a few days’ pause, readers are once again pushing back as I question the “America First” bonafides of the early Trump appointees.

Last Friday, I mentioned that Defense Secretary-designate Pete Hegseth expressed the hope in 2018 that the Third Temple will be built on the site of the Temple Mount/Al-Aqsa Mosque in Jerusalem.

“Why is that wrong?” a reader asks.

“Going by the testimony of the very Book all sides over there purport to revere, that land (including the Temple Mount) remains title deeded to the sons of Jacob, and never to any Arabs (i.e., other descendants of Abraham).

“You seem to be interpreting the Middle Eastern intrafamilial inheritance feud through an inappropriate Western and first-world, non-secular framework. Almost no one over there wants a two-state solution or shared control over anything. When speaking candidly, the Arabs say they are on religious jihad against Israel, and they will only back down in the face of overwhelming power. It is demonstrably just about that simple.

“Israel will have relative peace to the extent it takes and dominates the land described in the Bible as belonging to the Israelites. The Arabs ought to repatriate their own on their own Arab lands, and thus bring an end to using more than a million Arab refugees as pawns... after all, those refugees are their brethren, and in 1948, it was the surrounding Arab nations in the first place who bore the largest share of responsibility for their plight.”

Dave responds: The last thing I’m going to do in a financial e-letter is engage in a theological debate.

Your beliefs are your business — unless you, or Pete Hegseth or Mike Huckabee, wish to make them the basis of public policy.

In that case they become 1) everyone’s business and 2) a grave First Amendment concern, given the prohibition on any law (or regulation or policy) “respecting an establishment of religion.”

It is passing strange that an incoming administration supposedly committed to “America First” is so devoted to the well-being of a foreign government seeking to expand its territory. But here we are: Israel’s settler movement calls the Trump appointees a “dream team.”

I remember what a (relatively) free country this was before the Sept. 11 attacks. Bin Laden’s foot soldiers were upfront about their prime motive — U.S. support for Israel. The lead hijacker Mohammed Atta said he was radicalized the moment in 1996 when Israel shelled the Qana refugee camp in Lebanon, killing 106.

But the Bush administration sold the American public a bill of goods about how “they hate us for our freedoms” — then began stripping us of those very freedoms.

The loss of liberties since has been relentless: The power elite couldn’t have pulled off COVID lockdowns, restrictions and mandates if they hadn’t first laid the groundwork with the Patriot Act and “See something, say something.”

I’ve already lived through one 9/11. I really don’t care to live through another.

But the longer that American leaders of both parties continue to ignore George Washington’s warnings about “sympathy for a favored nation”... the higher the risk of a repeat.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets