Blackouts… Powered by AI?

![]() Blackouts… Powered by AI?

Blackouts… Powered by AI?

It took exactly three months for a burning issue to make it from our humble daily dispatches to the front page of the Financial Times…

It took exactly three months for a burning issue to make it from our humble daily dispatches to the front page of the Financial Times…

Back in January, the power elite were gathered at the World Economic Forum’s annual shindig in Davos, Switzerland — oohing and aahing about the possibilities of artificial intelligence.

What they weren’t talking about was where all the electricity was going to come from to power ever-more robust forms of AI.

But Paradigm’s tech-investing authority Ray Blanco was: “The rapid growth in internet traffic and cloud computing has led to skyrocketing energy demands for data centers around the world,” he said in these 5 Bullets on Jan. 18.

In years past, the biggest demand came from video. No more: Now it’s AI.

“This results in a massive challenge for data center operators,” said Ray, “struggling to support relentless growth in traffic and power consumption.”

In the three months since Ray said that, a typical data center’s computing power needed to double just to keep pace with the demands of AI.

In the three months since Ray said that, a typical data center’s computing power needed to double just to keep pace with the demands of AI.

It will double again three months from now. And so on…

About three weeks ago, The Wall Street Journal’s editorial board sat up and took notice. “Projections for U.S. electricity demand growth over the next five years have doubled from a year ago,” the editors wrote.

“Electricity demand to power data centers is projected to increase by 13–15% compounded annually through 2030. Yet a shortage of power is already delaying new data centers by two–six years, according to commercial-real estate firm CBRE Group. It is also driving Big Tech companies into the energy business. Amazon this month struck a $650 million deal to buy a data center in Pennsylvania powered by an onsite 2.5 gigawatt nuclear plant.”

Enlightening, no? But that was on the editorial pages. If you read only the news pages, you might have seen the item about Amazon’s nuke plant, but you wouldn’t have necessarily put two and two together.

Finally, the Journal’s salmon-colored British competition stepped up to the plate today — three months after we tipped you off.

“Electricity supply is becoming the latest chokepoint to threaten the growth of artificial intelligence, according to leading tech industry chiefs, as power-hungry data centers add to the strain on grids around the world.

“Billionaire Elon Musk said this month that while the development of AI had been ‘chip constrained’ last year, the latest bottleneck to the cutting-edge technology was ‘electricity supply.’ Those comments followed a warning by Amazon chief Andy Jassy this year that there was ‘not enough energy right now’ to run new generative AI services.”

The situation would be bad enough even if the electric grid weren’t already being pushed to its limits. But as we’ve chronicled regularly for two years now, it is.

The situation would be bad enough even if the electric grid weren’t already being pushed to its limits. But as we’ve chronicled regularly for two years now, it is.

While the mainstream has downplayed the fact, the capacity of the grid is no greater now than it was in 2011.

And with data centers demanding ever more juice… at the same time that Americans are being pushed to adopt electric vehicles… at the same time that coal and nuclear plants are being shut down and new solar and wind capacity isn’t nearly enough to make up the difference…

… well, something’s gotta give.

We’ve previously addressed the possibility that Americans might soon be subject to South African-style “load shedding” — rolling blackouts made necessary to prevent the grid from collapsing altogether.

What we haven’t addressed is the investing possibilities. Because there are companies out there wrestling with this problem, aiming for solutions to keep the grid up 24/7 while still feeding AI’s enormous and growing appetite.

The mainstream isn’t talking about that, either… but rest assured the Paradigm editors are performing their due diligence right now in search of the best opportunities. Watch this space in the weeks and months ahead.

(And in the meantime, consider getting a generator as your editor did in 2022.)

![]() The Impact of Bitcoin Halving, in One Chart

The Impact of Bitcoin Halving, in One Chart

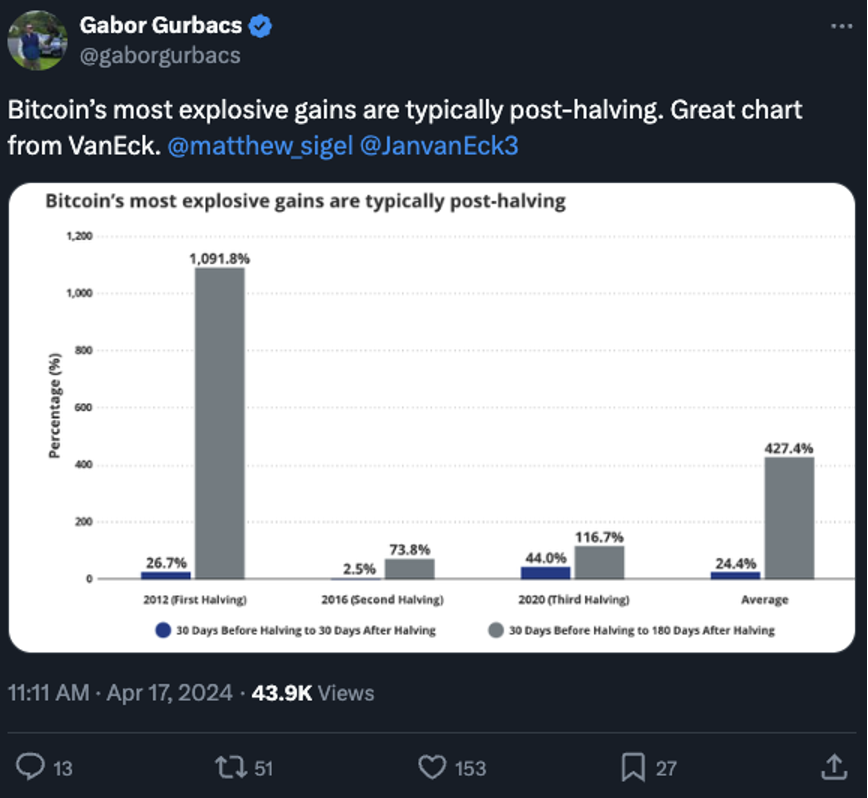

With Bitcoin’s “halving” coming tomorrow or Saturday, here’s a chart that says what we said yesterday — just in a more strikingly visual way.

With Bitcoin’s “halving” coming tomorrow or Saturday, here’s a chart that says what we said yesterday — just in a more strikingly visual way.

The chart comes to us from the VanEck fund family. It depicts Bitcoin’s price action during the previous three halvings — an every-four-years event when the proceeds from Bitcoin mining are cut in half — as well as an average of the three.

As you can see, the gains to be had in the 60 days surrounding a halving are fairly meager. But if you wait six months after the halving, your patience is rewarded handsomely.

Assuming the average performance plays out this time — unlikely, but we’re just doing a thought experiment — we’d be looking at $265,000 Bitcoin. (It’s going for a little under $64,000 this morning.)

Even a gain half that size would be mighty nice for only six months.

But as our crypto evangelist James Altucher has been saying for days now, Bitcoin halvings tend to drive far more explosive gains in tiny alt-coins — with the potential to 100x your money or more.

James has six such coins in mind right now. You’ll want to be in position before the halving — which, again, takes place sometime between midday tomorrow and midday Saturday.

“If you wait until after the halving,” James says, “these coins could be trading much, much higher — and you’ll have missed this opportunity forever.”

You don’t want to be kicking yourself after the fact. A short time ago, James recorded an urgent update about this situation on his phone. Best give it a look right away.

As for more conventional asset classes, the stock market is trying to stage a modest recovery after the S&P 500 notched four straight days of losses.

As for more conventional asset classes, the stock market is trying to stage a modest recovery after the S&P 500 notched four straight days of losses.

The S&P is up a little less than half a percent as we wrote to 5,044. It wouldn’t be surprising to see the index oscillate between 5,000–5,100 for a few days before moving decisively one way or the other.

Bond yields are moving higher again, but not as high as the case Tuesday. The yield on a 10-year Treasury is now 4.63%.

Precious metals today are the same story they’ve been all week — gold within reach of $2,400 and silver over $28.

Crude continues to trade near its April lows at $82.51. As long as it holds over $80, it looks like a “buy the dip” opportunity.

![]() Hey, It Worked Two Years Ago…

Hey, It Worked Two Years Ago…

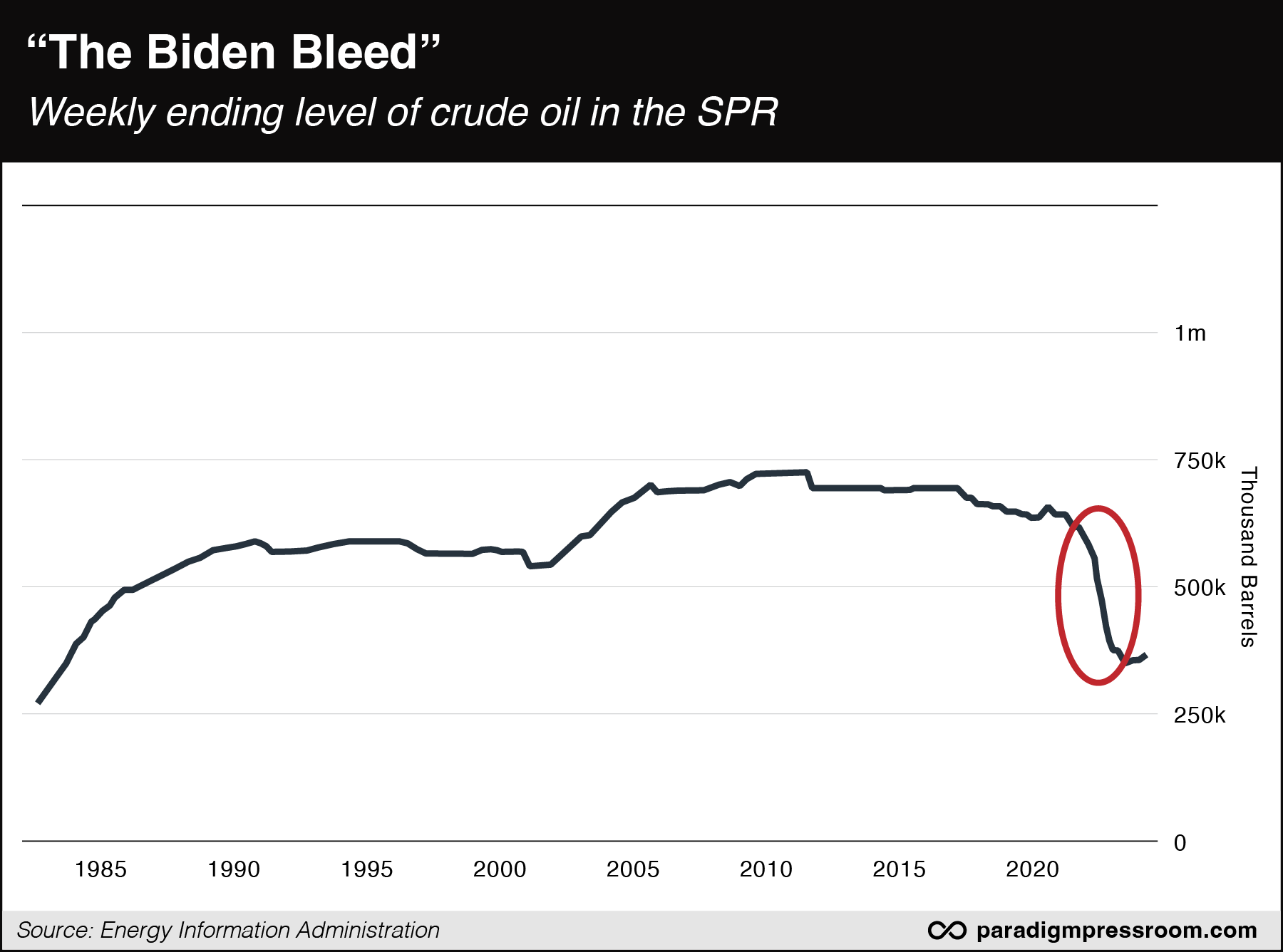

Don’t look now, but the White House might be thinking once again about draining the Strategic Petroleum Reserve to keep gasoline prices down in an election year.

Don’t look now, but the White House might be thinking once again about draining the Strategic Petroleum Reserve to keep gasoline prices down in an election year.

➢ In other news, that ultimate swamp creature John Podesta took over last month from John Kerry as the Biden administration’s “climate czar.”

If the White House were flat ruling it out, Podesta could have said so.

As a reminder, the Biden administration drained the SPR — an oil stash maintained by the federal government in the salt caverns of Texas and Louisiana — at an unprecedented rate in 2022.

As a reminder, the Biden administration drained the SPR — an oil stash maintained by the federal government in the salt caverns of Texas and Louisiana — at an unprecedented rate in 2022.

Presidents of both parties have used the SPR to mess with fuel prices over the decades, but Biden took it to a whole other level…

And while the disruption to energy markets from Russia’s invasion of Ukraine gave him cover, it looked like an attempt to keep a lid on gasoline prices ahead of the midterm elections.

But as you can see, a similar pace of drawdown this year would nearly deplete the SPR — which is hypothetically there for dire emergencies like a war that shuts down the Persian Gulf for months on end.

That said, tapping the SPR isn’t the only possibility this year. Maybe Biden would try to channel his inner Richard Nixon and slap price controls on gasoline?

Of course, price controls inevitably lead to shortages and gas lines — as they did in the ’70s — but Biden could blame the shortages on “hoarders.”

Not that we want to give him any ideas. We’re just trying to tease out some possibilities and stay ahead of the curve…

![]() Cops Crack Gold Caper

Cops Crack Gold Caper

It took a while, but cops in Canada think they’ve solved the gold heist of the century.

It took a while, but cops in Canada think they’ve solved the gold heist of the century.

A year ago, thieves made off with 6,500 gold bars worth $14.6 million. The bars had arrived at Pearson Airport in Toronto on an Air Canada flight from Zurich, Switzerland. One of the thieves showed a phony airway bill — and that was good enough to take possession of the bars weighing about 880 pounds, which they hauled away in a box truck.

By one reckoning, that made for the sixth-biggest gold heist in history.

The first clue emerged last September when cops in Philadelphia pulled over a guy from Ontario for a traffic violation. Inside the car they found a stash of 65 firearms that investigators say were destined for Canada.

The driver is now suspected of being the getaway driver in the theft. Meanwhile, Peel Regional Police in Ontario announced this week they’ve picked up five more suspects — two of them Air Canada employees — while three more are still at large.

As for the gold, cops say so far they’ve recovered just over $65,000 worth of “pure gold” that had been melted down and refashioned into “crudely made” bracelets. Also seized were smelting pots, casts, molds and $313,000 in Canadian bank notes that investigators say were the proceeds of gold sales.

The bracelets, the cash, the guns [Peel Regional Police photos]

The bracelets, the cash, the guns [Peel Regional Police photos]

Meanwhile, Brink’s is suing Air Canada for fouling up the transfer of the gold. "No security protocols or features were in place to monitor, restrict or otherwise regulate the unidentified individual's access to the facilities," according to Brink’s — a claim Air Canada strenuously denies.

![]() Mailbag: Bitcoin ETFs, Uncle Sam’s Debt, a Satisfied Reader

Mailbag: Bitcoin ETFs, Uncle Sam’s Debt, a Satisfied Reader

“When Bitcoin halves, what effect will it have on the Bitcoin ETFs?” says a reader’s short note.

“When Bitcoin halves, what effect will it have on the Bitcoin ETFs?” says a reader’s short note.

The answer is probably nothing different than happens with Bitcoin itself. The new “spot” ETFs, after all, are designed to track the price action of Bitcoin. Presumably they’ll do the job better than the older Bitcoin ETFs that were linked to Bitcoin futures and not the crypto itself.

That said, the spot Bitcoin ETFs are still quite new and there are close to a dozen of them. It’s not unreasonable to expect one of them might hiccup in the next few months for reasons we can’t begin to anticipate now…

“Dave, we keep hearing about inflation restraining an interest rate drop — but not much about the difficulties the guv'ment is having in selling its debt,” says our next inquiry.

“Dave, we keep hearing about inflation restraining an interest rate drop — but not much about the difficulties the guv'ment is having in selling its debt,” says our next inquiry.

“If that is, in fact, correct, Econ 102, or would it be 201, tells us knuckle-crawlers that they can't drop rates and expect to get more buyers of increasingly junky debt. What am I missing?”

Dave responds: Nothing.

That said, a sudden debt apocalypse — in which a Treasury auction goes “no bid” — isn’t necessarily in the cards.

“There is no risk of a failed auction of new bonds,” Jim Rickards wrote his Strategic Intelligence readers in February. “If foreign investors didn’t want them, it would be a simple matter to get U.S. banks to pick up the slack.”

The Treasury relies on about two dozen “primary dealers” — big financial institutions that underwrite Treasury auctions in exchange for a host of privileges from the government and the Federal Reserve. They are obligated to bid if no one else steps up — but they are not obligated to bid at a certain rate.

Thus, says Jim, “The risks in Treasuries are not default or rollover. The real risks are higher interest rates or a collapse in the exchange value of the dollar.”

“Thank you for offering such a dynamic service,” says our final correspondent.

“Thank you for offering such a dynamic service,” says our final correspondent.

“While we may not agree on every point discussed or raised, the advice, information, insights and intel that you've been offering since I joined Paradigm Press in 2022 has been invaluable.

“In fact, so much so that I am now better informed across a whole array of disciplines (which of course is essential for investment strategy and decision-making purposes).”

Dave: Thanks for the praise — and for the pointed reminder about why we do what we do.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets

P.S. Emily has the issue tomorrow, so allow me to be the first to wish you a Happy Patriots’ Day. It’s the least I can do, having overlooked Jefferson’s Birthday since it fell last Saturday.