Big Brother, Now Powered by AI

![]() Big Brother, Now Powered by AI

Big Brother, Now Powered by AI

“2024 is the year Minority Report is coming true,” says Paradigm’s venture capital veteran James Altucher.

“2024 is the year Minority Report is coming true,” says Paradigm’s venture capital veteran James Altucher.

Welcome in to our second and final day wrapping up the epic 7 Predictions Summit – presented live to an online audience of 7,300 on Wednesday afternoon. And it went over extremely well: “This whole Zoom presentation is over-the-top outstanding,” enthused one attendee.

As I suggested toward the end of yesterday’s opportunity-themed edition of 5 Bullets, today’s edition will be somewhat darker. Nonetheless, the objective is the same — to help you prosper no matter what’s going on in the markets, the economy or the world at large.

To refresh your memory, Minority Report was the 2002 Tom Cruise movie that coined the creepy expression “precrime.”

To refresh your memory, Minority Report was the 2002 Tom Cruise movie that coined the creepy expression “precrime.”

From Wikipedia’s plot summary: “In 2054, the federal government plans to nationally implement the Washington, D.C., prototype ‘Precrime’ police program, which has been operating for six years.

“Three clairvoyant humans (‘precogs’) receive psychic impressions of an impending homicide, and officers analyze their visions to determine the location and apprehend the perpetrator before the crime can occur. Would-be killers are placed in an electrically induced coma and held in a panopticon-like prison facility.”

Maybe you already see where we’re going with this: Who needs precogs housed in a place called “the Temple” when you’ve got artificial intelligence?

Maybe you already see where we’re going with this: Who needs precogs housed in a place called “the Temple” when you’ve got artificial intelligence?

Before we go any further, James is keen to accentuate the upside of AI: “AI is the first technology I’ve seen where the hype equals the reality,” he said on Wednesday.

Yep, more so than the internet. Coming from a guy who designed the first websites for corporate clients like American Express, HBO and Disney, that’s quite the statement.

The allure of AI is so strong, it overpowers the gloomy zeitgeist of recession, war and political anger: “People are very enthusiastic about new innovations happening right now,” James says.

Governments are also enthusiastic — about the potential for AI to identify acts of fraud and terrorism, possibly before they ever go down.

Governments are also enthusiastic — about the potential for AI to identify acts of fraud and terrorism, possibly before they ever go down.

AI can process gobs of data in a way mere mortals at America’s three-letter agencies cannot.

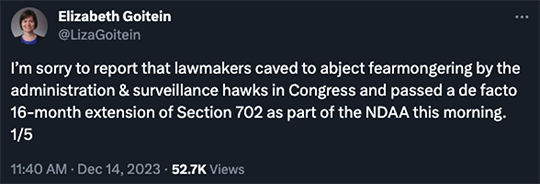

Yes, the potential for abuse is massive — especially since Congress just reauthorized Section 702 of the Foreign Intelligence Surveillance Act, over the objections of civil liberties-minded Democrats and Republicans alike. (It takes a lot to bring both AOC and MTG together on the right side of an issue!)

Theoretically, Section 702 allows the feds to eavesdrop on foreigners’ electronic communications abroad. But as a practical matter, millions of Americans get swept up in this cyber-dragnet — no warrant required. In recent years, Section 702 has been used to go after everyone from BLM activists to Jan. 6 protesters.

Yes, it’s totally investible — in the sense of “you can’t stop the madness so you might as well make money off it.”

Yes, it’s totally investible — in the sense of “you can’t stop the madness so you might as well make money off it.”

To date, the big player in this AI-enabled cybersecurity space has been the Peter Thiel-founded Palantir (PLTR). But by now, James says PLTR is richly valued at 15 times sales. (Not earnings, sales!)

In contrast, James identified a much smaller under-the-radar name during the 7 Predictions Summit — still valued at a mere 1X sales.

It’s totally understandable if you want to pass on this opportunity — but if you want to give it your full consideration, you can review James’ portion of the 7 Predictions Summit at this link. It covers a lot of ground, including his agreement with Jim Rickards (!) that a 2024 recession is in the bag.

![]() Dollar Death Spiral, the Next Chapter

Dollar Death Spiral, the Next Chapter

As if an AI-empowered surveillance state isn’t bad enough, we’ve got the death of the petrodollar to contend with.

As if an AI-empowered surveillance state isn’t bad enough, we’ve got the death of the petrodollar to contend with.

That was the theme of Paradigm’s energy and military-affairs authority Byron King on Wednesday. “For half a century,” he said, “the petrodollar has been the foundation for the growth of U.S. government spending as well as national liquidity and solvency.”

We went in depth about the petrodollar only a few days ago, but to recap: After Washington backed Israel in the Yom Kippur War of 1973 and Arab nations imposed an oil embargo… the United States struck a deal with Saudi Arabia. Saudi Arabia agreed to price its oil in U.S. dollars and use its clout to get other OPEC nations to do likewise. In return, the U.S. government protected Saudi Arabia and its allies against foreign invaders and domestic rebellions.

We also described how serial blunders in Washington are dooming the petrodollar, but Byron brought a new dimension to the discussion: “If the issue was ‘just money’,” he says, “the petrodollar might be OK.”

But it’s not: America’s security guarantees to the House of Saud and the other Gulf sheikdoms look shaky indeed after the debacles of Iraq, Afghanistan and Ukraine. And yes, Ukraine is a debacle, Byron says: “In 22 months, Ukraine has lost three armies and the fourth is dying this winter. Russia has defeated and/or wrecked everything that Ukraine-U.S.-NATO has thrown into battle.”

The result is that come New Year’s Day, the BRICS grouping of countries will effectively become BRICS+OPEC.

The result is that come New Year’s Day, the BRICS grouping of countries will effectively become BRICS+OPEC.

Brazil, Russia, India, China and South Africa are about to be joined by three powerful petrostates — Saudi Arabia, Iran and the United Arab Emirates.

Saudi Arabia is already selling oil to China and taking yuan in return. “It is crystal-clear obvious,” says Byron, “that the Saudis are backing away from the U.S. security guarantees that are the foundation of the petrodollar.”

Long story short — you can see Byron’s full presentation here — the result is a flood of dollars currently sloshing around overseas are about to come flooding home.

You thought inflation was bad during 2022? Wait till the petrodollar deal comes undone: “It’ll be like a dam break.”

How to invest? “Gold and energy are a great place to be,” says Byron — who recommended three ETFs you should absolutely include in your portfolio. Once more, here’s the link to Byron’s portion of the Summit.

![]() A Winning Play No Matter What Oil Prices Do

A Winning Play No Matter What Oil Prices Do

In contrast to James and Byron, Jim Rickards’ big call for 2024 seems positively… well, upbeat isn’t the right word, but…

In contrast to James and Byron, Jim Rickards’ big call for 2024 seems positively… well, upbeat isn’t the right word, but…

As noted above, Jim believes a 2024 recession is a near-certainty and indeed might well be underway. But if you’ve been reading these missives regularly, you probably know that already.

Here’s the thing: While oil prices typically crater during a recession — they collapsed from $147 to $33 during the 2008 financial crisis — oil prices might remain elevated during a 2024 recession.

That’s because unlike nearly every other asset class, oil is subject to “market manipulation by sovereign states,” says Jim.

And as it happens, Jim believes the three biggest oil-producing nations in the world all have an incentive to keep oil prices elevated.

And as it happens, Jim believes the three biggest oil-producing nations in the world all have an incentive to keep oil prices elevated.

- Saudi Arabia needs high oil prices to buy off its restive population with bread and circuses, while keeping the Saudi princes in the lavish lifestyle to which they’re accustomed. “Saudi needs $75 oil just to meet its budget,” says Jim

- Russia needs high oil prices to finance its war effort in Ukraine

- The United States under the Biden administration is limiting oil production with an aim of keeping prices high — so as to “nudge” Americans away from fossil fuels and into electric vehicles.

To be sure, there’s no guarantee that manipulations on the parts of Saudi Arabia, Russia and the United States can keep oil prices elevated. Indeed, Jim won’t rule out $45 oil in the event of recession. (Checking our screens, it’s a hair above $71 this morning.)

Jim says the surest bet to cover both eventualities is… the two American oil producing giants, Exxon Mobil (XOM) and Chevron (CVX).

Jim says the surest bet to cover both eventualities is… the two American oil producing giants, Exxon Mobil (XOM) and Chevron (CVX).

Obviously if crude prices remain elevated, XOM and CVX are in great shape.

But they’re still in great shape if oil prices fall. They’ll benefit from falling interest rates, falling labor costs and falling transportation costs.

In addition, both companies recently announced strategic acquisitions — Exxon buying out Pioneer Natural Resources and Chevron acquiring Hess. Jim says both of these deals will create new economies of scale that the market is not yet pricing in.

[Disclosure: Jim says he has a small position in CVX. Should he decide to part with it, he’ll give readers a heads-up before he actually sells.]

![]() The 2024 AI Shakeup

The 2024 AI Shakeup

AI was also the focus of Paradigm’s tech-and-biotech authority Ray Blanco — and he warned that the AI plays that worked in 2023 won’t work in 2024.

AI was also the focus of Paradigm’s tech-and-biotech authority Ray Blanco — and he warned that the AI plays that worked in 2023 won’t work in 2024.

As mentioned yesterday, the AI story of this year was Nvidia — which staged a 225% rally on the strength of its high-end chips that are ideal for the demanding tasks of chatbots like ChatGPT. Nvidia “can’t make enough of these chips,” says Ray — and until now, it was the only game in town.

In recent weeks, Advanced Micro Devices (AMD) has come in the market with chips Ray says are “competitive with any specs Nvidia makes” — and at a much more attractive price. Meanwhile, Intel plans to jump into the space next year. “2024’s going to be the year to buy the laggards,” Ray advises.

Also in 2024, Ray sees AI transforming the beaten-down biotech sector — and not a moment too soon, given that a typical biotech ETF is in line to end 2023 in the red for a third year running.

Also in 2024, Ray sees AI transforming the beaten-down biotech sector — and not a moment too soon, given that a typical biotech ETF is in line to end 2023 in the red for a third year running.

AI can dramatically accelerate the development of new drugs — and improve the odds of success. At present, 90% of trials end in failure at a cost of $2.6 billion. But with AI performing much of the preliminary work, all that starts to change.

“We’re probably going to see an AI-specific biotech ETF” next year, says Ray. But in the meantime, he suggests the SPDR S&P Biotech ETF (XBI) — which is geared toward small-cap developmental-stage companies and not the lumbering pharma giants. Ray sees XBI jumping 50% next year.

If you want a specific name with much higher potential, Ray identified one during his talk that’s absolutely worth a look: “They’ve spent 10 years building this AI-driven discovery engine,” he says. Here’s a link to Ray’s presentation during the 7 Predictions Summit.

![]() The Markets and the Mailbag (Costco Gold Redux)

The Markets and the Mailbag (Costco Gold Redux)

A wild week in the markets is winding down quietly.

A wild week in the markets is winding down quietly.

The major U.S. stock indexes are all in the green, but only the Nasdaq is up meaningfully — by a half percent at 14,838. If that holds, it’ll be another year-to-date high… but it’s still nearly 8% below the November 2021 record.

Treasury yields are meandering, the 10-year note at 3.92%.

Gold is holding its own at $2,035, silver at $24.02. Bitcoin is back below $42,000 for the moment.

The big economic number of the day is industrial production — up 0.2% in November, a little less than expected. Manufacturing rebounded with the end of the auto worker strike. Energy production and mining also expanded, while utility output shrank.

All told, 78.8% of America’s industrial capacity was in use last month. This number has spent most of 2023 below the 50-year average of 79.7%.

To the mailbag: “Dave, Emily — Is it just me or did gold and silver prices make nice moves overnight without getting smashed — plus open strong?

To the mailbag: “Dave, Emily — Is it just me or did gold and silver prices make nice moves overnight without getting smashed — plus open strong?

“I know, I’m probably jinxing them again by mentioning that. Last week was ugly, not surprisingly, after the big milestones and moves into the prior weekend.

“But look, no 0-dark-30 raids this time!

“I’ll crawl back under my rock now.”

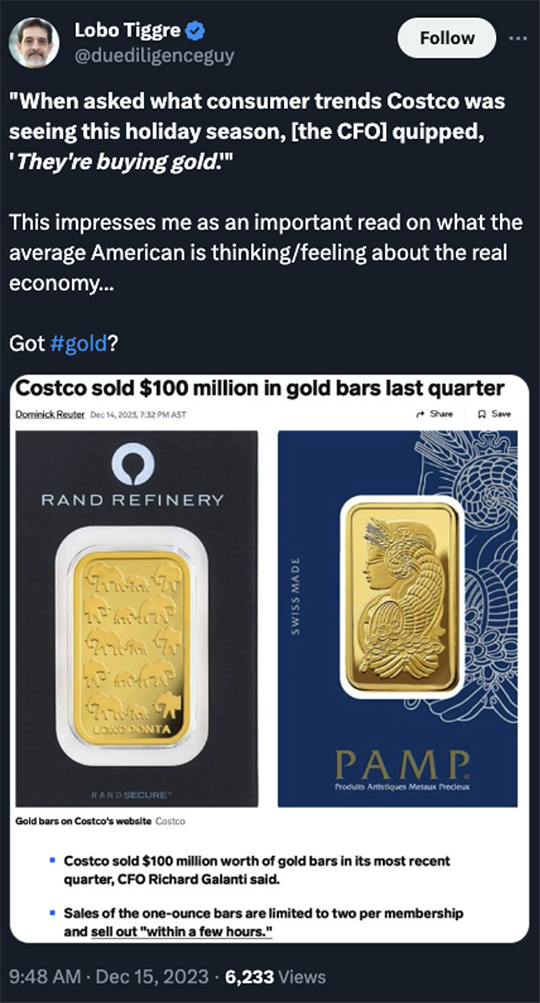

Dave responds: Costco reported its quarterly numbers after the closing bell yesterday, and guess what some of the Q&A on the conference call was about…

As we mentioned in September, Costco is selling these bars at an extremely slender premium over spot — and Costco’s gold gambit might well disrupt the market for one-ounce coins and bars.

Anyway, it’s mighty telling about the mood out there when you consider COST’s customer base is a little more affluent than average, no?

Have a good weekend,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets

P.S. The positive feedback we got from viewers after the 7 Predictions Summit was simply mind-blowing. Just one example…

It’s rare when we bring all of our experts together at one time to share their best ideas.

But did you know a select circle of our readers has access to our entire team — all the time? They’ve secured the “Master Key” to our business.

It’s not for everyone — but if you enjoyed more than one editor’s talk on Wednesday, it might well be for you.

We keep the available spots strictly limited — and even if we don’t hit the limit later today, we’re taking this offer off the table at midnight tonight. Head to the website 221spots.com to explore the privileges and benefits of membership.