DEI Is Not a Four-Letter Word

![]() Diversity Is Not a Four-Letter Word

Diversity Is Not a Four-Letter Word

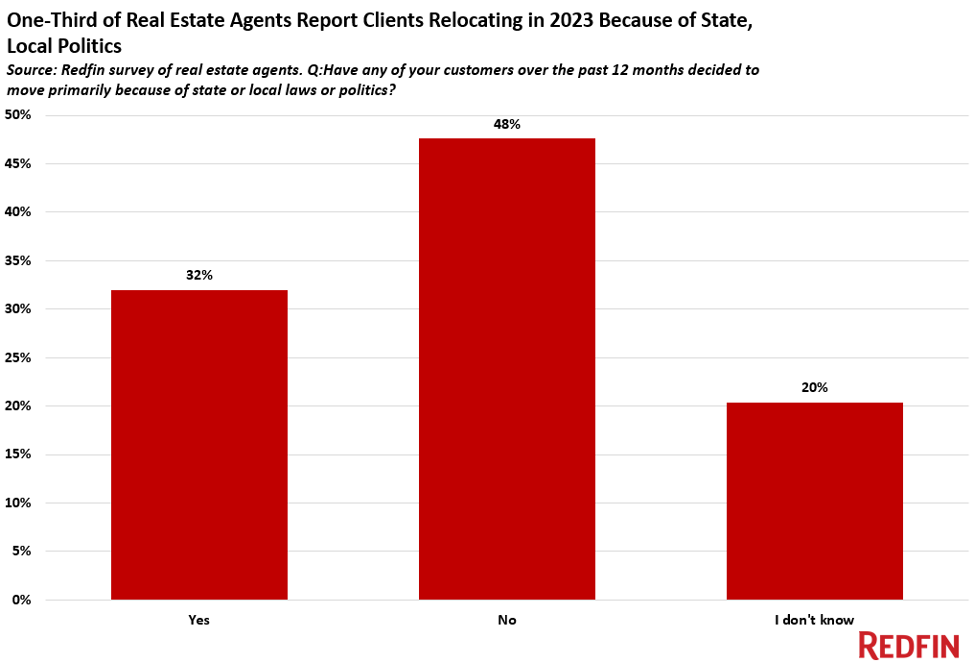

“Have any of your customers over the past 12 months decided to move primarily because of state or local laws or politics?”

“Have any of your customers over the past 12 months decided to move primarily because of state or local laws or politics?”

That’s a question put to 500 real estate agents across the U.S. as part of a December 2023 survey sponsored by Redfin. Of the 500 surveyed, one out of three agents answered yes.

“A record share of homebuyers relocated to a different metro area in 2023,” Redfin says. “Some of the most common migration routes for homebuyers last year were from blue states to red or purple states: San Francisco to Austin; Seattle to Phoenix; New York to Orlando and other parts of Florida.

“That’s due largely to housing affordability, but some homebuyers moved because they wanted to live in a more conservative place.”

Redfin adds: “This is the first time we’ve asked this question in an agent survey; we are unable to provide historical comparisons.” (It’s not the first time, however, a Redfin survey has dredged up culture war issues, including abortion and LGBTQ legislation.)

Plus, there is a historic comparison…

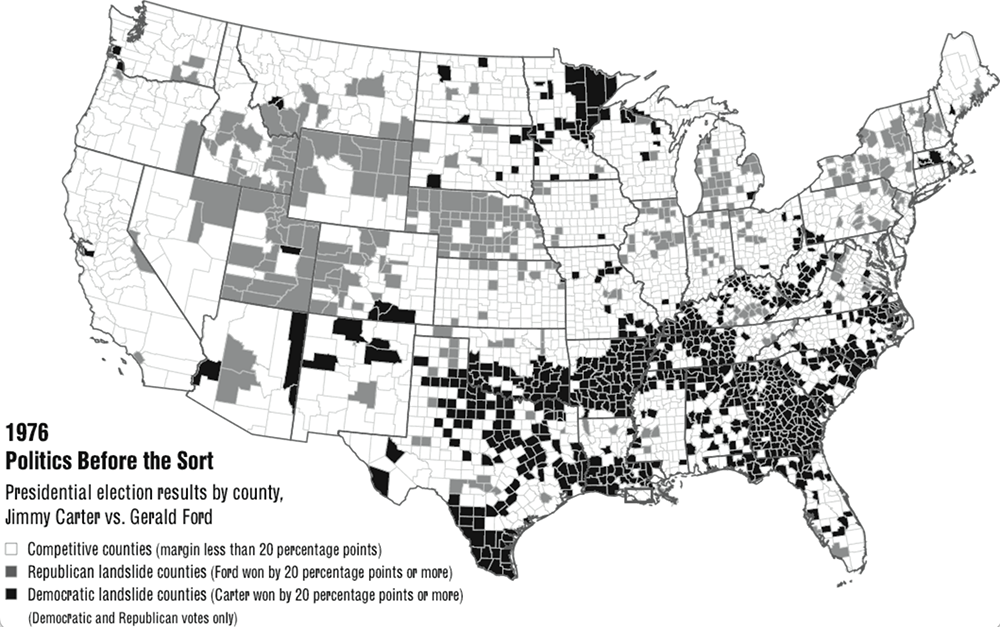

“Most communities in the nation are growing more politically one-sided — either more solidly Democratic in presidential elections or more reliably Republican,” says Bill Bishop, author of the 2008 book The Big Sort.

“Most communities in the nation are growing more politically one-sided — either more solidly Democratic in presidential elections or more reliably Republican,” says Bill Bishop, author of the 2008 book The Big Sort.

“The ‘red’ and ‘blue’ maps of the states are totally misleading,” Bishop says. “The real differences in American politics today are found at the level of the community.”

Specifically, Bishop examines the political leanings of U.S. counties, before the “Sort”...

Courtesy: thebigsort.com

Click map to enlarge

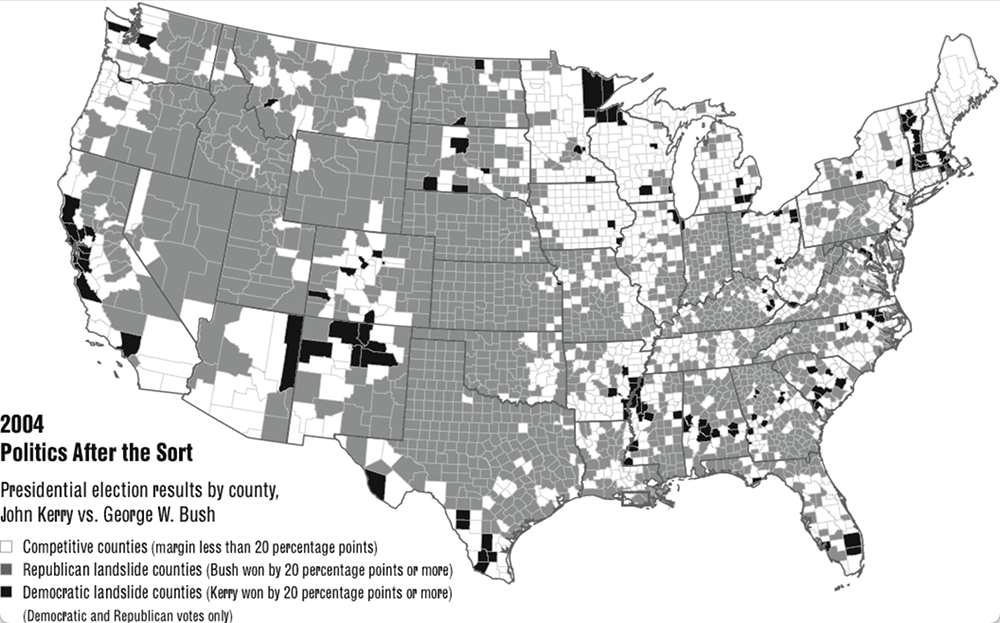

And after….

Courtesy: thebigsort.com

Click map to enlarge

As far as Bishop is concerned, the “Big Sort” was already over 20 years ago — by the time of the horrid Bush-Kerry election. (Gee, maybe Trump-Biden isn’t that bad after all…)

So what was the genesis of this national sorting?

“The country fractured in the 1960s — around 1965, to be precise,” Bishop contends.

“The country fractured in the 1960s — around 1965, to be precise,” Bishop contends.

“In that one year,” he says, “trust in major institutions began to decline; membership in mainline churches started to drop; divorce and crime rates began to climb; allegiance to political party dissolved as people lost faith in traditional party labels; membership in long-standing civic organizations (the Elks, bowling leagues) started to drop, as did the percentage of daily newspaper readers.

“Society seemed to unravel all at once, and when it came back together, the broad-based institutions that had sustained this country were replaced by ones that were more politically homogeneous.”

(One could argue that 2020 was another such unraveling, as our managing editor Dave Gonigam wrote brilliantly last year.)

“Remember, the Big Sort isn't at heart a political phenomenon,” Bishop notes. “It's the way we've come to live over the past 30 years.” Well, almost 60 years now…

“America was established, however, to benefit from this national diversity,” Bishop says.

“America was established, however, to benefit from this national diversity,” Bishop says.

“The Founders believed that when people with diverging opinions hashed out their differences face-to-face, the country would be better off. The clashing of opinions would produce a better result. It was a brilliant insight.

“The Founders sought to make diversity a creative force.” Not that we should be too Panglossian about the Founders’ level of diversity, equity and inclusion (DEI), right? By and large, political discourse — and action — was reserved for white landowning males.

But here’s the crux: “Differences didn't have to end in hate. They could be wielded to craft the best answer to problems. The Founders sought to turn the vice of disagreement into the virtue of new understanding.”

Bishop’s 2008 takeaway (just as true in 2024): “Now that simply doesn't happen — in Congress, in our legislatures or between our increasingly isolated neighborhoods.

“We've replaced a belief in a nation with an oversized trust in ourselves and our carefully chosen surroundings,” he concludes.

[Since American tribalism is such a top-of-mind issue this election year, we want to hear your opinions…

First, the data shows homebuyers moving from blue states to red states. What factors do you think are driving this migration pattern? Is it mostly economic or political or a mix? (Bonus points if you can speak from personal experience.)

Last, the Founding Fathers believed bringing together diverse opinions could produce better outcomes for citizens. Do you think this vision is still achievable today? If so, how? If not, what changes would be needed?

Thanks in advance for your feedback — looking forward to a lively “mailbag”!]

![]() Inflation Sticks (and Sucks)

Inflation Sticks (and Sucks)

Don’t say we didn’t warn you: Inflation persisteth.

Don’t say we didn’t warn you: Inflation persisteth.

The Labor Department is out this morning with January’s consumer price index, and it rings in hotter than expected — up 0.3% month-over-month.

Thus the year-over-year inflation rate has slightly decelerated from 3.4% in December to 3.1% in January. Shelter costs accounted for two-thirds of the headline increase. On a 12-month basis, shelter rose 6%.

All to say, the Federal Reserve is still having a time wrangling inflation back to its 2% target.

And for the 25th-straight month, the NFIB Small Business Optimism Index remains below its half-century average of 98 — down two points in January, in fact, to 89.9.

The top worry among small-business owners? “Inflation remains a key obstacle on Main Street,” says NFIB Chief Economist Bill Dunkelberg.

With those negative economic bellwethers, stocks are sliding today. All the major U.S. stock indexes are in the red — each having lost about 1% market cap at the time of writing.

With those negative economic bellwethers, stocks are sliding today. All the major U.S. stock indexes are in the red — each having lost about 1% market cap at the time of writing.

The S&P 500 has retreated below 5,000 while the Big Board and Nasdaq are down to 38,386 and 15,750 respectively.

Crude, on the other hand, is up 1.20% to $77.87 for a barrel of West Texas Intermediate, but precious metals have hit the skids. Citing Kitco’s price, gold is down 1.25% to $1,993.90 per ounce; silver likewise has pulled back over 2%, barely hanging onto $22.

In sympathy with stocks, crypto is sliding today, with flagship Bitcoin down 2.65% to $48,730 and Etherum down 0.30% to $2,600.

![]() Climbing a “Wall of Worry”

Climbing a “Wall of Worry”

“There’s a saying on Wall Street that the market tends to climb a ‘wall of worry,’” says Paradigm’s retirement-and-income specialist Zach Scheidt. “Here’s what that means…

“There’s a saying on Wall Street that the market tends to climb a ‘wall of worry,’” says Paradigm’s retirement-and-income specialist Zach Scheidt. “Here’s what that means…

“When there are a lot of concerns in the overall market, the market tends to drift higher and higher.

“That may sound like it’s completely illogical,” he says, “but when investors have lots of concerns weighing on their minds, they tend to keep a larger amount of capital on the sidelines.

“That means there is a lot of ‘dry powder’ sitting on the sidelines waiting to be put to work.

“And as things play out and worries are alleviated, or turn out to just not be as bad as people may have thought, investors start putting that cash to work.

“As more money gets put to work it naturally pushes the market higher. We’ve seen this play out over the last year.

“Throughout that time, investors have been plagued with many concerns, to say the least — inflation… shifting Fed expectations… geopolitical turmoil… these are obviously real concerns.

“But one by one as these issues are slowly resolved…

“Investors start putting their ‘dry powder’ to work and the market moves higher,” says Zach

“Investors start putting their ‘dry powder’ to work and the market moves higher,” says Zach

For example? “On Thursday, the S&P 500 crossed the historic 5,000 benchmark… And as more investors become buyers, it instills FOMO in investors’ minds. Which further fuels the rally.

“A lot of this FOMO investing has been in sectors with innovative technologies, which is where we are looking for investing opportunities right now,” Zach adds.

“Small-cap stocks have been on my radar for some time,” he says. “This is a group of stocks that have been left behind as so many investors focus on the Magnificent Seven tech stocks.

“Some of those large stocks still have room to run. But many small stocks have much better prospects.

“That’s because smaller stocks have more room to grow and often have more innovation. These stocks are also much cheaper than their large-cap counterparts.

“So small-cap stocks could have a long way to go just to catch up to the gains larger stocks have already enjoyed,” says Zach.

If small caps play catch-up, investors could see impressive returns for the iShares Russell 2000 ETF (IWM).

“I don’t think the run for small-cap stocks is over,” Zach concludes. “In fact, it’s probably just getting started with several months of gains ahead of us!”

![]() Spanish Rice Bombs EU Climate Proposal

Spanish Rice Bombs EU Climate Proposal

A traditional Spanish rice variety called “bomba” — a key ingredient in paella — is under existential threat.

A traditional Spanish rice variety called “bomba” — a key ingredient in paella — is under existential threat.

Rice farmers in the Valencia region report that their 2023 harvest of bomba “bomb” rice was half that of the 10-year average.

They attribute this disastrous harvest to disease caused by the Pyricularia fungus, following an EU ban on a pesticide that farmers have relied on for 40 years to combat the fungus.

Spanish farmers further argue it’s unfair that major rice-exporting countries including Brazil, India and Cambodia can still use the pesticide, while EU environmental rules have outlawed the pesticide for European farmers since 2018.

Adding insult to injury, imported rice doesn’t have to adhere to the EU’s strict standards on pesticide residue limits.

So last week, Farmers in Valencia took to the streets in tractors to demonstrate against EU agricultural rules…

Translation: “Without farms, you don’t eat”

Bomba rice “is very likely to disappear,” says rice farmer Miguel Minguet. “Our crop is going to be lost to regulations.”

“The European Commission has been forced to backpedal,” Reuters reports, “with President Ursula von der Leyen [last] Tuesday proposing the withdrawal of the EU's plan to halve the use of pesticides.”

“The European Commission has been forced to backpedal,” Reuters reports, “with President Ursula von der Leyen [last] Tuesday proposing the withdrawal of the EU's plan to halve the use of pesticides.”

In addition, the European Commission amended its climate proposal for reducing greenhouse gas emissions by 2040 after ongoing pressure from farmers throughout the Eurozone.

A previous proposal draft called for a 30% cut in agricultural pollution between 2015 and 2040. “Also excised were recommendations for citizens to make changes to their behavior, like eating less meat, and a push to end fossil fuel subsidies,” Politico says.

The updated plan still recommends an overall 90% emissions reduction from 1990 levels by 2040 across all sectors.

However, the role of agriculture is now framed more positively, emphasizing its importance for Europe's ‘food sovereignty.’ References to phasing out fossil fuel subsidies have also been deleted.

The latter comes after “some of the largest demonstrations have been in Germany, prompted by a cut to diesel subsidies,” adds Politico.

The EU's proposal, however, is still subject to change; the final draft will be presented today.

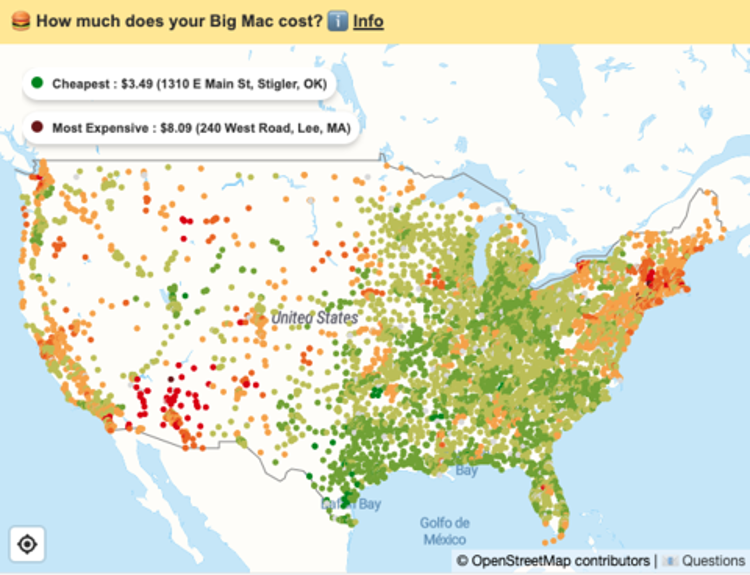

![]() How “McPricey” Is Your Local Mickey D’s?

How “McPricey” Is Your Local Mickey D’s?

We introduced our Saturday highlight issue with a brief message about McDonald’s earnings… and peak inflation pricing?

We introduced our Saturday highlight issue with a brief message about McDonald’s earnings… and peak inflation pricing?

First, a reader reminded us of the website tracking the most expensive and the “McCheapest” Big Macs in the U.S.

Second, after soliciting feedback from our readers, I noted: “My daughter tells me that the three Mickey D’s within 1½ miles of my home each have different prices. Oy.”

“What oy?” a reader grouses. “See how gas prices vary.

“These are signs of a competitive market that has been price-optimized by corporations servicing their franchisees. Specialists advise on pricing that will maximize profits without reducing volume too much. Every location has slightly different demand/price curves.”

Emily: Fair enough. I retract my “oy.”

“Before I bought my retirement home in Idaho, I drove back and forth between Idaho and California several times a year,” writes one of our longtime readers. “I generally stopped at McDonald's along the way for coffee and sandwiches.

“Before I bought my retirement home in Idaho, I drove back and forth between Idaho and California several times a year,” writes one of our longtime readers. “I generally stopped at McDonald's along the way for coffee and sandwiches.

“There was a steady price decline from California to Idaho. The fish filet was nearly $5 at my place in California and it steadily declined through Nevada and Oregon, until it was under $3 in Idaho. (As a bonus, Idaho also has a lower sales-tax rate.)

“As far as labor costs go, aside from extreme cases like California, markets often determine those. Idaho has a minimum wage under $8 per hour. Yet for over a year now, my local McDonald's has devoted most of the space on its sign advertising for workers at $15 per hour, plus free meals each shift and paid time off.

“The free market works if given the chance.”

You all take care, and join us tomorrow for another round of 5 Bullets.

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets

P.S. Are you worried about central bank digital currencies (CBDCs)... aka “Biden Bucks”?

Don’t be.

All you need to protect yourself and your money is a new alternative gold currency.

To show you how it works, Paradigm’s macro authority Jim Rickards just recorded a quick two-minute video walking you through all the details.

Best of all, if you respond by Wednesday, Jim will even give you a special offer to claim this gold currency for FREE.