BRICS Cements Dollar’s Demise

![]() The BRICS Cement Their Currency Agenda

The BRICS Cement Their Currency Agenda

The BRICS leaders' summit in Kazan, Russia — scheduled for Oct. 22–24 — is expected to make a significant announcement regarding its BRICS’ currency plan.

The BRICS leaders' summit in Kazan, Russia — scheduled for Oct. 22–24 — is expected to make a significant announcement regarding its BRICS’ currency plan.

This event has been overshadowed by other geopolitical events (i.e. Ukraine, Israel, Lebanon, etc.). But according to our macroeconomics authority Jim Rickards, it could have far-reaching consequences for the U.S. dollar.

This e-letter, meanwhile, has been on the case since the spring of 2014 — when Russian and Chinese ministers used the word “de-dollarization” to describe the topic of a meeting they’d convened. Later that year, the two countries struck a natural gas deal that by most accounts was priced in rubles and yuan, not dollars.

For its part, the BRICS group has expanded considerably since its inception in 2009: new members include Egypt, Ethiopia, Iran and the United Arab Emirates (UAE).

With over 20 aspiring members waiting to join — including major economies like Indonesia, Turkey and Nigeria — the bloc's economic and geopolitical influence continues to grow.

At the same time, the BRICS currency is progressing rapidly…

“The BRICS currency is very far along in establishing itself as a viable payment currency,” Jim says. First, there is a distinction between a payment currency and a reserve currency…

“The BRICS currency is very far along in establishing itself as a viable payment currency,” Jim says. First, there is a distinction between a payment currency and a reserve currency…

“A payment currency is the accounting unit to pay for imports and exports; it’s really just a way of keeping score,” Jim continues. “Periodically, trading partners settle the score with a transfer of assets that can include commodities, dollars, euros or gold.

“The prerequisites are…

- “An agreed-upon value (which can be fixed to another currency or pegged to gold)

- An agreed-upon issuer (the New Development Bank, created by BRICS in 2014 and based in Shanghai, may be suitable for this purpose)

- Secure payment channels (high-speed, encrypted digital pipelines for authenticated message traffic)

- And digital ledgers.

“Moving from a payment currency to a reserve currency is more difficult…

“Reserves are not actual currency deposits,” Jim notes. “They’re securities, such as U.S. Treasury notes or German government notes (bunds), controlled by the treasury or finance ministry of each country.

“Reserves are not actual currency deposits,” Jim notes. “They’re securities, such as U.S. Treasury notes or German government notes (bunds), controlled by the treasury or finance ministry of each country.

“They are denominated in dollars or euros,” Jim explains, “but they are securities, not cash. The prerequisite here is a large liquid bond market, surrounded by extensive legal infrastructure.

“It will take years to develop a BRICS-denominated bond market, although the process could be accelerated…

“Members of the BRICS currency union could use surplus ‘BRICS’ payment currency to buy gold bullion to hold in their reserves.

“Russia, China and South Africa are all major gold producers and China has an extensive network of refineries so there should be ample gold available for purchase,” he says. “When needed for purchases or settlements, the gold could be easily sold for BRICS currency.

“So there is a short path to making ‘BRICS’ a viable reserve currency: gold…

But what does it mean for the dollar to lose its “reserve currency” status?

But what does it mean for the dollar to lose its “reserve currency” status?

Historically, the Dutch guilder, French franc and British pound each took their turn as the world's reserve currency, mirroring the rise and fall of these countries’ global influence.

The British pound’s reign as the reserve currency, for instance, coincided with the height of the British Empire which, at its peak in the early 20th century, controlled an impressive quarter of the Earth’s land surface.

However, the pound's dominance began to wane following World War I in 1914, Jim likes to remind us. This decline continued for about three decades, culminating in the Bretton Woods agreement of 1944, effectively marking the end of the pound’s status as the primary global reserve currency.

The dollar’s loss of reserve currency status will advance likewise: It’s a process, not an event.

Jim’s takeaway? “The BRICS currency is coming soon in the role of payment currency. It will not signal the immediate end of the dollar, but it will mean the dollar will have a reduced role in total global payments.

“It will take longer for the BRIC to become a reserve currency, although a linkage to gold could accelerate that process,” he says.

Without a doubt, the rise of a new BRICS currency could reshape the global monetary landscape and challenge the U.S. dollar's long-standing dominance.

![]() Is Powell a Genius?

Is Powell a Genius?

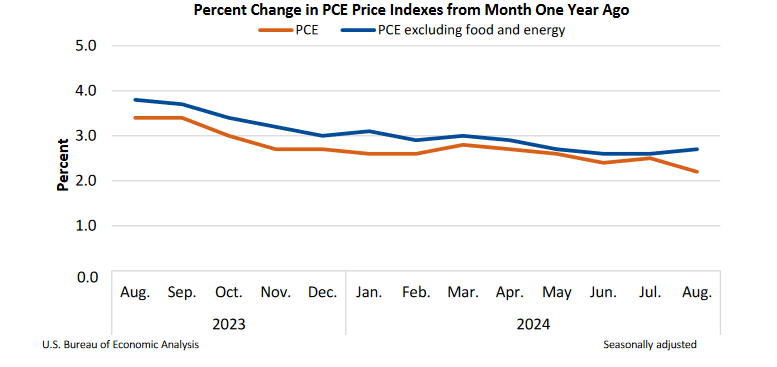

Inflation is moving closer to 3% than to the Federal Reserve’s preferred 2% target. This morning, the Commerce Department issued its read on “core PCE” which strips out “volatile” food and gasoline prices.

Inflation is moving closer to 3% than to the Federal Reserve’s preferred 2% target. This morning, the Commerce Department issued its read on “core PCE” which strips out “volatile” food and gasoline prices.

By this yardstick, consumer prices rose 0.1% in August — below the 0.2% economists expected. Meanwhile, the year-over-year inflation rate ticked up to 2.7% (moving in the wrong direction, but in line with expectations).

Is Fed Chair Jerome Powell a genius? Some mainstream financial outlets think so. “Policymakers were on the right track with the recent interest-rate cuts,” Barron’s affirms.

And Quincy Krosby of LPL Financial tells Reuters: “The core year-over-year at 2.7% suggests that another round of 50 basis points needs to come under careful scrutiny unless the labor market suggests weakness.”

How’s the market responding to the inflation news? Of the three major U.S. indexes, only the Dow is making positive strides — up almost 1% to 42,560. But the S&P 500 is barely in the green at 5,745 while the tech-heavy Nasdaq is down about 0.30% to 18,130.

Commodities? Oil is up about 0.75% to $68.15 for a barrel of WTI. But precious gold and silver have plunged 1% and 1.25% respectively to $2,671.20 per ounce and $31.94.

Crypto, meanwhile, is in the green. Bitcoin’s gained 1.65% to $66,120 and Ethereum’s up 1.30% to $2,694.50.

![]() The World’s Largest Exporter Is Worried

The World’s Largest Exporter Is Worried

This week, we've been reporting on an underreported potential strike as the International Longshoremen’s Association is still at a standstill with the U.S. Maritime Alliance. The contract for 45,000 workers expires on Monday.

This week, we've been reporting on an underreported potential strike as the International Longshoremen’s Association is still at a standstill with the U.S. Maritime Alliance. The contract for 45,000 workers expires on Monday.

That said, U.S. ports aren’t exactly world-class. “In 2023 the Port of Los Angeles-Long Beach complex, largest in the U.S., only ranked ninth for volume among the world’s container ports, and New York-New Jersey didn’t crack the top 20.”

Yes, it could create some snarls for holiday shoppers. On the other hand: “China rightly has to worry about moving its stuff out as quickly as possible,” says an article at FreightWaves.

“The U.S. is the largest market for everything from cellphones to furniture to model trains made in China, the world’s largest exporter.”

And without automation — a key issue that’s being thrashed out at the bargaining table — “getting containers through those ports is like trying to push an elephant through a keyhole,” the article adds.

- “But a union isn’t a union without dues-paying members, so preserving jobs by keeping automation technology out of U.S. ports is always a high priority for ILA leadership even as, observers say, it compromises the efficiency of operations.”

So who else should be worried about a strike? “Let consumers worry about it… They’ll be the ones paying for disruptions, delays and other assorted supply-chain snarls that will be baked into the price of whatever shiny object hits store shelves.”

![]() Avoid the Self-Checkout Line

Avoid the Self-Checkout Line

Former Olympic athlete Meaggan Pettipiece's life was turned upside-down after a self-checkout mishap at an Indiana Walmart in March.

Former Olympic athlete Meaggan Pettipiece's life was turned upside-down after a self-checkout mishap at an Indiana Walmart in March.

Despite the mother of four paying $176 for other items, Pettipiece’s receipt showed she’d failed to scan a ham and asparagus, valued at $67. Walmart security called the police, leading to Pettipiece's arrest for shoplifting.

During the arrest, officers found vapes and anti-nausea medication in her purse, resulting in additional charges of possession of cannabis and a controlled substance.

“In the aftermath of the arrest, with a torrent of headlines sweeping across the state, Pettipiece resigned from her role as an NCAA Division 1 softball coach at Valparaiso University,” The Independent reports.

“However, it was later discovered that the machine did not register her ham and asparagus when she scanned them. Not only that, but the vapes did not contain nicotine or THC.

“[Nor] did the anti-nausea pills belong to her,” The Independent says. “Instead, they belonged to an assistant coach, who reportedly asked the former All-American softball player to carry them for her during a softball game days before her arrest.”

Good news? Last week, Indiana officials dropped all charges against Pettipiece after her lawyer filed for a dismissal earlier this month.

“I’m happy, obviously,,” Pettipiece says, but after a five-months long “living nightmare,” she says: “I lost my career, I lost my job, the life I was building and it’s been really difficult.

“I’m not sure of the future,” she adds. “I’d like to figure out which direction I’m going to go in.”

We only hope that direction leads to a good lawyer…

![]() Mailbag: More Health Care Loose Ends

Mailbag: More Health Care Loose Ends

“Why is there a shortage of doctors in the U.S.?” asks a reader discussing health care once again today. “Dave, you responded with some good assumptions as to the cause…

“Why is there a shortage of doctors in the U.S.?” asks a reader discussing health care once again today. “Dave, you responded with some good assumptions as to the cause…

“Here’s one I’m surprised you didn’t include: We are a litigious society. My husband was a neurosurgeon. When he retired in 2003, malpractice insurance coverage, if he was sued during the statute of limitations following his retirement, was $60,000. I hate to think what the cost is now.

“Here’s another thing to consider: DEI policies practiced in medical schools afford some individuals an opportunity to enter medical school. But I’d like to see the stats on what percentage of these students actually complete medical school and continue their education with specialty residencies.

“Here’s the kicker: Out of nine countries, the United States spends more on medical care than any others, but is ranked dead last in the quality of care rendered.

“The bottom line: If my husband were alive today and saw how medicine is practiced and the quality of care, he’d die all over again.”

“In early 2022, I had a heart attack,” a second reader writes with his own health care assessment.

“In early 2022, I had a heart attack,” a second reader writes with his own health care assessment.

“My cardiologist was in the same group that fired and sued Dr. Peter McCullough. When he released me, he told me to discontinue use of ivermectin and HCQ. I fired him and told him he should honor his Hippocratic Oath.

“While I was in the hospital, I learned that nurses had completely lost the ability to draw blood. Every time they needed to draw blood, they stuck me, on average, five times.

“In late 2023, I was diagnosed with the most aggressive type of prostate cancer. The tumor was removed, and I started chemotherapy. Three months later, I was scheduled to start proton radiation. During this time, I met with my proton radiation doctor. The first thing he asked was, ‘Why are you taking ivermectin?’ I told him it was for COVID. His response was, ‘Oh, you’re one of those people.’

“My proton radiation doctor was supposed to have given me a full plan of treatment, but that did not happen. Before I started treatment, I asked him if he was treating my lymph nodes. He told me no, because it was impossible. After pushback he did the impossible and decided to treat my lymph nodes.

“I was supposed to take 44 treatments, with a treatment every weekday. That should have required two months to complete. Due to lapses, lack of training and equipment failures it has been over six months, and I still require nine treatments.

“The first two treatments I received did not count, because the proton radiation did not hit the markers. The markers are designed to absorb the proton radiation. Therefore, the first two treatments shot radiation into my body.

“As bad as health care has become, it will get much worse as the WOKE continues to implement their DEI plans.”

Emily: Dave said it yesterday: “We don’t do ‘personal finance’ stuff around here.” And I’ll add today: We don’t do personal health care stuff around here either.

Take care, reader, and enjoy your weekend!