Decoding DeepSeek

![]() A Deep Breath About DeepSeek

A Deep Breath About DeepSeek

OK, the initial panic is over. Time to take a deep breath.

OK, the initial panic is over. Time to take a deep breath.

Well, and also time for a grim chuckle at the state of AI in America. Right, Emperor Palpatine?

That “cheap Chinese knockoff” analogy is more apt than you might think, by the way — but we’re getting ahead of ourselves.

Last night, Donald Trump said the advent of the Chinese AI engine DeepSeek is “a wake-up call” for the U.S. Big Tech. Gee, what was the subject line of yesterday’s 5 Bullets?

For the record, Nvidia lost nearly $600 billion of market cap in a single day yesterday. All told, the value of the company shrank by $892 billion between its peak on Jan. 6 and its trough yesterday.

That’s mighty close to Paradigm trading pro Enrique Abeyta’s prediction that sometime during 2025, NVDA’s market cap would be scalped by $1 trillion.

So back to the big picture for AI. This morning, the question to ask is, is it really true?

So back to the big picture for AI. This morning, the question to ask is, is it really true?

Has Big Tech poured tens of billions of dollars down a rathole for data centers and power generation and development personnel — only to be shown up by a budget Chinese operator few Americans ever heard of until two or three days ago?

Did DeepSeek really pull off a large language model equal to or better than ChatGPT at only 1/20th of the cost?

“Here’s the reality check,” says Paradigm AI and crypto authority James Altucher — after he had his team put DeepSeek through its paces.

“Here’s the reality check,” says Paradigm AI and crypto authority James Altucher — after he had his team put DeepSeek through its paces.

“It's good, but it's not quite the ChatGPT killer everyone's making it out to be.

“Think of it like a Chinese knockoff of a designer handbag. From a distance, it looks pretty similar to the real thing. But up close, you start noticing the differences.

“DeepSeek's responses often miss the mark in subtle but important ways. The kind of mistakes that might not show up in performance tests but make a big difference in real-world use.”

Nonetheless, James concedes that DeepSeek has demonstrated that “you don't need unlimited resources to build a decent AI model. That's what’s making investors nervous.

“After all, if a small team in China can build this for $6 million, what does that say about the billions being spent by tech giants?”

But there’s something crucial that James says the mainstream is overlooking: For the U.S. tech giants, “AI isn’t just another product line. It’s essential to their future.”

But there’s something crucial that James says the mainstream is overlooking: For the U.S. tech giants, “AI isn’t just another product line. It’s essential to their future.”

That is, it’s not just about building chatbots. These companies are in “an arms race for the future of computing itself.

“Microsoft learned its lesson the hard way when it dismissed smartphones as a fad. That mistake cost them an entire market. They're not about to make the same mistake with AI.

Neither is Google, Amazon, Meta or Apple.”

Whoever wins the AI race might dominate technology for the next decade or longer, James says.

Which means two things…

- “DeepSeek isn't going to slow down AI investment.

- “But it will force companies to be more transparent about their AI spending and progress.”

Nothing wrong with that.

Thus for Nvidia and the other chipmakers, “the future still looks bright. Whether it's tech giants building premium AI models or startups building budget versions, they all need chips. Lots of them.

“For investors, this means the AI revolution is entering its next phase,” James concludes.

“For investors, this means the AI revolution is entering its next phase,” James concludes.

“We're moving from the ‘Wild West’ phase, when money was no object, to a more mature market where efficiency matters. This is exactly what happened with the internet, cryptocurrency and every other major tech revolution.

“And just like in those revolutions, the real moneymaking opportunities are still ahead of us.”

So… as I said off the top, it’s time to take a breath. But it’s not time to breathe easy.

That’s because — as we’ve been mentioning for a few days now — the newest addition to the Paradigm team anticipates an ominous period for markets during the next 60 days.

Mason Sexton says it’s baked into the cake no matter what Donald Trump does… no matter what a Chinese AI firm does… no matter what the Federal Reserve does.

We take his prophecy seriously because of his spooky-accurate market calls going back more than 40 years now. He called the start of an epic bull market in 1982. And much more recently he called the top and bottom of the COVID crisis.

At the bottom in 2020, he recommended 13 stocks — all of which could have made you a fortune if you’d acted on his recommendation. At the time, however, his work was available only to private clients paying up to $10,000 a month.

But what Mr. Sexton anticipates now is something Americans haven’t witnessed in 50 years — and its impact will extend well beyond the markets and the economy.

For that reason, he sought a bigger platform — and we’re privileged to say he chose to join forces with Paradigm Press to get the word out.

Tomorrow at 11:02 a.m. EST you can join Mason for a LIVE online event we’re calling, simply, The Prophecy.

(Why the peculiar start time? You won’t know if you don’t watch.)

Your host for the event is none other than Mason’s son, radio host Buck Sexton.

It’s a Paradigm exclusive unlike anything we’ve done before — and we still have a few available spots. Click here right away and we’ll reserve yours.

![]() Power to the People (and AI Data Centers)

Power to the People (and AI Data Centers)

If James Altucher’s thesis is correct and the knee-jerk reaction to Nvidia is overdone… then the knee-jerk reaction to the “downstream” AI companies is even more overdone.

If James Altucher’s thesis is correct and the knee-jerk reaction to Nvidia is overdone… then the knee-jerk reaction to the “downstream” AI companies is even more overdone.

We’re thinking specifically about the electricity providers — especially the ones with nuclear power plants in their portfolios — that are best positioned to thrive from the build-out of AI data centers.

While NVDA sold off 17% yesterday, some of the “independent power producers” took an even bigger hit — Constellation Energy 21% and Vistra 28%, for example.

The aforementioned Enrique Abeyta says that reaction is definitely overblown.

“The fundamental reality,” says Enrique, “is that the United States is facing a power crisis regardless of the level of AI power demand growth.”

Exactly. The power grid is so rickety that folks like myself in a central swath of the country from the Upper Midwest to the Lower Mississippi Valley have been at ongoing risk of rolling blackouts since mid-2022 — months before ChatGPT broke into public consciousness.

Why? Too many coal and nuclear plants are being shut down, and there’s nowhere near enough wind and solar capacity coming online to replace them. Nationally, the grid’s capacity was no bigger in 2024 than it was in 2011. It has to grow, AI or no.

Besides, even if DeepSeek is everything its creators say it is, the U.S. tech giants will simply study its ins and outs (DeepSeek is open source, the code out in the wild for anyone to examine and explore) and go from there.

“They will then build even more powerful models where the Chinese startup can’t compete,” Enrique says.

“In all scenarios, the demand for power in the U.S. goes higher.”

![]() Beyond Tech, There’s Opportunity

Beyond Tech, There’s Opportunity

For as wicked as yesterday’s sell-off was, there are pockets of strength. Paradigm chart hound Greg Guenthner sees them all over.

For as wicked as yesterday’s sell-off was, there are pockets of strength. Paradigm chart hound Greg Guenthner sees them all over.

“For starters,” he says, “I'm keeping an eye on tech names that have little involvement in the AI ecosystem.

“While the Nasdaq Composite finished lower by more than 3% on Monday, more than 1,600 components finished the day in positive territory. Of these stocks, 150 gained more than 5%. Sharp declines in NVDA, ORCL, AVGO, MSFT, GOOG and TSLA masked many of the positives happening under the surface.”

And outside of tech, “consumer staples, consumer discretionary and financials all managed to post gains yesterday.” The Dow industrial average posted a 0.7% gain at day’s end — even though NVDA was added to the index three months ago!

Then there are the Chinese stocks: The DeepSeek buzz had a halo effect yesterday for China’s Big Tech names like Alibaba (which still trades on the NYSE despite the delisting of several other Chinese firms in recent years). FXI, the big China ETF, posted a gain of nearly 1%.

“NVDA is not the stock market,” Greg reminds us — “no matter how much the financial media insists otherwise.”

Indeed for the moment, the free fall in tech has been arrested.

Indeed for the moment, the free fall in tech has been arrested.

At last check, the Nasdaq is up 1.2% on the day, and NVDA up 3.3%. The other major indexes are in the green as well, the S&P 500 up a little less than half a percent at 6,037.

We’re headed into the meat of earnings season — with four of the “Magnificent 7” names set to report tomorrow and Thursday. Oh, and the Federal Reserve issues its latest proclamation on interest rates tomorrow.

Precious metals are starting to recover yesterday’s losses, gold at $2,757 and silver back above $30. Crude is flat at $73.14. Bitcoin has recovered the $100,000 level.

One economic number of note: Durable goods orders for December surprised to the downside, falling 2.2%. But that number was skewed badly by orders for aircraft and military hardware, which are notoriously volatile month to month. Take those out and orders for “core capital goods” rose a solid 0.5%.

![]() Trump Tariff Turbulence

Trump Tariff Turbulence

What is the Trump administration’s tariff policy, really?

What is the Trump administration’s tariff policy, really?

The Financial Times reports that Treasury Secretary Scott Bessent — who won Senate confirmation yesterday — seeks an across-the-board tariff on all U.S. imports. It would start at 2.5% and rise gradually each month to perhaps as high as 20%, which is the number Donald Trump repeated often while campaigning last year.

The news only adds to the uncertainty about Trump’s intentions.

A few days ago, Trump said he might impose a 10% tariff on goods from China effective this Saturday.

“That claim should be taken seriously,” says Paradigm’s macro maven Jim Rickards — “but it’s important to understand Trump and the art of the deal.

“At other times in recent days, Trump has said his tariffs could be 25% and that he might apply them to China, Canada and Mexico all at once. He has also threatened tariffs against the EU because they do not buy enough U.S. products and many of their members do not pay their fair share of NATO defense costs.

“There’s an extent to which these tariff threats are real and represent good economic policy,” Jim goes on.

“There’s an extent to which these tariff threats are real and represent good economic policy,” Jim goes on.

“There’s another extent to which the tariffs may or may not be good economic policy, but they are being used as financial weapons to achieve geopolitical goals or punish those who do not act in accord with U.S. policy.

“Finally, some of these claims may be pure theater at this point designed to give Trump leverage in upcoming negotiations.

“That’s the point. The target country really doesn’t know if it’s the early stage of a negotiation, a real policy position or a punishment for real or alleged opposition to U.S. goals. Trump likes to keep his opponents off-balance. He’s good at it.

“Unfortunately, he keeps investors and markets off-balance also because you don’t know if the tariffs will stick or not or if they’ll even be imposed.

“All you can do as an investor is follow the news, use your best analysis as to when Trump is serious or not and place your bets accordingly.” Jim is doing exactly that in Rickards’ Strategic Intelligence and his other publications.

![]() Comic Relief

Comic Relief

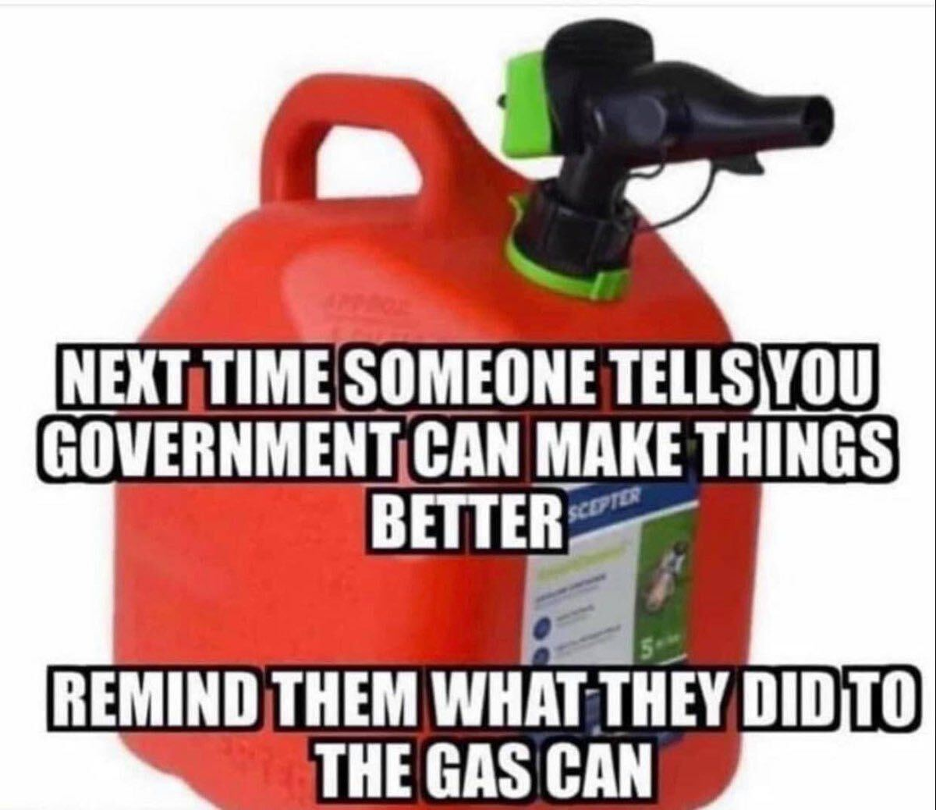

We conclude with an item from the meme-o-sphere that your editor can relate to from personal experience. Perhaps you do too?

We conclude with an item from the meme-o-sphere that your editor can relate to from personal experience. Perhaps you do too?

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets