Fallen Angel’s Phoenix Moment

![]() Historic Tech Turnaround

Historic Tech Turnaround

What’s happening at Intel “could be one of the biggest turnarounds in tech history,” says Paradigm’s AI authority James Altucher.

What’s happening at Intel “could be one of the biggest turnarounds in tech history,” says Paradigm’s AI authority James Altucher.

“Intel has been suffering through what can only be described as a brutal year. While competitors like Nvidia Corp. (NVDA) have seen their stocks explode during the AI boom, Intel has largely missed the party.

“But that might be about to change dramatically.”

As we mentioned in passing last week, the company named a new CEO, Lip-Bu Tan. As Tan formally takes over today, the news is worth exploring in more depth — especially since mainstream coverage is missing the point.

“Tan is no stranger to corporate turnarounds. His track record speaks for itself,” says James.

“Tan is no stranger to corporate turnarounds. His track record speaks for itself,” says James.

“He's the executive who turned Cadence Design Systems from a struggling company into a powerhouse.” During his tenure as CEO from 2009-2023, the firm doubled its revenue while growing its profit margin.

His shareholders thrived during that 14-year span — CDNS soaring 3,200%.

Tan also served on Intel’s board for two years until last summer. When he stepped down, he called it a “personal decision based on a need to reprioritize various commitments.” But every indication is that he had differences with CEO Pat Gelsinger over a slow and inefficient corporate culture.

Gelsinger “got quit” in December, as the saying goes.

“Now Tan has the opportunity to implement his vision directly,” says James.

“To understand why this matters, you need to understand Intel's unique position,” he goes on.

“To understand why this matters, you need to understand Intel's unique position,” he goes on.

Intel isn’t just a chip designer competing with firms like Nvidia and Advanced Micro Devices.

Nor is it only a chipmaker competing with the likes of Taiwan Semiconductor and Samsung.

It does both — competing with all those players.

And it’s a costly undertaking. “Intel lost $19.2 billion last year as it ramped up investments in manufacturing,” James says. “The losses are expected to continue until the fall.”

So far, Wall Street has greeted Tan’s appointment with a big bump to INTC’s share price — almost 25% in less than a week.

For that momentum to continue, “Tan will have to make some big moves,” says James — “such as selling assets, forming new partnerships or landing major foundry customers.”

For that momentum to continue, “Tan will have to make some big moves,” says James — “such as selling assets, forming new partnerships or landing major foundry customers.”

Easier said than done, James concedes. Even so, James says this is a fallen tech angel’s Phoenix moment to rise from the ashes. “Longer term, Intel is a no brainer.

“Here's what gets me excited: Intel has all the pieces to be an AI powerhouse. It just needs to put them all together. With Tan at the helm, that's exactly what could happen.”

James’ conservative estimate of INTC’s profit potential — 200–400% in the next three–five years.

“That's not just optimism talking,” he hastens to add. “It's based on Intel's massive manufacturing capabilities, decades of chip development expertise, government support and new leadership.

“For investors willing to be patient, this could be one of those rare opportunities to get in on the ground floor of something big.”

That said, James has his eye on something even bigger and more urgent today.

That said, James has his eye on something even bigger and more urgent today.

As we mentioned yesterday, Nvidia CEO Jensen Huang is delivering the keynote address at the company’s annual “GTC” conference, laying out the company’s future AI plans and advancements.

“What he had to say was even bigger than what I initially predicted,” says James. “Huang shared details on the highly anticipated rollout of ‘the X Chip’ — the most powerful chip in AI history.”

As James has said for several days now, Elon Musk is one of the X-Chip’s biggest customers. This state-of-the-art chip is the linchpin to what James calls “Elon’s endgame” — transforming Musk’s Project Colossus into the most powerful AI upgrade in history.

Musk and Nvidia are taking on a third partner in this venture — a tiny company that James says has 50X potential over the next 12 months. “Now that the news is out,” he says, “time is critically limited to get into this tiny stock.” You’ll want to click here and check out James’ presentation while it’s still fresh.

![]() The Fed Is Irrelevant

The Fed Is Irrelevant

“Despite the drama and publicity surrounding Federal Reserve meetings, the Fed is irrelevant,” says Paradigm macroeconomics maven Jim Rickards.

“Despite the drama and publicity surrounding Federal Reserve meetings, the Fed is irrelevant,” says Paradigm macroeconomics maven Jim Rickards.

Today the Fed opens one of its periodic two-day meetings to set monetary policy. At the end of the meeting tomorrow, the Fed will leave its benchmark fed funds rate at 4.5% — where it’s been for the last three months.

What’s the fed funds rate, anyway? “The fed funds rate is basically an overnight interbank unsecured lending rate,” says Jim.

“Yet there has not been a meaningful fed funds market since 2008 because banks have trillions of dollars in excess reserves parked at the Fed and don’t need to borrow from each other to meet reserve requirements. Put differently, the Fed is targeting something that doesn’t exist.

“The nearest functional equivalents to fed funds are the secured overnight financing rate (SOFR), which is the rate for interbank lending secured by Treasury securities collateral (basically the repo rate) or the yield on a 1-month Treasury bill.”

The SOFR rate published by the New York Fed at the close of business yesterday was 4.32%. Meanwhile, if you buy a 1-month T-bill today, you’ll get a yield of 4.31%.

Notice that both of those are lower than the current fed funds target of 4.5%.

In other words, the market is already pushing short-term interest rates lower irrespective of what the Fed does.

In other words, the market is already pushing short-term interest rates lower irrespective of what the Fed does.

These falling rates “are a sign that growth is slowing, and the U.S. economy is heading into a recession (at worst) or sliding sideways (at best),” Jim says.

But the Fed doesn’t take its cues from the market. Instead it follows the inflation and unemployment indicators.

Inflation is falling relative to two or three years ago, but still not enough for the Fed’s liking. Meanwhile, unemployment is rising, but not to alarming levels. Thus, the Fed is standing pat on rates — in hopes of containing inflation further.

Whatever. The Fed’s actions don’t give us a clear picture of the economic outlook. The market does.

“Interest rate markets and other indicators such as the yield curve and swap spreads are telling us the economy is slowing, unemployment will get worse and longer-term interest rates will start to come down on their own as short-term rates already have,” says Jim.

“Don’t watch the Fed; watch the interest rate markets if you want to know what’s going on.”

![]() Markets, Industry, War

Markets, Industry, War

So much for the stock market’s recovery. Meanwhile, gold is pushing solidly past $3,000.

So much for the stock market’s recovery. Meanwhile, gold is pushing solidly past $3,000.

After a rally going back to last Friday, the major U.S. stock indexes are back in the red — the S&P 500 down 1.2% to 5,606. The Dow’s losses aren’t as bad; the Nasdaq’s are worse.

Gold has powered its way to $3,025. But we’re getting mixed signals from silver and the mining stocks: Silver is ruler-flat at $33.82 while the HUI index of mining shares is up 1.3% to 356.

Not much crypto action, with Bitcoin at $81,556.

If U.S. industry is getting twitchy about tariffs, it’s not showing up in one of the major economic indicators.

If U.S. industry is getting twitchy about tariffs, it’s not showing up in one of the major economic indicators.

Industrial production grew 0.7% in February, according to the Federal Reserve — way more than anticipated by the typical Wall Street economist, who was looking for only 0.2%.

Manufacturing blew out expectations, growing 0.9%. Mining output and energy production grew as well, while utility output shrank after January’s cold snap.

All told, 78.2% of America’s industrial capacity was in use last month, the highest since last June.

Crude is little moved at $67.59 now that the Israel-Hamas ceasefire is over.

Crude is little moved at $67.59 now that the Israel-Hamas ceasefire is over.

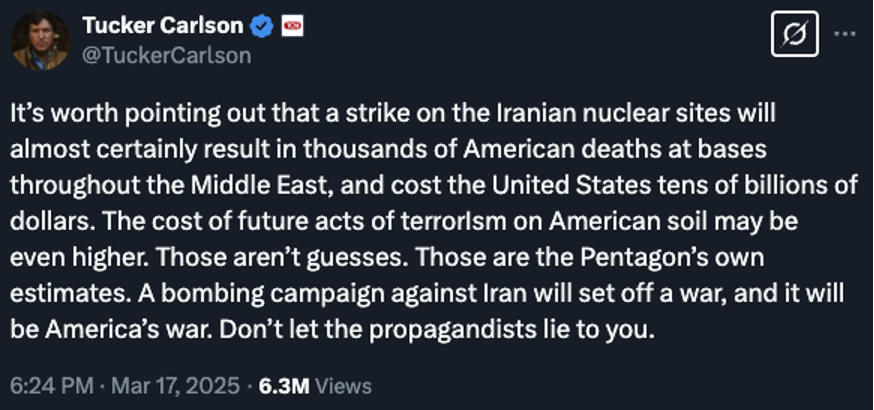

As perhaps you’ve heard, Israel has resumed bombing the Gaza Strip after a two-month pause. Meanwhile, Donald Trump says he will hold Iran responsible for every attack carried out by Yemen’s Houthi faction in solidarity with Hamas.

If you’re feeling a certain 2002 march-to-war vibe right now, you’re onto something. Except that this time, thousands of U.S. casualties might come in one fell swoop rather than being dragged out over a decade.

And to think it was only last May when Trump told podcaster Tim Pool, “You can solve problems over a telephone. Instead they start dropping bombs. Recently, they’re dropping bombs all over Yemen. You don’t have to do that.”

![]() Energy Sanity

Energy Sanity

“New York Gov. Kathy Hochul (D) wants to work with President Donald Trump (R) on developing artificial intelligence, nuclear power, and data centers despite their differences on other political issues,” says an eye-opening Bloomberg report.

“New York Gov. Kathy Hochul (D) wants to work with President Donald Trump (R) on developing artificial intelligence, nuclear power, and data centers despite their differences on other political issues,” says an eye-opening Bloomberg report.

It was at the start of 2024 when we began warning you about the prodigious demands that AI will make on the power grid. As the year went on, Big Tech began to embrace nuclear power as a green option that, unlike wind and solar, can guarantee the always-on “baseload” power that data centers need.

In recent weeks, the Trump administration asked state governments for comments about AI and energy policy.

For her part, Hochul says she’s all-in: “New York is continuing to help New Yorkers launch businesses and access good jobs in this growing economy while building an AI future that is safe, sustainable and globally competitive,” she said in a statement Monday. “We welcome opportunities to collaborate with the Trump administration to advance those goals.”

This development is the latest in a series of about-faces by Hochul — lest residents of the Empire State freeze in the dark.

This development is the latest in a series of about-faces by Hochul — lest residents of the Empire State freeze in the dark.

Officially, New York state has “climate” goals that include a 40% cut in carbon emissions from 1990 levels and 70% reliance on renewable electricity by 2030.

But as we chronicled last summer, Hochul acknowledged she and her comrades will have to go “a little bit slower” because “the cost has both gone up so much I now have to step back and say, ‘What is the cost on the typical New York family?’”

Embracing nuclear power is one thing… but embracing natural gas is another. Still, Hochul might be ready to do so. She met with Trump last Friday to discuss the construction of a natural gas pipeline through the Empire State.

The Constitution Pipeline “would bring gas from Pennsylvania’s drilling fields to New York,” according to the NewsNation network — “but Williams Cos. Inc. canceled the project in 2020 following opposition from politicians and environmentalists in New York.”

No word on how the talks went, but Trump’s energy secretary Chris Wright is enthusiastic.

"It's just such a win, win, win,” he tells Fox Business. “This will lower costs for people in the New York area, for New England. Not just heating costs, which is a big deal — old houses are heated by fuel oil. Natural gas is just so much cheaper and it burns cleaner.

"It'd also lower electricity prices, which, of course, everyone would cheer for that as well, and allow businesses in New England or in the New York City area to expand and grow their businesses and grow more jobs."

The times, they are a-changin’...

![]() About Those New Crypto ETFs…

About Those New Crypto ETFs…

A reader writes with a follow-up question to a special edition we published on Presidents’ Day.

A reader writes with a follow-up question to a special edition we published on Presidents’ Day.

On that day, James Altucher wrote in anticipation of new ETFs linked to the cryptos XRP and Solana. Launch is still months away, however.

“XRP is currently traded on several crypto exchanges,” the reader says. “Is there reason to wait until the ETF option is available to purchase XRP? I understand that an ETF is a more secure/simpler process than direct crypto investment.”

Dave responds: If you’re sold on XRP’s potential — it appears to be down 32% from its peak two months ago — there’s no reason to wait. Especially if you’re comfortable with a platform like Coinbase.

Indeed, federal approval of the ETF might well give the price a nice bump when approval comes…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets