Dollar 911

- It’s time to get serious (“Operation Sandman”)

- Russia’s shot heard round the… Oh, never mind!

- Don’t expect low natural gas prices to last

- Team Biden’s electrical-transformer rules face pushback

- Mailbag: “What Trump tax break?”

![]() Rickards’ Emergency Dollar Warning

Rickards’ Emergency Dollar Warning

Nearly three months after we mocked the viral “Operation Sandman” internet rumor… it’s time to get serious.

Nearly three months after we mocked the viral “Operation Sandman” internet rumor… it’s time to get serious.

Assuming you’ve long since forgotten… Sandman was billed as “a collaboration of 100-plus nations in agreement to simultaneously sell off their U.S. Treasury holdings.” Result? “The dollar and all dollar-denominated assets will plunge to near-ZERO literally overnight.”

That was at the end of March. Supposedly it was all going to go down by mid-April. Obviously it did not.

But that’s not, as it turns out, the end of the story…

On Friday, Treasury Secretary Janet Yellen struck a complacent tone about the fate of the dollar.

On Friday, Treasury Secretary Janet Yellen struck a complacent tone about the fate of the dollar.

She was at a finance conference in Paris — where the other attendees included Brazil’s President Luiz Inacio Lula da Silva and South Africa’s President Cyril Ramaphosa.

You’ll notice that’s two of the five BRICS nations, the others being Russia, India and China.

Lula said the dollar’s role as the global reserve currency puts countries like Brazil at a disadvantage. Ramaphosa said “the issue of currency” would be “on the agenda” when the BRICS leaders meet in his country on Aug. 22.

If you’ve been keeping up with us the last couple weeks, you know that Paradigm’s macroeconomics authority Jim Rickards anticipates the BRICS leaders will use that occasion to unveil an alternative super-currency to the dollar, one that will likely have gold backing.

But Yellen was unimpressed: “There is a very good reason why the dollar is used widely in trade,” she said, “and that’s because we have deep, liquid, open capital markets, rule of law and long and deep financial instruments.”

Again, the complacency — reminds me once more of an “anti-motivational” poster I’ve shared in the past…

Which brings me to the urgent note Jim Rickards sent you from the Paradigm Pressroom earlier today…

Which brings me to the urgent note Jim Rickards sent you from the Paradigm Pressroom earlier today…

“I’ve received intelligence,” he said, “that suggests we’re just days away from a devastating change to the dollar… and to the entire American way of life.”

To be clear, this is not related to the BRICS summit, still eight weeks away. “This is much more urgent and personal than that,” he added.

Even I’m not privy to all the details yet — Jim’s been hard to get ahold of — but the drift I’m getting is that it really is something akin to the Sandman rumors back in the spring. And the timeframe could be closer to eight days.

Rest assured, whatever it is, Janet Yellen does not see it coming.

But even though she and the rest of the Biden administration will be blindsided, you don’t have to be.

Events are moving so quickly that Jim has called an Emergency Dollar Warning webcast for tomorrow at 1:00 p.m. EDT. He’ll be located right outside the White House.

Yeah, I know — short notice, middle of the day, all of that. Make the effort anyway. Jim says you may have as little as a week to prepare for what’s just around the corner… but if you do, you’ll be able to lay on a trade that made 2,300% in 13 months during a crisis very much like the one that’s coming.

Click here and you’ll be instantly registered: We’ll follow up with a link to the event and everything else you need to know to get ready.

![]() Mutiny in Russia… and the Markets Were Closed!

Mutiny in Russia… and the Markets Were Closed!

In the meantime… imagine how nutso the markets would have been if the Russian mutiny had taken place during the week.

In the meantime… imagine how nutso the markets would have been if the Russian mutiny had taken place during the week.

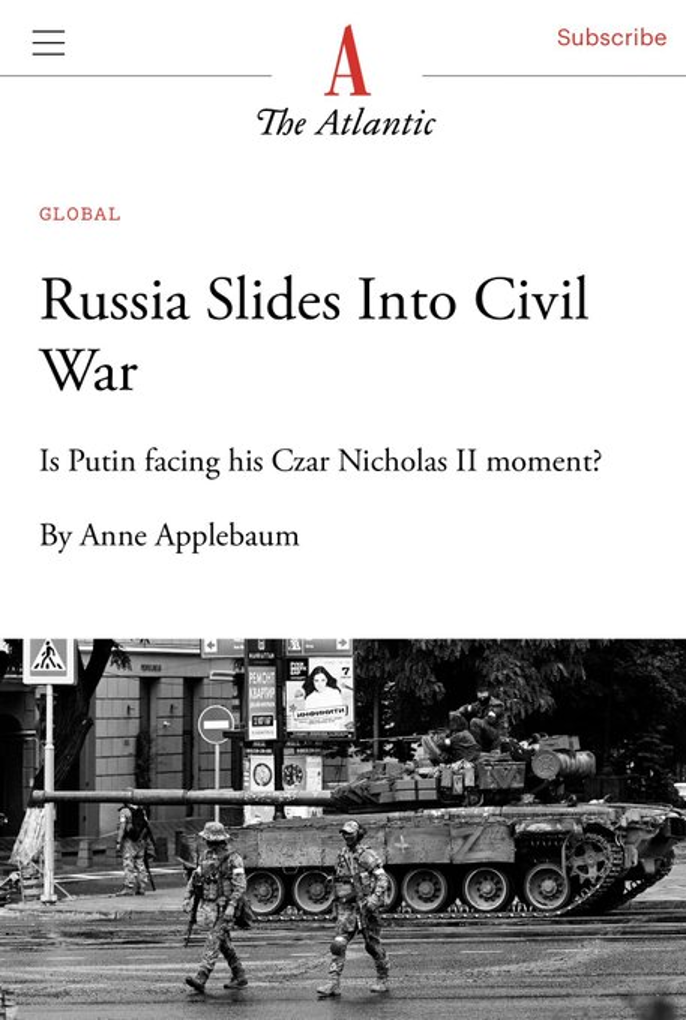

It was certainly an entertaining 18 hours late Friday and Saturday. We got a chance to witness dozens of mainstream American pundits beclown themselves — none more than Anne Applebaum, the Atlantic writer who’s supported every U.S. intervention of the last 20-plus years.

In the event, Vladimir Putin and his family did not face an impromptu firing squad. The Wagner Group mercenaries did not march on Moscow and their leader Yevgeny Prigozhin agreed to exile himself in Belarus.

And the only asset class that was trading the whole time was crypto. Bitcoin held the line on $30,000 throughout, and it continues to do so this morning.

The major U.S. stock indexes are trying to recover a bit of last week’s losses: At last check the Dow is flat, just over 33,700… the S&P 500 is up a smidge to 4,355… and the Nasdaq is up 0.4% to 13,547.

Gold is up microscopically at $1,923; silver’s a bit better, up 31 cents to $22.74. Crude is little moved, a few pennies over $69.

![]() Natgas Set for a Rebound

Natgas Set for a Rebound

Natural gas prices are down big-time from last year’s peak. Don’t expect it to last.

Natural gas prices are down big-time from last year’s peak. Don’t expect it to last.

Natgas peaked at nearly $10 per million Btu last summer after Russia invaded Ukraine, scrambling the fuel’s international flows.

Then came a glut late last year and early this year — thanks in part to a mild winter. “By the time winter ended,” says Paradigm income specialist Zach Scheidt, “tanks were full, less [U.S.] gas was being exported to Europe and producers were left to figure out what to do with their excess gas.”

And prices fell to their lowest since 2020.

But looking forward, “there’s plenty of evidence to indicate that we’ll become even more dependent on natural gas in the near future,” says Zach.

“Although it may be a fossil fuel, natural gas burns much cleaner than other fuel sources like oil and coal while still producing a comparable amount of energy. It’s often thought of as a ‘bridge fuel’ as economies transition from relying on traditional energy sources like fossil fuels to renewables like solar, wind or hydropower.

“So while the sector does face some political pressure from Washington similar to other fossil fuels, our reliance on natural gas isn’t going away anytime soon.

“And as one of the cleanest and most readily available fuel sources for generating electricity, it’ll be an important part of the world’s increasing electrification. Think about new advances in electric vehicles, artificial intelligence, crypto mining and computer chips.

“These technologies all need electricity to function — and lots of it! These are just a few factors that should help drive more demand for electricity and natural gas for years to come.”

Zach already has a bargain-priced natgas name paying a fat dividend in the Lifetime Income Report portfolio — and he’s on the hunt for more.

![]() 5 Bullets Follow-Up: Transformers

5 Bullets Follow-Up: Transformers

There’s now pushback in Congress against the Biden administration’s new rules governing electrical transformers.

There’s now pushback in Congress against the Biden administration’s new rules governing electrical transformers.

We’ve been chronicling a transformer shortage since last fall — when utilities were reporting yearlong wait times for replacements, and costs exploding fivefold. By last month, we took note that the shortage had stalled construction of a housing development in South Carolina.

At a time when the power grid is already at risk, you can see how a transformer shortage might be a problem — especially in the South now that hurricane season is upon us again.

Still, the Energy Department is barreling ahead with new standards for transformers set to take effect in 2027. Yes, they’d cut energy waste in half… but they could make the transformer shortage even more acute.

In response, Rep. Richard Hudson (R-North Carolina) has introduced a bill that would put a stop to the new rules. “The Department of Energy should be focusing on strengthening the U.S. supply chain for distribution transformers for the next five years, not further disrupting it,” he says.

The bill has the backing of the utility industry: “Distribution transformers are essential for both ensuring grid reliability, including restoring power following natural disasters and storms, and supporting the clean energy transition and economic growth in our communities,” says Duke Energy’s Dwight Jacobs.

We’ll keep you posted on the bill’s progress.

➢ Speaking of Duke Energy and power disruptions, it’s been over six months since gunmen shot up two of the company’s substations in Moore County, North Carolina — leaving 40,000 customers without power for four days. There’ve still been no arrests.

![]() Mailbag: Taxes… and Polarization

Mailbag: Taxes… and Polarization

“What Trump tax break?” a reader writes from California after the 2017 tax bill came up here last week.

“What Trump tax break?” a reader writes from California after the 2017 tax bill came up here last week.

“Took away real estate tax deduction and I lost $12K per year in deductions that cost me an extra $5K per in federal taxes.

“Only Trump’s super-rich buddies got a tax break. Screwed over the middle-class homeowner!”

Dave responds: To be sure, many folks in high-tax states like yours got a raw deal with the $10,000 cap on deductions for state and local taxes. And it’s not even indexed for inflation — another example of “gotcha” taxes!

But this too is set to expire at the end of 2025…

“Dave, you are not a lefty!” says our next entry — responding to a reader who said last week, “It seems you guys are lefties to me.”

“Dave, you are not a lefty!” says our next entry — responding to a reader who said last week, “It seems you guys are lefties to me.”

“Over many years now, I have been called a hard-core conservative, a borderline anarchist, a Christian fundamentalist, et al. These are all accurate observations of what I believe. I voted for Trump in both elections. And yet I occasionally get tagged as a lefty. For example...

“I recently had a disagreement with my son. He's all for the U.S. government appropriating the Russia Central Bank's money. I explained why that is theft, violates the rule of law and would cause the U.S. additional problems. He took the position that Putin is a terrible person and deserves it. Personally, I hope Putin is destroyed, but I am not willing to engage in another wrong, theft, to accomplish that.

“Rush Limbaugh had a tagline about the left saying that for them, it is always symbolism over substance. It is true. I also think this could be applied to other groups. I do not recall you ever relying on just symbolism to make your point.

“You are definitely not a lefty. Just because I may disagree with you from time to time, it does not make you a lefty.”

“I'm Canadian but the political problems are similar north and south of the 49th parallel,” chimes in our final correspondent today.

“I'm Canadian but the political problems are similar north and south of the 49th parallel,” chimes in our final correspondent today.

“I'm frustrated that everything gets polarized and you're either with us or against us. I believe one of the things that reinforces this thinking is the use of Conservative versus Liberal (our two main Canadian political parties), Democrat versus Republican, left versus right (ideology), etc.

“I'm religiously agnostic, believe in balanced budgets, small government, gun control, free speech, LGBTQ rights, more open than closed borders, against tariffs, anti-war, against forgiving student debt, think the education system is broken and higher education is a racket and climate alarmism is ruining the planet and our society.

“I could go on and on, but the point I'm trying to make is that I do not fit neatly into a ‘left’ or ‘right’ label and I believe that most people don't. But by continuing to use these labels we make issues tribal rather than have a healthy debate about the issue at hand.

“Therefore what I've tried to do in my own life is not use these (and many other) labels in my everyday discourse. My hypothesis is that if we could convince everyone to do the same we'd take a step in getting to fact-filled discussions rather than name-calling.

“I appreciate the time you've taken to read my rant. I read The 5 every day and have done so for some years as it is in many ways my best source of unbiased news.”

Dave responds: Interesting that you didn’t cite your position on the trucker protest.

That’s just an observation, not a judgment. South of the border, too, it’s my sense that out of sheer exhaustion… folks would just as soon blot out the whole COVID experience and pretend it didn’t happen, even though in many cases, broken family ties and friendships can’t be mended.

Anyway, thank you for your trust. Reader trust is something I never take for granted; rather, it has to be earned anew each day.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets