Big Tech’s Wake-Up Call

![]() DeepSeek: The Impact

DeepSeek: The Impact

When it comes to the big market-moving story of the day (week? year?)... different generations react in different ways…

When it comes to the big market-moving story of the day (week? year?)... different generations react in different ways…

- Boomers: OMG, my retirement is tanking!

- Xers: Ooh, I better download this DeepSeek thing.

- Millennials/Zers: What’s a sputnik?

Let’s take each of these in reverse order. We’ll save the market impact for last because it could easily last beyond today — and turn out to be the prelude to something even bigger.

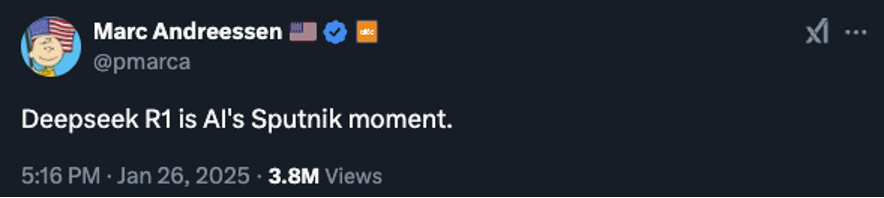

It was the venture capitalist Marc Andreessen — an Xer who developed the first widely used web browser in the 1990s — who piqued the curiosity of younger generations…

It was the venture capitalist Marc Andreessen — an Xer who developed the first widely used web browser in the 1990s — who piqued the curiosity of younger generations…

If you’re young enough and your public-school education was inadequate enough, Sputnik was the first artificial Earth satellite — launched by the Soviet Union in 1957.

As legend has it, the “Sputnik moment” was a wake-up call for Americans to get their butts in gear when it came to science and space, leading ultimately to the moon landing in 1969.

(Whether that’s actually true is a story for another day…)

Sputnik is suddenly “a thing” because a little-known Chinese firm has come up with an AI model that supposedly is leapfrogging anything out of Silicon Valley to date.

Sputnik is suddenly “a thing” because a little-known Chinese firm has come up with an AI model that supposedly is leapfrogging anything out of Silicon Valley to date.

DeepSeek, it’s called. One week ago today, the company released a paper describing the model behind it. If the hype can be believed, it’s more capable than ChatGPT — capability achieved without high-end American semiconductors.

Even more impressive, this capability was supposedly achieved at the paltry cost of $6 million, a fraction of the coin laid out by the likes of OpenAI and Google.

By yesterday, DeepSeek became the most-downloaded app at Apple’s App Store — a fact Chinese state media are keen to trumpet this morning…

Our Xer colleague Sean Ring put DeepSeek through its paces this weekend. “It’s the real deal,” he writes in our sister e-letter The Rude Awakening.

Also significant: The company behind DeepSeek is not one of China’s tech giants like Alibaba or Tencent. It got its start in 2021 as a side hustle for a hedge fund manager named Liang Wenfeng.

On to the market impact. That deserves a bullet of its own today…

![]() DeepSeek: The Fallout

DeepSeek: The Fallout

If everything DeepSeek says is true, it blows up nearly every assumption U.S. tech companies have built into their business plans. Which is why the stock market is in a minor meltdown.

If everything DeepSeek says is true, it blows up nearly every assumption U.S. tech companies have built into their business plans. Which is why the stock market is in a minor meltdown.

Tens of billions of dollars for data centers? Gigawatts of power consumption? Armies of developers? What if none of it is necessary?

With that, AI chip darling Nvidia is down 12.7% at last check.

As you might recall, Paradigm trading pro Enrique Abeyta’s signature prediction for 2025 is that $1 trillion would be slashed from NVDA’s market cap. Using NVDA’s all-time intraday peak as the starting point — only three weeks ago today — we’re more than 80% of the way there.

Even before DeepSeek burst on the scene, Enrique was getting “Cisco” vibes from Nvidia.

Even before DeepSeek burst on the scene, Enrique was getting “Cisco” vibes from Nvidia.

Cisco was one of the darlings of the dot-com boom along with Microsoft, Intel and Dell. At the peak of the bubble in 1999 and early 2000, corporate customers couldn’t get enough of Cisco’s routers and switches.

But the buildout of the internet got ahead of itself; as a result, sales dried up and Cisco’s revenue ended up falling for three years before resuming a steady march higher. (Meanwhile, CSCO’s share price still hasn’t equaled its 2000 peak.)

“Competitors to CSCO who were way behind either caught up with better products or with attractive pricing,” says Enrique. “The product wasn’t as good, but it was a lot cheaper, more available and ‘good enough.’

“This is what I think eventually happens to NVDA.”

Note well: Enrique wrote that for our Truth & Trends e-letter on Thursday — before DeepMind freaked out the entire U.S. tech sector.

The freakout extends beyond Nvidia, to be sure.

The freakout extends beyond Nvidia, to be sure.

The chip companies are taking it the worst… but the tech giants dumping bazillions into “large language models” are in the red as well — Microsoft by 3% as we write, and Google parent Alphabet by 2%.

(Heh — MSFT reports earnings on Wednesday afternoon. The conference call could be interesting.)

The tech-heavy Nasdaq as a whole is down 2.3% on the day. The S&P 500 is off 1.5% or 90 points — but it’s still holding the line on 6,000. In contrast, the Dow is barely in the red.

The sell-off extends beyond stocks, too: Gold is down $40 to $2,730 and silver has broken below $30. Crude is down over a buck to $73.53. Bitcoin is back under $100,000.

As much as today is a jolt… there’s something else coming into view that’s likely much bigger.

As much as today is a jolt… there’s something else coming into view that’s likely much bigger.

In recent days we’ve been telling you about Mason Sexton — the newest member of the Paradigm team, a 40-plus year market veteran and perhaps the best market timer in history.

He nailed the start of an 18-year bull market in 1982. He called the crash of 1987. He called the bottom of the financial crisis in 2008–09. And at the very bottom of the COVID crash in March 2020, he recommended 13 stocks — all of which could have made you a fortune if you’d acted on his recommendation.

While Mr. Sexton was a media sensation for his bang-on calls in the 1980s, he then dropped out of sight for over three decades — advising only high-end private clients.

But his newest big call is so important, he’s seeking a bigger platform that can benefit everyday Americans like you.

Not just anyone, though. Only paid subscribers to a Paradigm Press publication will have access to his first event for us — this Wednesday at exactly 11:02 a.m. EST.

At that time, he’ll tell you about a significant event on the horizon unlike anything we’ve seen in decades.

And it could hit America in the next eight weeks.

We still have slots available for this event called The Prophecy. But they’re filling up fast. You can confirm your spot and RSVP right here

![]() DeepSeek’s Triumph: Made in America

DeepSeek’s Triumph: Made in America

Assuming DeepSeek’s claims are true, “credit” goes in large part to the Biden administration.

Assuming DeepSeek’s claims are true, “credit” goes in large part to the Biden administration.

On Friday at our sister e-letter The Daily Reckoning, contributor Adam Sharp reminded us that in 2022, Team Biden cut off Chinese access to Nvidia’s cutting-edge graphics processing units. At that time, those Nvidia GPUs were the only hardware suitable for AI.

“These tech sanctions have backfired spectacularly,” Adam writes. “We cornered China and gave them only one way out: innovation. It appears they have met the challenge. They learned to build cutting-edge AI applications without high-end Nvidia GPUs. As a result, they can now build models for a tiny fraction of the cost we do…

“If we had simply let China have access to top Nvidia chips, these breakthroughs probably wouldn’t have happened for years. They wouldn’t have needed to. And Nvidia would have sold a LOT more chips. Now China has its own competing chips, and is making the most of its hardware by maximizing efficiency.”

But don’t take it from us, take it from this morning’s Financial Times…

After Washington banned Nvidia from exporting its most powerful chips to China, local AI companies have been forced to find innovative ways to maximise the computing power of a limited number of onshore chips — a problem Liang’s team already knew how to solve. “DeepSeek’s engineers know how to unlock the potential of these GPUs, even if they are not state of the art,” said one AI researcher close to the company.

That said, there’s plenty of blame to go around. As the Council on Foreign Relations pointed out in a commentary last fall, the limits on exports of chips and chipmaking equipment began during the Trump 45 administration. Biden just piled on more of those limits.

One final thought before we move on to other matters: Will the feds look for some “Chinese spying” or “Chinese propaganda” excuse to ban DeepSeek — just as they sought to ban TikTok?

One final thought before we move on to other matters: Will the feds look for some “Chinese spying” or “Chinese propaganda” excuse to ban DeepSeek — just as they sought to ban TikTok?

After all, the legislation banning TikTok gives the president the authority to ban any app or website that’s foreign-owned (or even subject to “foreign influence”).

![]() Copper’s Moment to Shine

Copper’s Moment to Shine

It’s not just oil that’s in line to get a lift from the Trump administration. There’s copper, too.

It’s not just oil that’s in line to get a lift from the Trump administration. There’s copper, too.

The global mining giant Rio Tinto is hoping the White House will put an end to a 12-year permitting battle over its Resolution copper mine in Arizona. “I do think that we have really good chances now to progress that project,” CEO Jakob Stausholm tells the Financial Times.

Rio holds the majority stake in the project, 55%. Another global giant, BHP, owns the other 45%. Once in production, it would be the biggest copper mine in North America, meeting 25% of U.S. demand.

For all the headlines about an economic slowdown everywhere in the world except the United States, the price of copper has held up remarkably well. At $4.30 a pound this morning, it’s down from a peak over $5 last spring… but higher than it was a year ago.

“Copper can finally breathe now,” says Alan Knuckman, our eyes and ears at the Chicago options exchanges. “There’s good risk-reward there.”

And our metals-and-mining maven Byron King is watching for possible takeover activity. Both Rio Tinto and BHP are looking for attractive acquisitions. Stay tuned…

![]() Air Canada Skates for an Epic Screw-up

Air Canada Skates for an Epic Screw-up

Now for an insane postscript to what we described last year as “the gold heist of the century.”

Now for an insane postscript to what we described last year as “the gold heist of the century.”

In 2023, thieves in Canada made off with 6,500 gold bars worth $14.6 million. The bars had arrived at Pearson Airport in Toronto on an Air Canada flight from Zurich, Switzerland. One of the thieves showed a phony airway bill — and that was good enough to take possession of the bars weighing about 880 pounds, which they hauled away in a box truck.

By one reckoning, that made for the sixth-biggest gold heist in history. Nine men are either under arrest or still at large.

As we mentioned in April 2024, Brink’s sued Air Canada for fouling up the transfer of the gold. Brink’s was out millions to a Swiss bank and a precious metals refiner — and sought full compensation from Air Canada.

Long story short, the two sides bickered in court over whether all the paperwork was filled out properly. (For its part, Brink’s said a form with the words “GOLD-GOLD-GOLD-GOLD-GOLD-GOLD-GOLD-GOLD-GOLD-GOLD-GOLD-GOLD” should have tipped someone off that the shipment deserved special care.)

For reasons left unexplained in this article from Canada’s National Post, the judge ruled Air Canada owed Brink’s compensation denominated in special drawing rights. SDRs are a sort of “super-currency” issued by the International Monetary Fund and circulated among governments and central banks. (It seems Air Canada’s liability limits for baggage losses on plain-ol’ passenger flights are denominated in SDRs as well. Who knew?)

At current exchange rates, the compensation of 9,988 SDRs works out to… C$18,600 or $12,921.05.

As you might imagine, Air Canada is doing the proverbial victory lap. “We are pleased with this decision by the court upholding our position on this matter,” says a company flack.

No official comment from Brink’s yet. Presumably that’s because the unofficial comment is something we couldn’t publish in a family e-letter?

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets